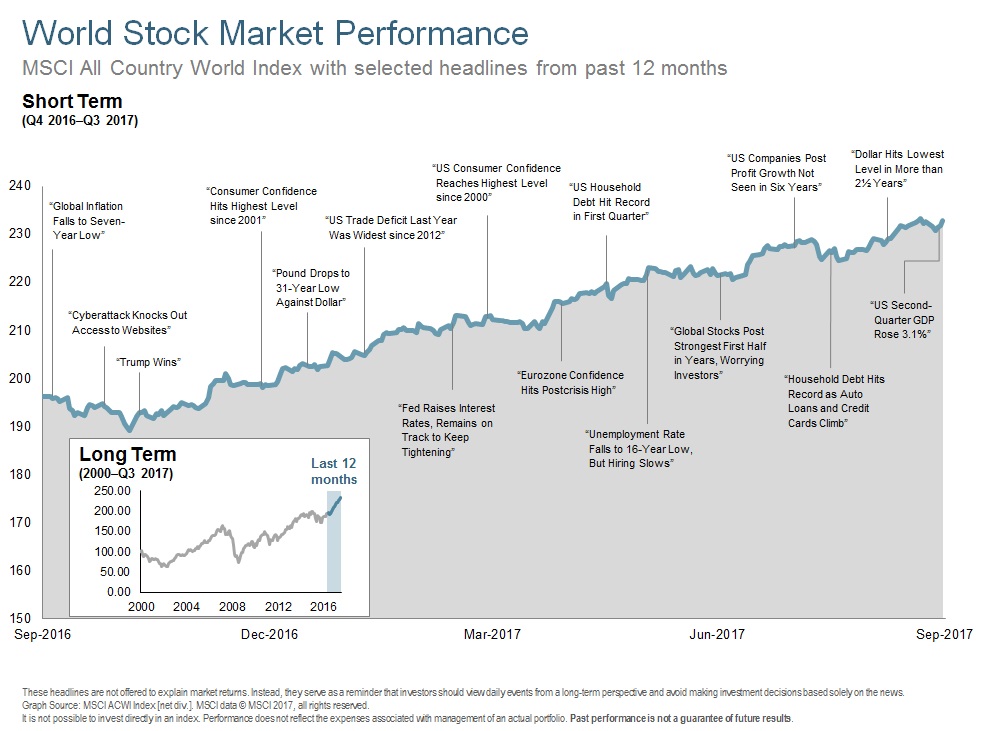

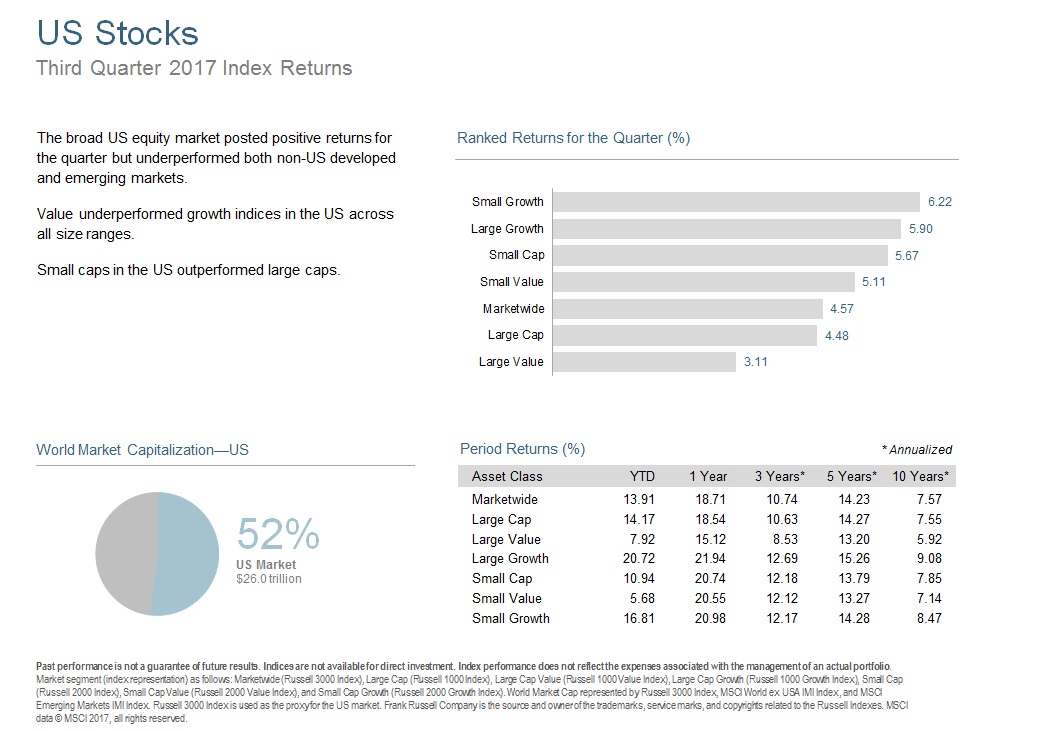

Fall is here, and while the leaves will be changing soon, the US stock market has seemingly been evergreen, posting its eighth consecutive quarter of positive returns. These gains have continued despite saber rattling from North Korea, two major hurricanes hitting the US mainland, a surprisingly gridlocked government, and even kneeling football players. We haven’t seen a winning streak this long since 1997, for those that are keeping track. The S&P 500 ended the quarter at a record high, as did the small cap Russell 