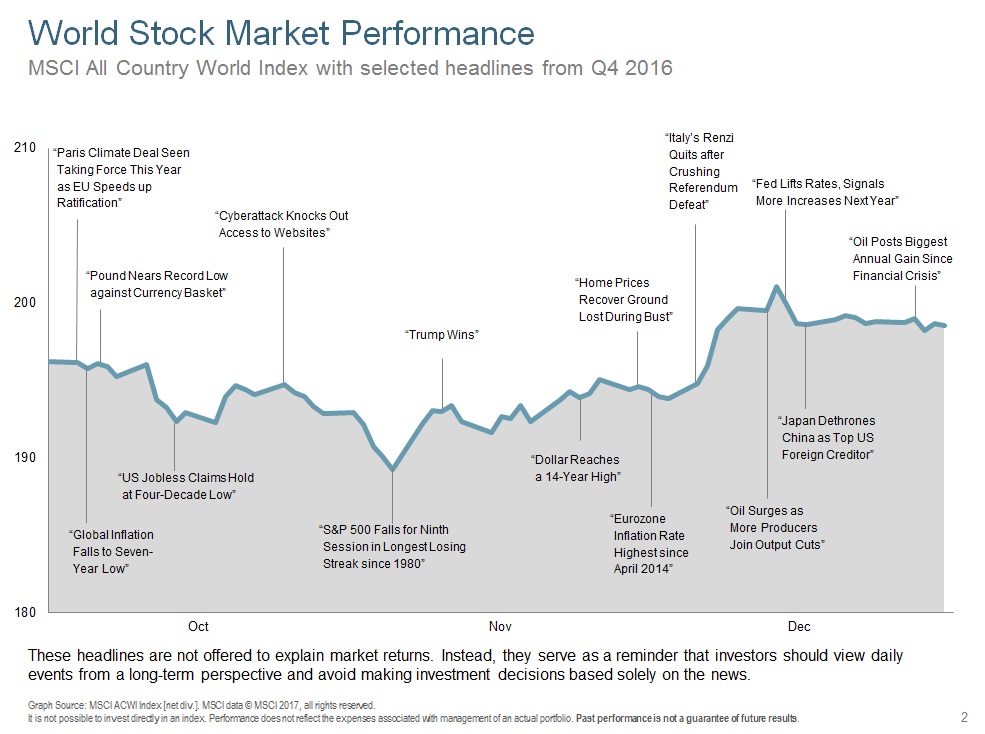

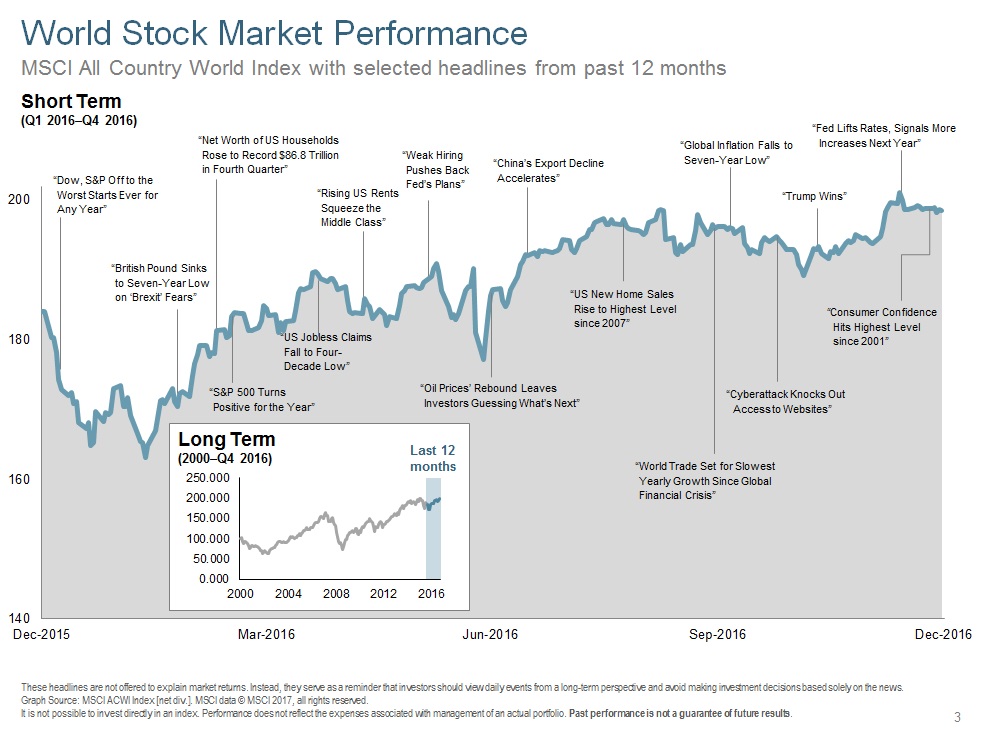

Donald J. Trump. Q4 2016 could be summed up in those three words. Just when it appeared that the presidential election was heading towards a certain victory for Secretary Clinton, the electorate delivered a punch to the nose of most pollsters (and Democrats). Initially, it also appeared that the unexpected outcome would deal a major blow to US stock markets, with overnight futures on election night dropping precipitously before rallying to close higher on the day after the vote.

