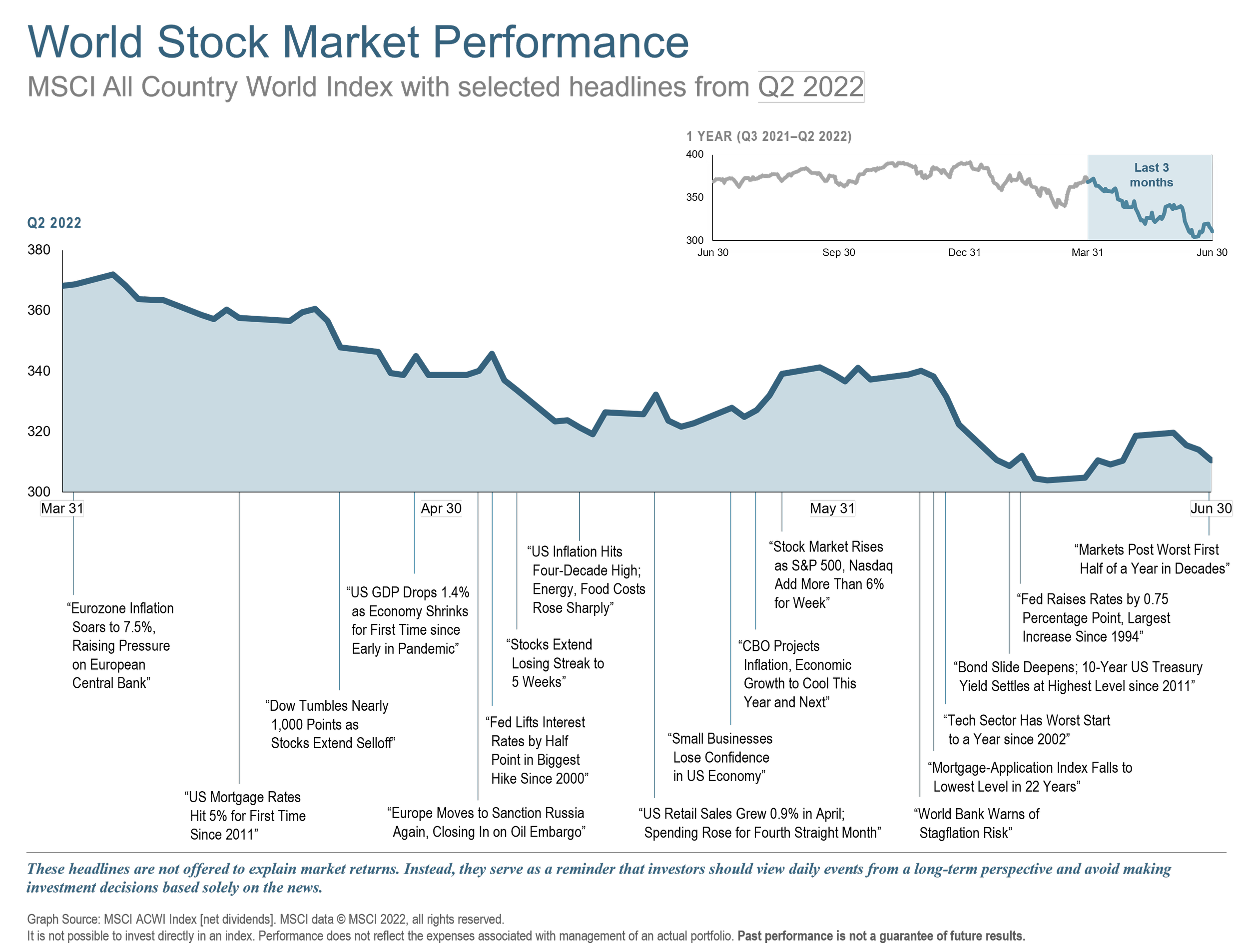

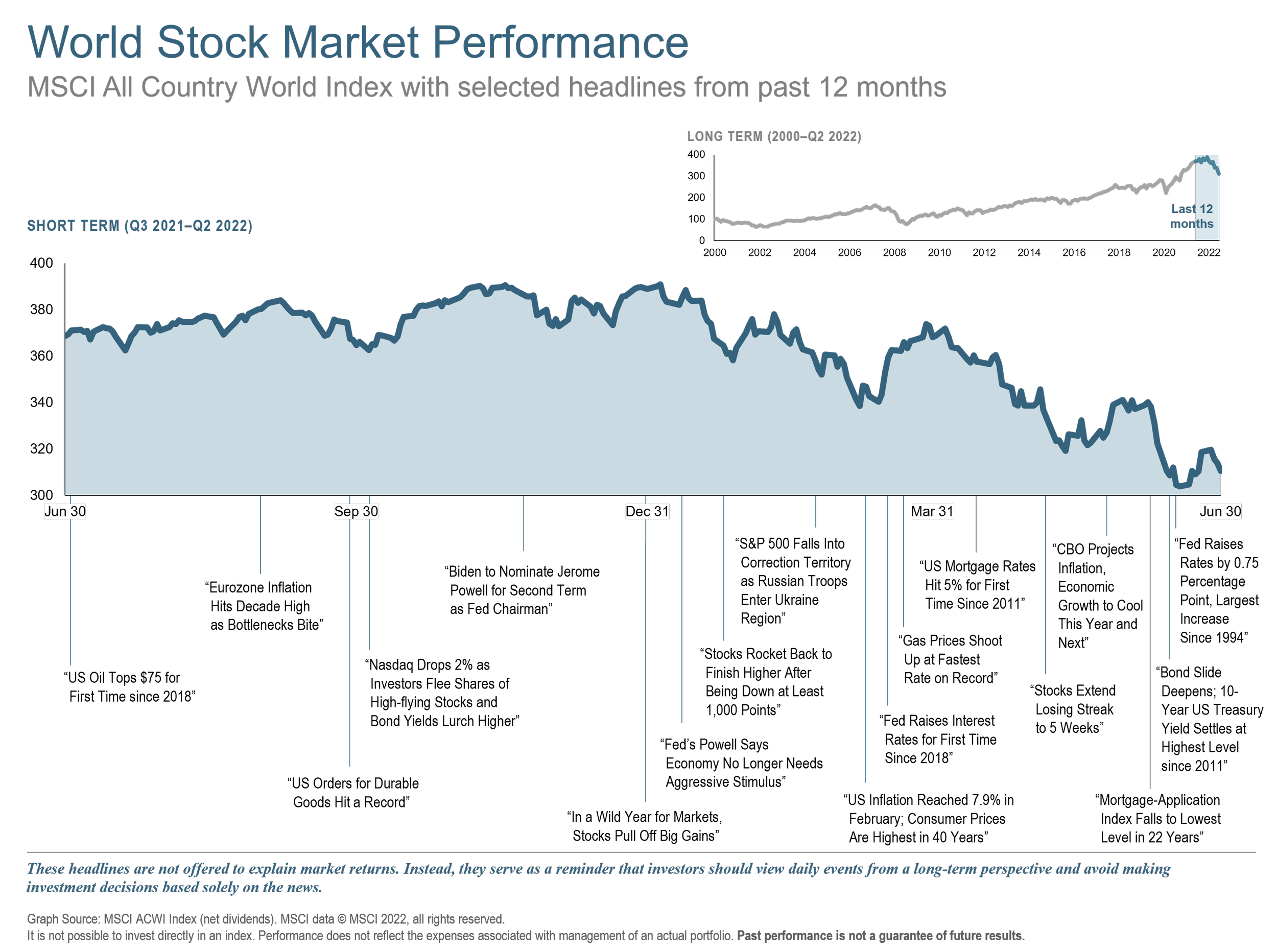

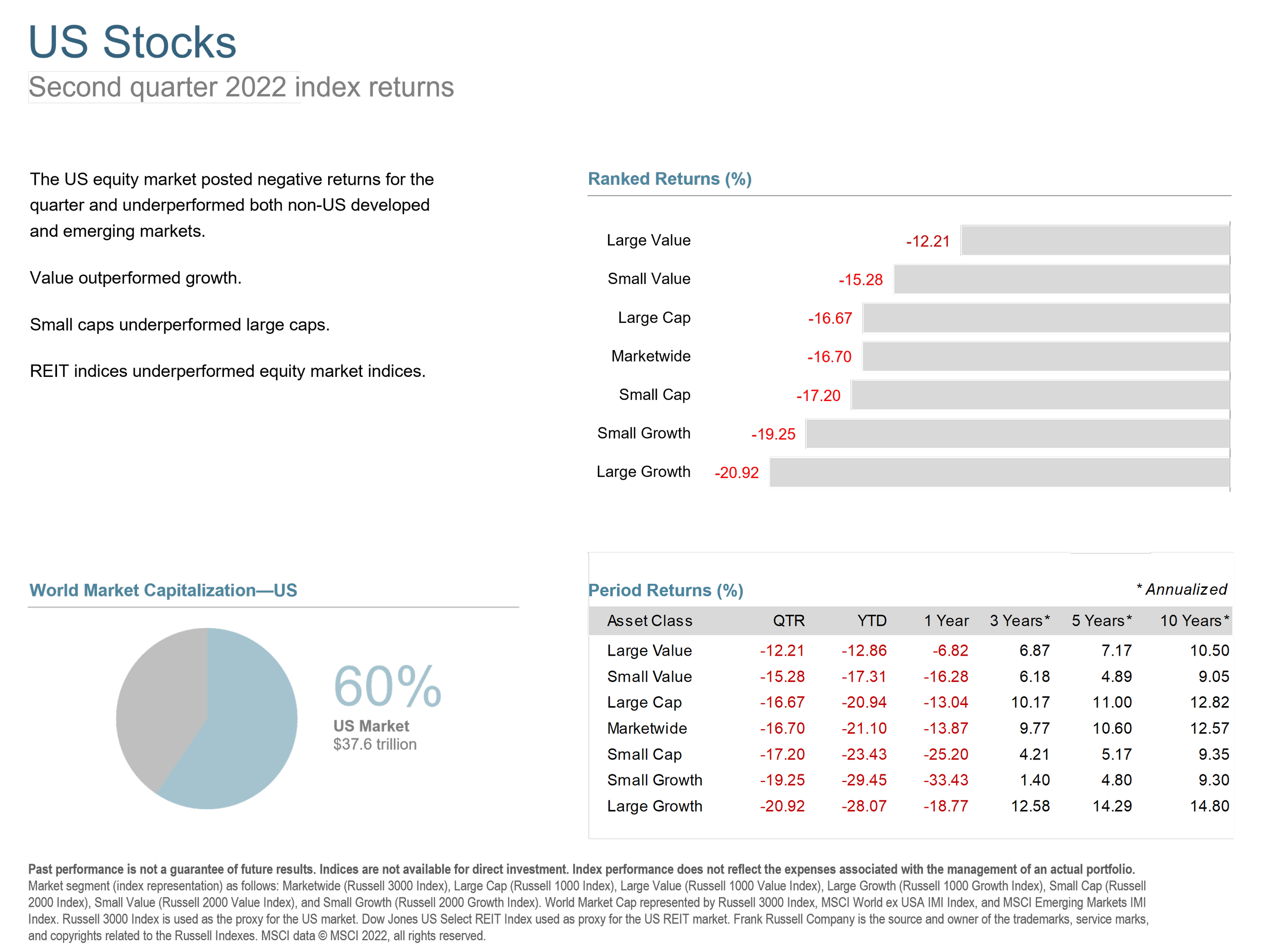

Q2 of 2022 continued the rough start we saw in Q1 as the war in Ukraine, Covid related lockdowns in China, inflation, and recession fears all increased in their intensity. With major indices such at the NASDAQ and S&P 500 down over 20% year to date as of the quarter end, we are officially in a bear market.

