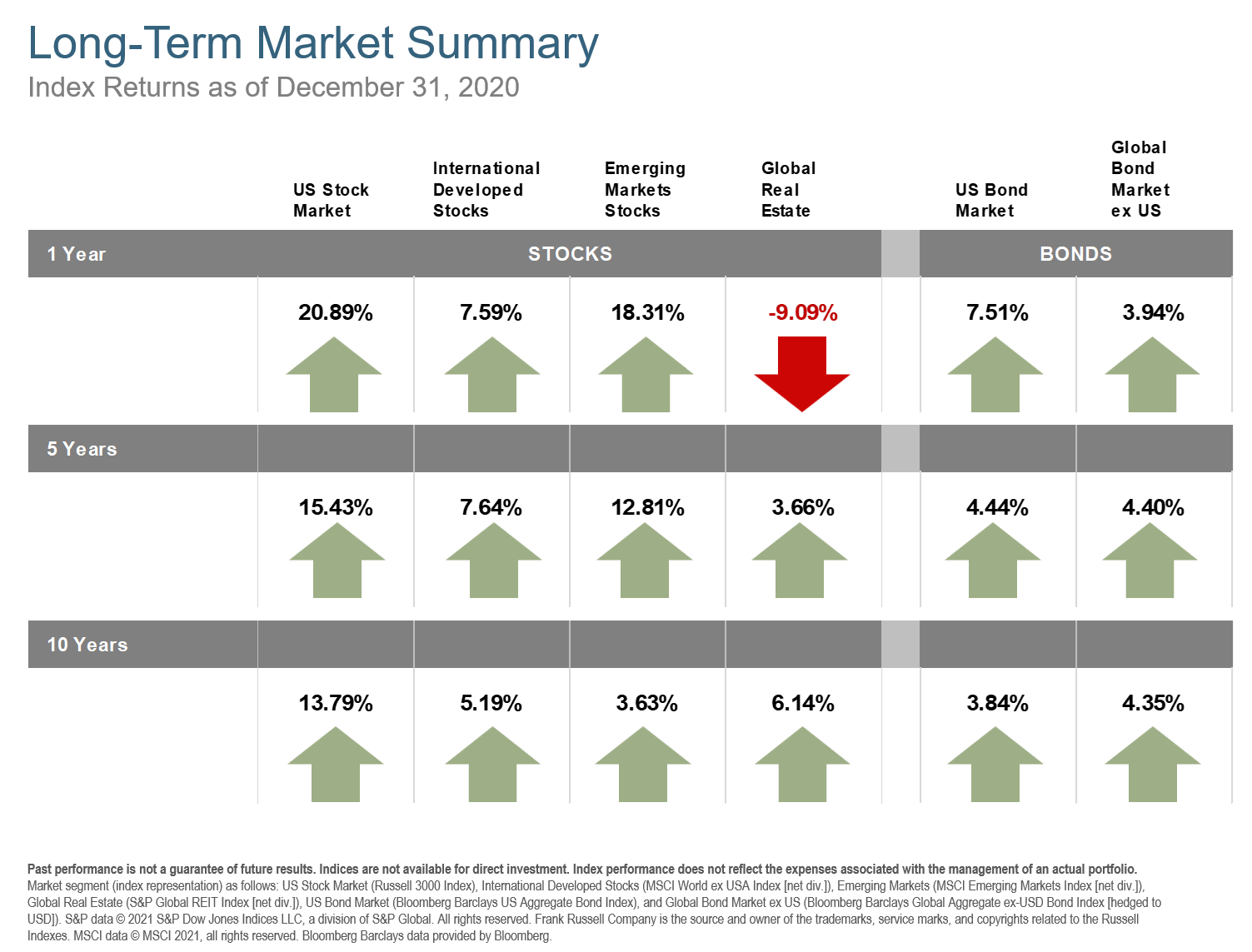

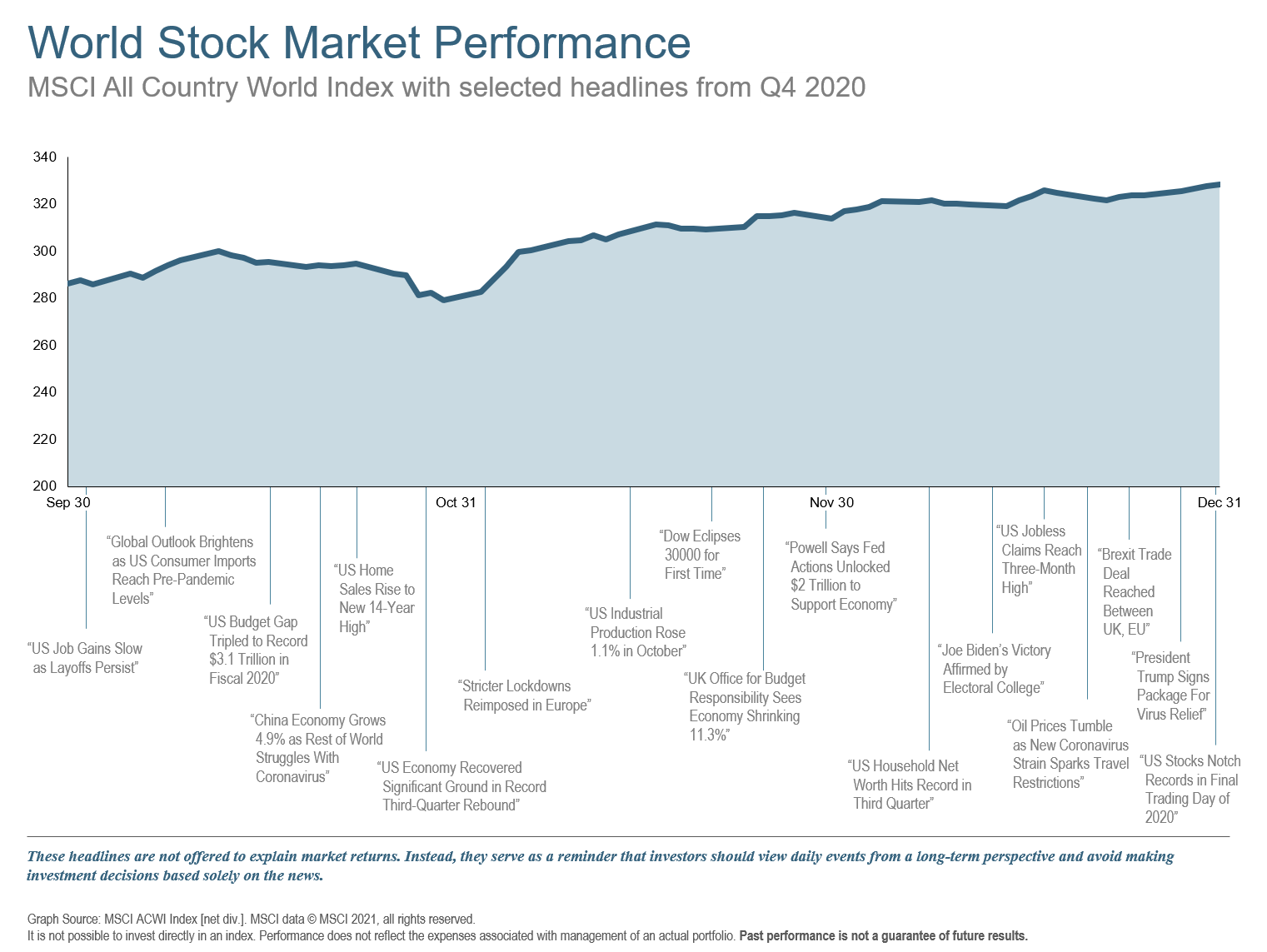

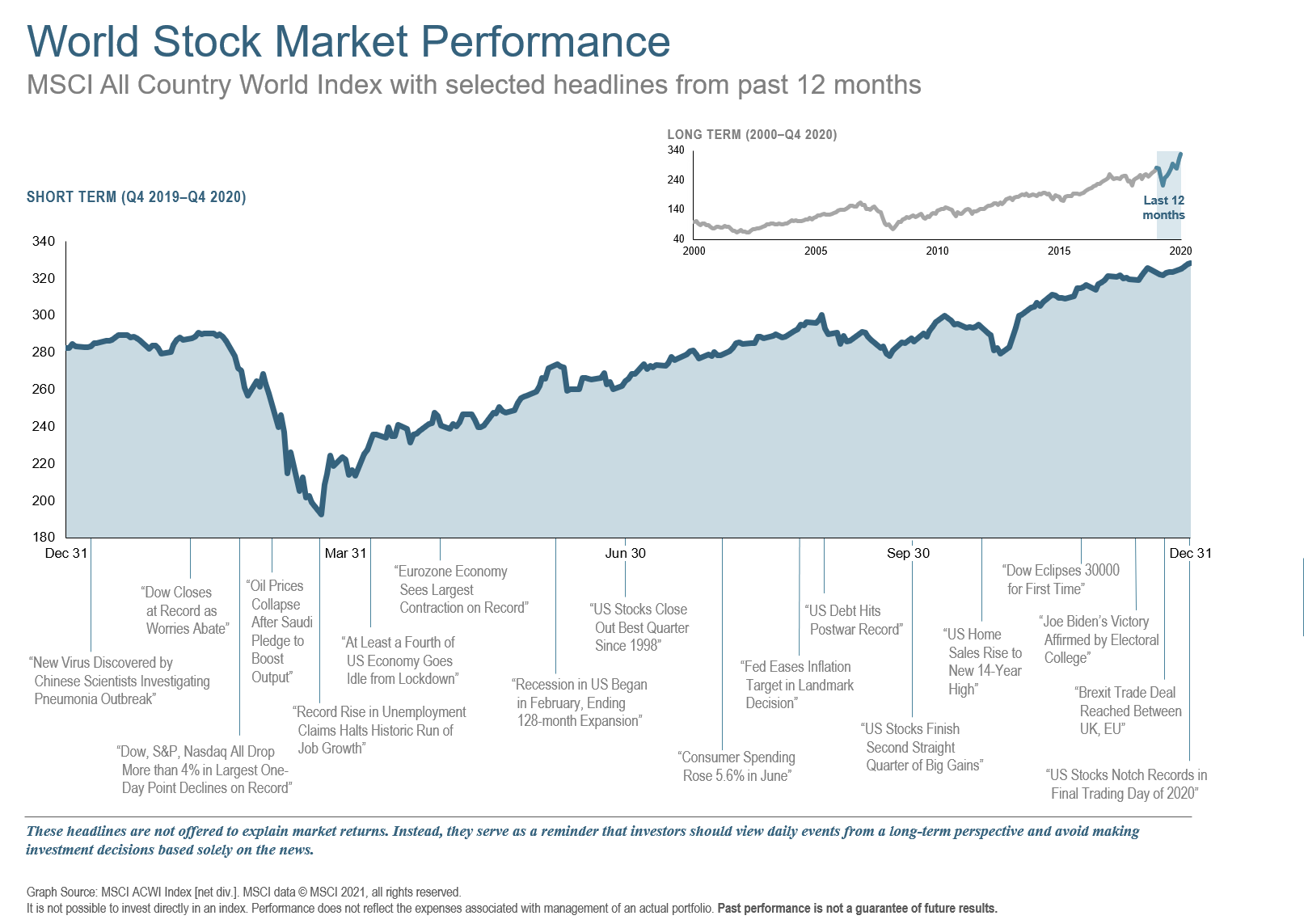

We ended 2020 with a new US President-elect, rising Covid-19 infections, and new lockdowns around the globe. However, new vaccines offered light at the end of the tunnel and an often stalemated US government reached rare consensus to offer the gift of $900 billion in new stimulus.

