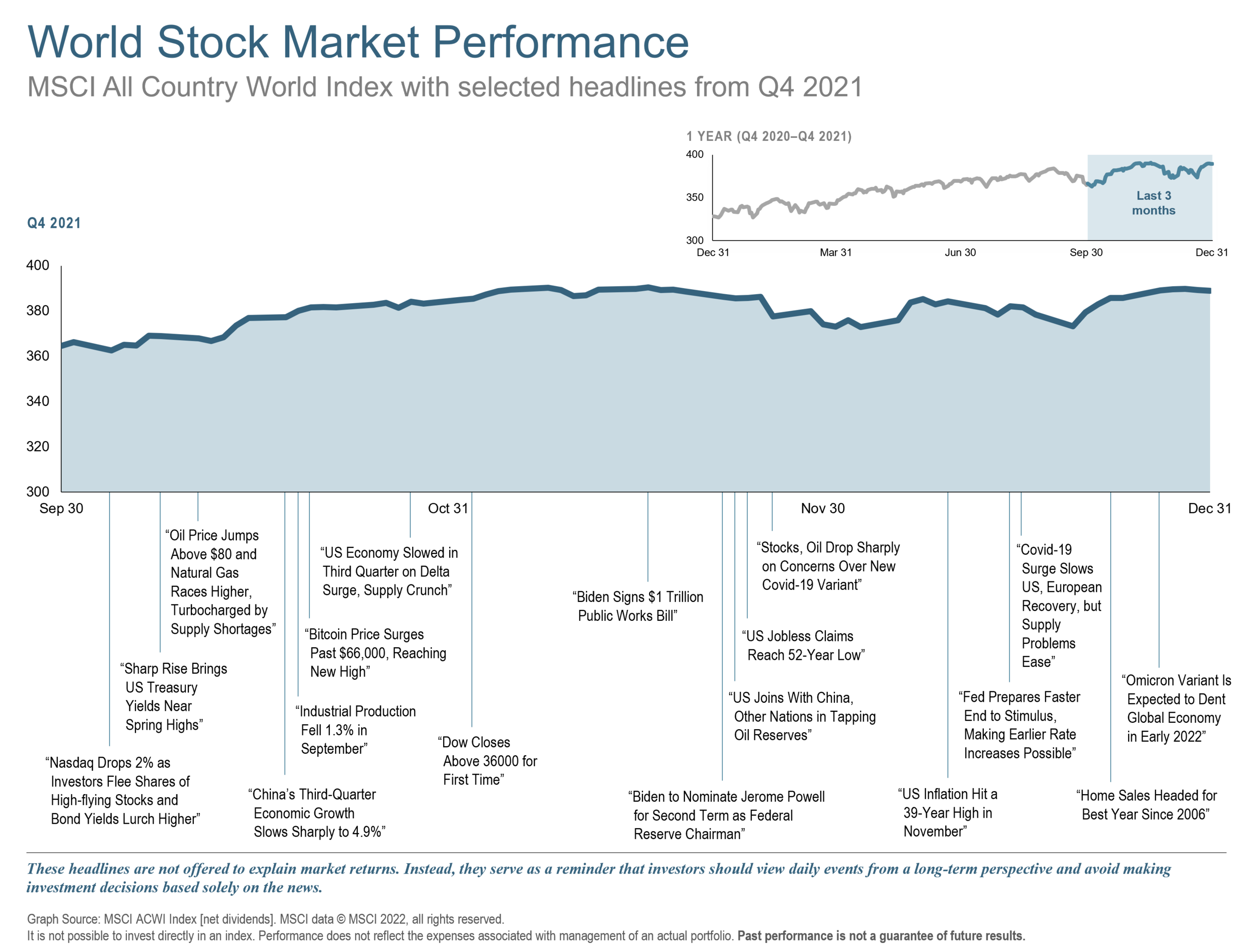

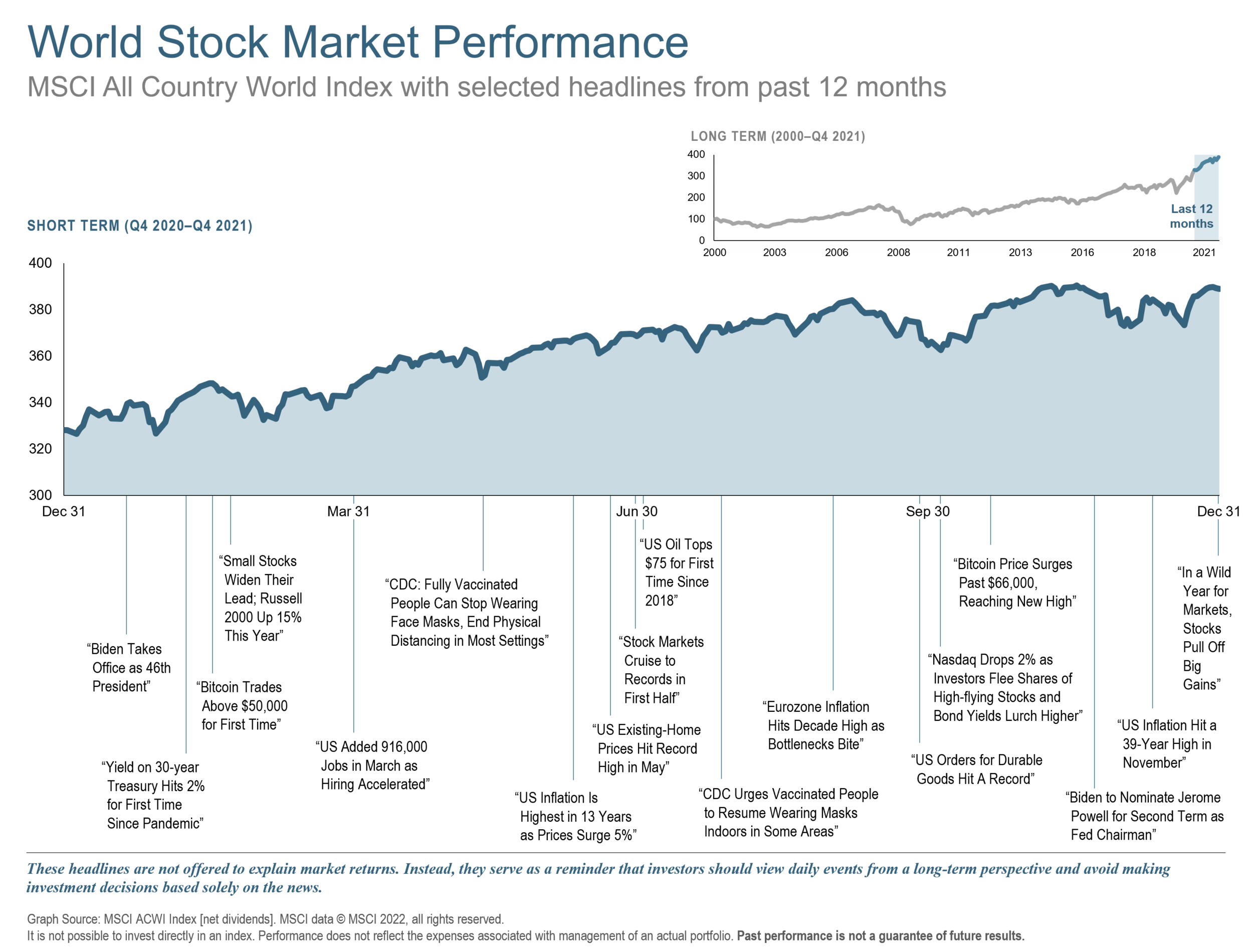

In the fourth quarter, developed market equities continued to rally with US Stocks leading the way up the “Wall of Worry”. Seemingly, there were many reasons for investors to take pause in Q4. A more virulant COVID 19 strain, Omicron, led to another surge of infections. Inflation rose above 6% for the first time since 1990. Fed Chair Jerome Powell said escalating inflation and an improving labor market warranted slowing quantitative easing sooner than previously suggested. There was also a failure by Senate Democrats (at least for the moment) to pass President Biden’s $3.5 trillion “Build Back Better” spending package.

In November, the US Consumer Price Index (CPI) jumped to 6.8% year-over-year, its highest reading in 39 years, and the unemployment rate fell to 4.2%. The rapidly tightening labor market and persistent inflationary pressures pushed the Federal Reserve to adopt a tighter stance. While the Federal Open Market Committee (FOMC) maintained the current federal funds target rate at a range of 0.00% – 0.25%, they announced plans to accelerate the tapering of asset purchases from $15 billion to $30 billion per month, beginning in January. This suggests tapering will conclude by March 2022, paving the way for additional rate hikes (most expect three of them) in 2022.

After Thanksgiving, there was a sharp selloff on Black Friday when a combination of news of Omicron’s emergence, a less accomodative Fed, and light liquidity due to the holiday sent stocks skidding. Markets recovered in December, however, as Omicron’s health impact appears less severe than than previous variants. Relieved investors jumped back into the market, bringing a Santa Claus rally that capped a strong year of performance.

