If you only looked at the year-end numbers, 2025 was a great year for investors.

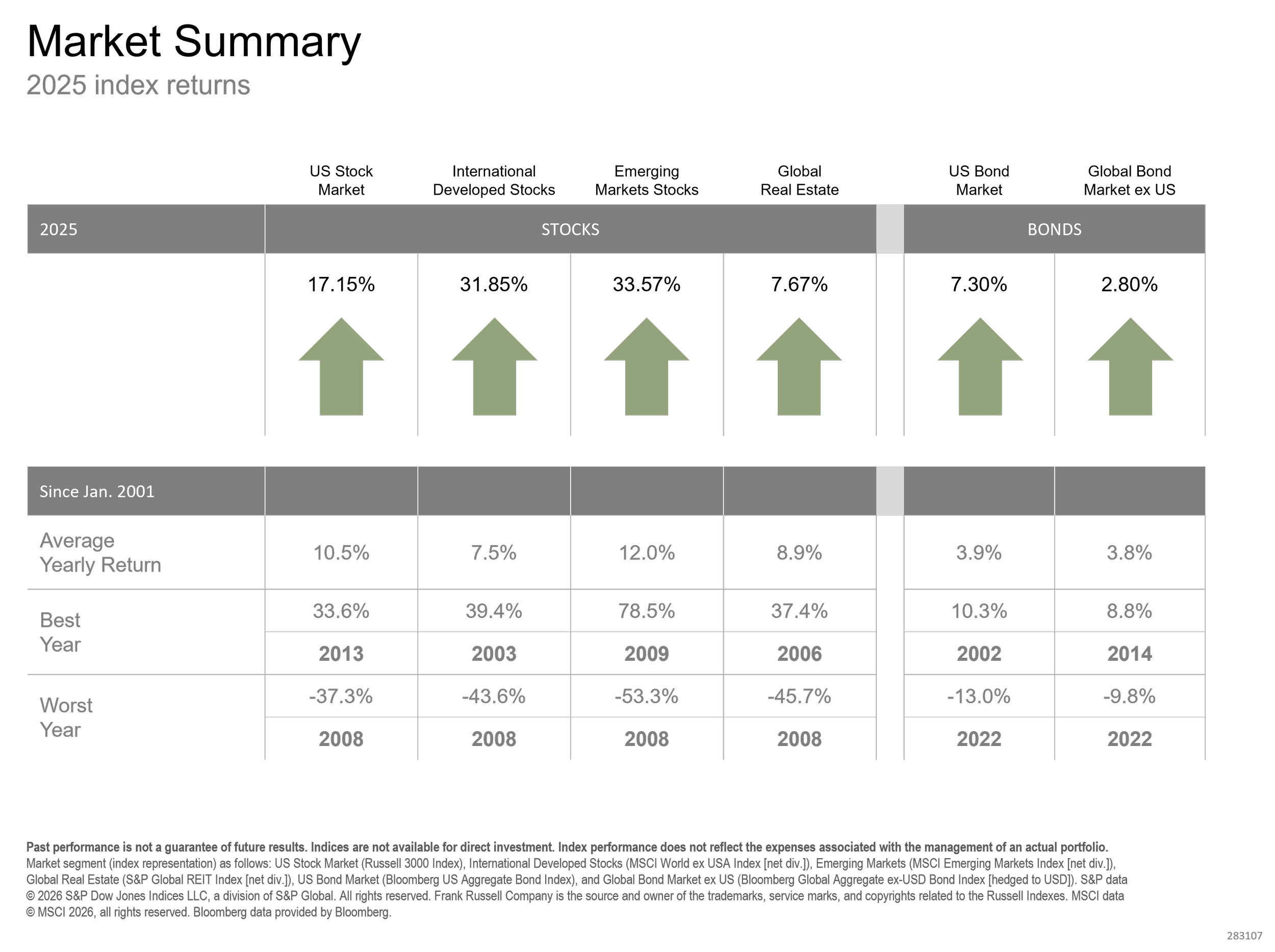

US stocks finished higher for a third straight year. International stocks outperformed the US with emerging markets leading the way. Bonds also produced positive returns, as inflation fears have waned.