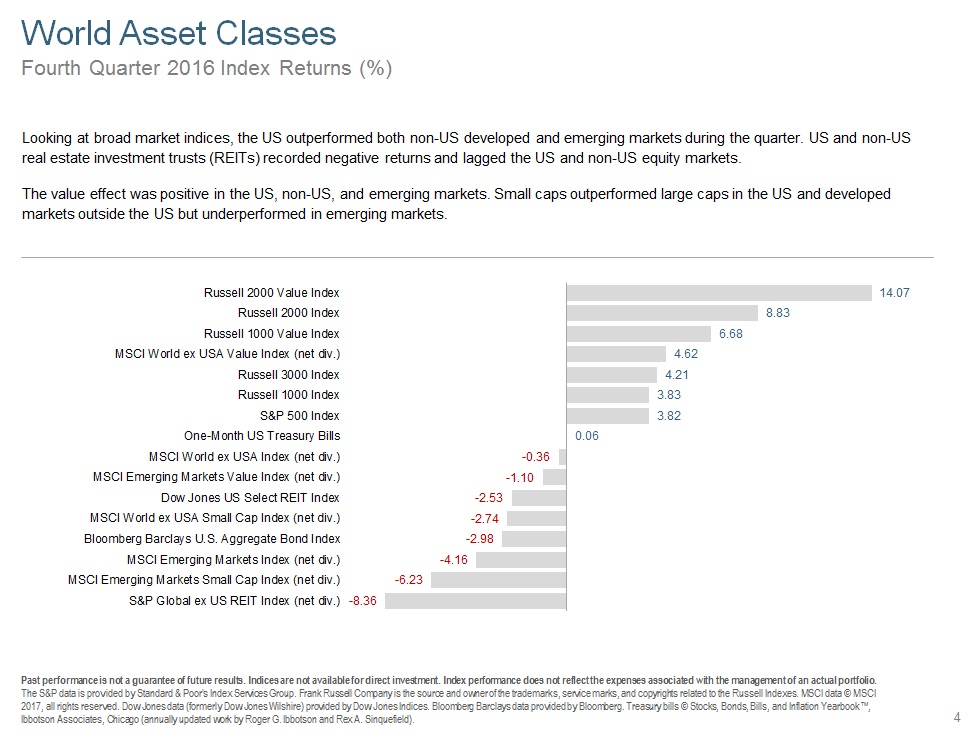

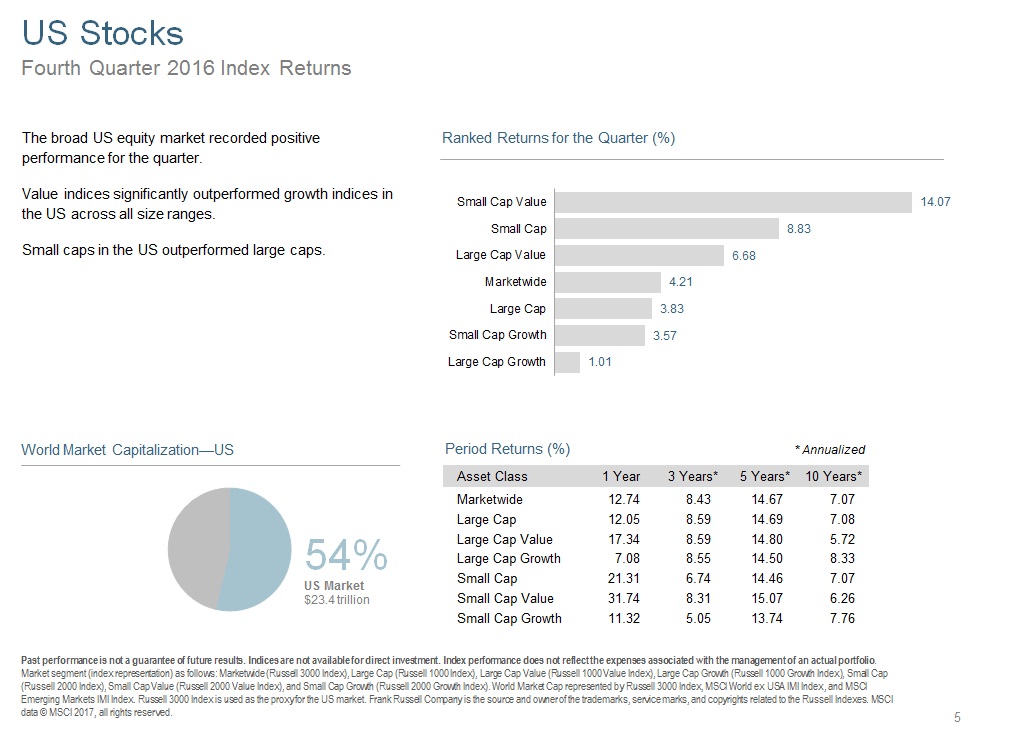

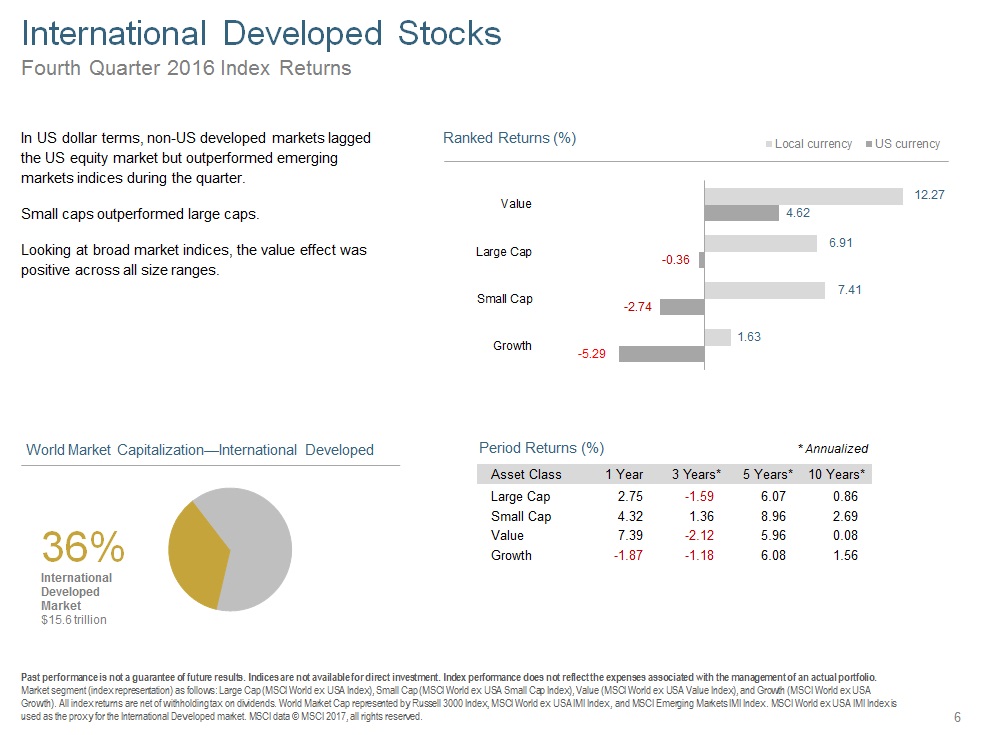