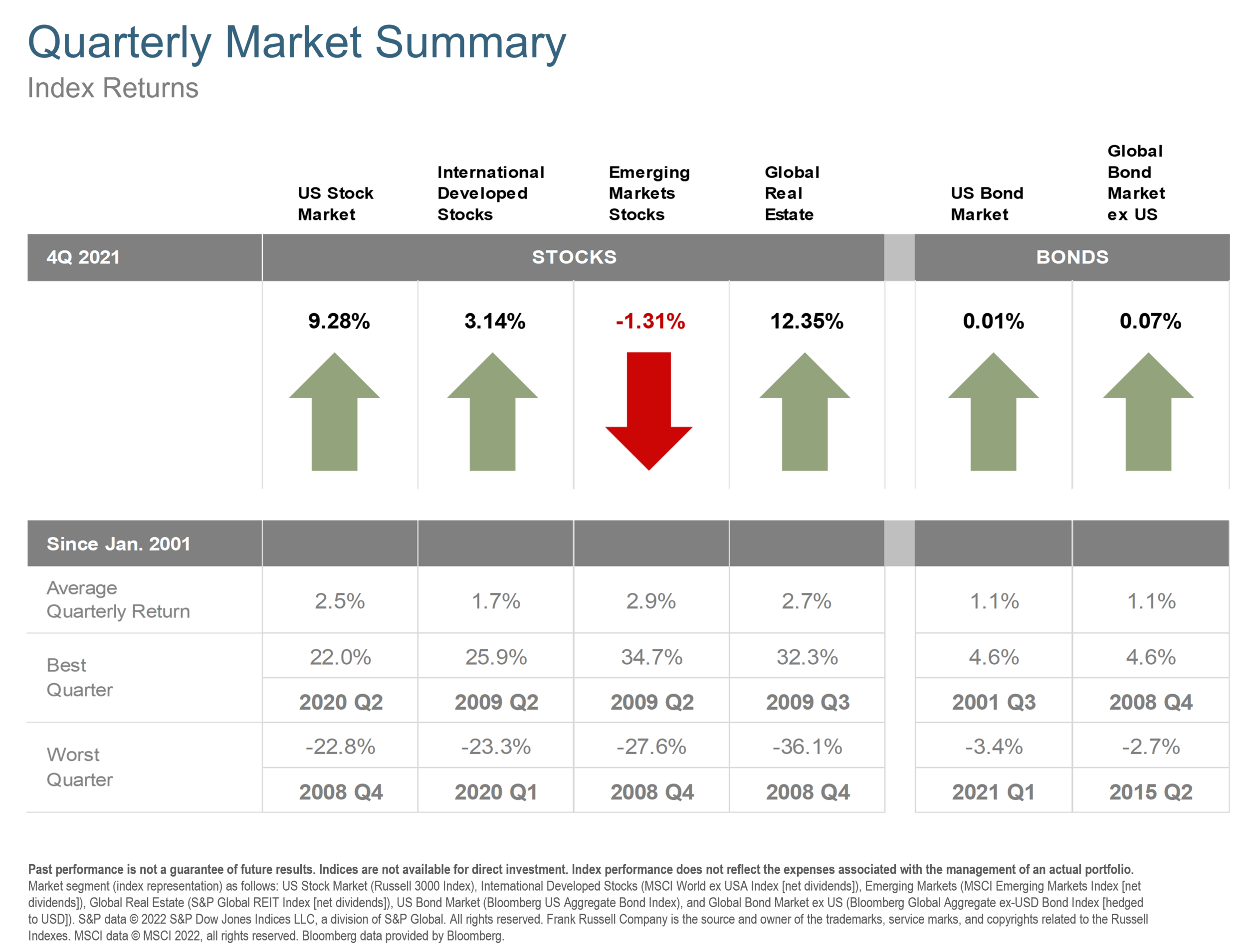

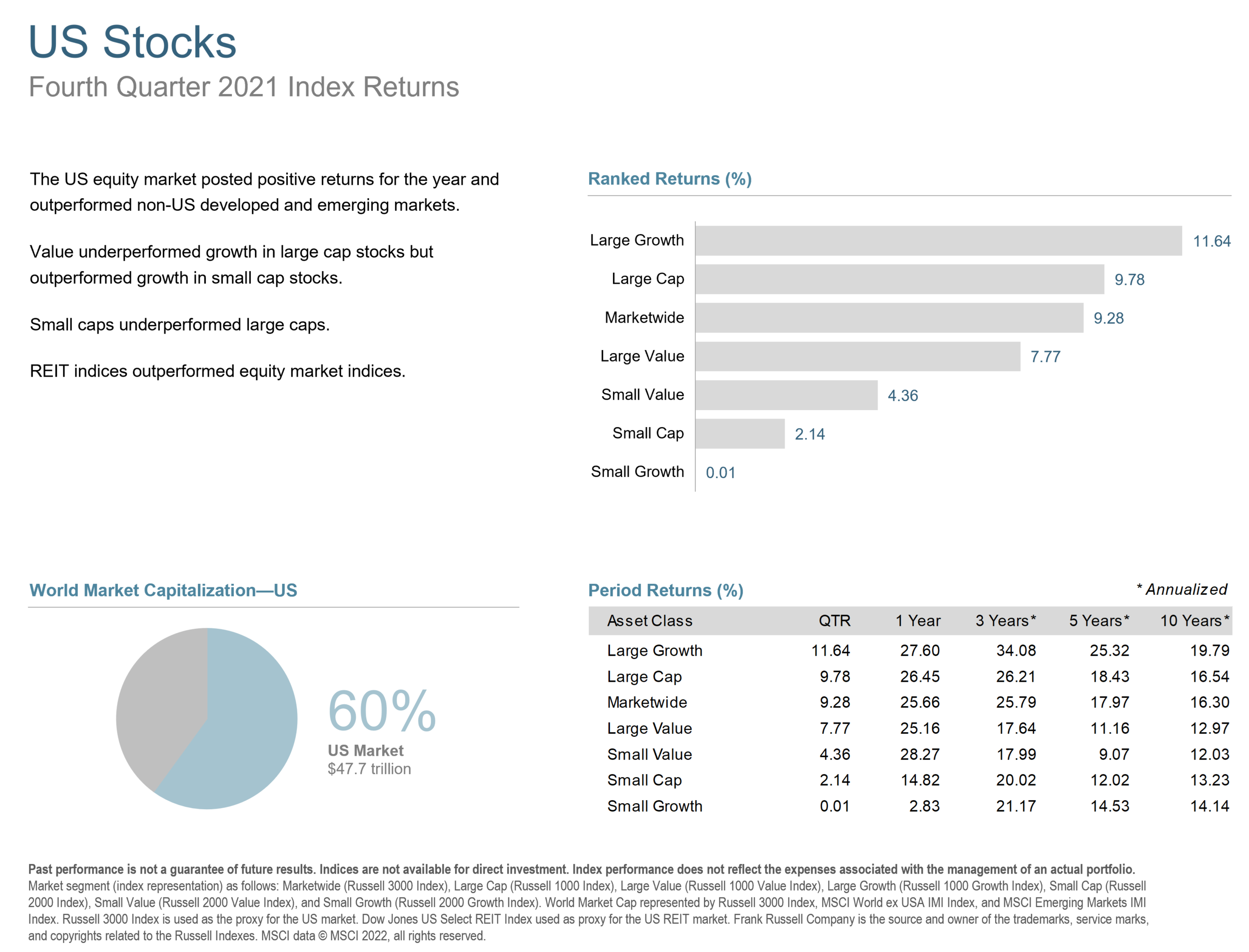

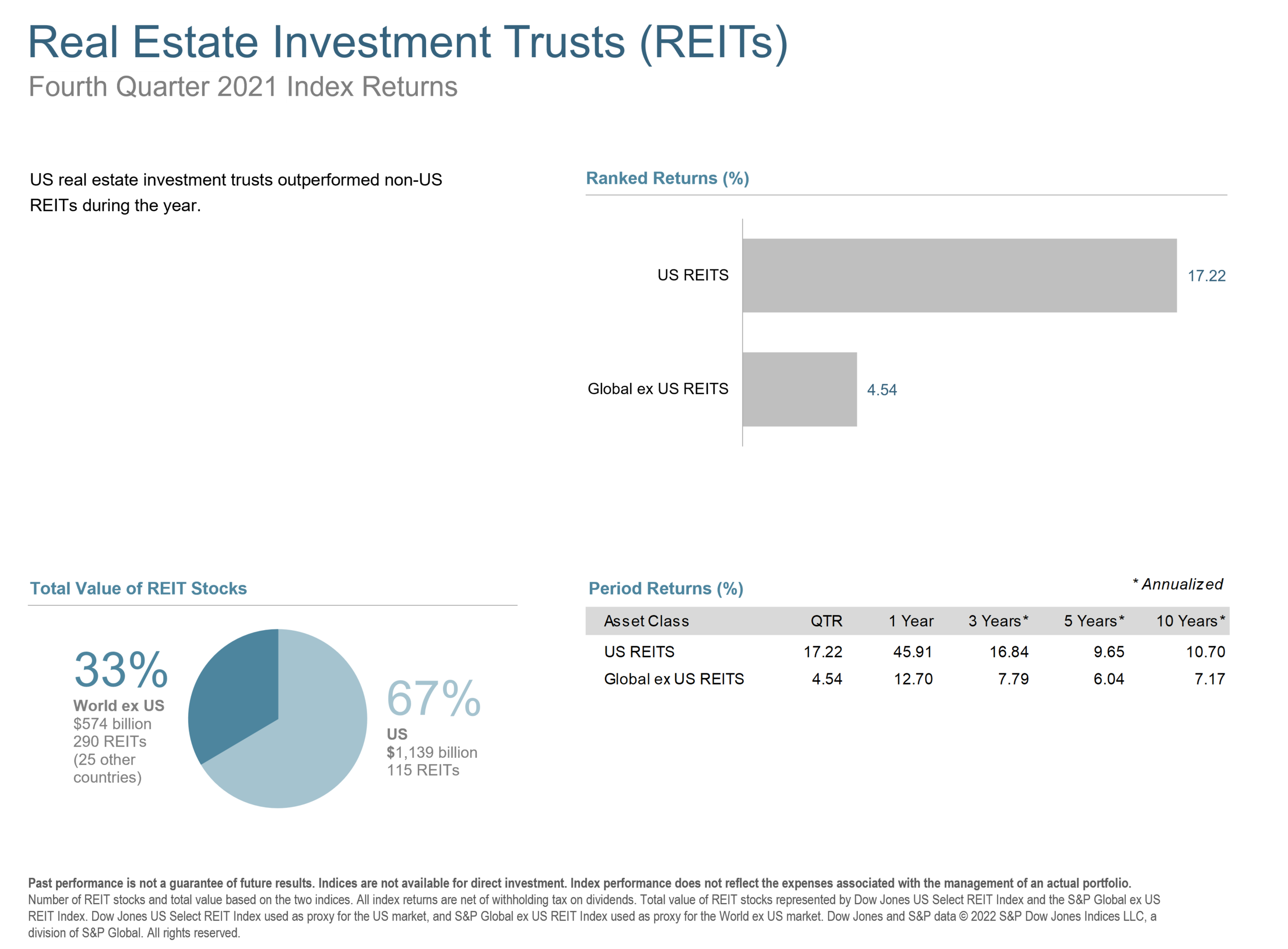

The US equity market posted positive returns for the year and outperformed non-US developed and