The Q2 2016 Market Review may be easier to navigate directly on www.atxadvisors.com than through the RSS feed email version. I apologize for any inconvenience the formatting may cause for our email subscribers.

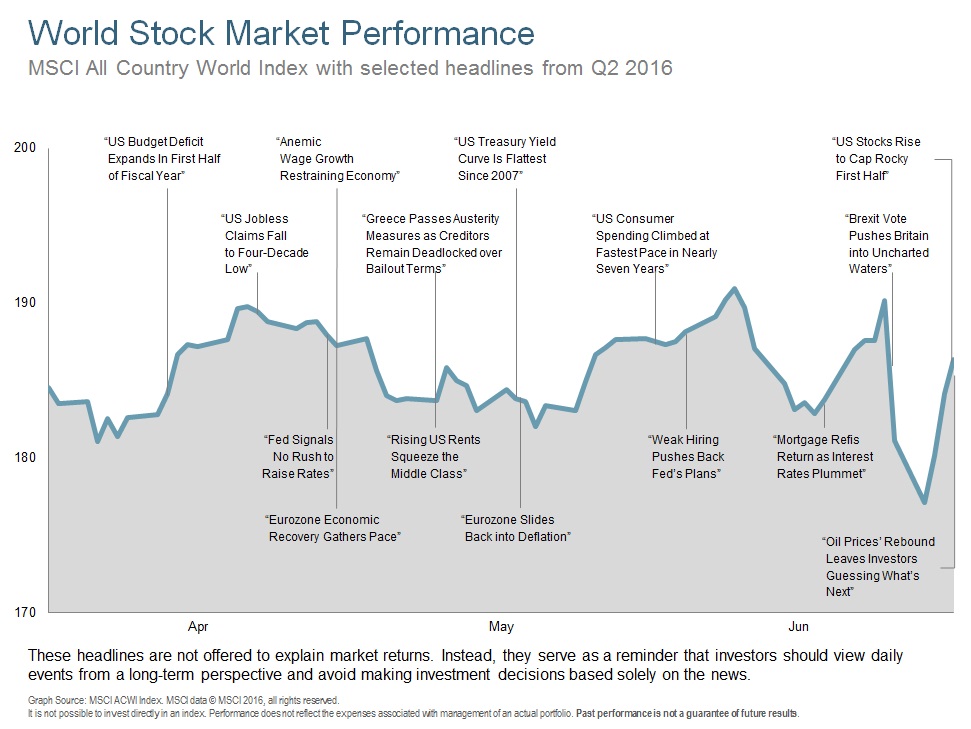

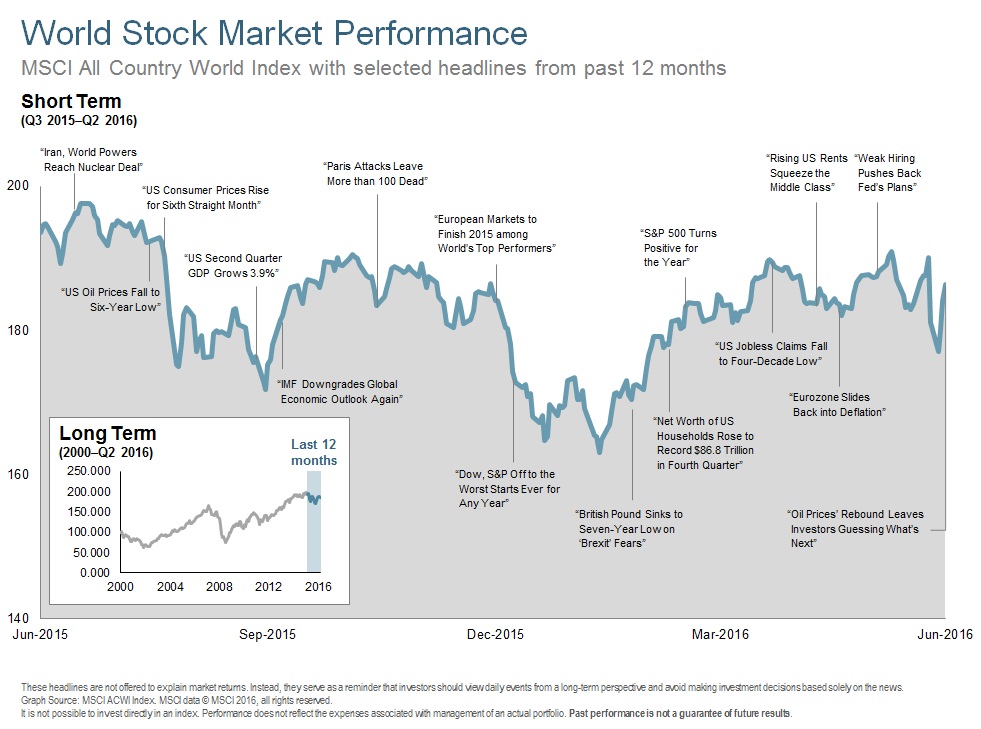

Those crazy Brits shocked just about everyone by voting to leave the EU back on June 23. Stock markets fizzled, bond markets sizzled, and cash suddenly looked like a very attractive safe haven. Leading up to the vote, most domestic, international developed, and emerging equity markets were up quarter to date. The initial selloffs in these markets signaled that Brexit was not priced into the markets’ expectations and that the ensuing uncertainty may be the beginning of the end and not the end of the beginning of the bull market (apologies to Sir Churchill). Then we rallied into the end of the quarter, recovering the Brexit losses, suggesting that perhaps the risk to world markets created by the possible reordering of the EU may not be the end of the world. Maybe those Brits ARE crazy, like a fox?

Does it make you wonder if our own elections in Q4 may hold similar unexpected outcomes? It could make for an entertaining fall, like from a bridge with a piece of elastic tied to your ankles. Now on to the review.

