It may have not been noticed by many, but I just took a couple of weeks off from the Accountable Update. The break was primarily due to a competing obligation, coaching my daughter's softball team. If you had tried to tell me when we started tryouts back in February that we would still be playing in mid-July at the PONY World Series in Lafayette, LA, I probably would have asked for your keys or at least checked to see if you had a designated driver. But as my daughter reminds me every time she overhears me talking about this group of overachievers, the hard working young ladies that made up our team believed from the beginning that they could earn a trip to the Bayou State as long as they kept working and believing.

It would have been easy to point out that last year, we didn't even have enough players in her age group to field a team, or that we lacked depth and experience at key positions, or that we were plagued by injuries and scheduling conflicts. Instead, they totally bought in to our motto that "hard work pays off" and showed up in the Texas heat 3-4 days a week to work on getting better.

They went through drills and repetitions of the basics of defense, pitching, and putting the ball in play at every practice. Throwing, catching, ground balls, fly balls as well as hitting cutoffs and running the bases were repeated over, and over, and over, etc. Batting practice always included laying down bunts. After all of that, we worked on conditioning to end each practice.

Then we went out and lost the only game we played in our first tournament, mainly because we didn't do many of the things we had been practicing very well. But something clicked at the next tournament, and kept clicking all the way to Lafayette. Once the girls started to see the evidence that through focusing on the basics they were getting better and stronger, it helped them to stay enthusiastic when the ball took a bad bounce or an umpire made a bad call.

If you've never witnessed a fast-pitch softball game, then you may not appreciate the value of enthusiasm. But hearing a dozen 12 year old girls doing LOUD chants ranging from the adorably cute to the absolutely cutthroat, can be extremely motivating or intimidating, depending on your perspective. That enthusiasm was infectious and would keep us in games that otherwise looked like big mismatches. It also offered a great lesson for all of us, especially in the investment world.

Enthusiasm can be difficult to maintain when the chips are down. With a seemingly never ending stream of horrible headlines, charlatans masquerading luck as skill, the echo chambers of social media, and divisive rhetoric from political "leaders" that often makes us feel pessimistic about our future, it's a wonder that any of us can view a glass as anything other than empty.

All it took was a week in Lafayette with a fabulous, hardworking, overachieving group of 12 year old girls to remind me that focusing on the basics and being optimistic can take us to unexpected heights.

If you still aren't feeling it, the following article by DFA's Jim Parker in his recent “Outside the Flags” column offers some other reasons to be optimistic that we may actually, somehow, be headed in the right direction.

Like Lafayette.

10 Reasons to Be Cheerful

Do you ever listen to the news and find yourself thinking that the world has gone to the dogs? The roll call of depressing headlines seems endless. But look beyond what the media calls news, and there also are a lot of things going right.