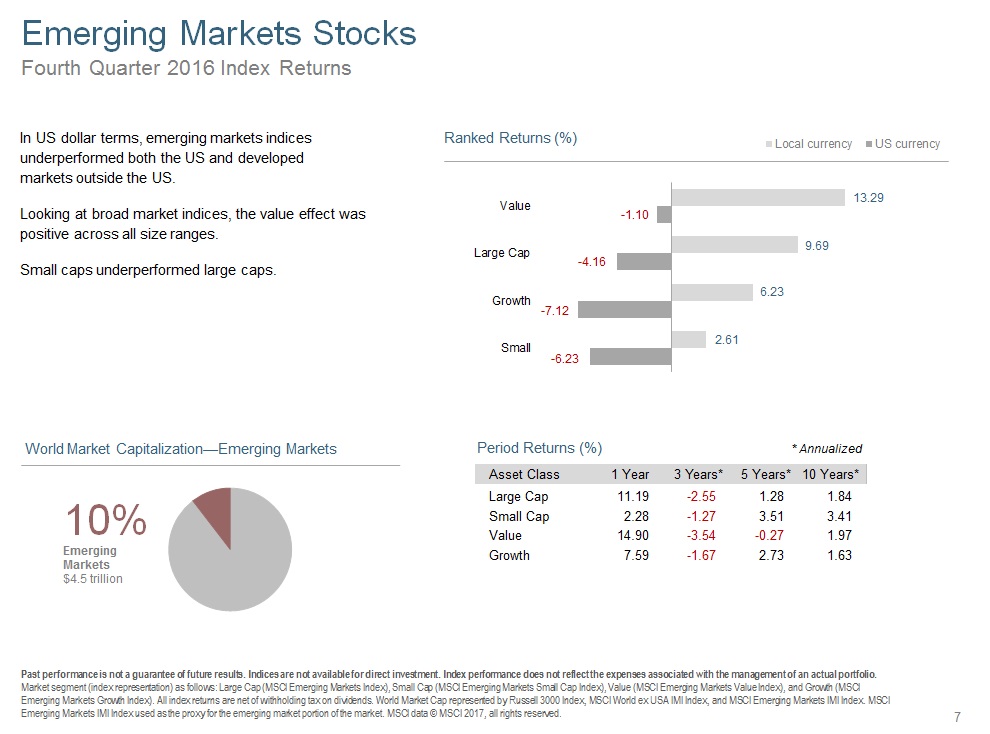

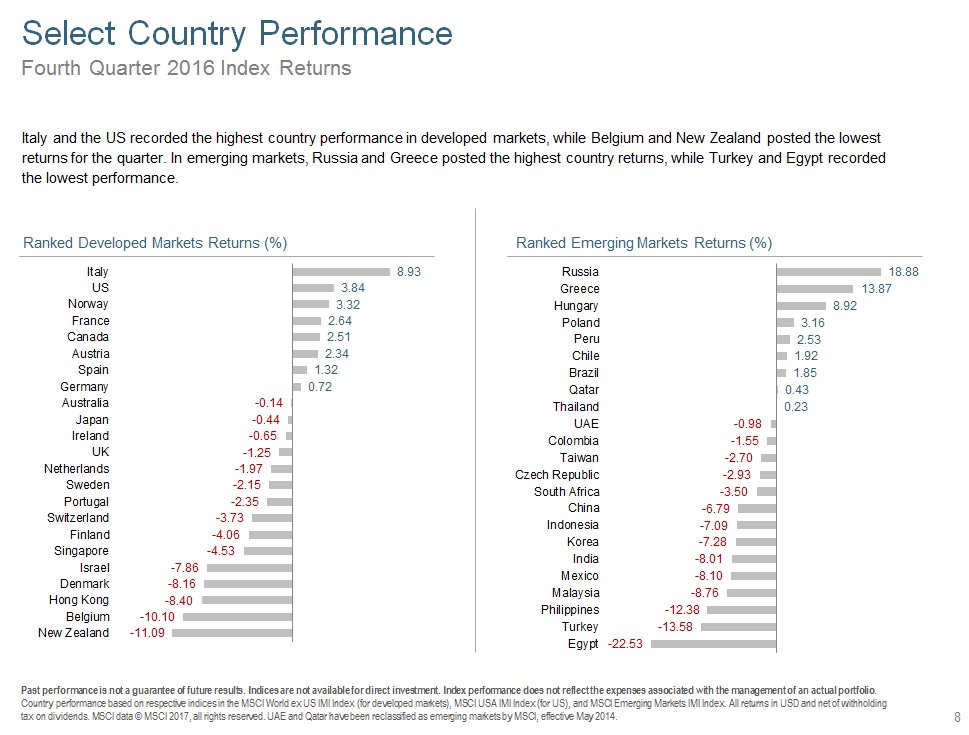

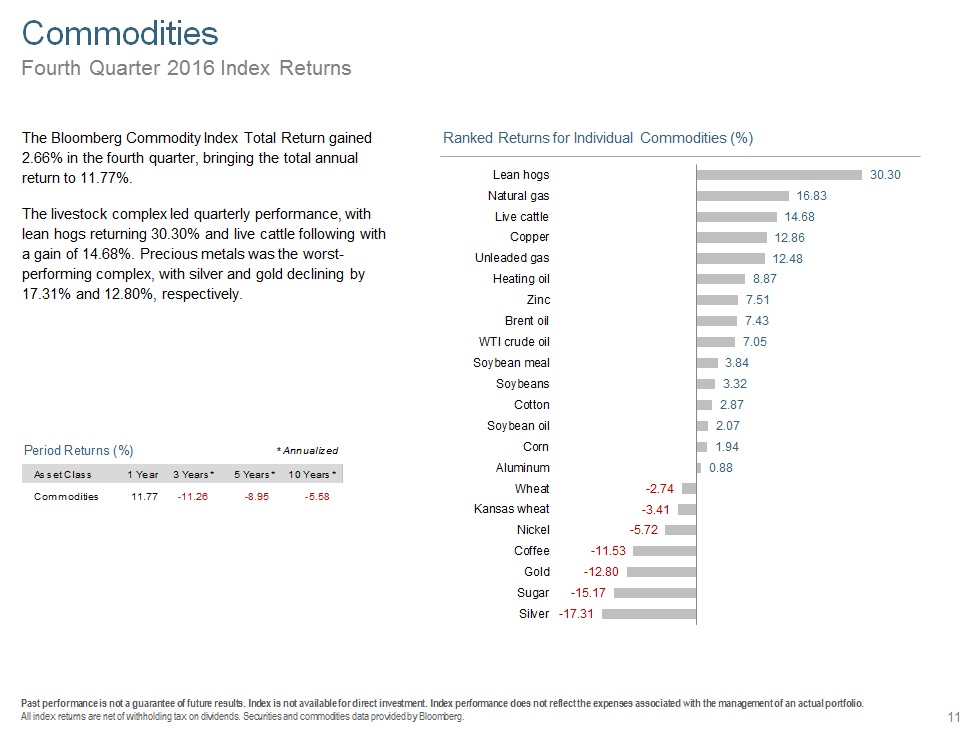