2000 index. As the economy has expanded (3.1% GDP in Q2), growth stocks have outpaced value stocks while small stocks outperformed larger ones.

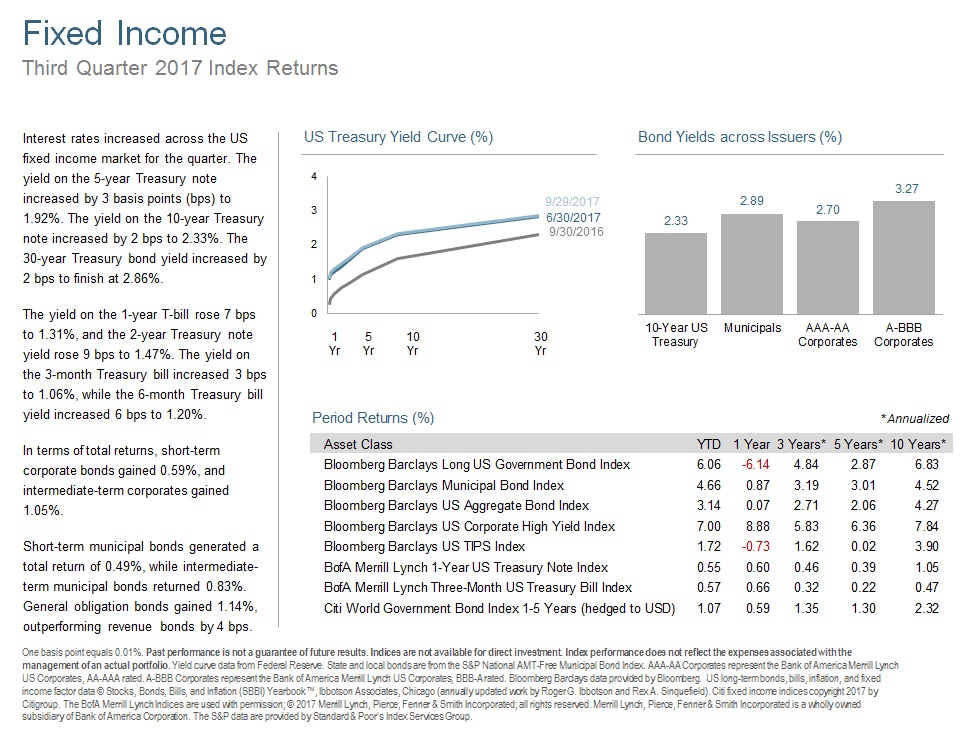

The Federal Reserve made no changes to monetary policy during the quarter but did announce that they would begin normalizing their balance sheet in October, by not reinvesting up to $10 billion of monthly interest and maturing principal. Expect more noise in Q4 as speculation increases on whether the FOMC will raise rates at their December meeting and who will replace Janet Yellen when her term expires next January.