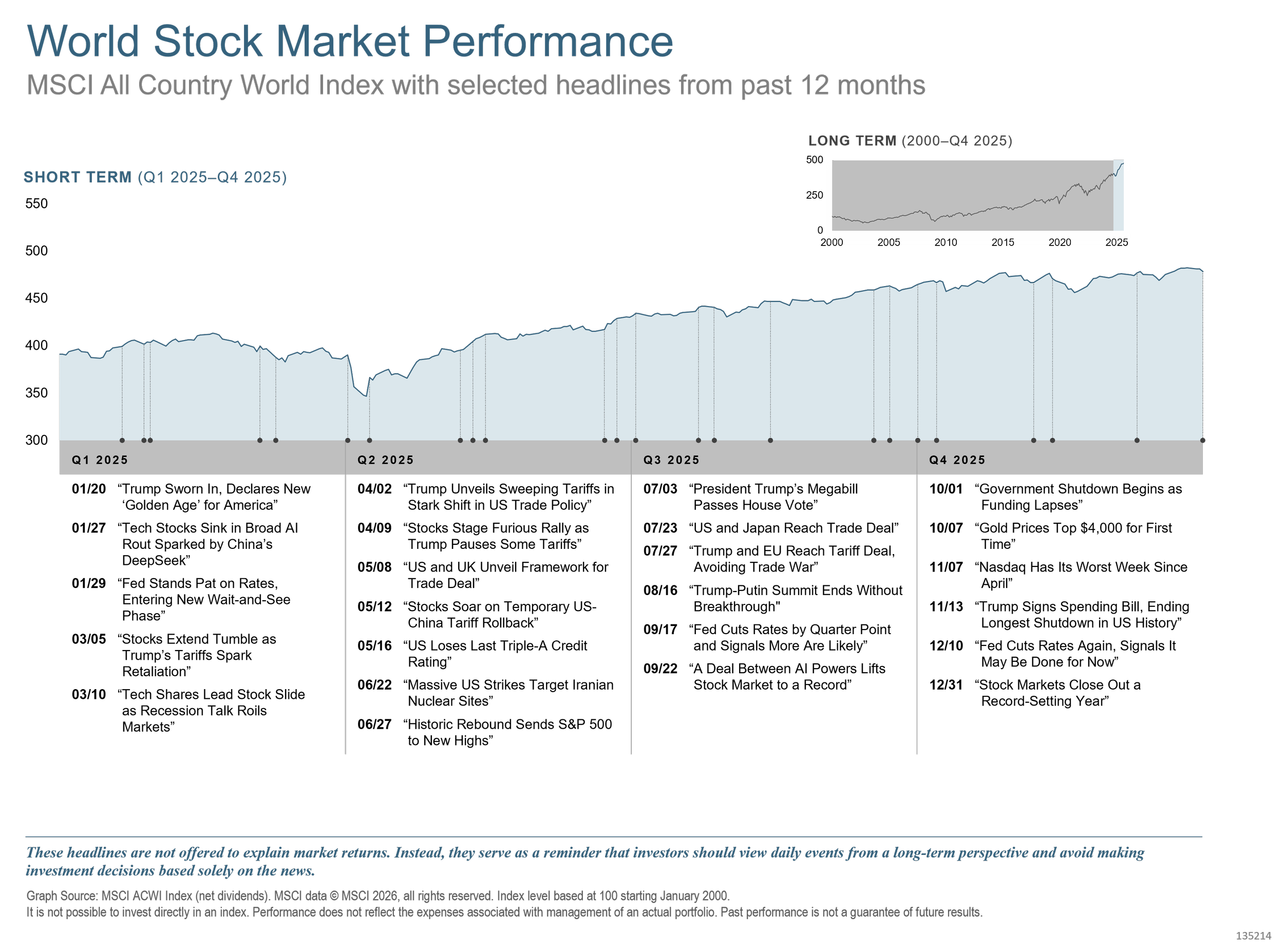

But the road to get here was not a smooth one.

Markets moved higher early in the year, hit a pothole in the spring, recovered, and finished with reminders that progress rarely comes without interruptions. Tariff headlines, interest-rate uncertainty, geopolitical concerns, and a government shutdown all appeared along the way.

None of these developments were predictable. All of them felt important at the time.

That difference between the destination and the drive is where most investor mistakes tend to occur.

