CONCLUSION

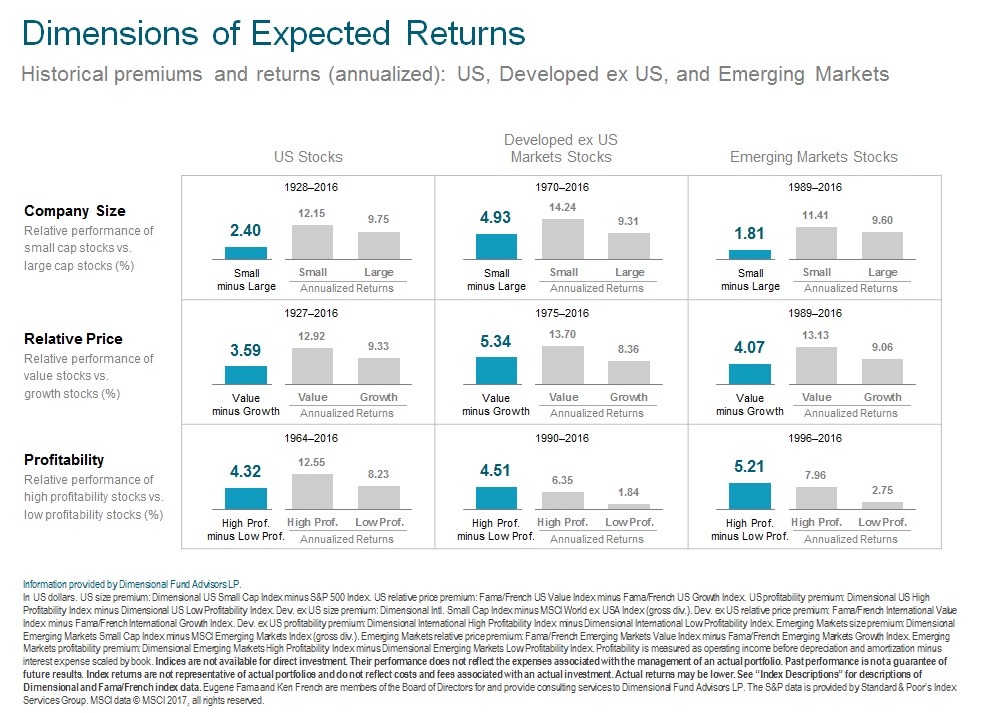

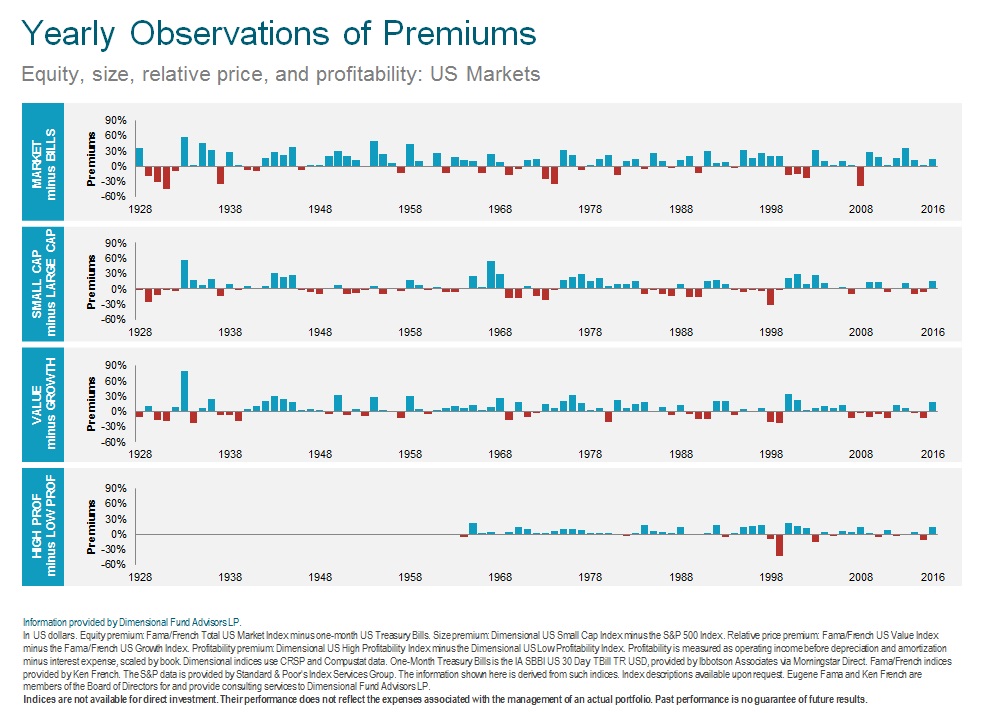

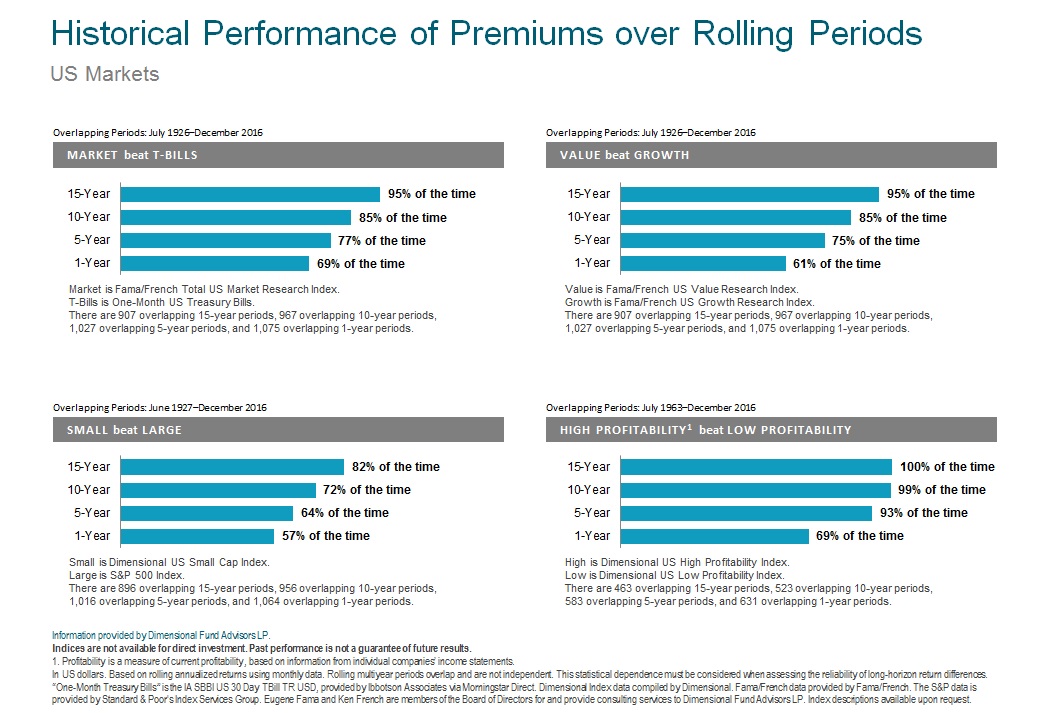

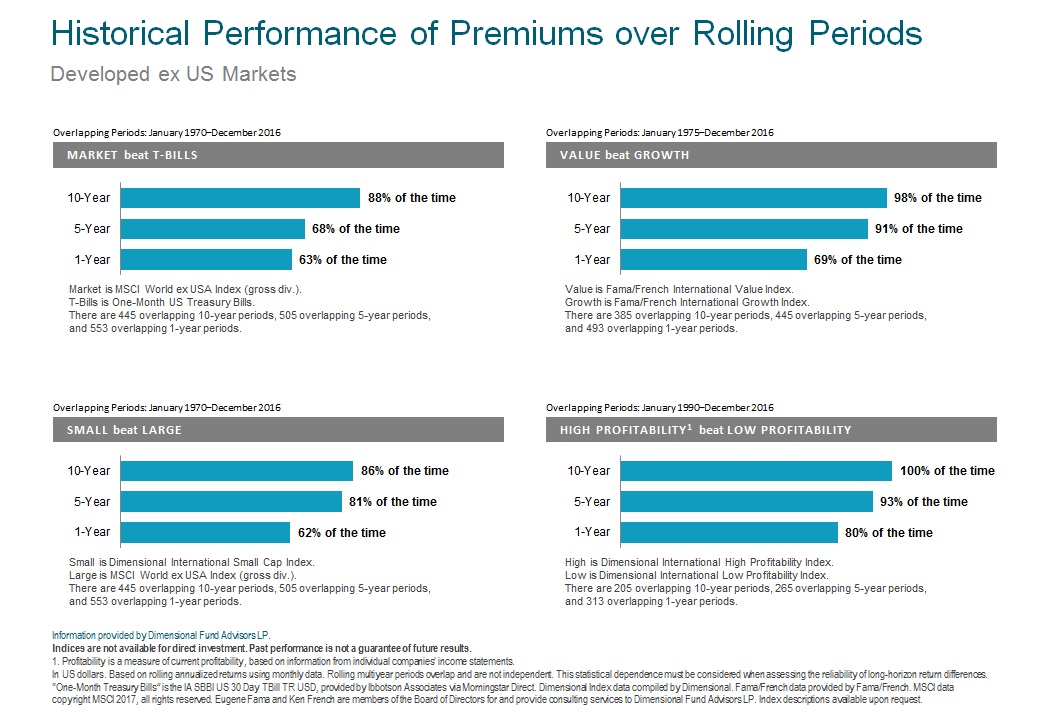

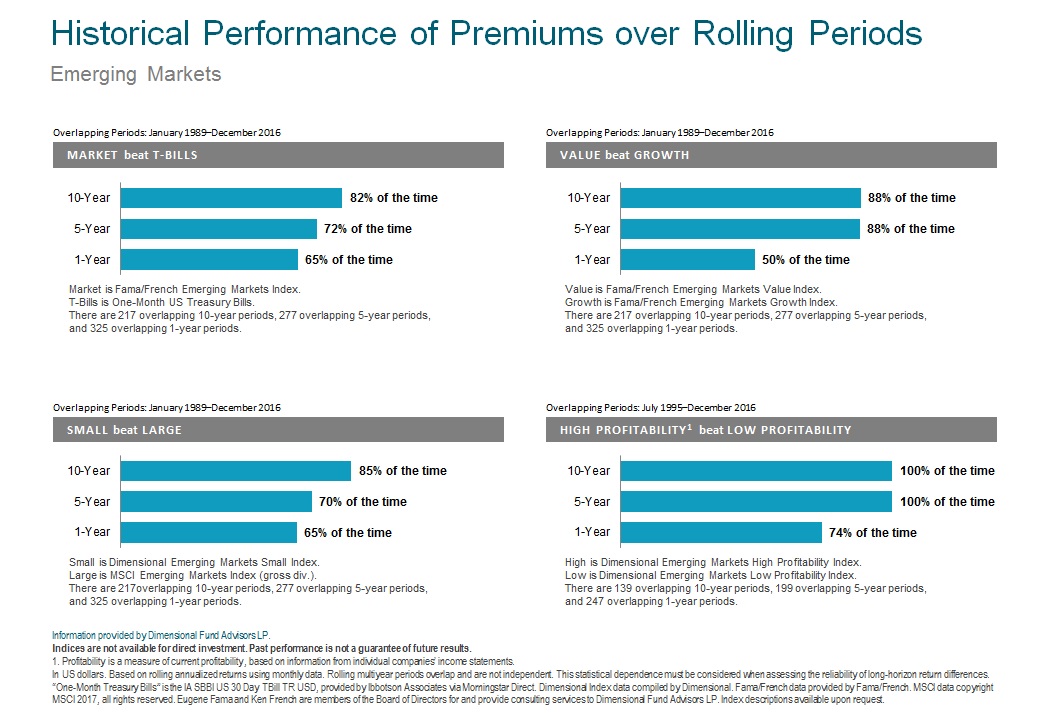

In summary, there are differences in expected returns across stocks. Variables that tell us what an investor has to pay (market prices) and what they expect to receive (book equity and future profits) contain information about those expected returns. All else equal, the lower the price relative to book value and the higher the expected profitability, the higher the expected return.

What Dimensional has learned from its own work and the work of Professors Fama, French, Novy-Marx, and Wahal, as well as others, is that current profitability has information about expected profitability. This information can be used in tandem with variables like market capitalization or price-to-book ratios to extract the differences in expected returns embedded in market prices. As such, it allows investors to increase the expected return potential of their portfolio without trying to outguess market prices.

[1]. Eugene Fama and Kenneth French, “Profitability, Investment, and Average Returns,” Journal of Financial Economics, vol. 82 (2006), 491–518.

[2]. G. William Schwert and Renè Stulz, “Gene Fama’s Impact: A Quantitative Analysis,” (working paper, Simon Business School, 2014, No. FR 14-17).