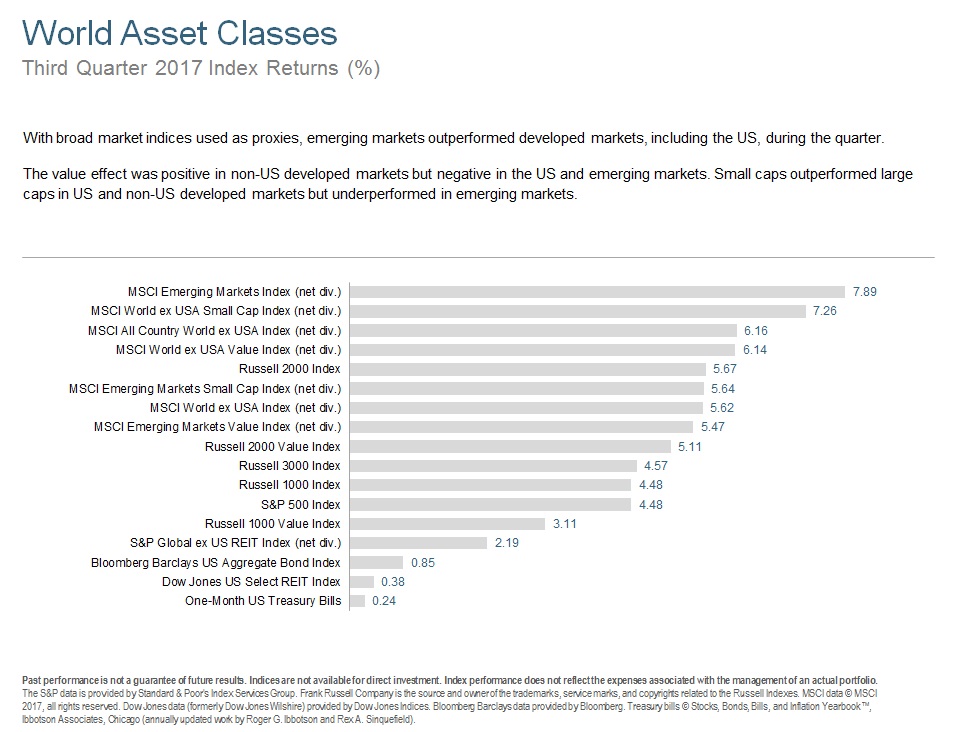

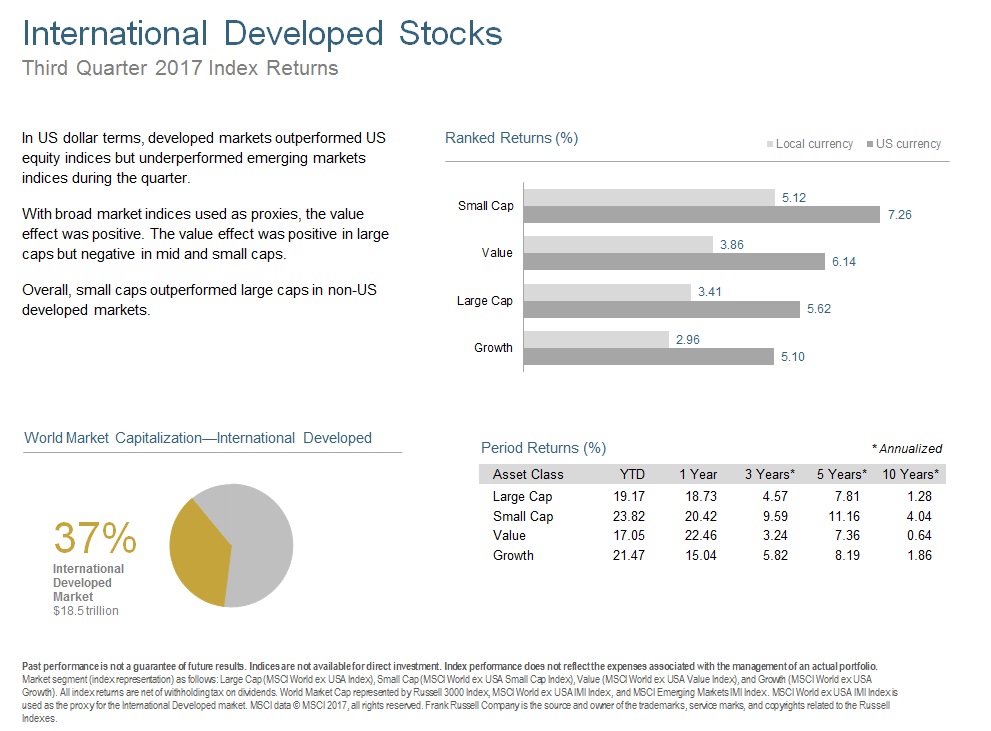

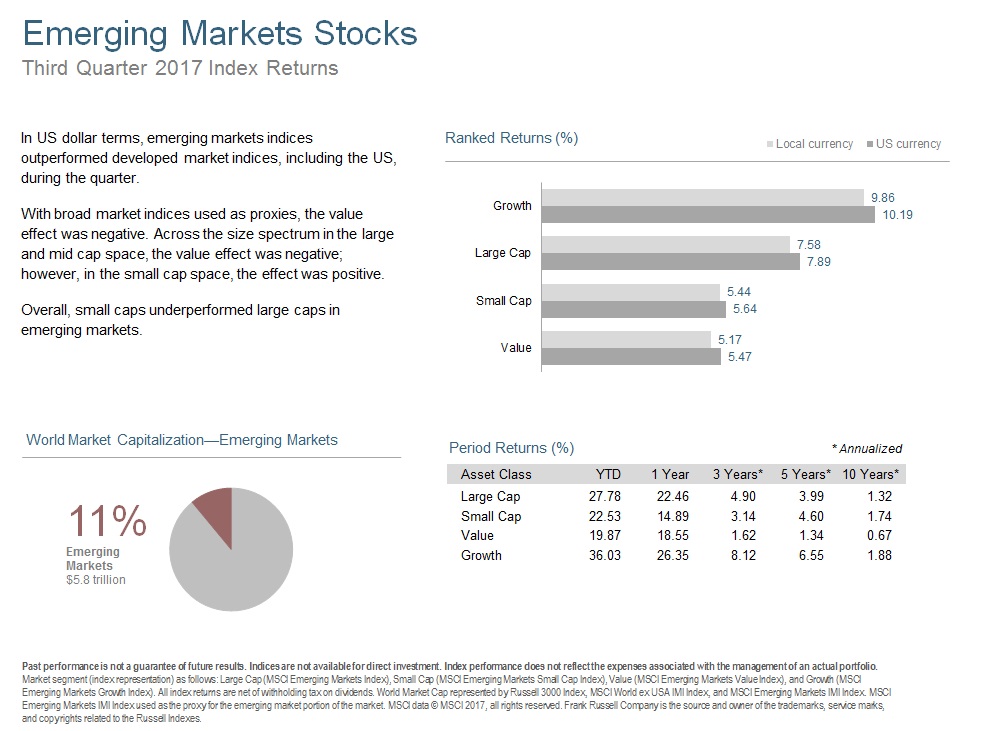

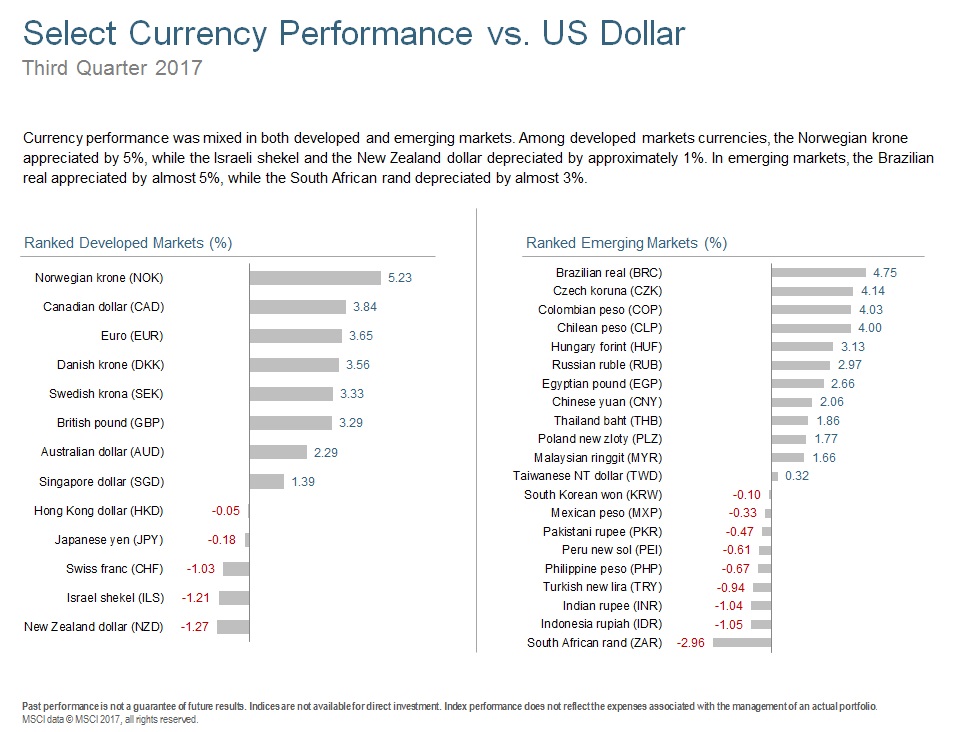

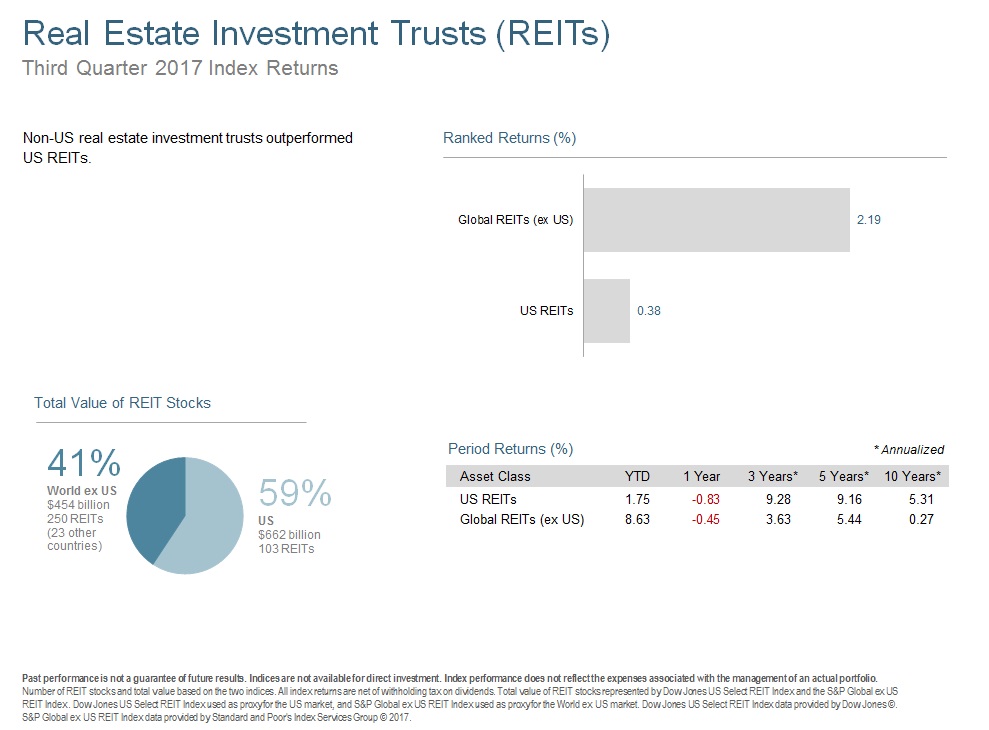

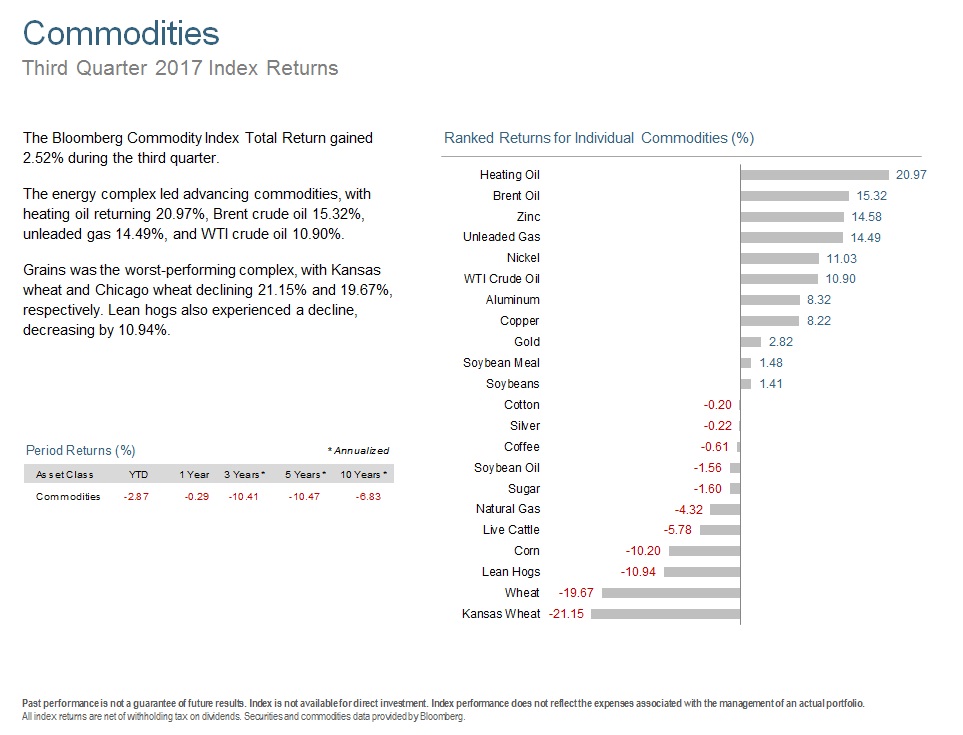

As good as domestic markets were, developed and emerging international markets were even better. Commodities and REITs, while positive, again were laggards. Bond yields were largely unchanged.