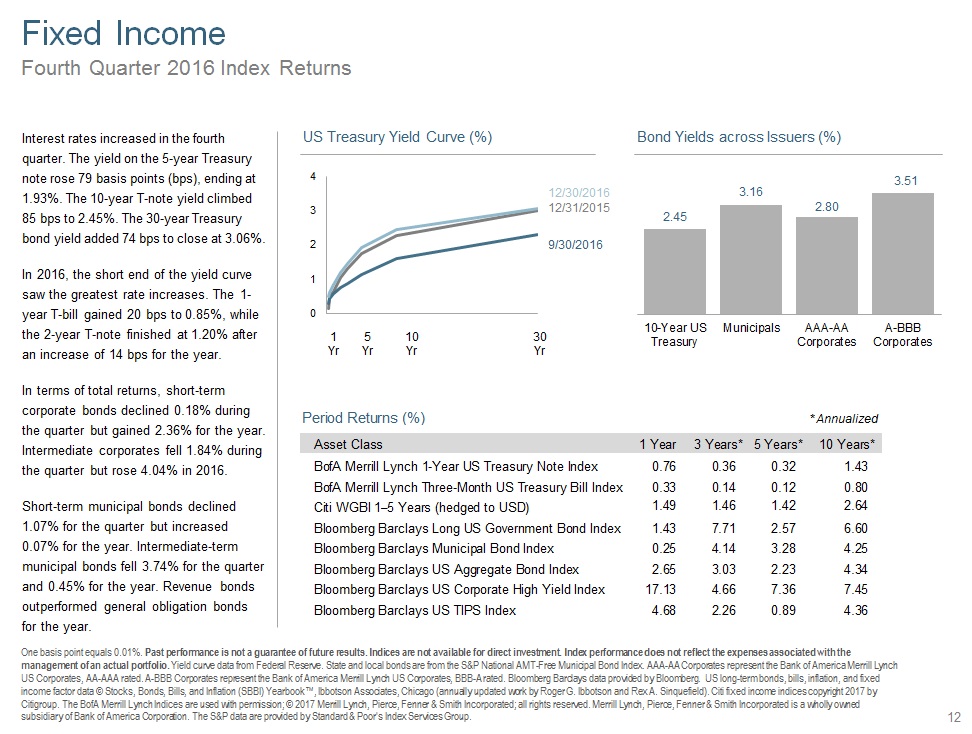

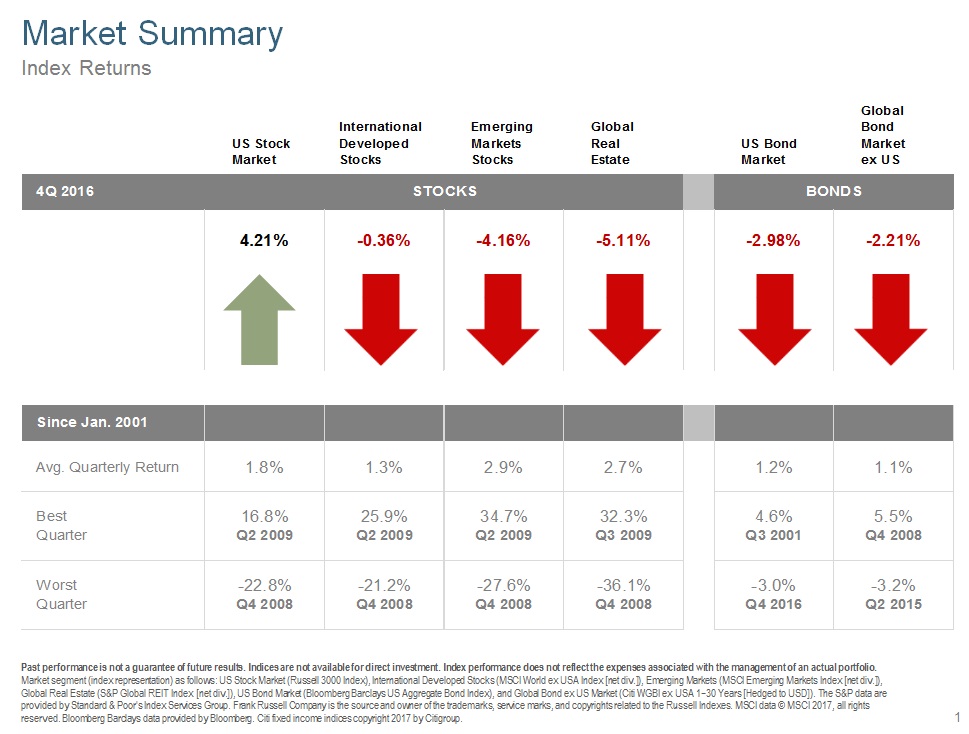

Despite the headwinds created by the Federal Reserve raising their benchmark interest rate and signaling more on the way, the US stock markets roared to new highs while developed international stock markets and emerging markets lagged. Commodities had a positive return overall even with precious metals declining significantly.