A look under the hood

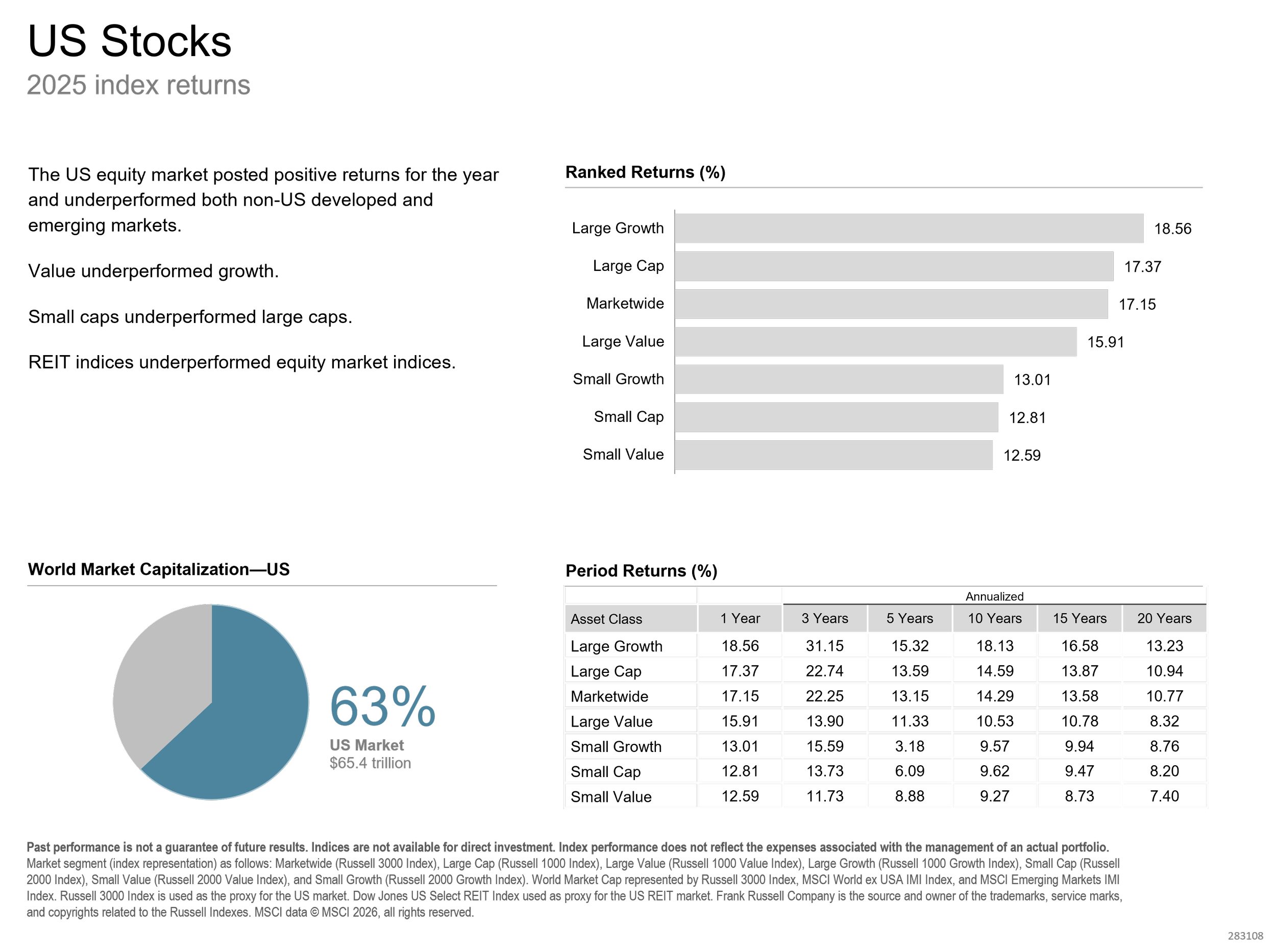

US equities posted positive returns, but leadership was narrow. Growth stocks outperformed value. Large companies outperformed small. Real estate lagged the broader equity market.