emerging markets. Value underperformed growth in large cap stocks but outperformed growth in small cap stocks. Small caps underperformed large caps. REIT indices outperformed equity market indices.

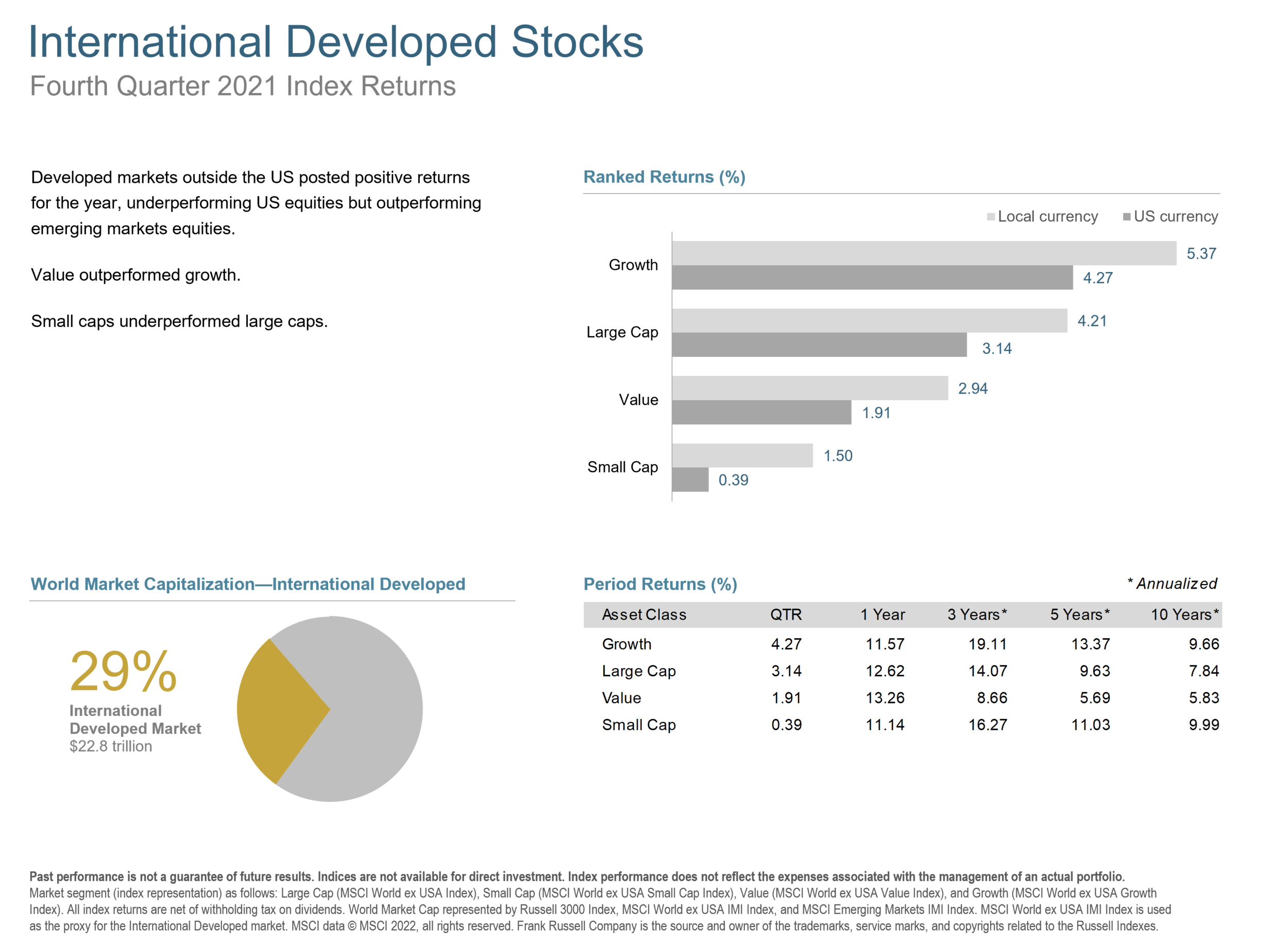

Developed markets outside the US posted positive returns for the year, underperforming US equities but outperforming emerging markets equities. Value outperformed growth. Small caps underperformed large caps.