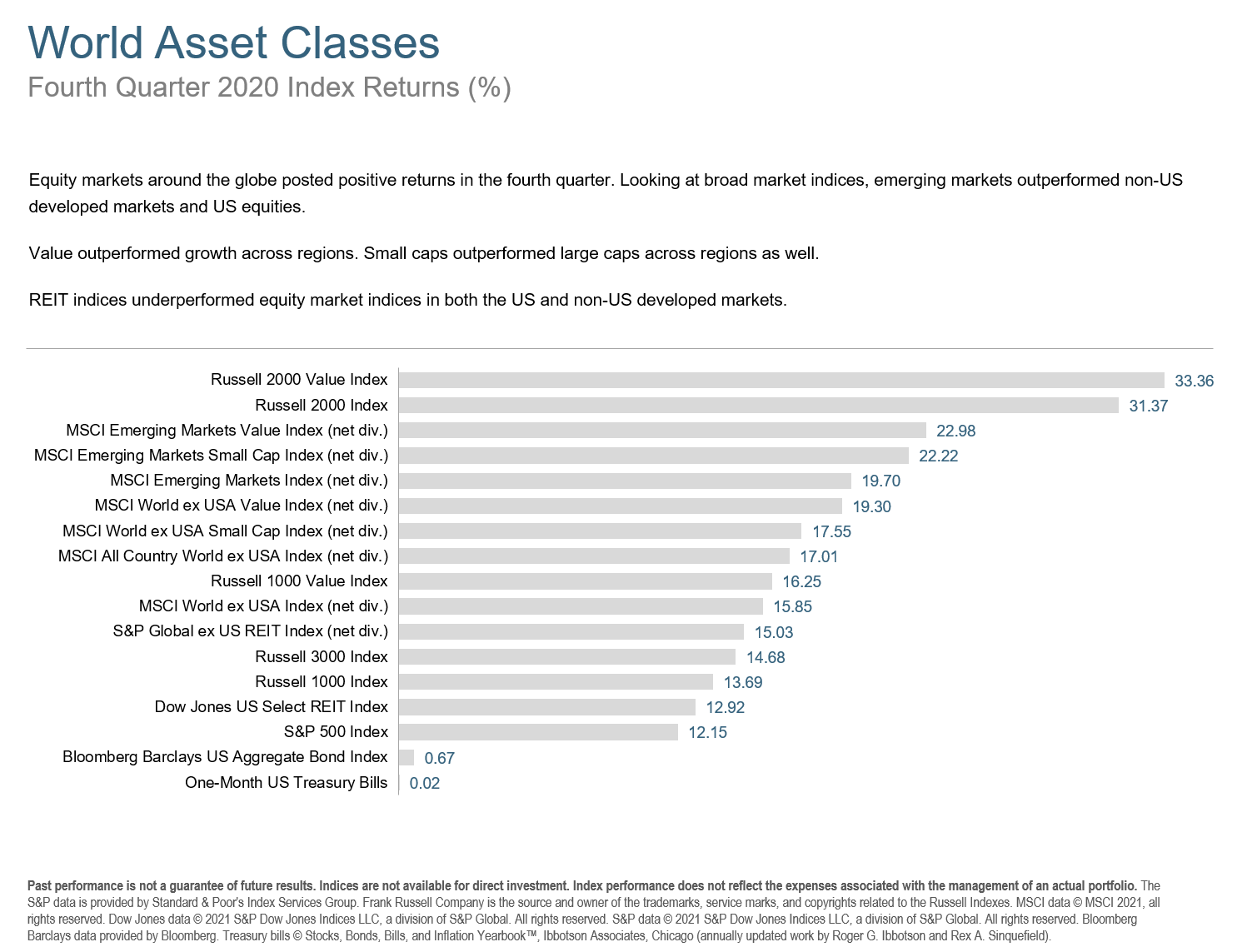

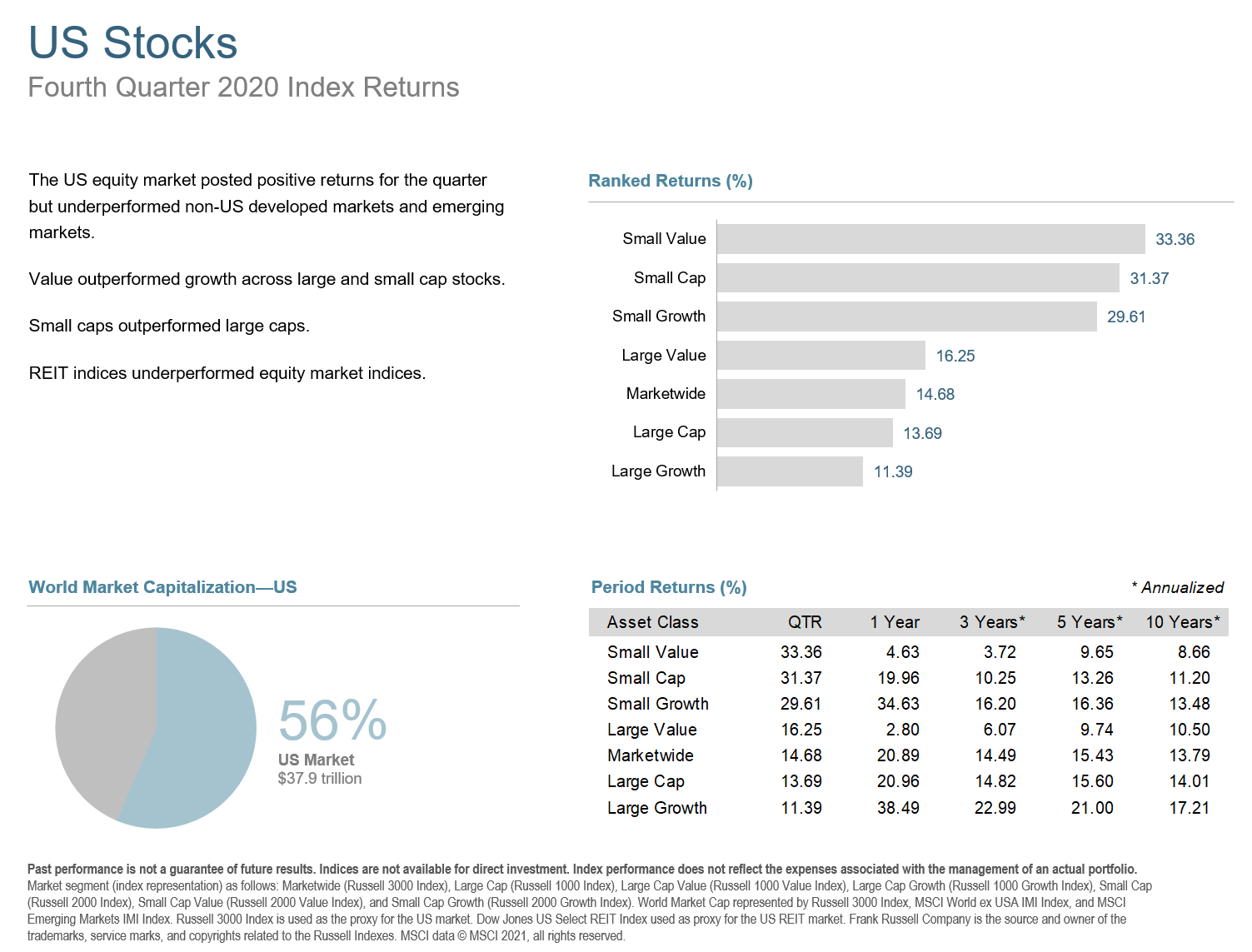

The Federal Reserve, continuing their accommodative spirit, announced it will continue with current levels of bond purchases, also known as quantitative easing. US markets showed appreciation by staging a massive rally. While the US equity market posted strong returns for the quarter, it underperformed non-US developed markets and emerging markets. Value stocks outperformed growth across large and small cap stocks. Small caps outperformed large caps. REITs underperformed stocks.

