“Predicting rain doesn’t count, building arks does.”

-Warren Buffet

3 Ways to Avoid 9 Mistakes

Yesterday, the Dow Jones Industrial Average fell 1.2%, the S&P 500 shed 1.5%, and the Nasdaq Composite dropped 1.9%. It marked the end of a 63-day stretch where volatility has been remarkably absent. In fact, the last time we saw a streak of trading days with fewer 1% moves in either direction was in 1995.

Whether this is the start of a new period of increased volatility, or just a temporary blip on the screen, the tendency can be to react. That’s why it can be helpful to also study the history of mistakes that investors tend to make and the lessons we have learned.

Back in 2010, the Library of Congress’s Federal Research Division prepared a report titled Behavioral Patterns and Pitfalls of US Investors. The report identified common investment mistakes as cited by academics and professionals across several fields including business, economics, finance, psychology, and sociology.

The report identified nine common mistakes, which were also used as the basis for an Investor Bulletin from the SEC in 2014. The good news is that I think you can avoid making all nine of these mistakes in three relatively easy ways.

First, let's look at the mistakes.

The Mistakes

- Active Trading: An investor using an active trading investment strategy engages in regular, ongoing buying and selling of investments. This kind of investor purchases investments and continuously monitors their activities in order to take advantage of profitable conditions in the market. The Report concludes that active trading generally results in the underperformance of an investor’s portfolio.

- Disposition Effect: The disposition effect is the tendency of an investor to hold on to losing investments too long and sell winning investments too soon. In the months following the sale of winning investments, these investments often continue to outperform the losing investments still held in the investor’s portfolio.

- Focusing on Past Performance of Mutual Funds and Ignoring Fees: When deciding to purchase shares in a mutual fund, the Report indicates that some investors focus primarily on the mutual fund’s past annualized returns and tend to disregard the fund’s expense ratios, transaction costs, and load fees, despite the harm these costs and fees can do to their investment returns.

- Familiarity Bias: Familiarity bias refers to the tendency of an investor to favor investments from the investor’s own country, region, state or company. Familiarity bias also includes an investor’s preference for “glamour investments;” that is, well-known and/or popular investments. Familiarity bias may cause an investor’s portfolio to be inadequately diversified, which can increase the portfolio’s risk exposure.

- Manias and Panics: Financial “mania” or a “bubble” is the rapid rise in the price of an investment, reflecting a high degree of collective enthusiasm or exuberance regarding the investment’s prospects. This rapid rise is usually followed by a contraction in the investment’s price. The contraction, or “panic” occurs when there is wide-scale selling of the investment that causes a sharp decline in the investment’s price.

- Momentum Investing: An investor using a momentum investing strategy seeks to capitalize on the continuance of existing trends in the market. A momentum investor believes that large increases in the price of an investment will be followed by additional gains and vice versa for declining values.

- Naïve Diversification: Naïve diversification occurs when an investor, given a number of investment options, chooses to invest equally in all of these options. While this strategy may not necessarily result in diminished performance, it may increase the risk exposure of an investor’s portfolio depending upon the risk level of each investment option.

- Noise Trading: Noise trading occurs when an investor makes a decision to buy or sell an investment without the use of fundamental data (that is, economic, financial, and other qualitative or quantitative data that can affect the value of the investment). Noise traders generally have poor timing, follow trends, and overreact to good and bad news in the market.

- Inadequate Diversification: Inadequate diversification occurs when an investor’s portfolio is too concentrated in a particular type of investment. Inadequate diversification increases the risk exposure of an investor’s portfolio.

Three Ways to Avoid Them

1. Let the markets work for you. Outsmarting other investors is tough, especially when you add in transaction costs. Invest in the broad markets, keep your transaction costs down, and structure your portfolio around expected dimensions of returns.