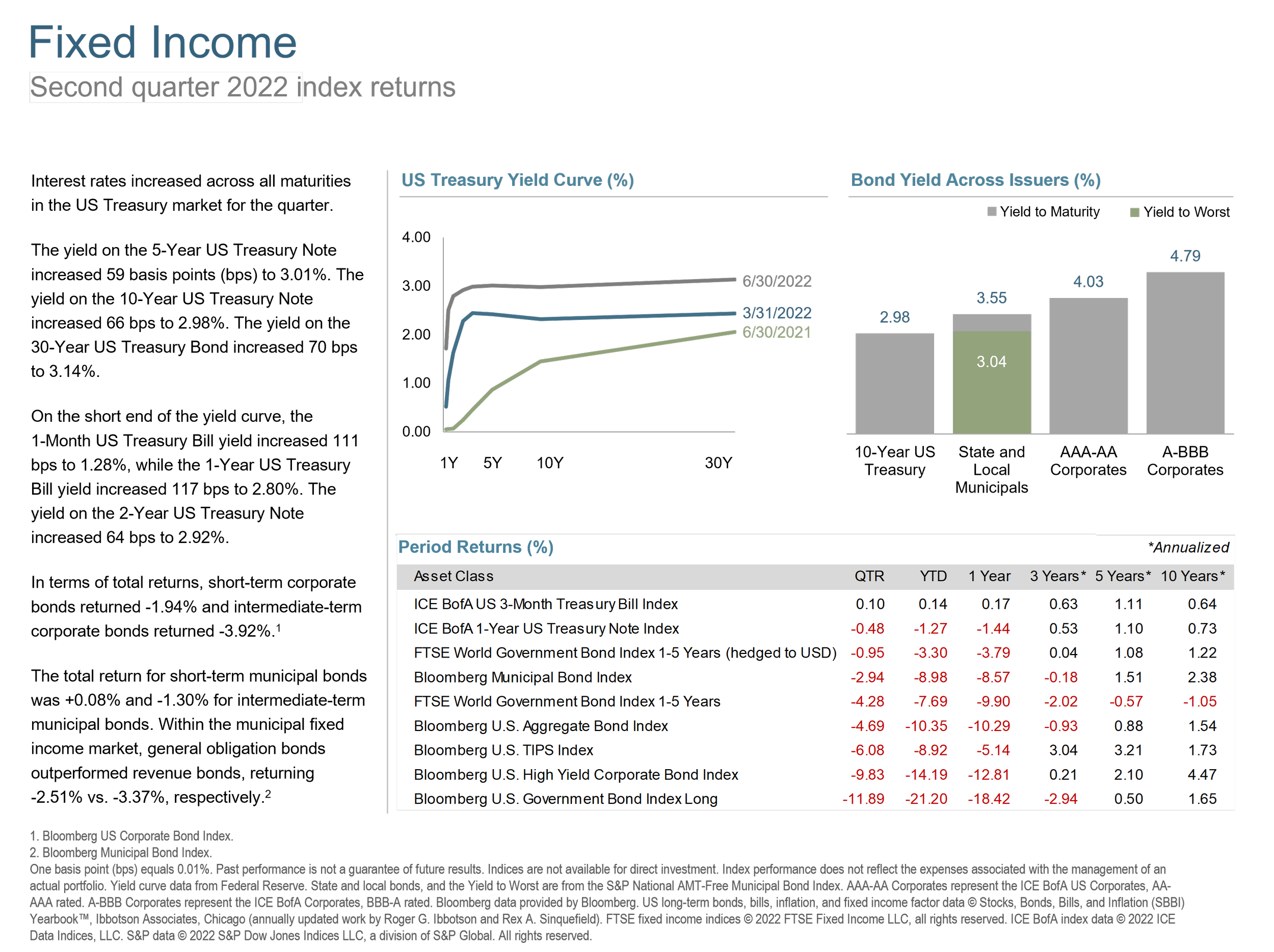

In May, the US Consumer Price Index (CPI) jumped to 8.6% year-over-year, the largest 12-month increase since the period ending December 1981, and the unemployment rate fell to 3.4%. The tight labor market and persistent inflationary pressures pushed the Federal Reserve to raise the federal funds rate target range by 50 basis points, to a range of 0.75% to 1.00% at their May Federal Open Market Committee (FOMC) meeting. This is the second consecutive Fed rate hike this year. In addition, the committee announced that they will begin reducing its balance sheet in June, initially by $47.5 billion per month, then by $95 billion per month after three months.

All of this doom and gloom has certainly had an impact on most, if not all, ATX Portfolio Advisors’ clients. Perhaps, most notably, we have not charged any of our “Fee Only When You’re Up” clients an advisory fee in 2022. Believe me when I say, no one would like to see the market turn positive than more than I. That being said, we always plan for the worst and hope for the best.

As for what we can do, I think Dimensional Fund Advisors Executive Chairman and Founder, David Booth, laid out a simple yet effective path to navigating the bear market in his June 22, 2022 perspective published on DFA’s blog.