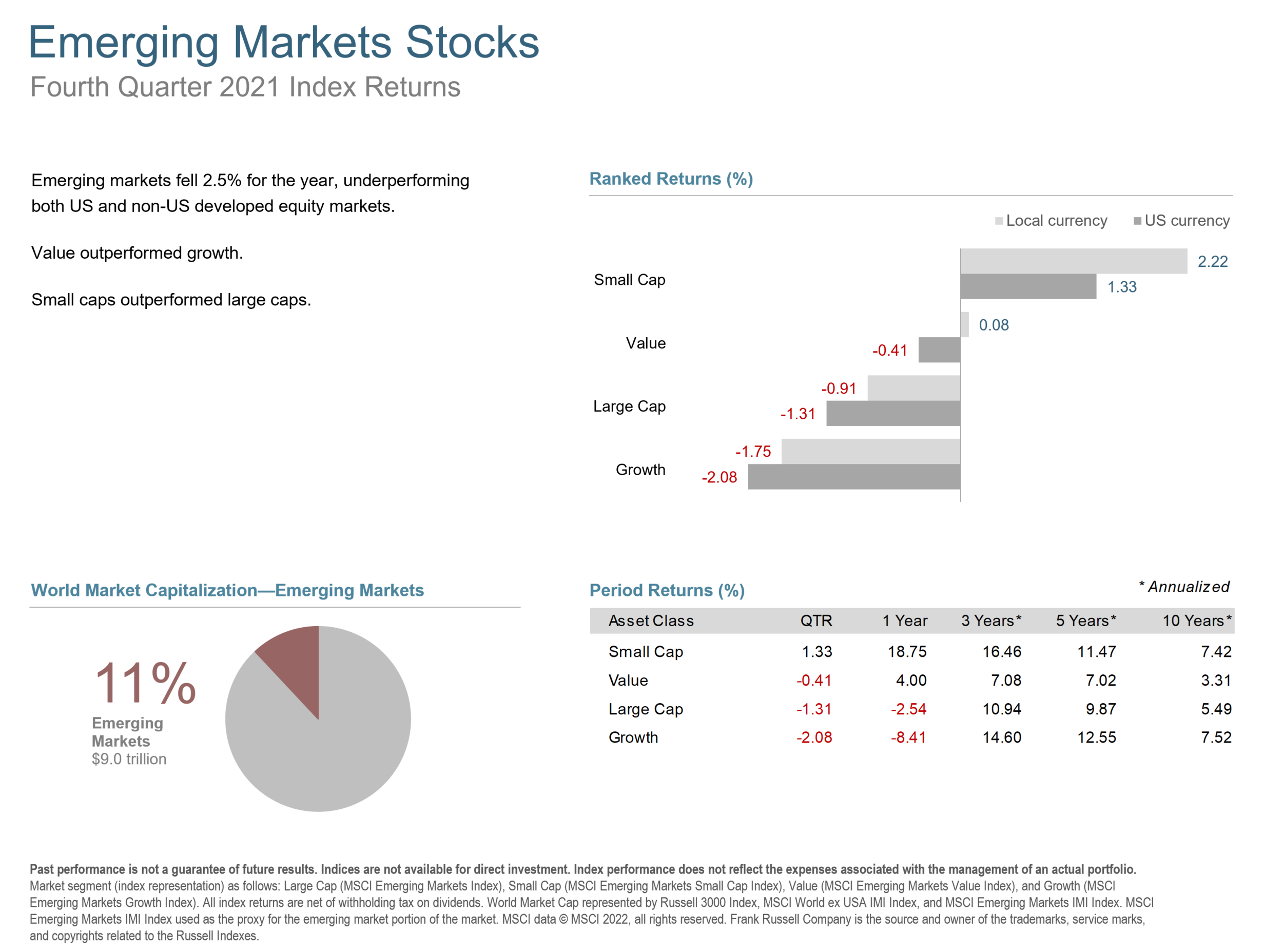

Emerging markets fell 2.5% for the year, underperforming both US and non-US developed equity markets.

Value outperformed growth. Small caps outperformed large caps.