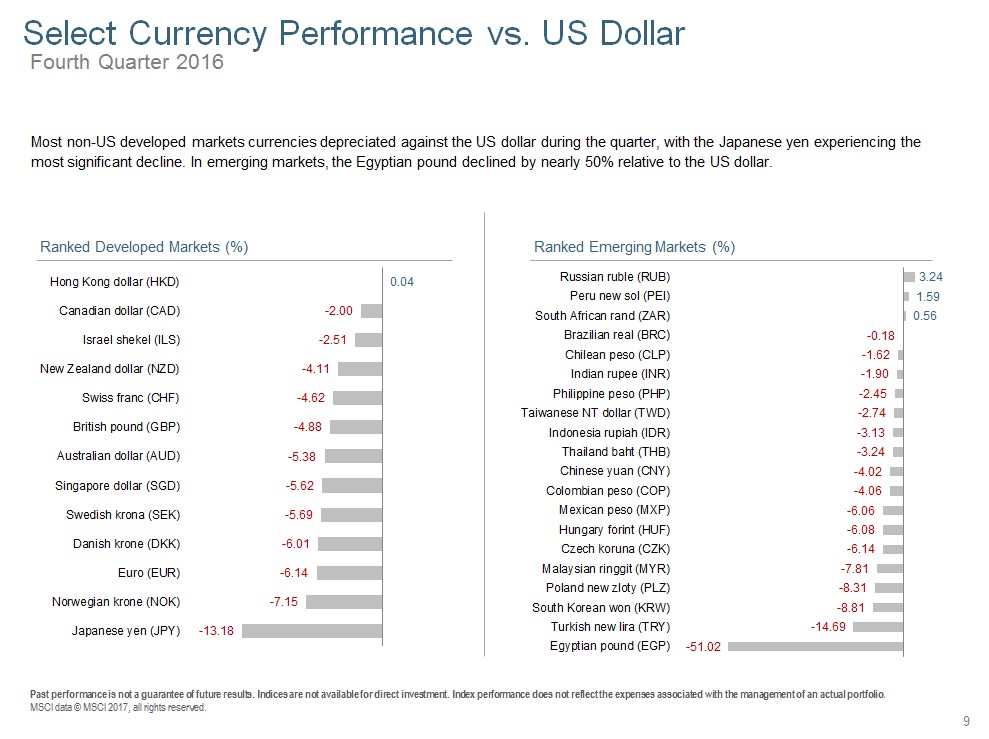

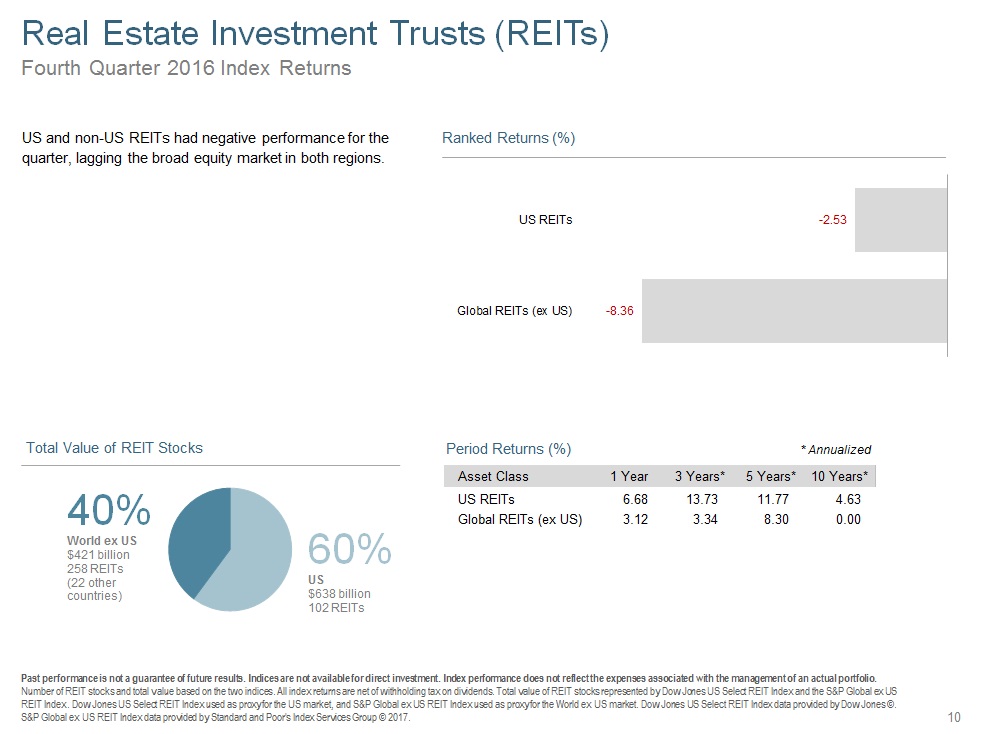

Fixed income markets and REITs had negative returns in the quarter, with the rising dollar exacerbating the losses of those denominated in foreign currencies. Municipal bonds performed worse than corporate or government bonds.

US Small cap stocks and value stocks were the star performers. The Russell 2000 Value Index, which tracks small company value stocks, outpaced the overall US market Russell 3000 Index by nearly 10%! This was a great example of how unexpectedly and dramatically the premiums from small cap and value investing can appear.

Within the US market, there has been a lot of turbulence under the surface as active investors have sold stocks from sectors that are thought to be less attractive