Equity markets around the globe posted even stronger returns in the fourth quarter. Looking at broad market indices, emerging markets outperformed non-US developed markets and US equities. Value stocks outperformed growth across regions and small caps outperformed large caps across regions as well. REITs underperformed equity market indices in both the US and non-US developed markets.

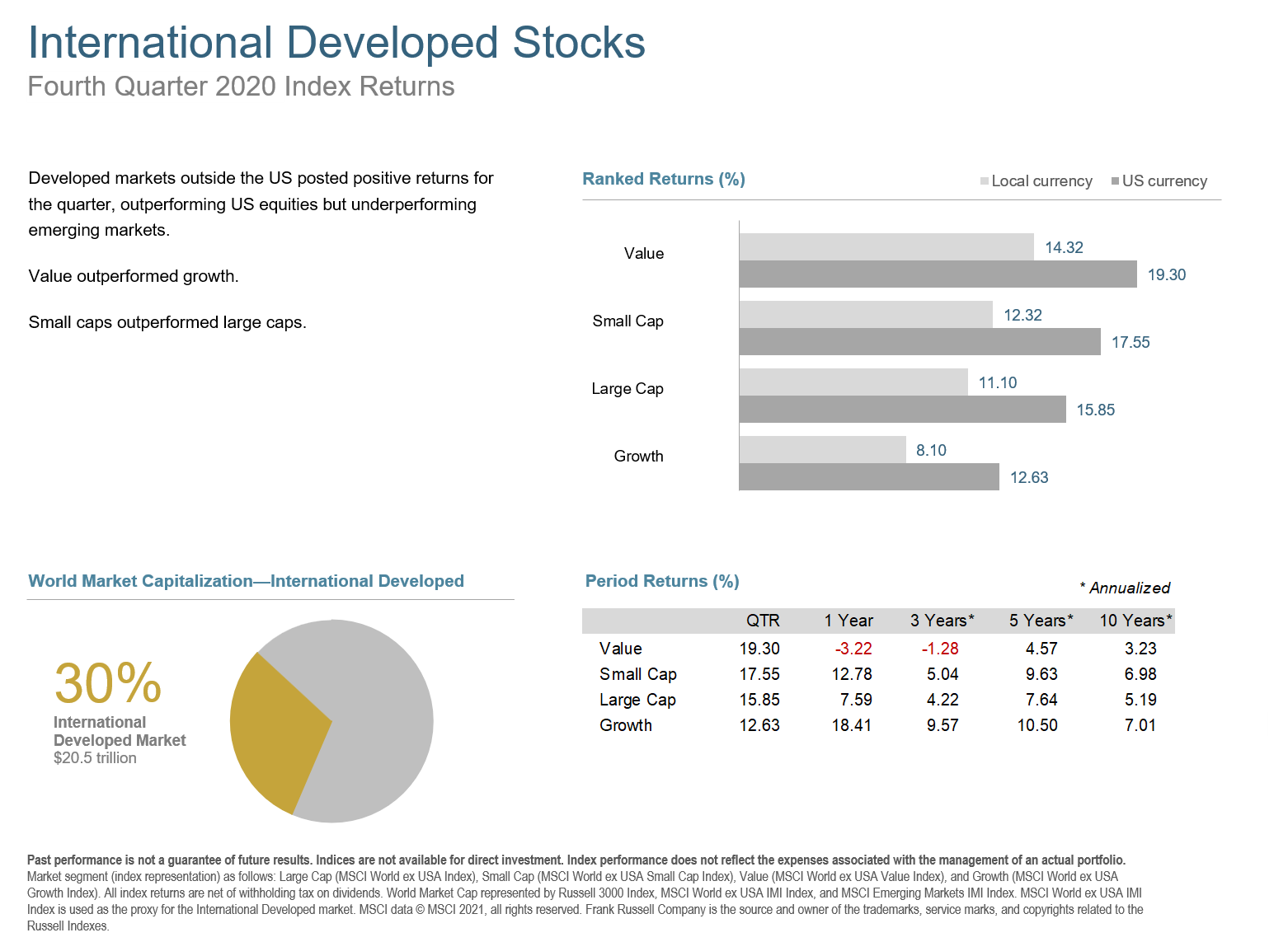

Developed markets outside the US were positive for the quarter, outperforming US equities but underperforming emerging markets. Value outperformed growth. Small caps outperformed large caps.