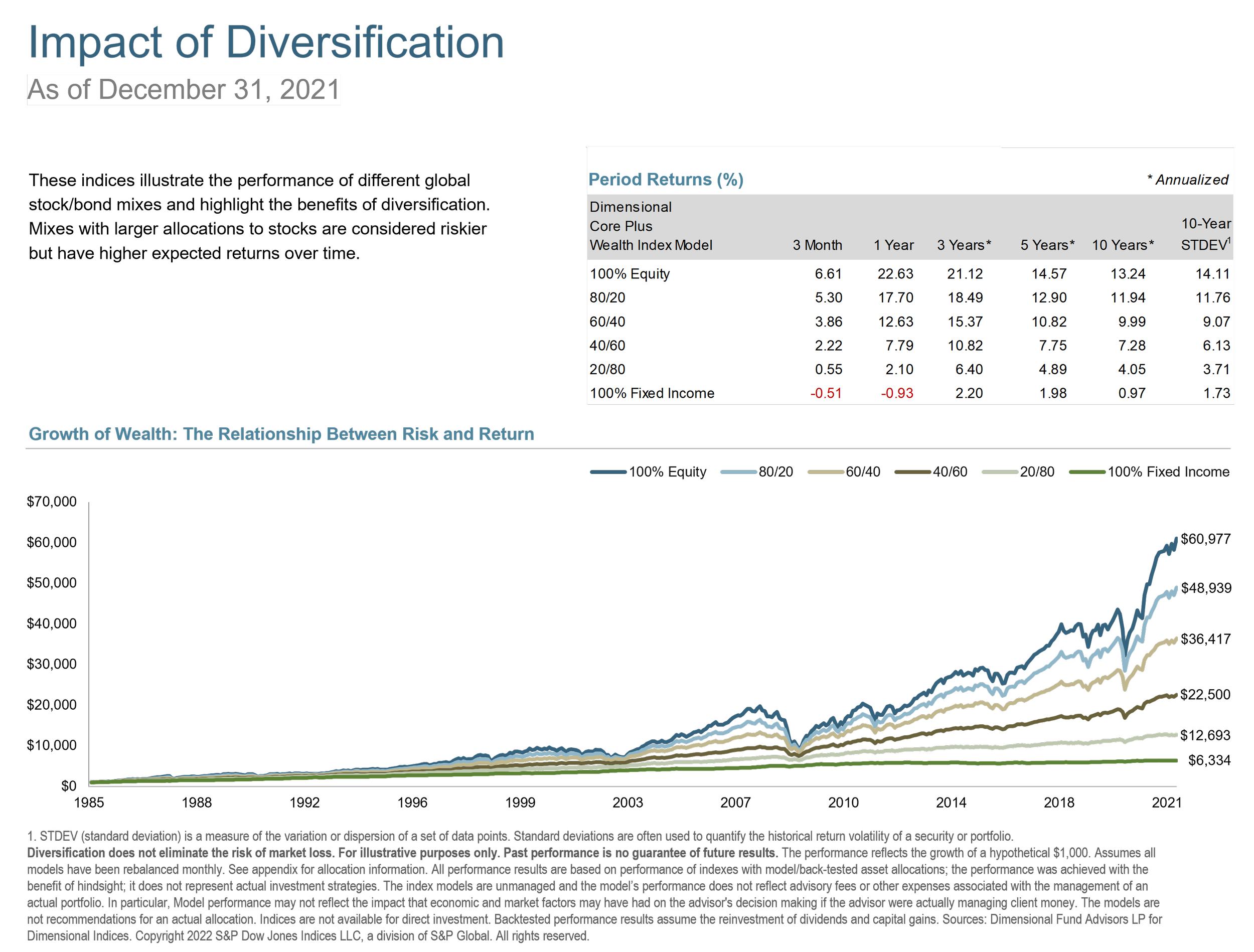

“First, answer the question, “Why are you investing?” It’s not a plan if there aren’t goals. If you want to retire in 30 years, you may be able to bear more risk in order to maximize the growth of your portfolio than you would if you hope to retire in three years.

Then, determine what balance of bonds and relatively more risky stocks is comfortable for you. If you reduce the percentage you have in stocks, you may feel better when markets go down, but you have to balance that with feeling like you’re missing out during times when the markets go up.

Focus on controlling the things that are in your control—like saving more and spending less.”