during a Trump presidency or when interest rates are rising. There is a great deal of discussion and concern in the press about what assets and sectors should be bought or sold due to the anticipated fiscal and economic policies we may see under the new administration.

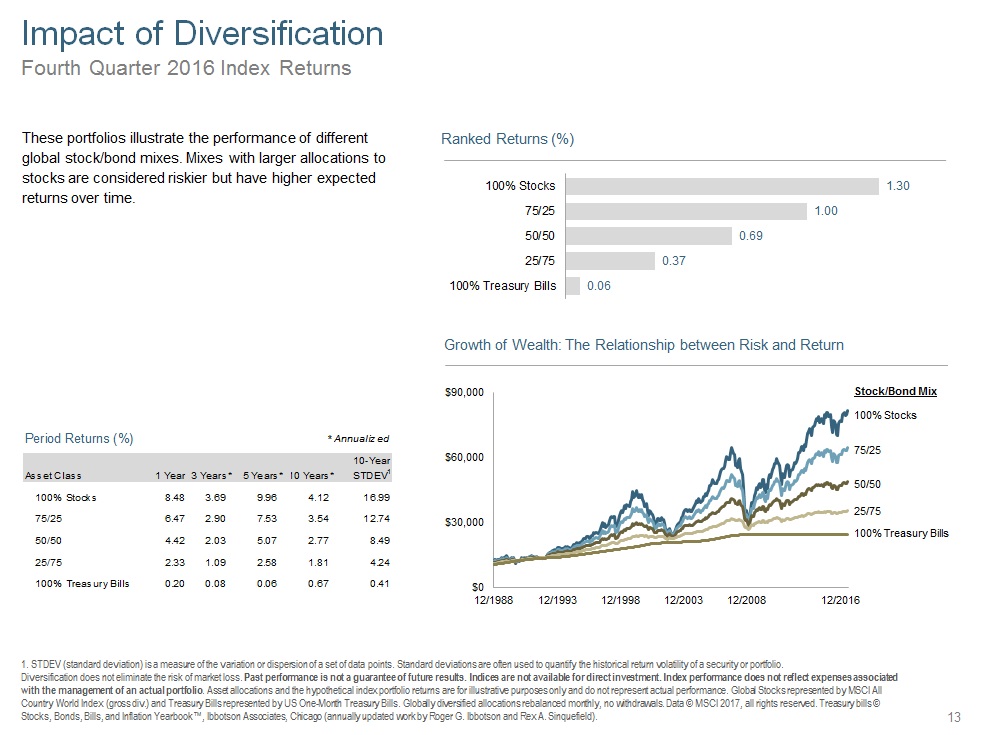

We choose to address these concerns by making asset allocation decisions based on your goals and risk tolerance, not the current wind direction. It's also worth remembering that when you buy the whole market, such as we do in our Accountable Portfolios, worries about what sectors are coming in or out of favor can be set aside.

The Q4 2016 Market Review consists of a dozen slides that summarize performance of a wide range of asset classes. Next week, I’ll share a recap of 2016.