[3]. Robert Novy-Marx, “The Other Side of Value: The Gross Profitability Premium,” Journal of Financial Economics, vol. 108 (2013), 1–28.

[4]. Sunil Wahal, “The Profitability and Investment Premium: Pre-1963 Evidence,” (December 29, 2016). Available at SSRN: ssrn.com/abstract=2891491.

GLOSSARY

Book Value of Equity: The value of stockholder’s equity as reported on a company’s balance sheet.

Discount Rate: Also known as the “required rate of return” this is the expected return investors demand for holding a stock.

Out-of-sample: A time period not included or directly examined in the data series used in a statistical analysis.

Market Microstructure: The examination of how markets function in a fine level of detail, this can include areas of inquiry such as: how traders interact, how security orders are placed and cleared and how information is relayed and priced.

Empirical Asset Pricing: A field of study that uses theory and data to understand how assets are priced.

Profitability Premium: The return difference between stocks of companies with high profitability over those with low profitability.

Realized Profitability Premium: The realized, or actual, return difference in a given time period between stocks of companies with high profitability over those with low profitability.

INDEX DESCRIPTIONS

Dimensional US Low Profitability Index was created by Dimensional in January 2014 and represents an index consisting of US companies. It is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three low-profitability subgroups. It is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: CRSP and Compustat.

Dimensional US High Profitability Index was created by Dimensional in January 2014 and represents an index consisting of US companies. It is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three high-profitability subgroups. It is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: CRSP and Compustat.

Dimensional International Low Profitability Index was created by Dimensional in January 2013 and represents an index consisting of non-US developed companies. It is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization of each eligible country. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three low-profitability subgroups. The index is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: Bloomberg.

Dimensional International High Profitability Index was created by Dimensional in January 2013 and represents an index consisting of non-US developed companies. It is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization of each eligible country. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three high-profitability subgroups. The index is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: Bloomberg.

Dimensional Emerging Markets Low Profitability Index was created by Dimensional in April 2013 and represents an index consisting of emerging markets companies and is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization of each eligible country. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three low-profitability subgroups. The index is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: Bloomberg.

Dimensional Emerging Markets High Profitability Index was created by Dimensional in April 2013 and represents an index consisting of emerging markets companies and is compiled by Dimensional. Dimensional sorts stocks into three profitability groups from high to low. Each group represents one-third of the market capitalization of each eligible country. Similarly, stocks are sorted into three relative price groups. The intersections of the three profitability groups and the three relative price groups yield nine subgroups formed on profitability and relative price. The index represents the average return of the three high-profitability subgroups. The index is rebalanced twice per year. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Source: Bloomberg.

Source: Dimensional Fund Advisors LP.

The Dimensional Indices have been retrospectively calculated by Dimensional Fund Advisors LP and did not exist prior to their index inceptions dates. Accordingly, results shown during the periods prior to each Index’s index inception date do not represent actual returns of the Index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

There is no guarantee investment strategies will be successful. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Eugene Fama is a member of the Board of Directors for and provides consulting services to Dimensional Fund Advisors LP. He is a professor of finance at the University of Chicago, Booth School of Business. In 2013, he received a Nobel Prize for his work on securities markets.

Ken French is a member of the Board of Directors for and provides consulting services to Dimensional Fund Advisors LP. He is a professor of finance at the Tuck School of Business at Dartmouth College.

Robert Novy-Marx provides consulting services to Dimensional Fund Advisors LP. He is a professor of finance at the University of Rochester, Simon Business School.

Sunil Wahal provides consulting services to Dimensional Fund Advisors LP. He is a professor of finance at Arizona State University, Carey School of Business.

[1]. Eugene Fama and Kenneth French, “Profitability, Investment, and Average Returns,” Journal of Financial Economics, vol. 82 (2006), 491–518.

[2]. G. William Schwert and Renè Stulz, “Gene Fama’s Impact: A Quantitative Analysis,” (working paper, Simon Business School, 2014, No. FR 14-17).

[3]. Robert Novy-Marx, “The Other Side of Value: The Gross Profitability Premium,” Journal of Financial Economics, vol. 108 (2013), 1–28.

[4]. Sunil Wahal, “The Profitability and Investment Premium: Pre-1963 Evidence,” (December 29, 2016). Available at SSRN: ssrn.com/abstract=2891491.