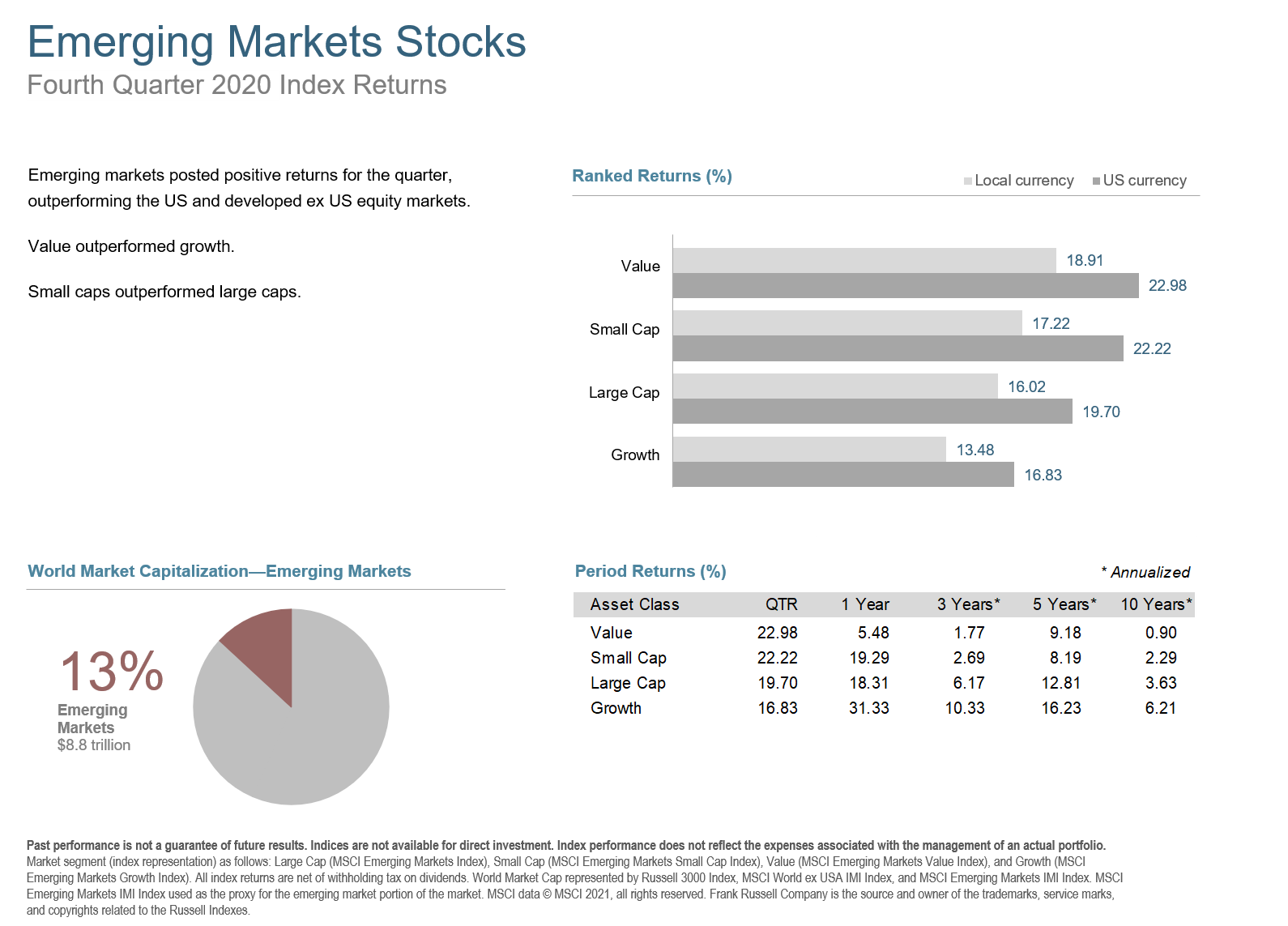

Emerging markets outperformed both the US and developed ex US equity markets. Value outperformed growth. Small caps outperformed large caps.