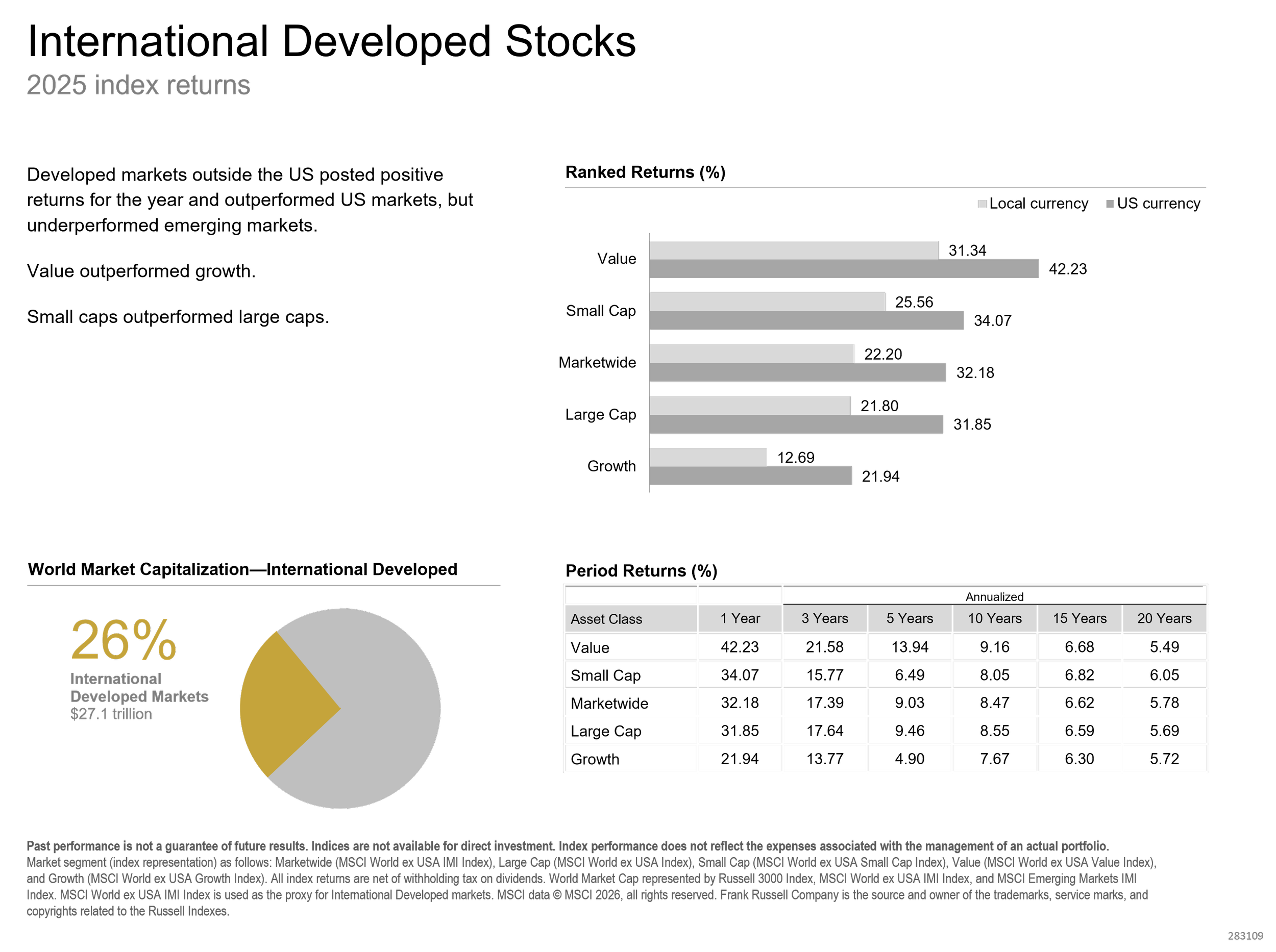

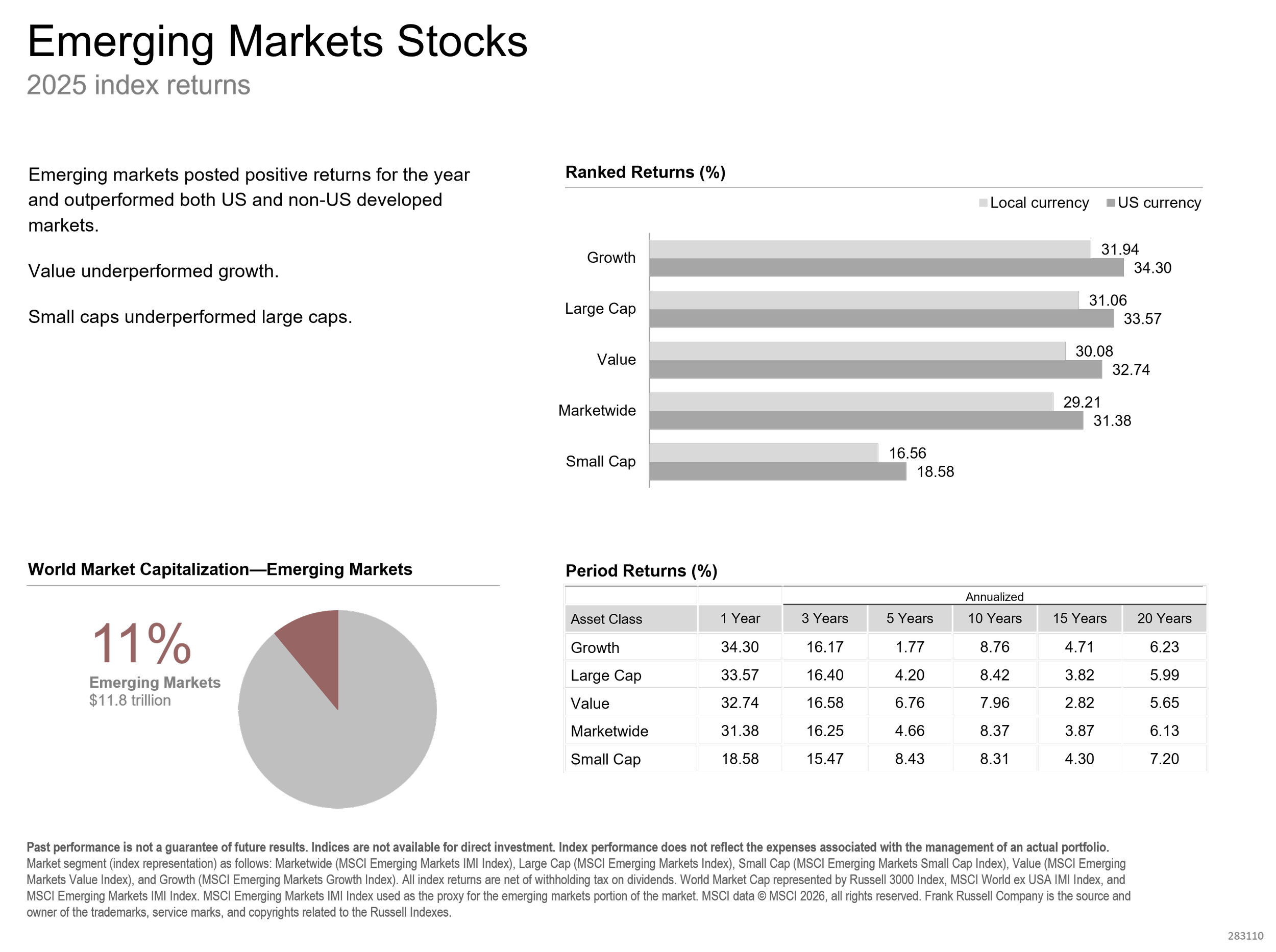

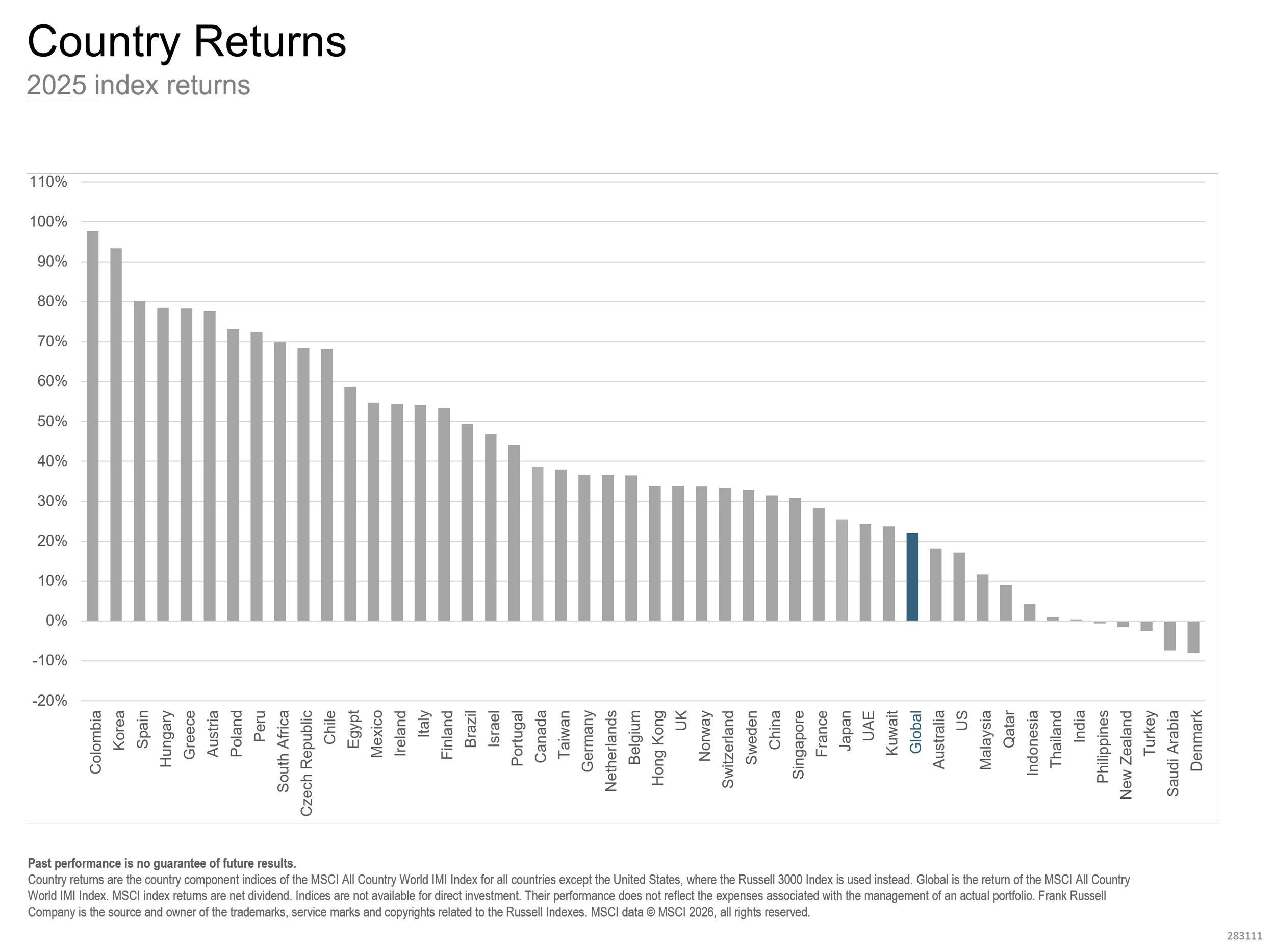

International developed markets outperformed the US by a wide margin, led by value stocks and smaller companies. Emerging markets did even better. Leadership rotated without much warning.