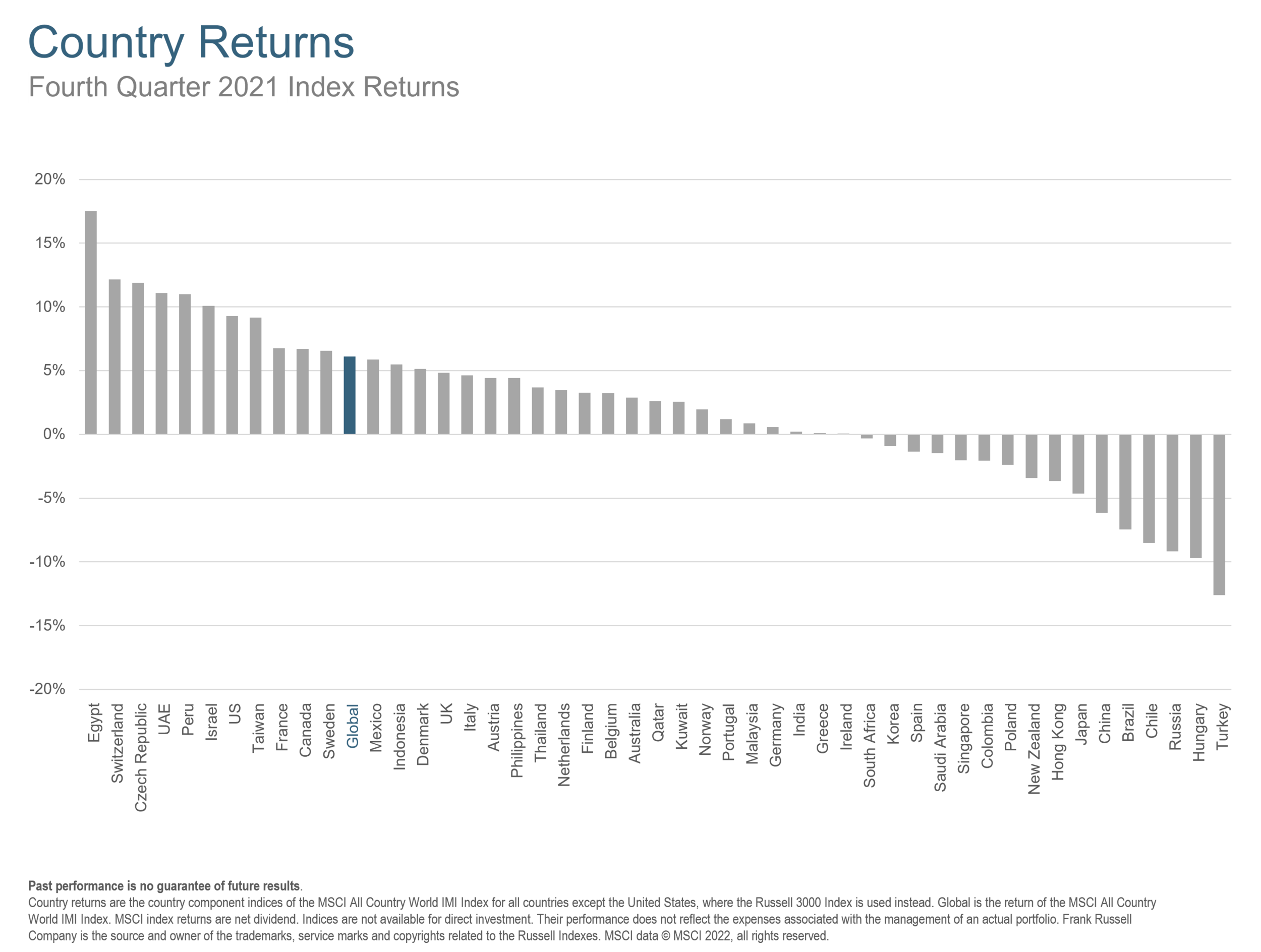

In US dollar terms, Eqypt and Switzerland recorded the highest country performance in international markets, while Hungary and Turkey posted the lowest returns for the quarter.

US real estate investment trusts outperformed non-US REITs during the quarter.

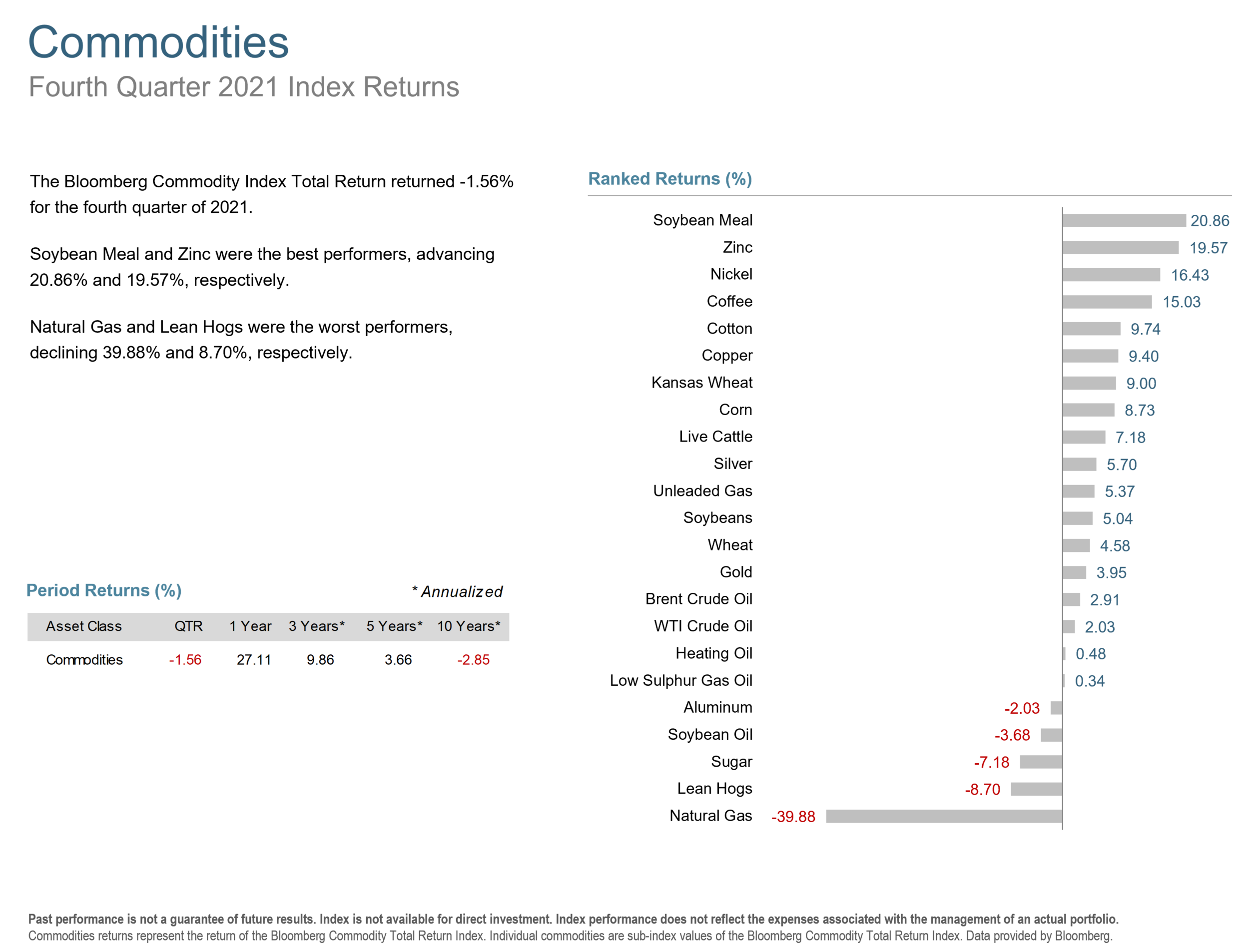

The Bloomberg Commodity Index Total Return returned -1.56% for the fourth quarter of 2021. Soybean Meal and Zinc were the best performers, advancing 20.86% and 19.57%, respectively. Natural Gas and Lean Hogs were the worst performers, declining 39.88% and 8.70%, respectively.