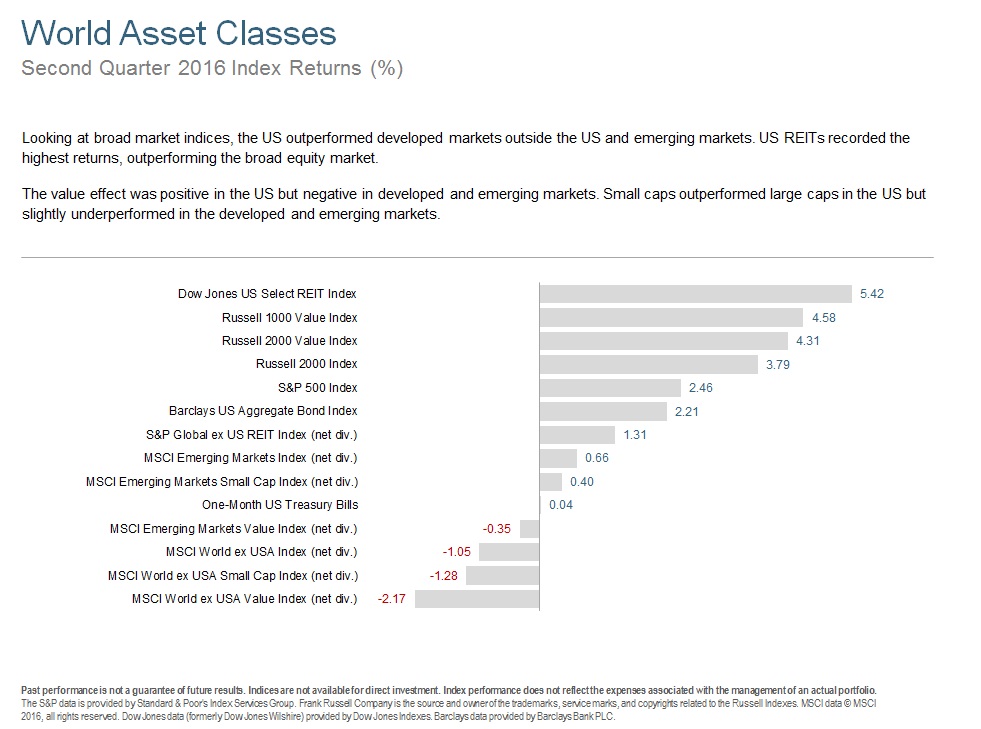

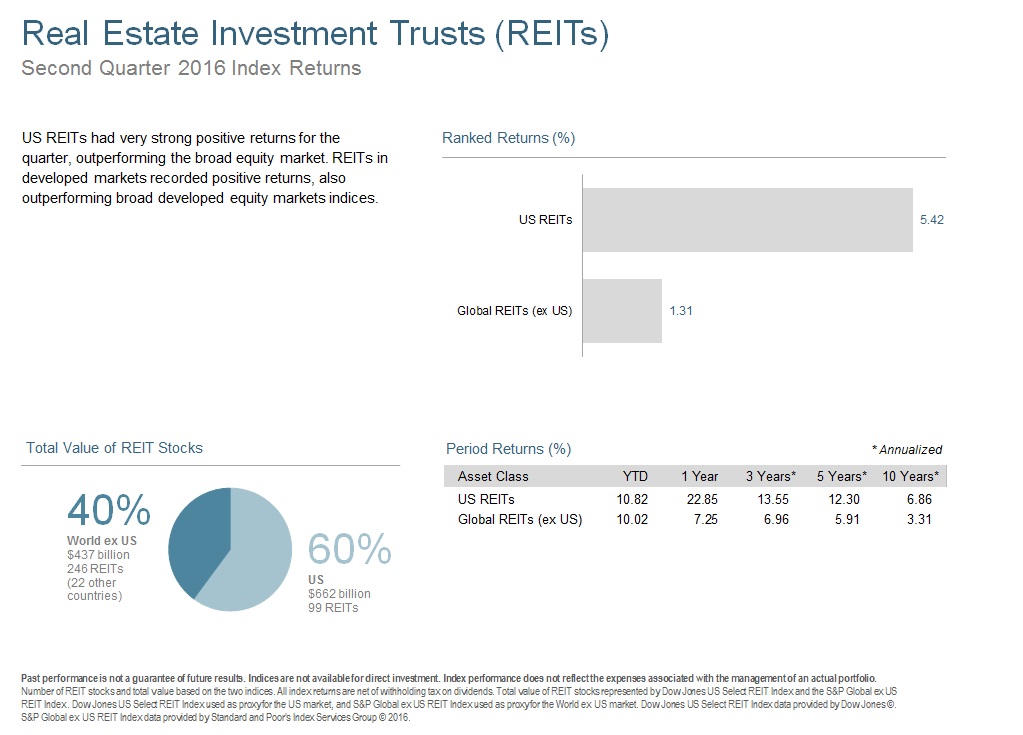

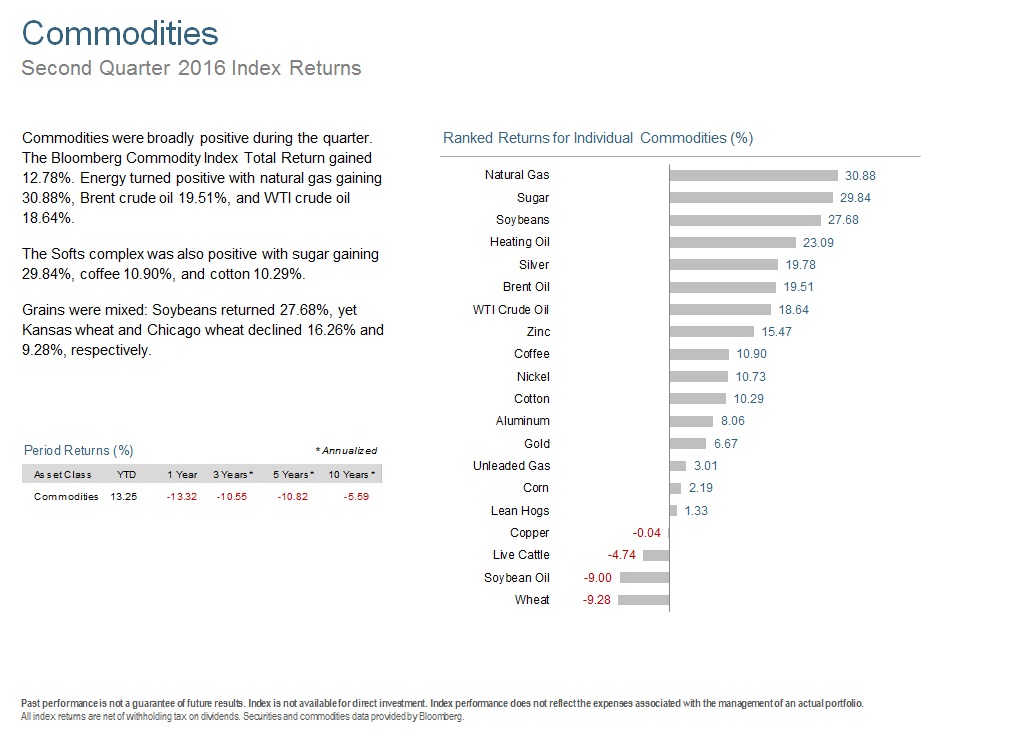

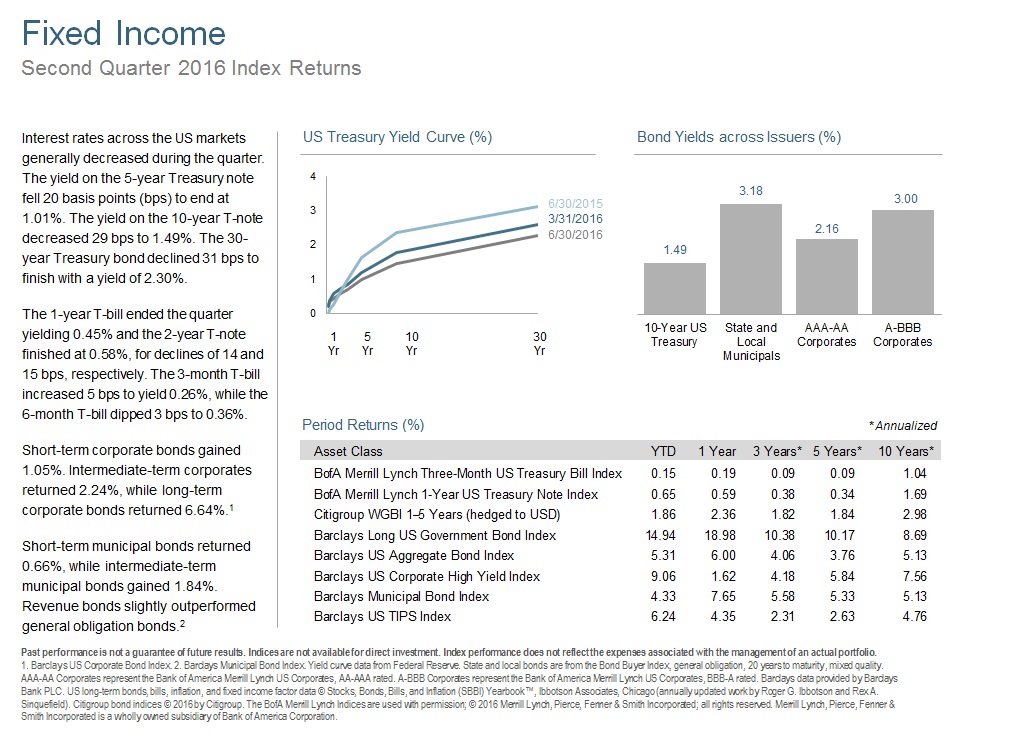

REITs and bonds were the star performers in Q2, which many attribute to the bond market forecasting an economic slowdown. Commodities have also shown signs of life, with the Bloomberg Commodity Index up 12.78% for the quarter, with oil and gas leading the way.

For the time being, however, the US economy is showing some resiliency. Job reports have generally been good, with the unemployment rate around 4.9% and wages actually ticking up as shortages of skilled workers strengthen the bid for those jobs. Also, the housing market keeps chugging along as the low interest rates encourage refinancing and purchases. Rising rents, stronger consumer confidence, and the aging Millennial generation are all factors that continue to be positives for housing.

The wind in our sails from the cheaper dollar in Q1 moved to our bow in Q2 with the “flight to quality” created by Brexit. There also is mounting evidence that near zero interest rates are encouraging stock buybacks and dividend increases more so than capital investments envisioned by policy makers. Just a little more evidence that markets will always find their way, in spite of what the politicians or bureaucrats want to happen.

All of this leaves me to ponder the same questions posed in Q1.

Will we remain bound to a "trade range" where the market bounces back and forth from a previous low and high as it continues a “time correction”? Or, are we due for a major bull or bear move? The fact is, it is impossible to know in the short term. If the market moves up, you can expect us to re-balance your portfolio by taking some profits from the winners. If it goes down we will likely buy more of the losers, even if we have to hold our noses while doing so.

As always, we look for opportunities to incorporate evidence backed approaches to managing our clients’ wealth to increase expected returns. When we encounter the inevitable occasional selloff, our Accountable pricing helps demonstrate that we sit on the same side of the table as our customers.