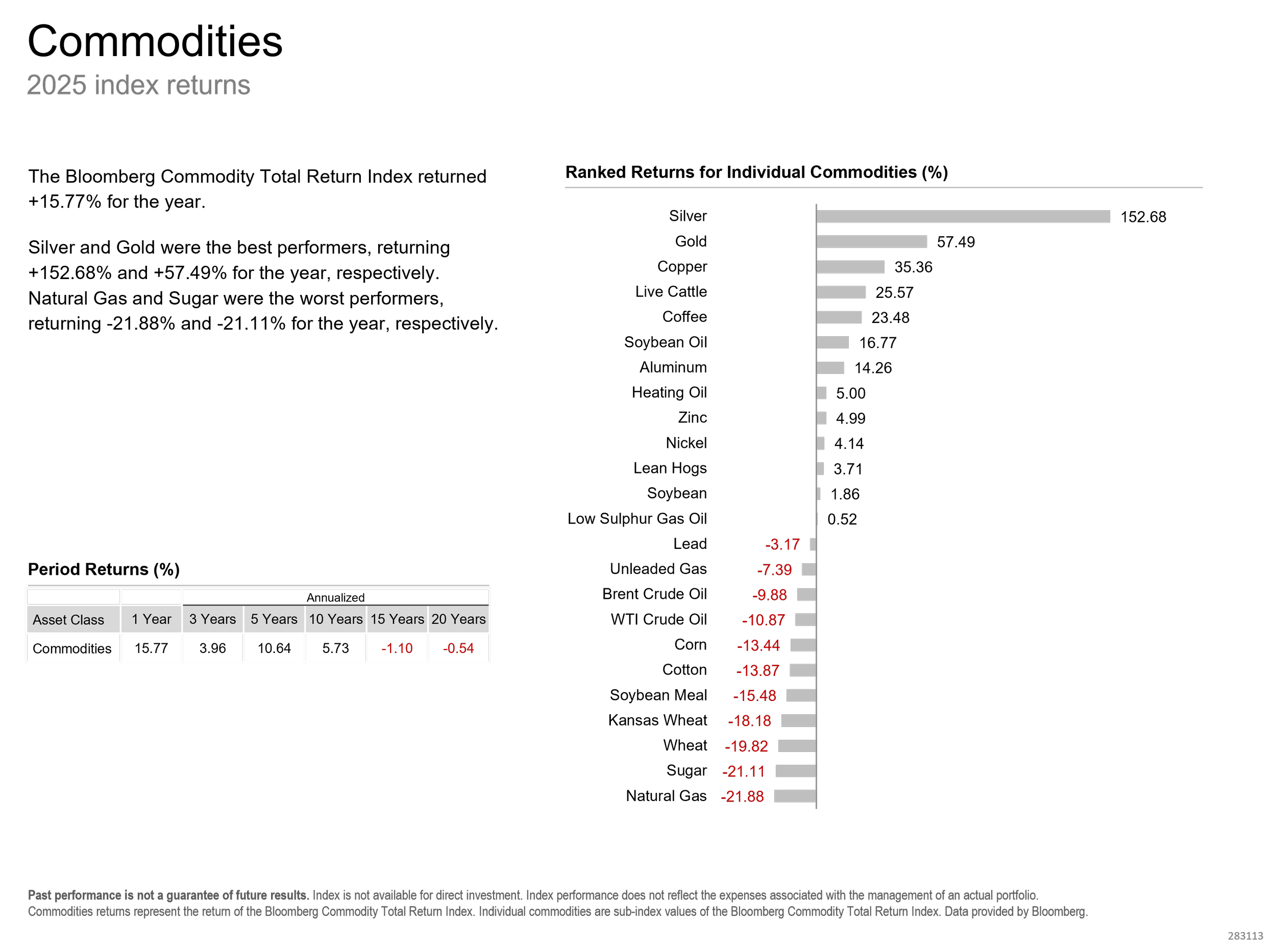

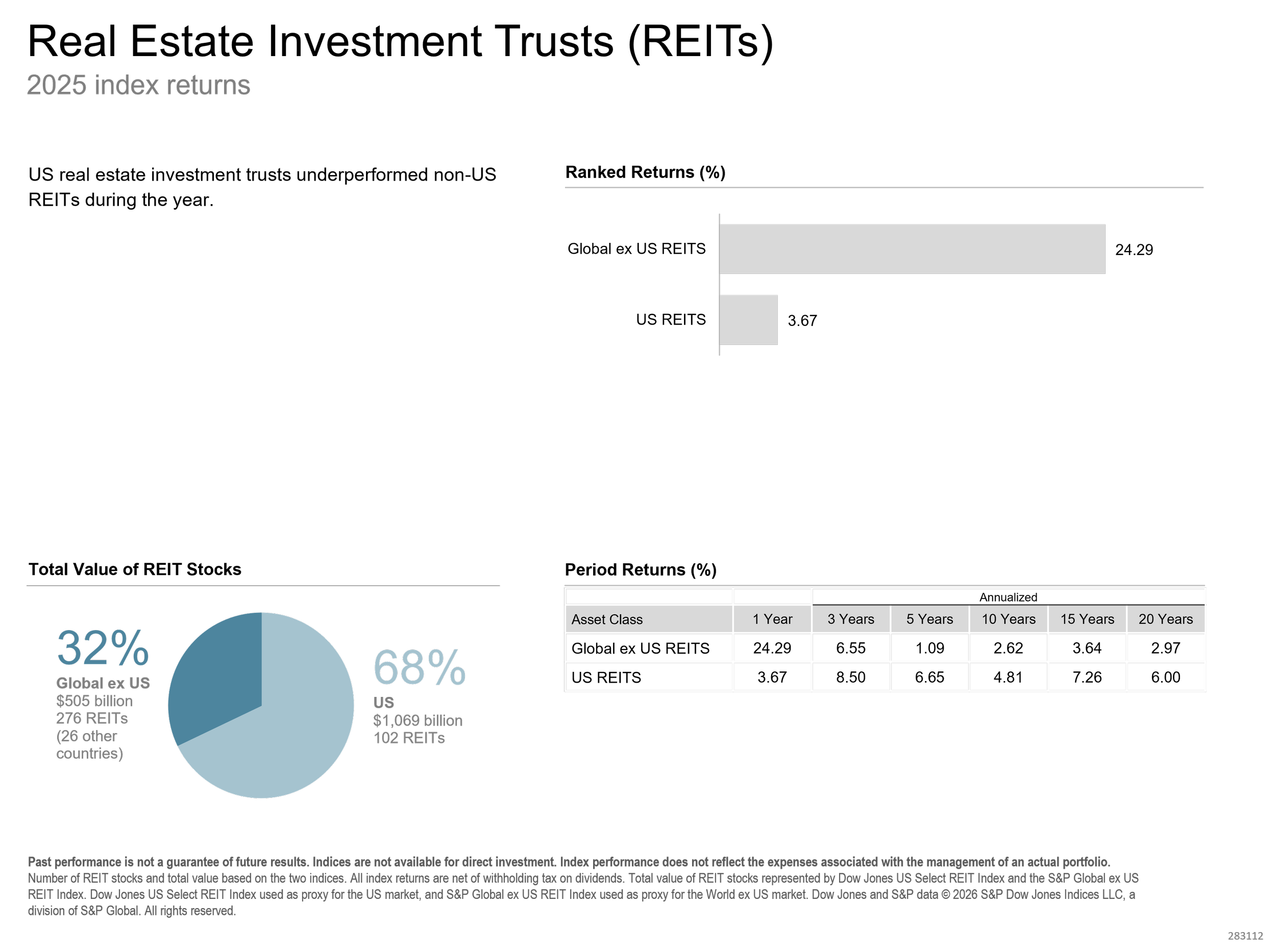

Commodities delivered strong overall returns, driven largely by precious metals. Real estate investment trusts struggled, particularly in the US.