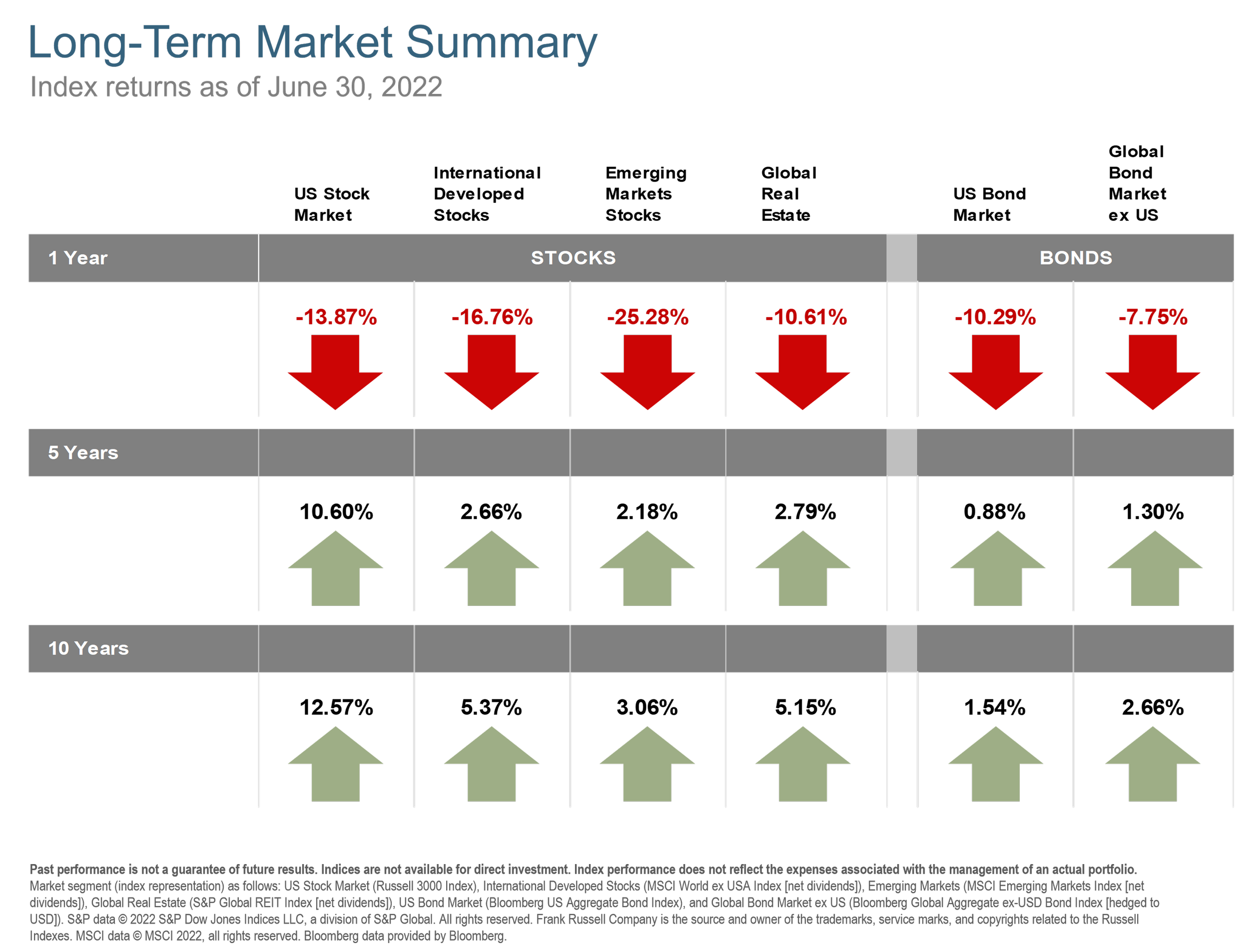

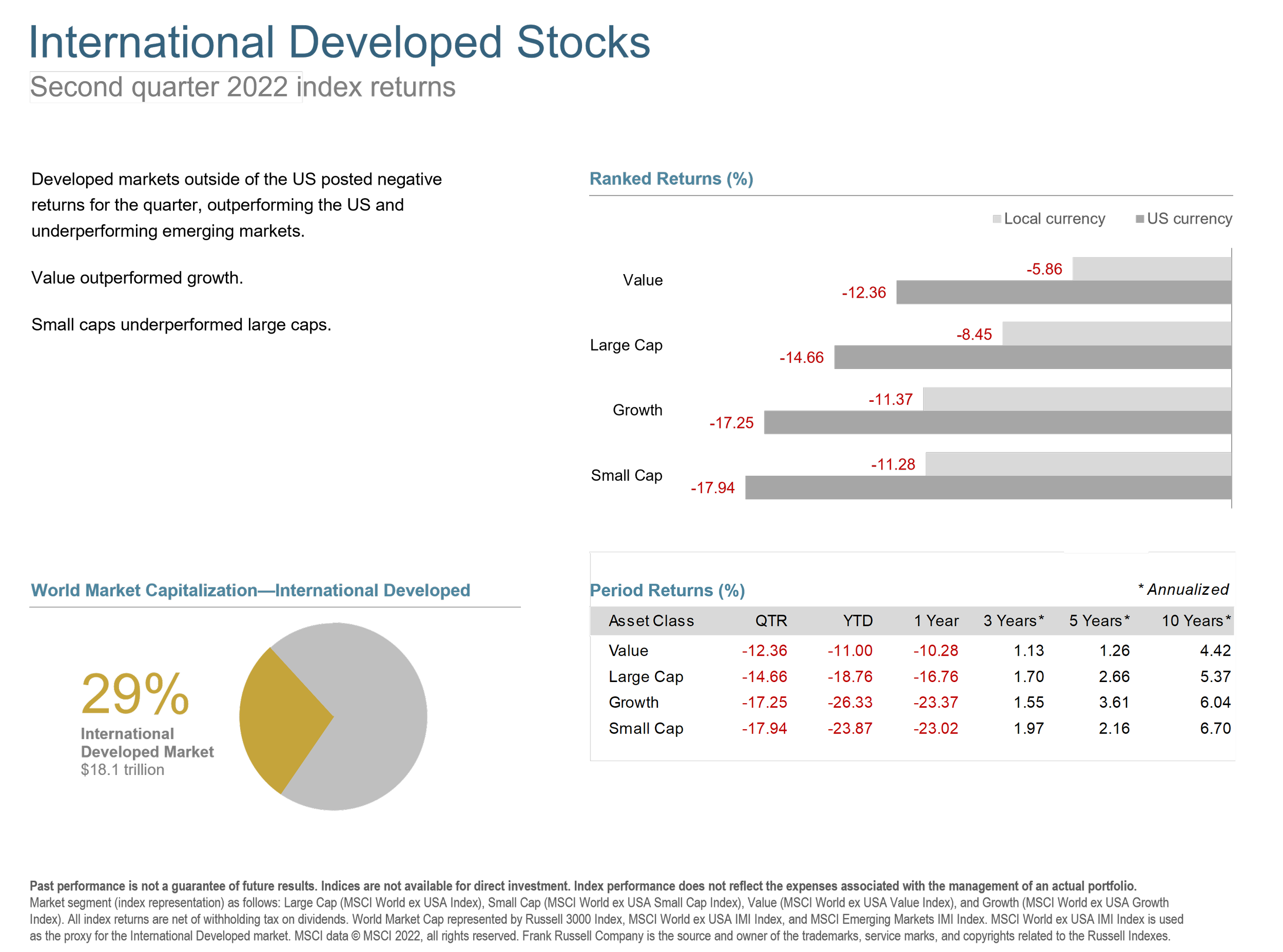

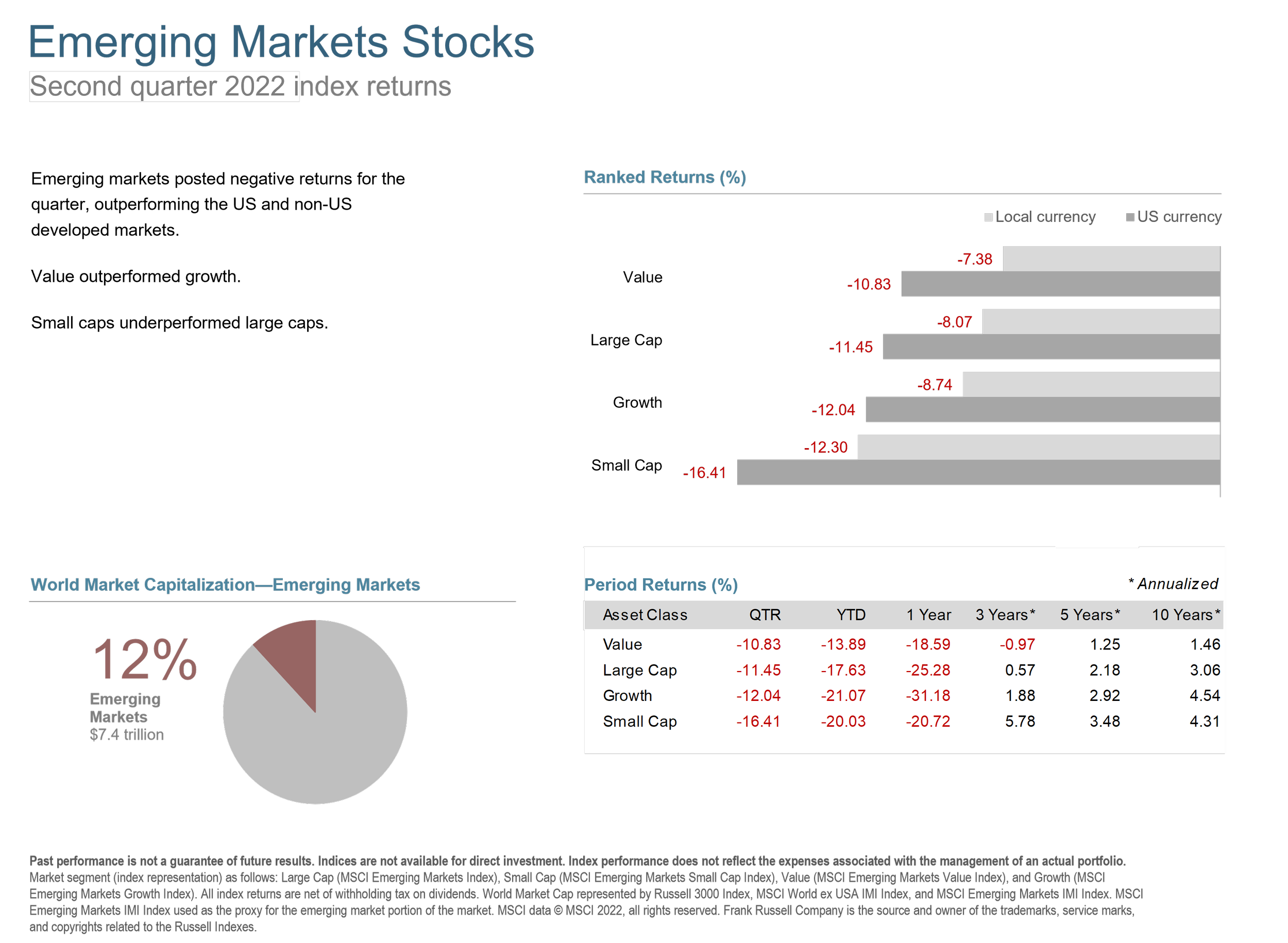

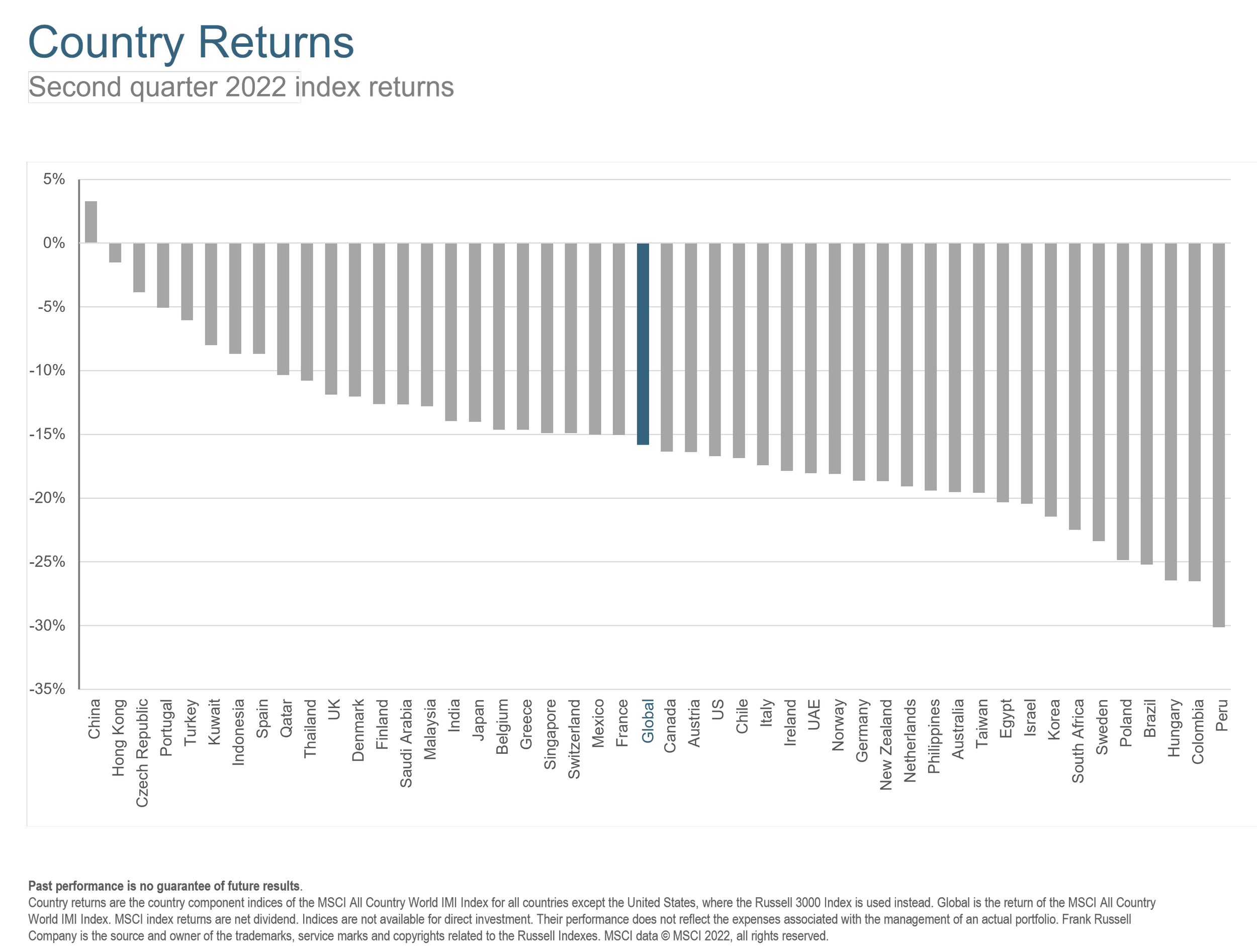