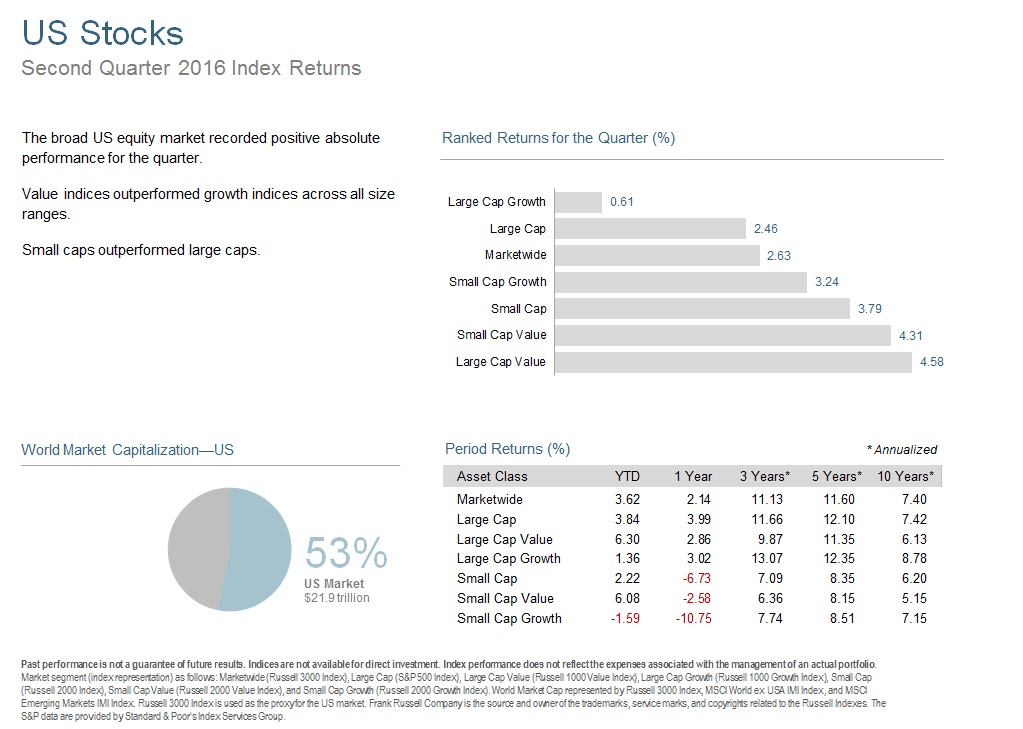

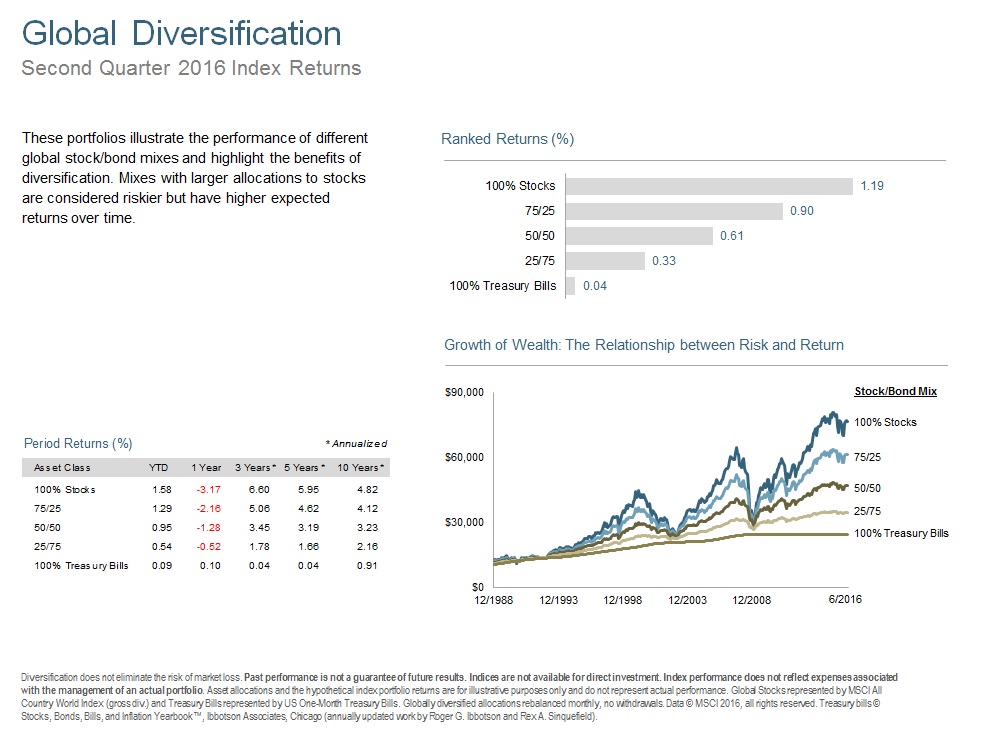

The Q2 2016 Quarterly Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. The report also illustrates the performance of globally diversified portfolios.