This has been a remarkable market. Maybe it is due to the Goldilocks economy of “just right” growth and low inflation? Perhaps it's the belief that a GOP Senate, House, and White House will finally agree on something (like tax reform)? Could it even be due to the average live weight price of turkeys? Every expert seems to have an explanation of why we keep going up. How many of them do you recall predicting this kind of bull run? Just keep in mind that markets seem to have a way of proving the largest number of people wrong at the most unexpected times.

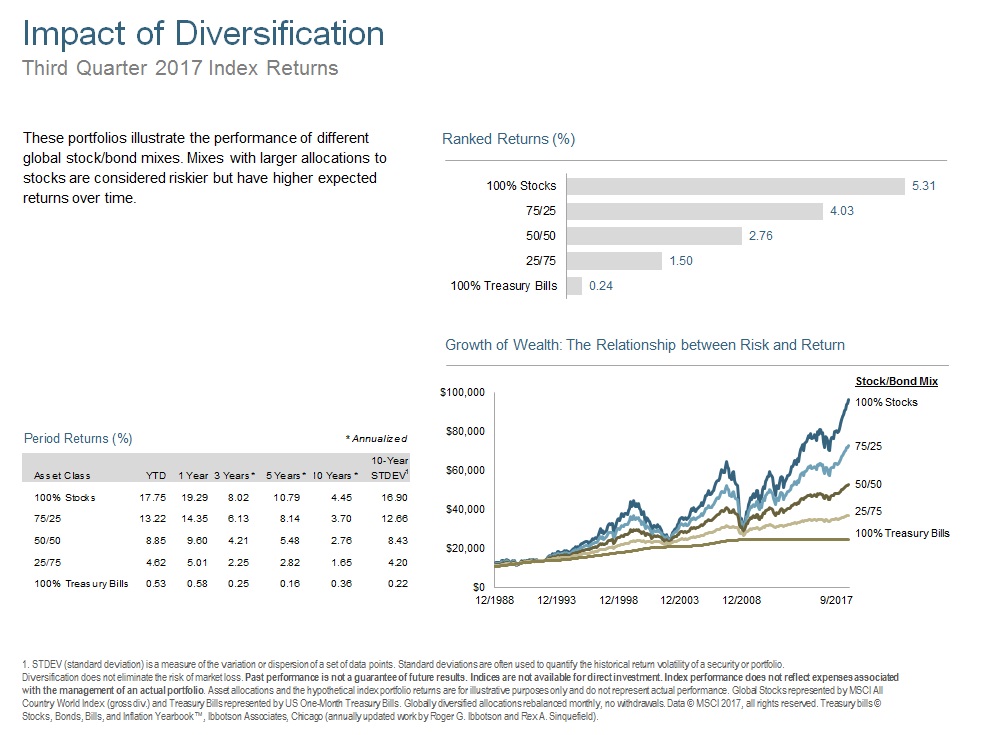

We’ll continue to hope, as we did at the end of Q2, that the next quarter produces another green screen in Q4. We’ll also continue to adjust portfolios that drift from their target allocations to keep clients in line with their capacity for risk while taking advantage of the benefits of diversification.

Sometimes I'm asked, "Why sell winners to buy less successful investments?" The answer is that having discipline when greed prevails is just as important as when fear rules the day. If you are feeling either emotion, it may be time to get together and do a portfolio review and/or discuss your financial plan. Otherwise, enjoy the Q3 2017 Market Review.