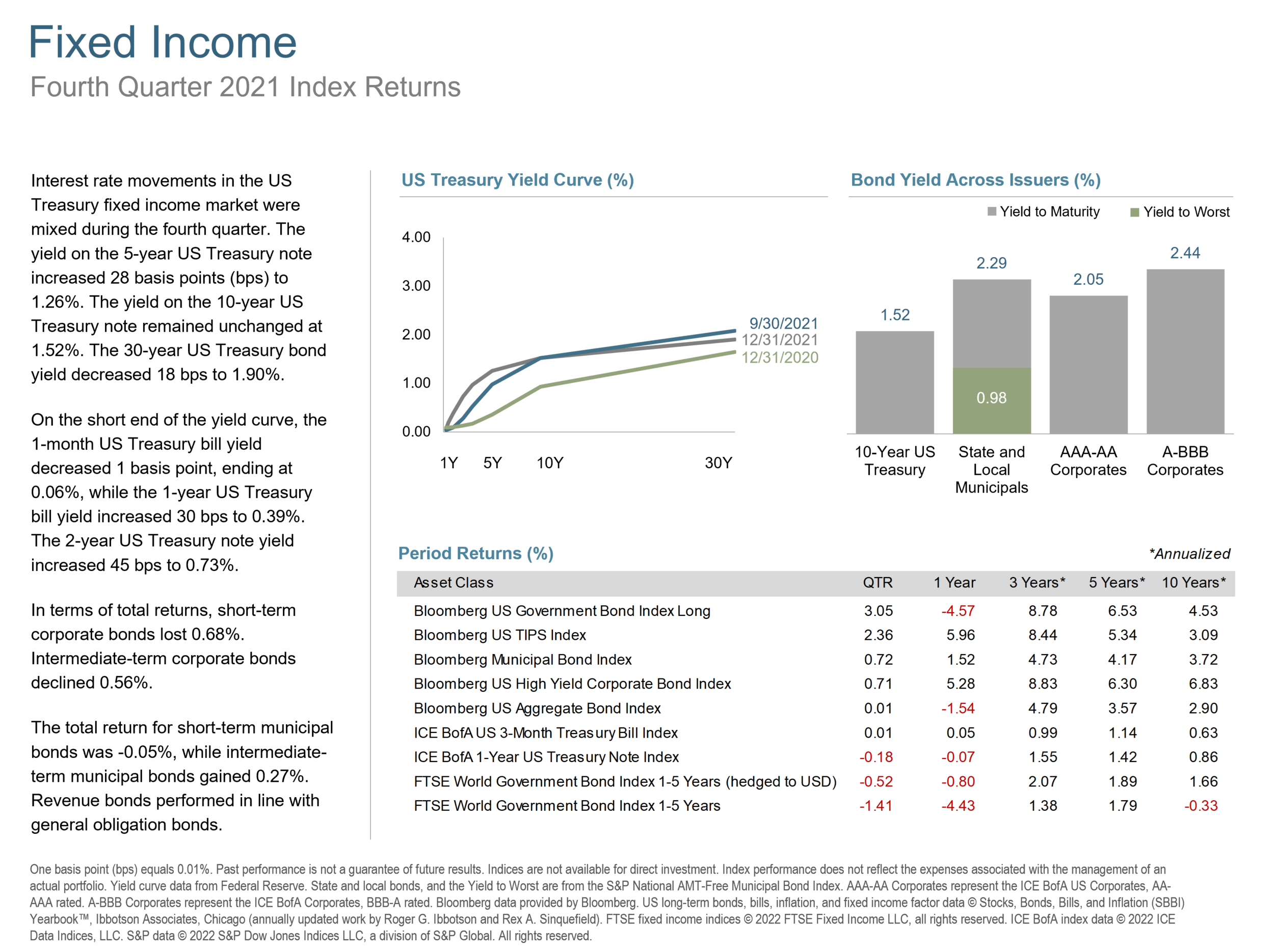

Interest rate movements in the US Treasury fixed income market were mixed during the fourth quarter. The yield on the 5-year US Treasury note increased 28 basis points (bps) to 1.26%. The yield on the 10-year US Treasury note remained unchanged at 1.52%. The 30-year US Treasury bond yield decreased 18 bps to 1.90%.

On the short end of the yield curve, the 1-month US Treasury bill yield decreased 1 basis point, ending at 0.06%, while the 1-year US Treasury bill yield increased 30 bps to 0.39%. The 2-year US Treasury note yield increased 45 bps to 0.73%.

In terms of total returns, short-term corporate bonds lost 0.68%. Intermediate-term corporate bonds declined 0.56%.

The total return for short-term municipal bonds was -0.05%, while intermediate-term municipal bonds gained 0.27%. Revenue bonds performed in line with general obligation bonds.