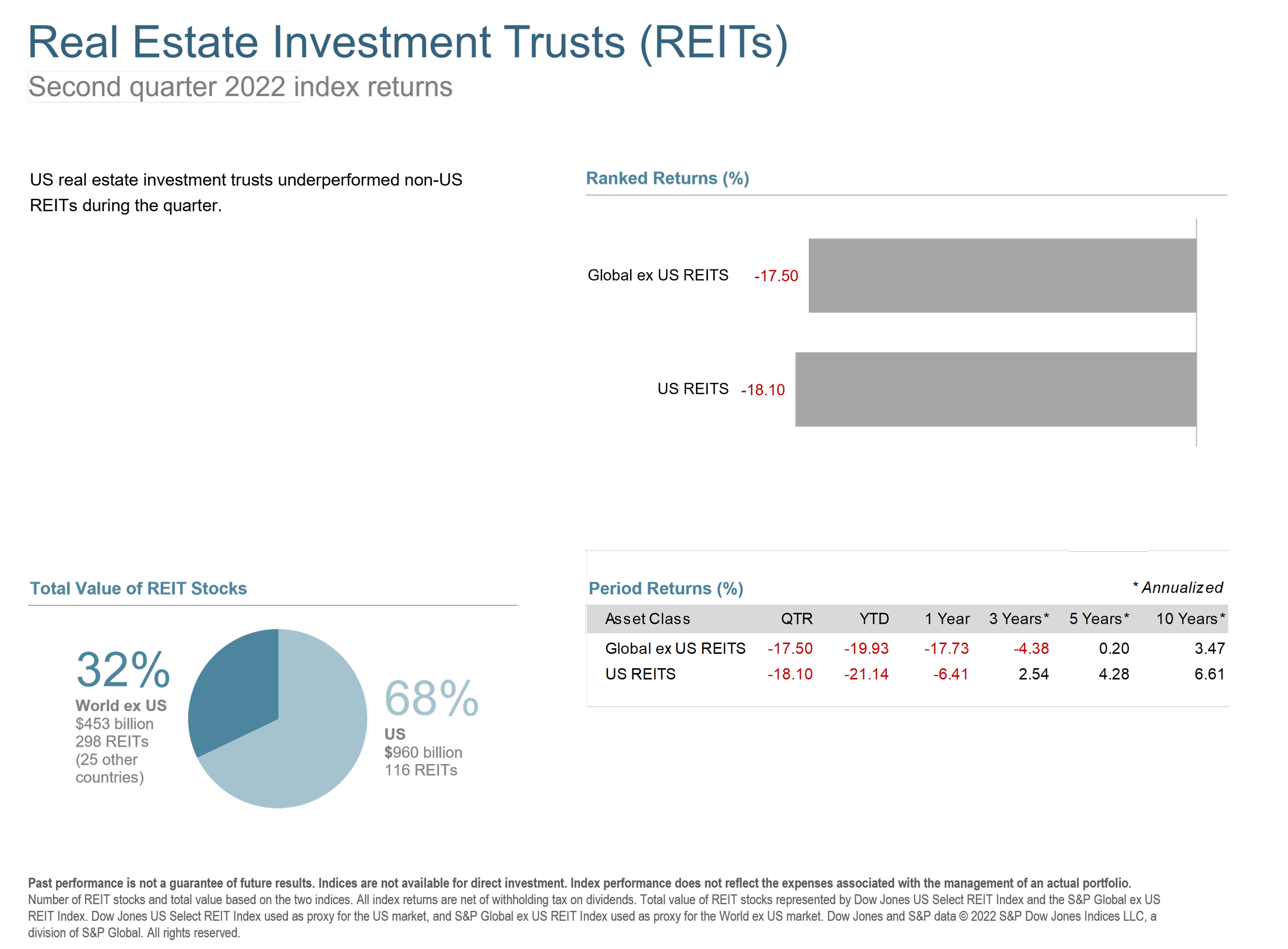

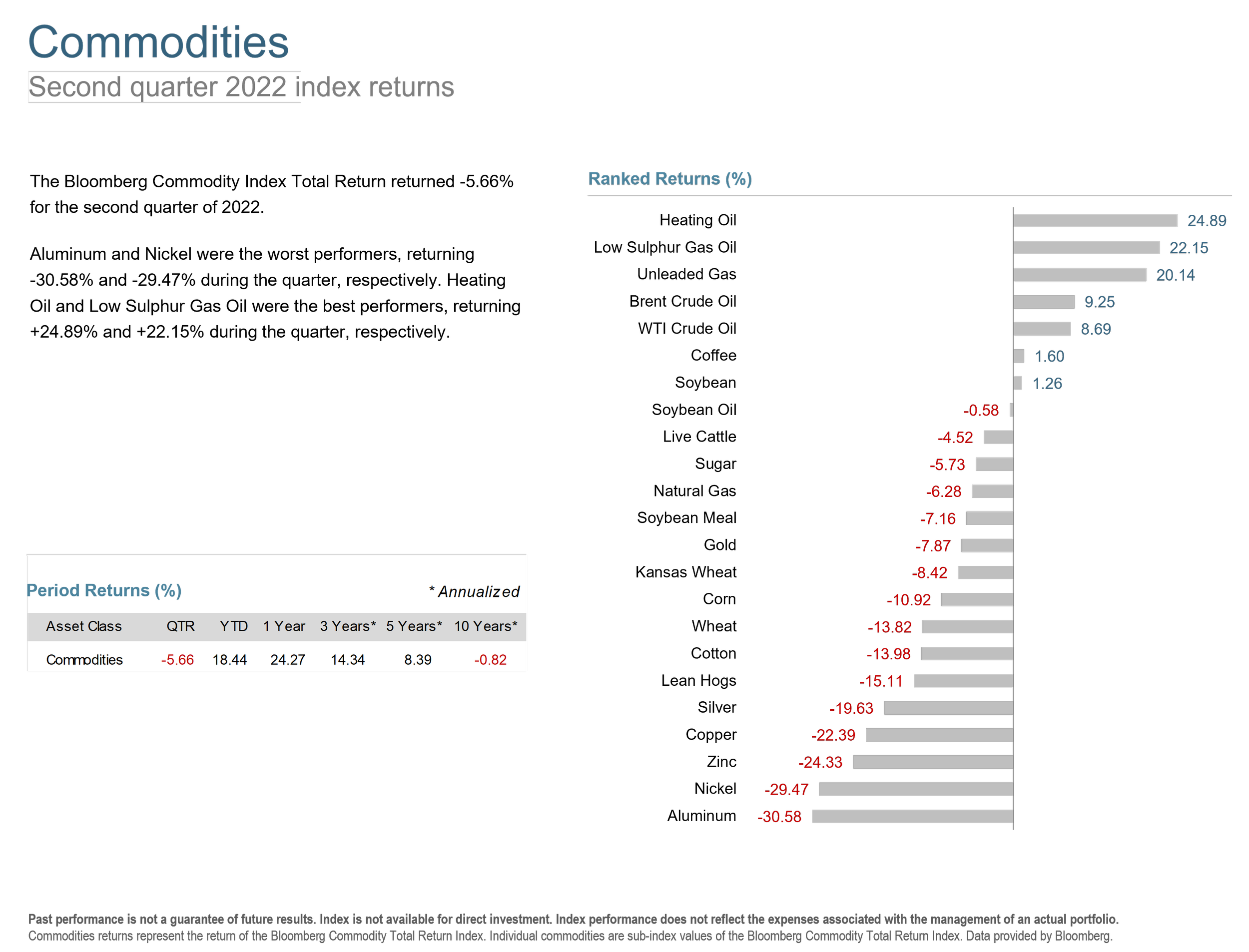

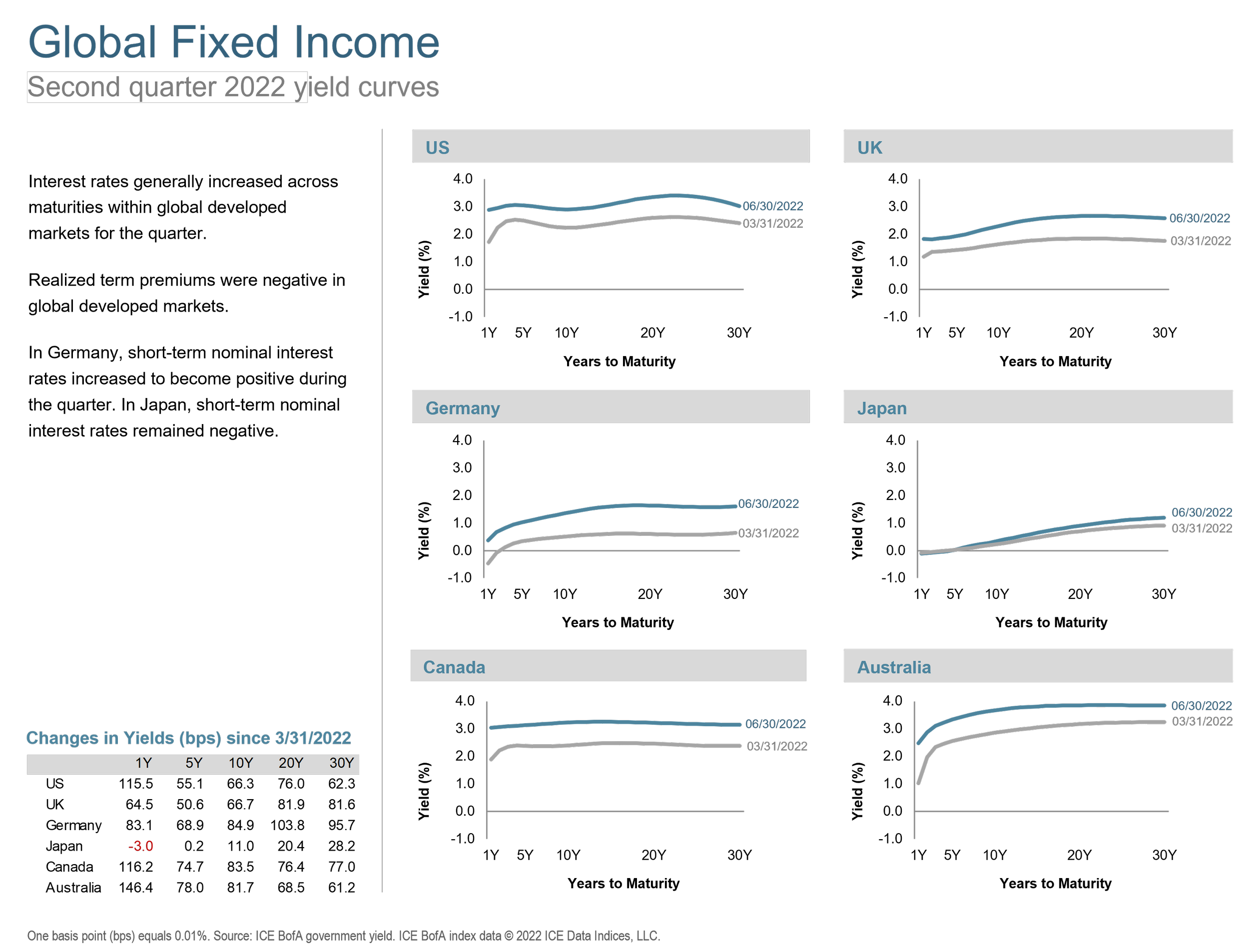

See the slides below for a review of Q2 2022.

Q2 reinforced the importance of having a long-term plan. Staying invested through turmoil is often easier said than done but understanding how volatility is likely to influence your plan’s success can go a long way towards managing our emotions.

With any market condition, a sound plan makes the ups and downs much more manageable. Get in touch to review your portfolio and plan.