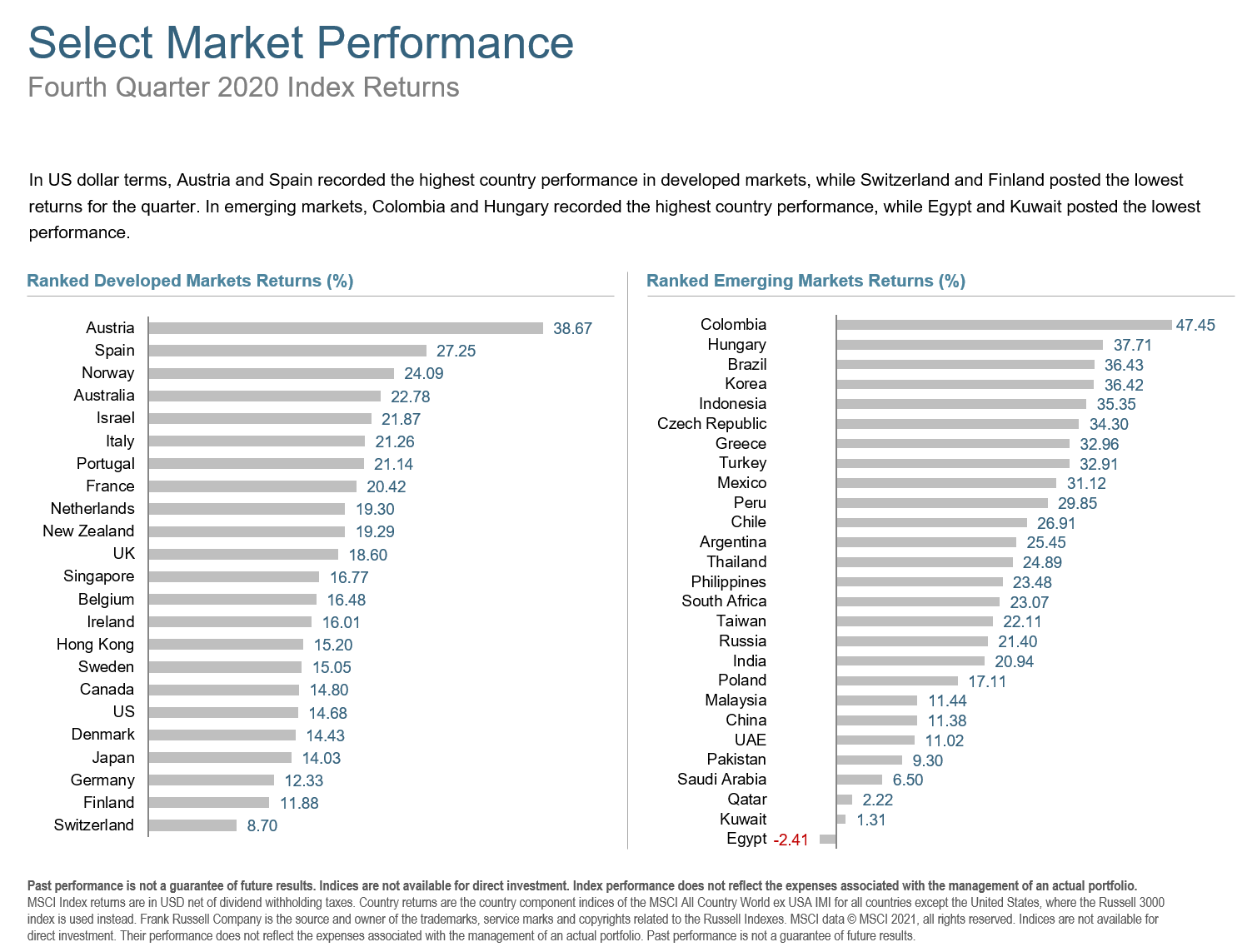

In US dollar terms, Austria and Spain recorded the highest country performance in developed markets, while Switzerland and Finland posted the lowest returns for the quarter. In emerging markets, Colombia and Hungary recorded the highest country performance, while Egypt and Kuwait posted the lowest performance.

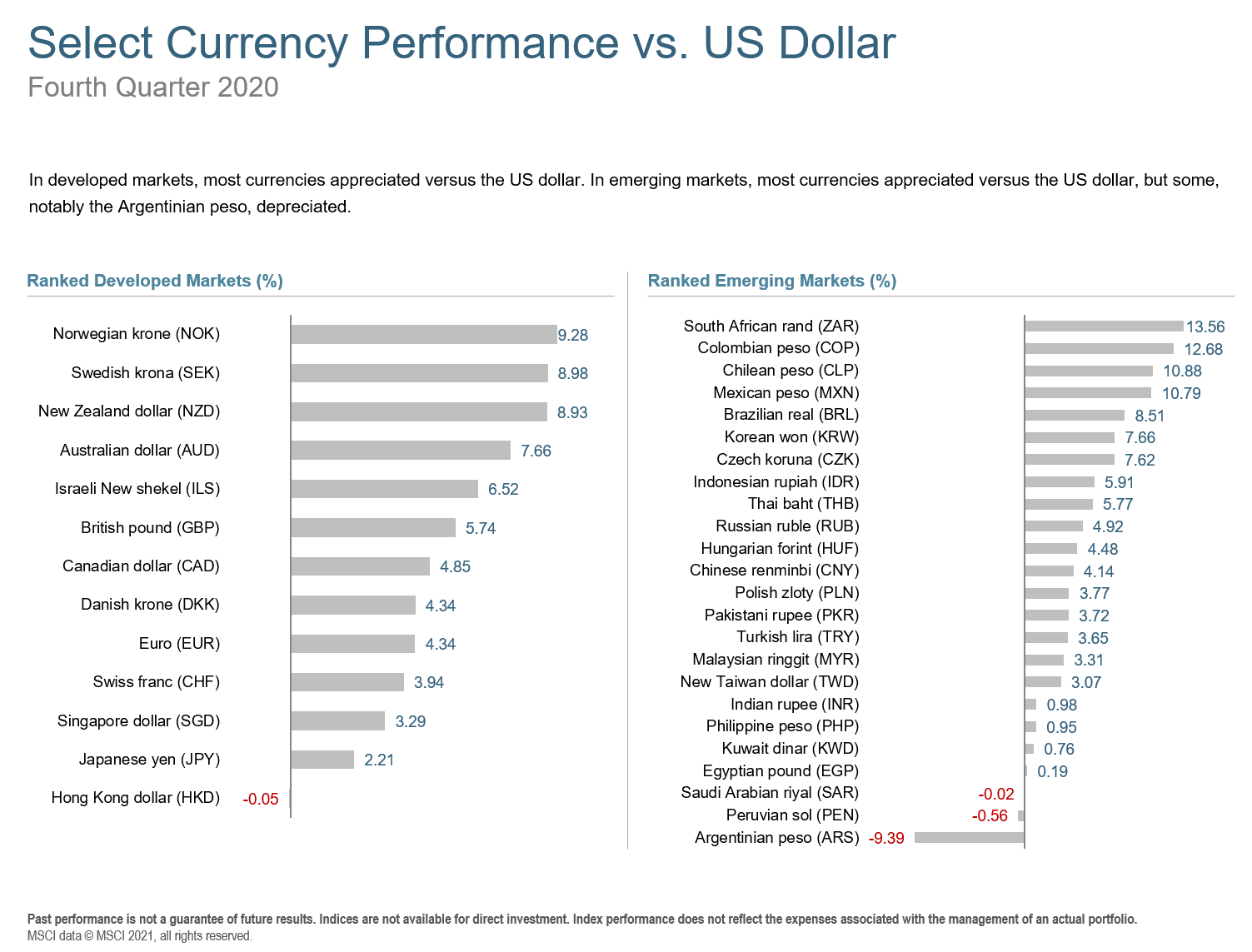

In developed markets, most currencies appreciated versus the US dollar. In emerging markets, most currencies appreciated versus the US dollar, but some, notably the Argentinian peso, depreciated.