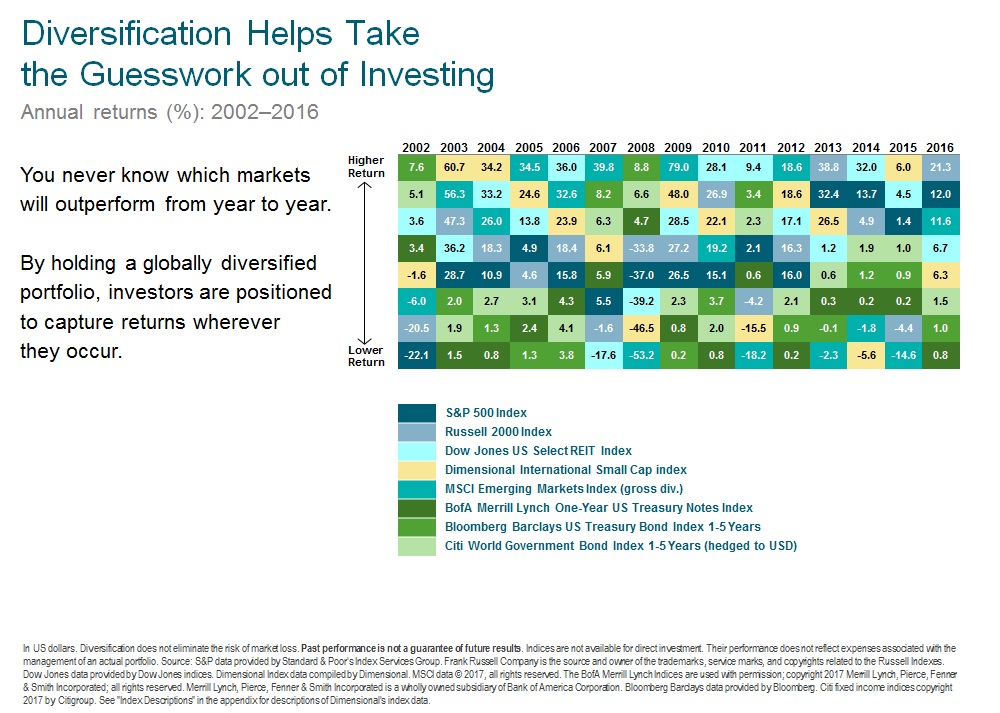

2. Diversify smartly. Diversification reduces risk that don't add to expected returns. Nearly half of the world's opportunities are outside the US.

3. Have a plan. Investors are people that are subject to normal emotions. Having a plan in place that you can review when the going gets tough can make the difference in achieving your goals or not. Markets reward discipline.

That's it, employ those three solutions and you will be well on your way to being a successful investor. Need help? Get in touch for a free review of your plan and portfolio.

Preparing to Get Hit by Life

“Life is what happens to you while you’re busy making other plans,” John Lennon sang in a verse of Beautiful Boy. Mike Tyson put it more bluntly, “Everybody’s got plans…until they get hit.”[i]

I think back to my early 30’s when the .com bubble was expanding. Business was good in the financial trades, with stocks rising 20% every year and customers literally standing in line to invest. Retirement seemed a certainty by the time I was 40. Along the way, a new baby, a move to California, a “once in a generation” bear market, another baby, a move back to Texas, another “once in a generation” bear market, and a foolish notion to start a new business now have me approaching 50 and planning to work for the foreseeable future.

While some may argue differently about the bear markets, most would probably agree that none of those life events were catastrophic. But what if something had happened that truly altered my plans, or those of my family?

Probably the most obvious catastrophe that most people think of is an untimely demise. The odds of that happening are pretty low when you are in your 30’s. For example, according to the Social Security Administration's cohort life tables, a 30-year-old male has a 98.5% chance of living to age 40, 95.5% chance of making it to 50, and a 90.5% probability of reaching his 60th birthday. Ladies have even higher odds of reaching the golden years, with nearly a 94% chance. With odds that high, it isn’t surprising that term life insurance is relatively affordable.

Insurance works best when it is used to protect against low probability but high impact events, such as premature death. Nevertheless, paying an insurance company for 20-30 years of protection that is very unlikely to be used isn’t high on the list of expenses most folks look forward to paying. But the thought that our families would have to move because they can’t afford the mortgage or that the kids would be forced into debt to pay for college are enough to motivate me to write that check each year.

But there are other risks that are more likely to impact you than an early death. According to the SSA’s Disability and Death Probabilities, a male born in 1996 has about a 20% chance of becoming disabled before retirement age. Unlike death, with a disability you not only lose your earning potential but continue to need to support your family AND yourself.

Both life and disability insurance are important tools for protecting yourself from a knockdown blow, but they will cost you. How much you should buy can vary based on your personal goals, attitude towards risk, and family situation. An independent financial advisor may be your best resource for helping you answer the question of how much and then find solutions that suit you.

In addition, other steps to protect you and your family from a potential KO are:

Establish liquidity. An emergency fund with several months’ worth of expenses set aside is the easiest solution, but establishing credit before it is needed can also be effective. A line of credit or a credit card may be difficult to obtain or more expensive to use if you wait until the primary breadwinner has stopped winning bread.

Review the beneficiaries on your accounts and insurance policies. These designations work very efficiently to transfer assets after death without going through probate. However, failing to name them, or having the wrong ones (i.e. ex-spouses, minor children) can complicate or ruin your plans.

Write a will. Clearly state who should inherit your property and take care of your minor children, pets, etc. Appoint an executor that is willing and able to execute the will when the time comes.

Consider trusts. There is a myriad of trust types that accomplish different objectives. They can help avoid probate, protect assets from creditors, and insure they ultimately pass to the heirs or causes of your choosing.

Set up health care directives. Living wills, medical power of attorney, and HIPPA authorizations spell out your desires, who can make decisions, and who can even talk to doctors about your condition. These tools can insure that your wishes are followed in the event you aren’t able to communicate and help avoid emotional conflicts between well-meaning family members.

Establish durable power of attorney. In case you are unable to make financial decisions, having a trusted person (spouse, child, etc.) appointed as your attorney-in-fact that can handle your affairs can make life much easier on your family.

Title your assets correctly. All the steps previously mentioned can be voided or made more complicated by not titling assets correctly. On a financial statement, it is helpful to list the registration of all your assets so that your financial planner or attorney can help identify potential disconnects with your plans.

Finally, it’s also a good idea to put a recent copy of your financial statements, wills, trusts, insurance policies, deeds, and other important documents in a place where they can easily be accessed by your attorney-in-fact or executor.

Don’t know where to start? Get in touch to discuss your plans.

[i] https://www.brainyquote.com/quotes/quotes/m/miketyson379007.html?src=t_plans