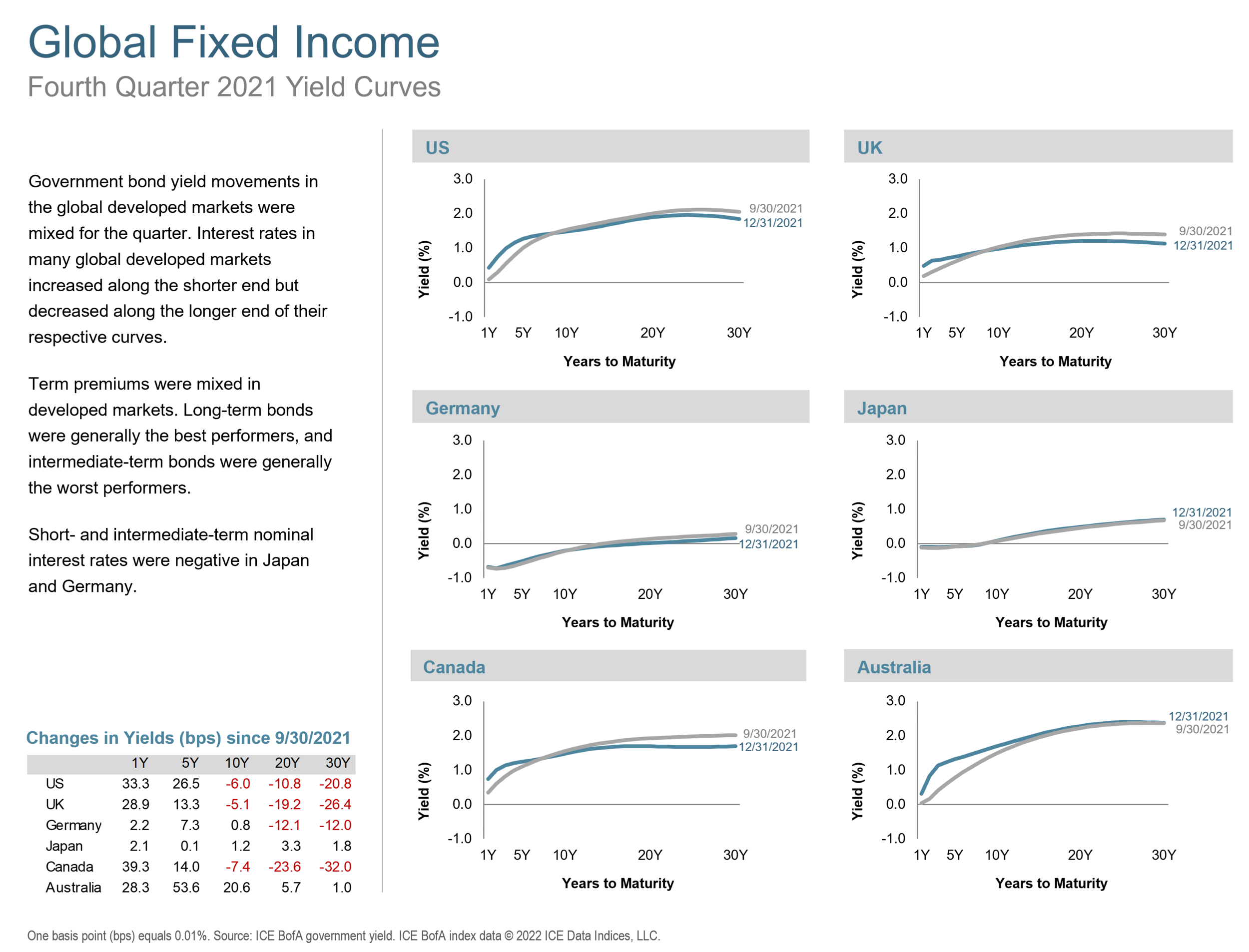

Government bond yield movements in the global developed markets were mixed for the quarter. Interest rates in many global developed markets increased along the shorter end but decreased along the longer end of their respective curves.

Term premiums were mixed in developed markets. Long-term bonds were generally the best performers, and intermediate-term bonds were generally the worst performers.

Short- and intermediate-term nominal interest rates were negative in Japan and Germany.

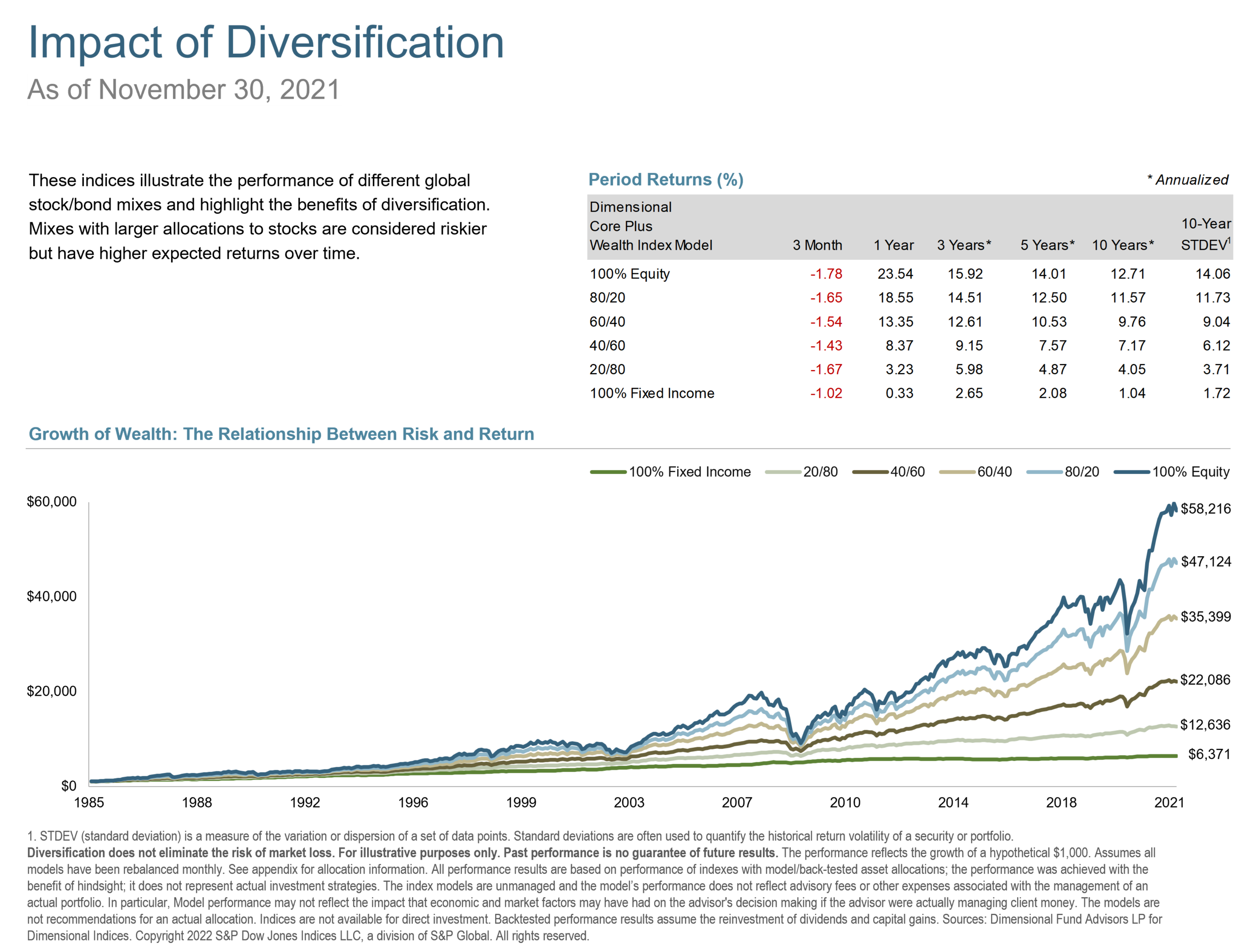

The last quarter of the year reinforced the importance of having a long-term plan. Staying invested through turmoil is often easier said than done but understanding how volatility is likely to influence your plan’s success can go a long way towards managing our emotions.

With any market condition, a sound plan makes the ups and downs much more manageable. Get in touch to review your plan.