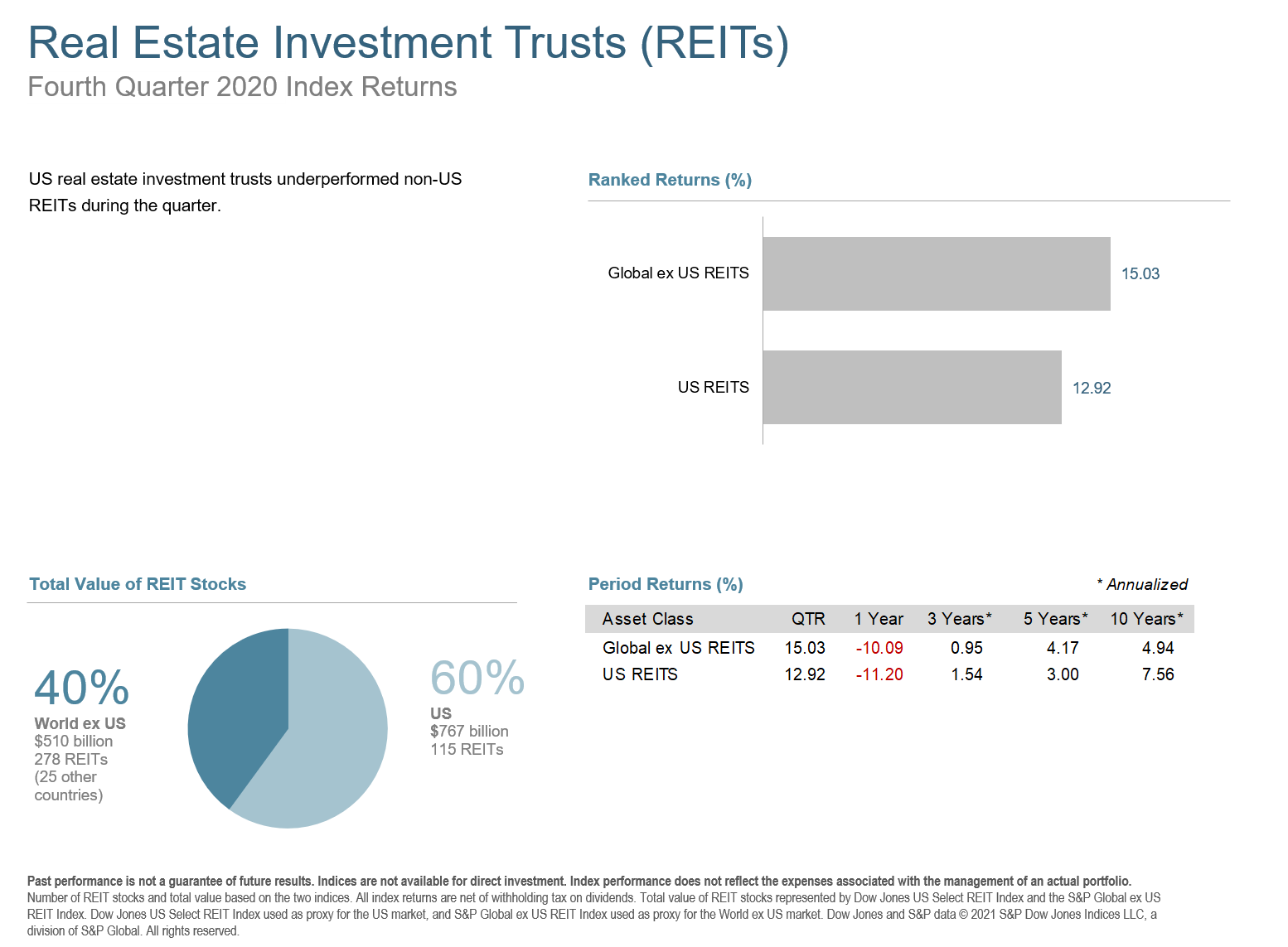

US real estate investment trusts underperformed non-US REITs during the quarter.

