For decades, annuity salespeople have leaned on one powerful word: guaranteed. “Guaranteed income for life” sounds like freedom from worry. But as with most financial products that promise peace of mind, it pays to ask what you’re giving up to get it.

If you’ve read one of my earlier pieces on the pitfalls of chasing “three-legged chickens,” you know I’ve never been shy about questioning the benefits of many variable annuities, such as claims of high returns + predictability + liquidity, all at once. However, insurance companies try to sell that bird again and again, even if the math still doesn’t add up.

Now, a new generation of insurance products, called insurance overlays or Protected Lifetime Income Benefits (PLIBs), are reframing how guaranteed income fits inside an investment portfolio. And it’s worth a closer look—not because it’s magic, but because it clarifies what guarantees are actually for.

The Problem with “Guarantee Everything”

When investors buy a traditional annuity, they typically trade away control of their money for two forms of insurance:

Investment risk protection: the insurer manages the portfolio conservatively.

Longevity protection: the insurer keeps paying even if you live far longer than expected.

The catch? You lose access to your principal. Your money is locked up, returns are limited, and heirs may get nothing. You’re paying for total certainty, but at the cost of flexibility, liquidity, and often, performance.

High fees, surrender schedules, and opaque crediting formulas turn the “guarantee” into an expensive straightjacket. As we said years ago, chasing high return, liquidity, and safety at once still means chasing a three-legged chicken.

A Different Design: The Insurance Overlay

An insurance overlay adds a lifetime-income guarantee to your existing portfolio without transferring the assets to an insurer. You keep your account at Schwab, Fidelity, or Vanguard (or whatever broker or mutual fund company you choose). The insurer simply overlays a contract saying, “If your portfolio ever hits zero, we’ll keep the income coming for life.”

You’ll pay about 1% a year on the covered assets. Stop paying, and you lose the guarantee but keep your portfolio, and there aren’t any surrender penalties.

That structure changes everything:

You retain liquidity and control.

You stay invested.

You maintain the potential for favorable tax treatment (i.e., capital gains vs ordinary income on taxable accounts)

You only insure the longevity risk, not the investment risk.

You can cancel anytime if the coverage no longer fits.

In short, the overlay doesn’t pretend to eliminate all risk. It defines which risk is worth paying to transfer.

What the Research Says

Dimensional Fund Advisors modeled 10,000 retirement simulations using different withdrawal and allocation rules. They compared traditional drawdown strategies to portfolios wrapped with an insurance overlay.

Findings:

The insured flexible strategy delivered the highest median lifetime income.

The insured fixed strategy maintained steady real income even during poor markets.

The overlay’s 1% cost reduced balances slightly but sharply cut the risk of running out of income late in life.

The key takeaway: pairing a diversified portfolio with targeted longevity protection provided better outcomes than buying a traditional annuity or going uninsured.

Guarantees Belong Where They Matter Most

Here’s the principle too often lost in annuity marketing: Guaranteed income is most valuable when it matches your essential expenses, not every dollar you plan to spend.

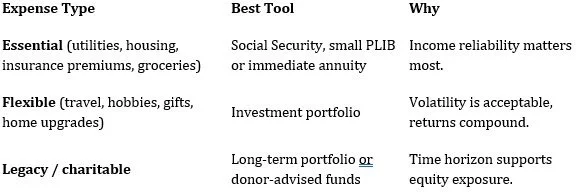

Covering your basics (housing, healthcare, food, and insurance premiums) with reliable income sources (Social Security, pensions, or a small insurance overlay) makes sense. It frees you to take market risk with your investment portfolio where it’s rewarded: funding the discretionary, lifestyle, and legacy goals that don’t need to be guaranteed.

Trying to guarantee everything forces you to overpay for certainty and under-invest for growth. That’s the trap the annuity industry rarely mentions.

A More Practical Framework

This isn’t about replacing annuities or rejecting guarantees altogether. It’s about allocating guarantees where they create the most planning efficiency per dollar.

Behavior Still Rules

A major advantage of insurance overlays is psychological. People resist annuitizing because once they hand over the money, it’s gone. Overlays avoid that finality. You can test-drive the protection, stop premiums, or withdraw funds as needed.

That flexibility makes adoption easier, and in retirement planning, the best strategy is the one clients will actually stick with.

The Bottom Line

Annuities promise safety but often at the cost of control, growth, and clarity. Insurance overlays aren’t cheaper; the 1% fee is real, but they’re cleaner. You see what you’re paying for and what you’re keeping.

Use guarantees surgically, not globally. Cover the needs with predictable income. Keep what you want in your portfolio. That’s how you balance confidence with opportunity and how you make lifetime income both protected and accountable.

If you would like to discuss how, or if, insurance overlays may make sense in your financial plan, get in touch.