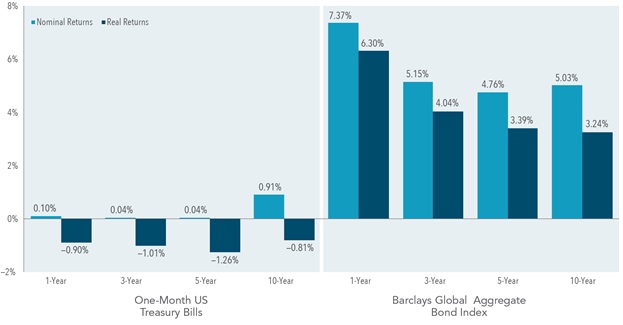

US stocks have been mostly down lately. Domestic stocks had largely defied the selloff seen in global markets for much of the year, but recently have given back most of their year-to-date gains. Some point to the slowdown as being caused by new tariffs resulting from trade disputes with China. Others suggest it is due to rising interest rates, primarily on the short-term end of the market.

Put simply, if the Fed wants to cool off the economy, they can raise the interest rates that banks pay for short term borrowing. Those higher costs are then passed on to borrowers, making people less likely to take out loans. Fewer loans equals less investment and spending, which leads to less economic activity. Usually, when the Fed is worried about a hot economy, long-term rates also rise as inflation concerns increase.

Sometimes, however, longer term interest rates stay down while the Fed raises short term rates. This is because longer term rates are market driven. If the market doesn’t collectively believe the economy is heating up enough to create inflation, then long term interest rates will typically stay low.

A yield curve gives a snapshot of how yields vary across bonds of similar credit quality, but different maturities, at a specific point in time. For example, the US Treasury yield curve indicates the yields of US Treasury bonds across a range of maturities. Bond yields change as markets digest news and events around the world, which also causes yield curves to move and change shape over time.

Historically, yield curves have mostly been upwardly sloping (short-term rates lower than long-term rates), but when short term rates and long-term rates are about the same, it is referred to as a flat yield curve. When short term rates exceed those with longer terms, it is called an inverted curve. Stock market investors get nervous as yield curves flatten. That is mainly because the central bankers seem to be trying to take fuel from a fire that the bond market considers to be under control. The fear for equity investors is that the Fed will totally extinguish the economy, sending us into recession.

So, are flat or inverted curves something to fear?