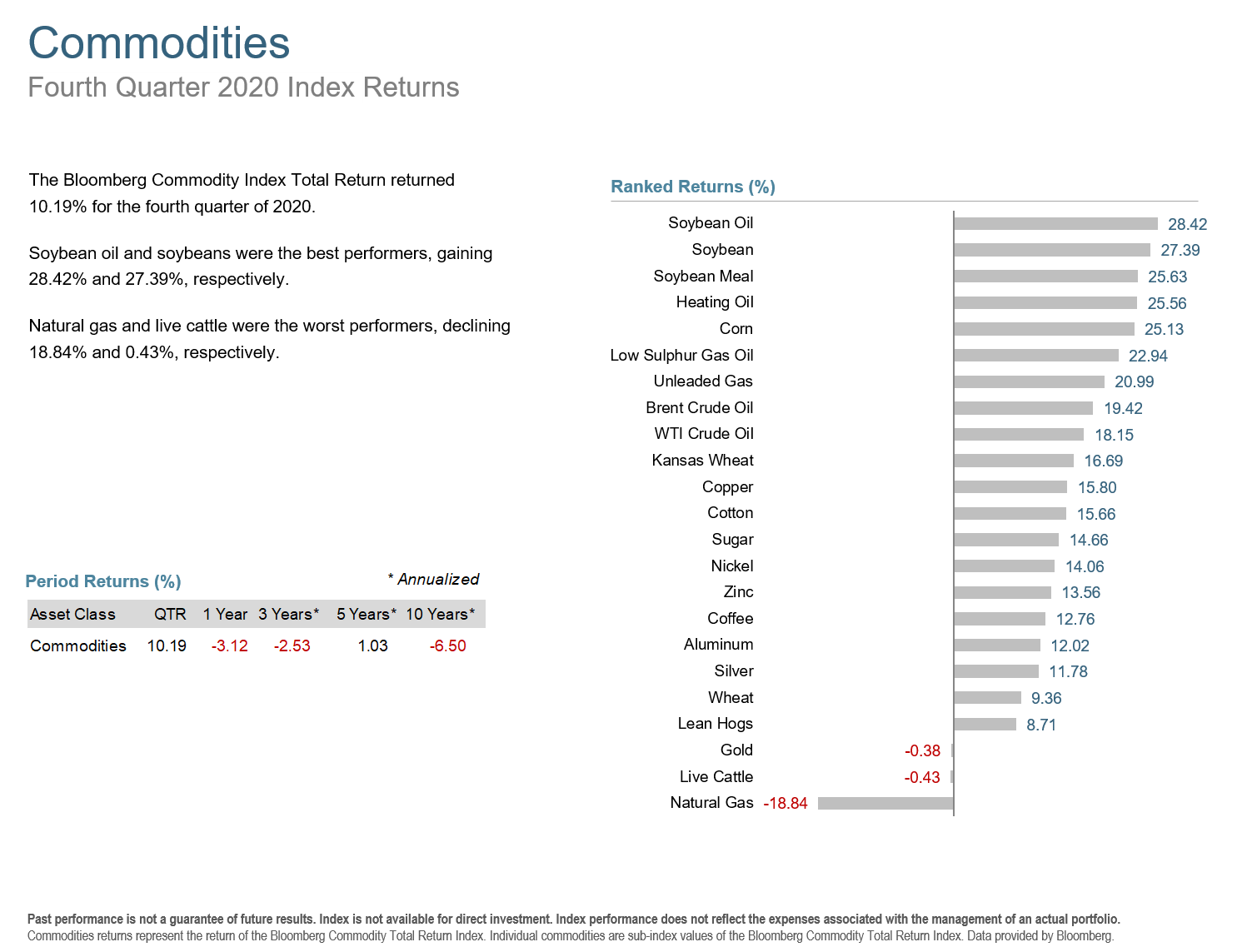

The Bloomberg Commodity Index Total Return returned 10.19% for the fourth quarter of 2020. Soybean oil and soybeans were the best performers, gaining 28.42% and 27.39%, respectively. Natural gas and live cattle were the worst performers, declining 18.84% and 0.43%, respectively.

Interest rate changes were mixed in the US Treasury fixed income market during the fourth quarter of 2020. The yield on the 5-Year US Treasury note increased 8 basis points (bps), ending at 0.39%. The yield on the 10-Year Treasury increased 29 bps to 0.93%. The 30-Year US Treasury bond yield increased 18 bps to finish at 1.64%. On the short end of the yield curve, the 1-Month US Treasury bill yield remained unchanged at 0.08%, while the 1-Year US T-bill yield decreased 1 bps to 0.13%. The 2-Year US Treasury note yield finished unchanged at 0.09%. In terms of total returns, short-term corporate bonds added 1.14%. Intermediate-term corporate bonds returned 1.76%. The total return for short-term municipal bonds was 0.44%, while intermediate-term municipals returned 1.36%. Revenue bonds outperformed general obligation bonds.

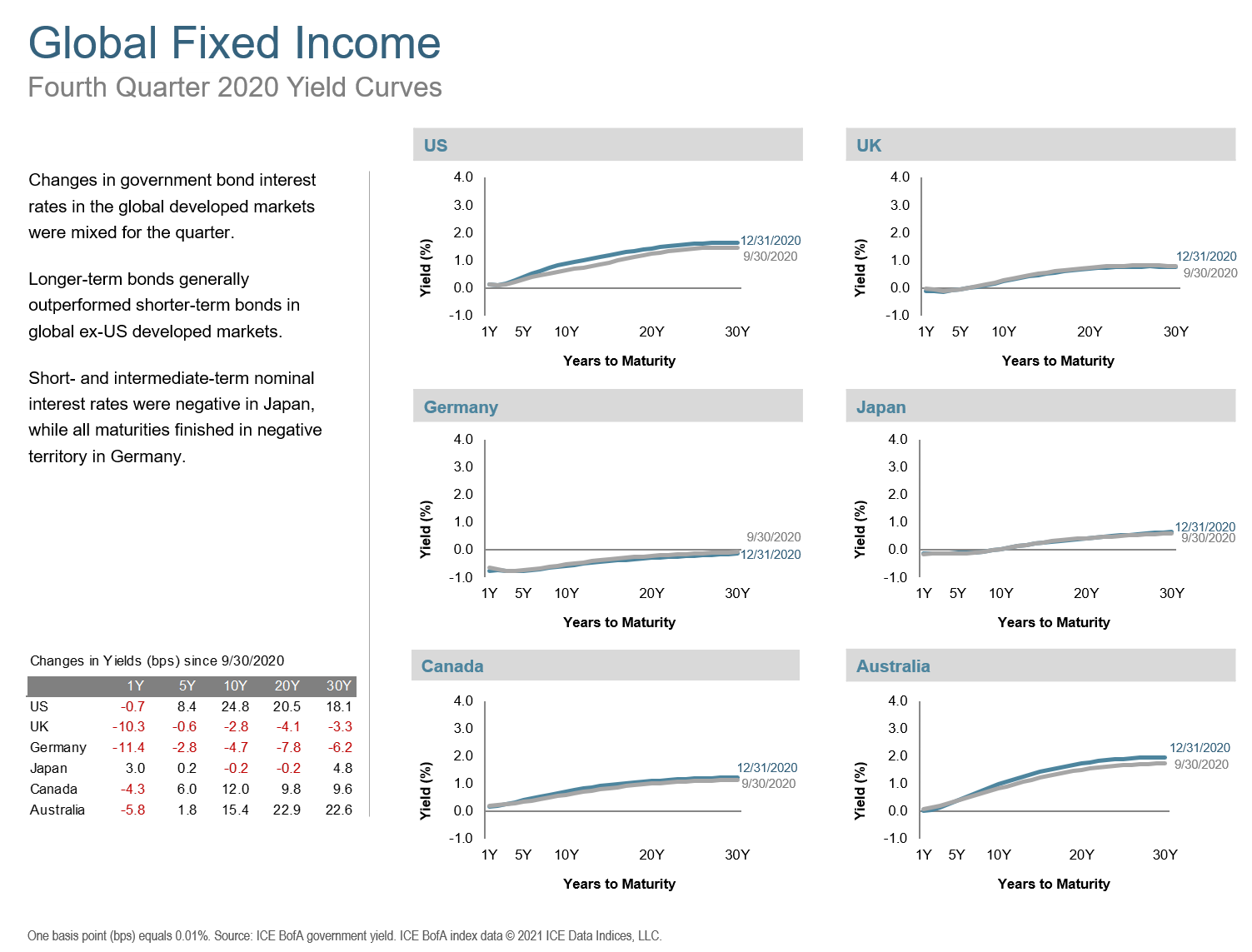

Changes in government bond interest rates in the global developed markets were mixed for the quarter. Longer-term bonds generally outperformed shorter-term bonds in global ex-US developed markets. Short- and intermediate-term nominal interest rates were negative in Japan, while all maturities finished in negative territory in Germany.

The Q4 2020 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As with any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan. Happy New Year!