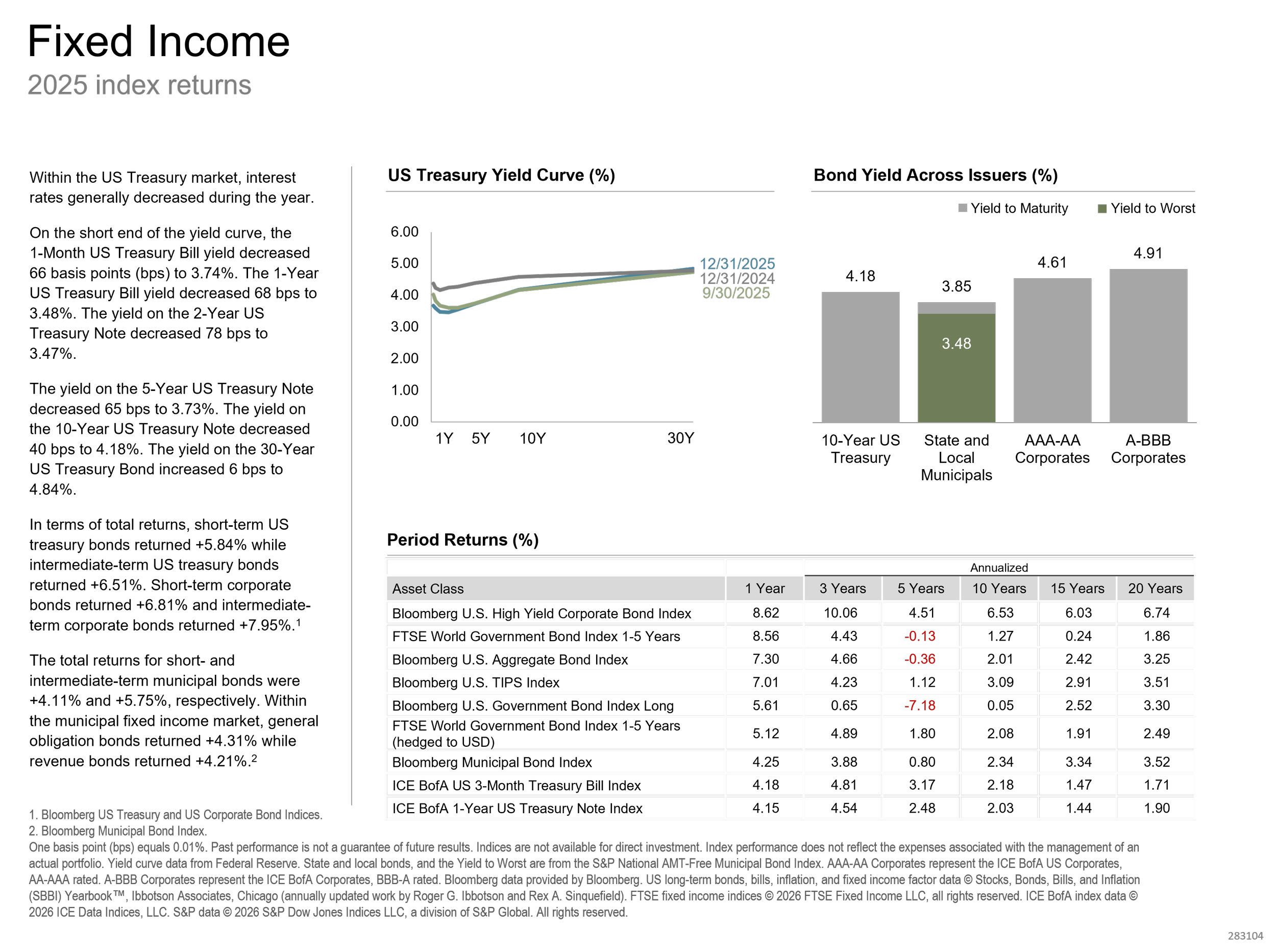

Fixed income was a welcome stabilizer. Interest rates generally declined in the US, and high-quality bonds produced solid positive returns. Bonds once again provided income and diversification.

As usual, different parts of the market took turns leading, and none of them sent advance notice.

The Destination matters more than the road conditions

We do not start a long drive assuming the road will be perfectly smooth. We expect traffic, weather, construction, and detours. We buckle up before you leave, not because we expect an accident, but because we know we can't control everything.

Investing works the same way.

Volatility is not a sign that something is broken. It is part of the terrain. The question is whether a portfolio is built to stay on the road when conditions change.

Diversification spreads risk across regions and asset classes. Holding cash for near-term needs keeps you from being forced to pull over at the wrong time. Rebalancing helps keep the portfolio aligned as markets move in different directions.

These are decisions made before the trip starts, not reactions made while driving.

The biggest hazard was behavioral

The most dangerous moments in 2025 were not associated with any specific headline. They showed up when investors felt the urge to grab the wheel and make sudden turns.

Markets can recover quickly and without warning, often while the news still looks uncomfortable. Investors who move to the sidelines waiting for clearer conditions often find that the road has already changed by the time they feel confident again.

This played out again during the year. Periods that felt stressful at the time proved temporary. Investors who stayed on the course achieved a better outcome. Those who tried to time the turns faced a much tougher drive.

Markets do not slow down to make things feel comfortable.

Looking ahead

If 2025 reinforced anything, it is that strong long-term results rarely come from smooth trips. Market leadership shifts. Short-term narratives fade. A sound plan matters more than predicting the next pothole.

Seatbelts do not eliminate bumps in the road. They help ensure those bumps do not end the trip.

That is how long-term plans stay intact. We don’t know what we will encounter on the road in 2026, but a good plan is like a seatbelt. It can save us in a crash, as well as give us confidence to stay on the road. If you need a plan or just need to review yours, get in touch.