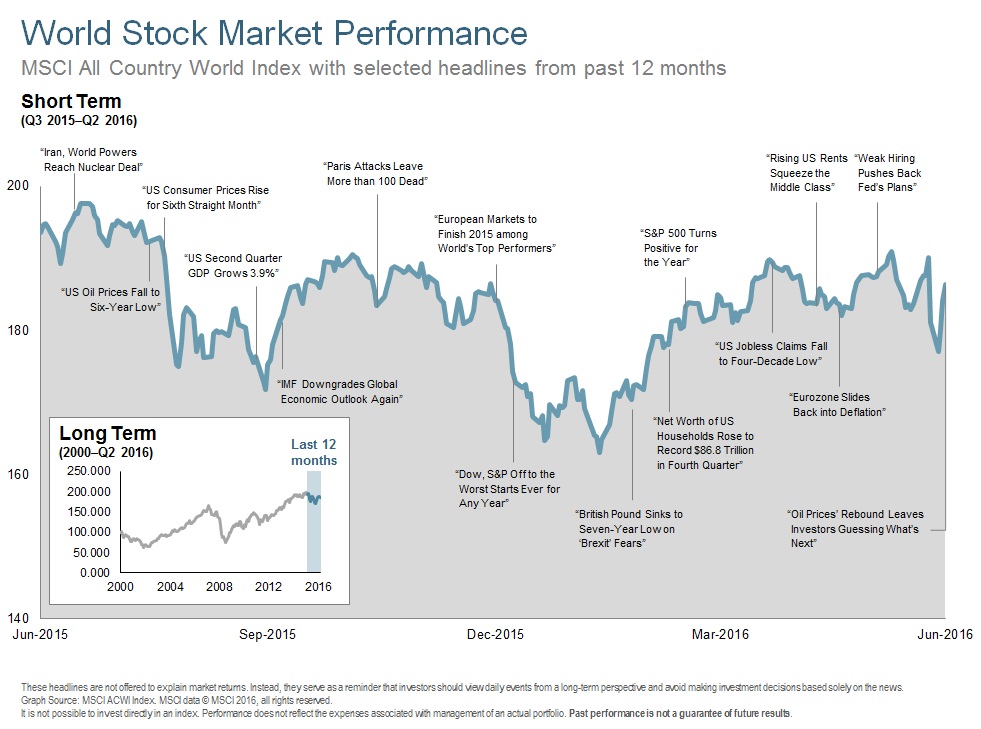

It’s true the world faces challenges in many areas, and the headlines reflect that. Europe has been grappling with a flood of refugees; as of May, the Chinese local A-share market declined by almost 20 percent1; and the US is in the middle of a sometimes rancorous election campaign.

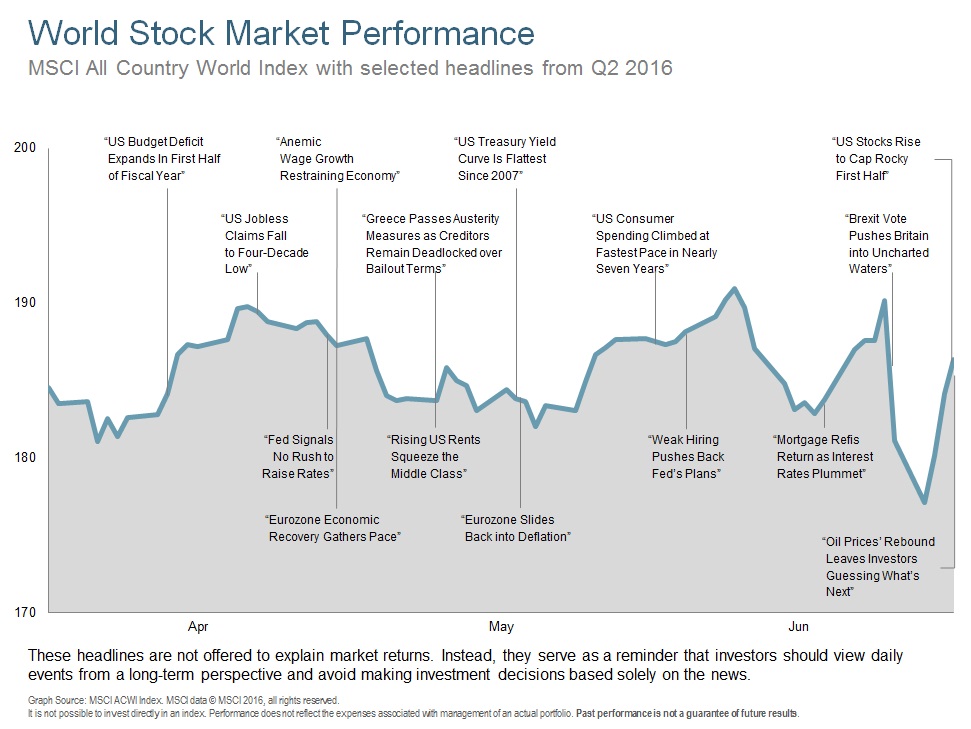

More recently, citizens of the United Kingdom voted to leave the European Union, creating significant uncertainty in markets over the long-term implications.

But it’s also easy to overlook the significant advances made in raising the living standards of millions, increasing global cooperation on various issues, and improving access to healthcare and other services across the world.

Many of the 10 developments cited below don’t tend to make the front pages of daily newspapers or the lead items in the TV news, but they’re worth keeping in mind on those occasions when you feel overwhelmed by all the grim headlines.

So here’s an alternative news bulletin:

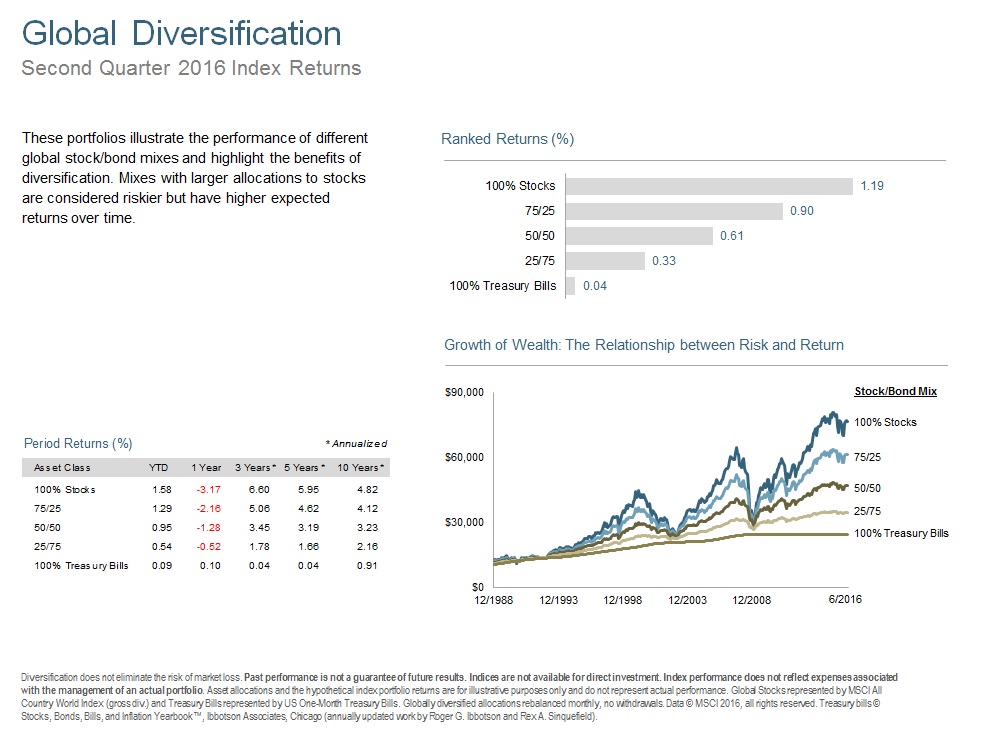

- Over the last 25 years ending May 2016, one dollar invested in a global portfolio of stocks would have grown to more than five and a half dollars.2

- Over the last 25 years, 2 billion people globally have moved out of extreme poverty, according to the latest United Nations Human Development Report.3

- Over the same period, mortality rates among children under the age of 5 have fallen by 53%, from 91 deaths per 1000 to 43 deaths per 1000.

- Globally, life expectancy has been improving. From 2000 to 2015, according to the World Health Organization, the global increase was 5.0 years, with an even larger increase of 9.4 years in parts of Africa.4

- Global trade has expanded as a proportion of GDP from 20% in 1995 to 30% by 2014, signaling greater global integration.5

- Access to financial services has greatly expanded in developing countries. According to the World Bank, among adults in the poorest 40% of households within developing economies, the share without a bank account fell by 17 percentage points on average between 2011 and 2014.6

- The world’s biggest economy, the US, has been recovering. Unemployment has halved in six years from nearly 10% to 5%.7

- The world is exploring new sources of renewable energy. According to the International Energy Agency, in 2014, renewable energy such as wind and solar expanded at its fastest rate to date and accounted for more than 45% of net additions to world capacity in the power sector.8

- We live in an era of innovation. One report estimates the digital economy now accounts for 22.5% of global economic output.9

- The growing speed and scale of data is increasing global connectedness. According to a report by McKinsey & Company, cross-border bandwidth has grown by a factor of 45 in the past decade, boosting productivity and GDP.10

No doubt many of these advances will lead to new business and investment opportunities. Of course, not all will succeed. But the important point is that science and innovation are evolving in ways that may help mankind.

The world is far from perfect. The human race faces challenges. But just as it is important to be realistic and aware of the downside of our condition, we must also recognize the major advances that we are making.

Just as there is reason for caution, there is always room for hope. And keeping those good things in mind can help when you feel overwhelmed by all the bad news.

Notes

1. As measured by the MSCI A Share Net Dividends Index in CNY.

2. As measured by the MSCI All Country World Index (gross dividends) in USD.

3. “Human Development Report 2015: Work for Human Development," United Nations.

4. “World Health Statistics 2016,” World Health Organization.

5. “International Trade Statistics 2015,” World Trade Organization.

6. “The Global Findex Database 2014: Measuring Financial Inclusion Around the World,” World Bank.

7. US Bureau of Labor Statistics, 15 March 2016.

8. “Renewable Energy Market Report 2015,” International Energy Agency.

9. “Digital Disruption: The Growth Multiplier,” Accenture and Oxford Economics, February 2016.

10. “Digital Globalization: The New Era of Global Flows,” McKinsey & Company, March 2016.

About Jim Parker

Jim Parker is a Vice President for DFA Australia Limited, a subsidiary of Dimensional Fund Advisors. As head of the communications and marketing team in Australia, Jim helps create strategies to communicate Dimensional's philosophy and process in ways that engage clients, prospects, regulators, and the media. He does so through presentations, books, papers, and articles, including his "Outside the Flags" column and, more recently, his weekly "Coffee Break" links to interesting articles.

Jim joined Dimensional in 2006 after 25 years working as a journalist in newspapers, television, radio, and online media. His specialty was financial journalism, particularly in relation to economics and financial markets. Jim holds a bachelor of arts in social and economic history from Deakin University and a journalism certificate from Auckland Technical Institute.