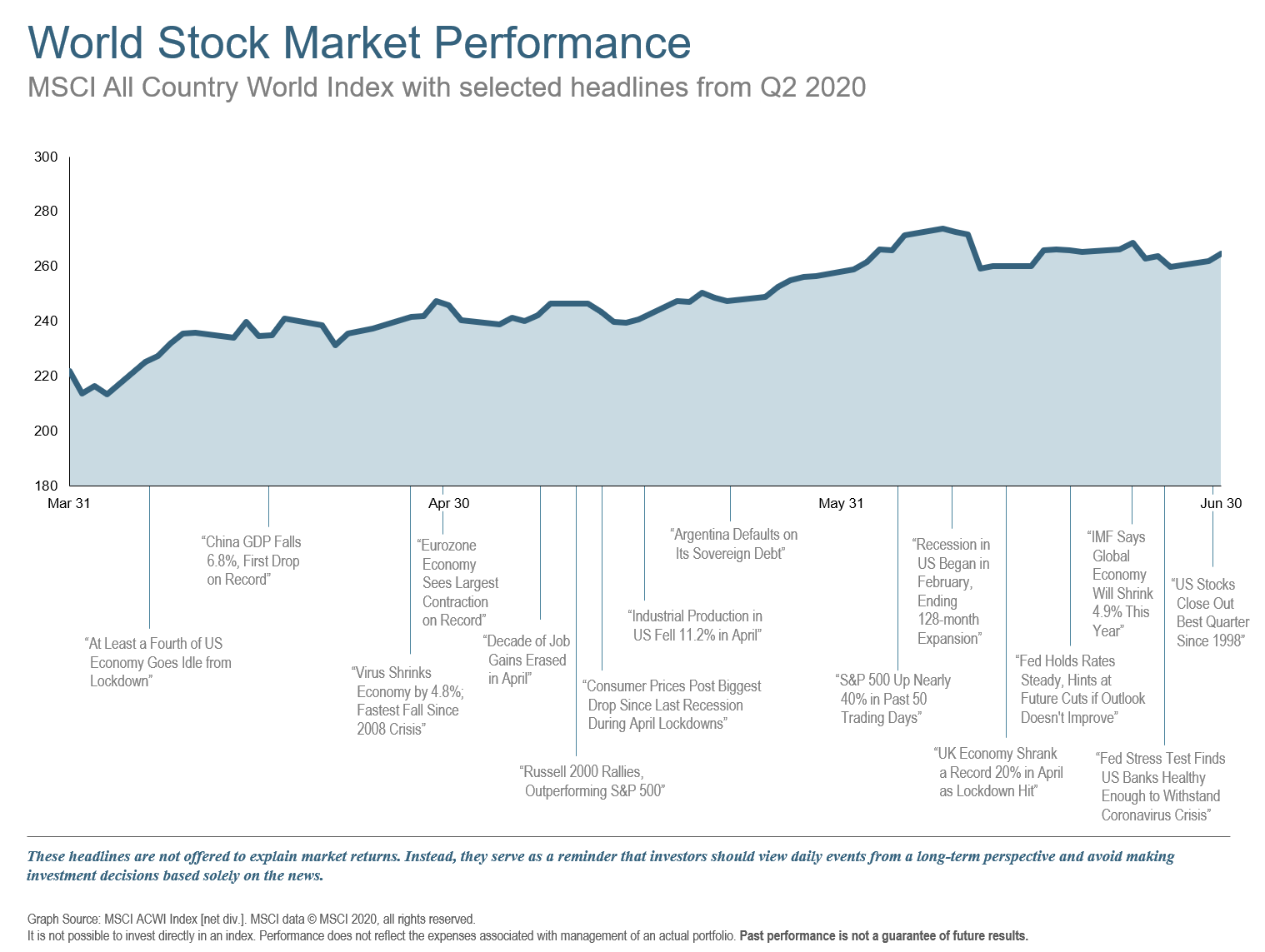

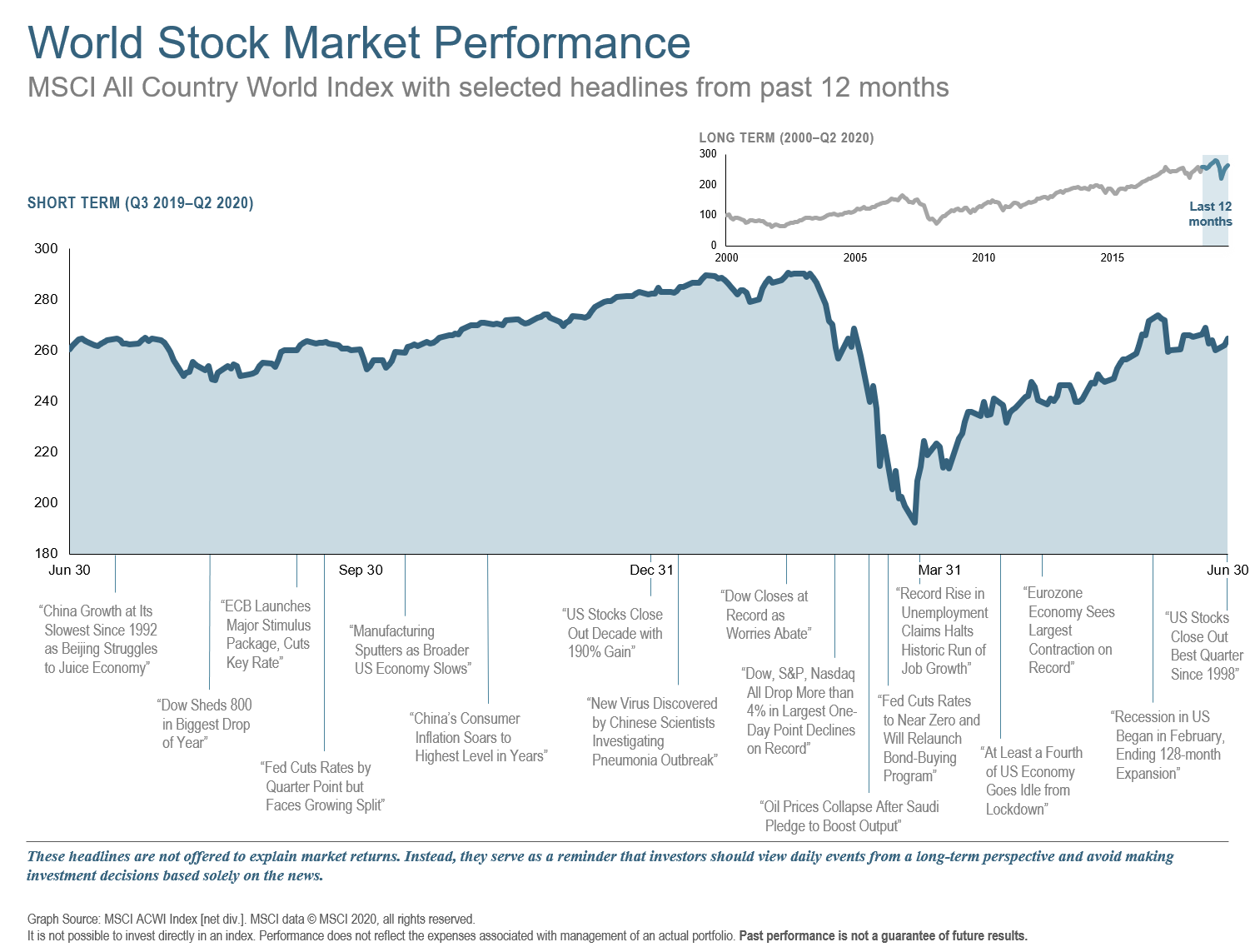

After the pandemic driven rout of equities in Q1, stocks and bonds staged an impressive recovery in Q2 as central banks and governments fired up the printing presses and economies started to reopen. As people started venturing out from the Covid lockdown, economic data has indicated a sharp rebound. Statistics such as US retail sales rose 17% month on month in May, and weekly claims for unemployment insurance slowed substantially from April to May.

While the US economy officially entered a recession during Q1, fears of a worst case scenario of the Covid crisis morphing from a toilet paper run into a bank run have apparently been avoided. Nonetheless, central banks don’t appear to be in the mood to back away from providing liquidity support where necessary. There also appears to be loose monetary policy for the foreseeable future as the Fed is “…not even thinking about thinking about raising rates”, according to Jerome Powell, chairman of the US Federal Reserve.

However, risks remain, as always. First, some companies will face solvency concerns, leading to layoffs and bankruptcies. In addition, the virus has not been fully contained, nor a vaccine approved. As we have seen first hand here in Texas, new infections are rising again in the US, while several emerging markets, including India and much of Latin America, haven’t been able to get the virus under control. Oh, and there is a pretty big election coming up in November that is already impacting markets as traders jockey to line up with the winning side.

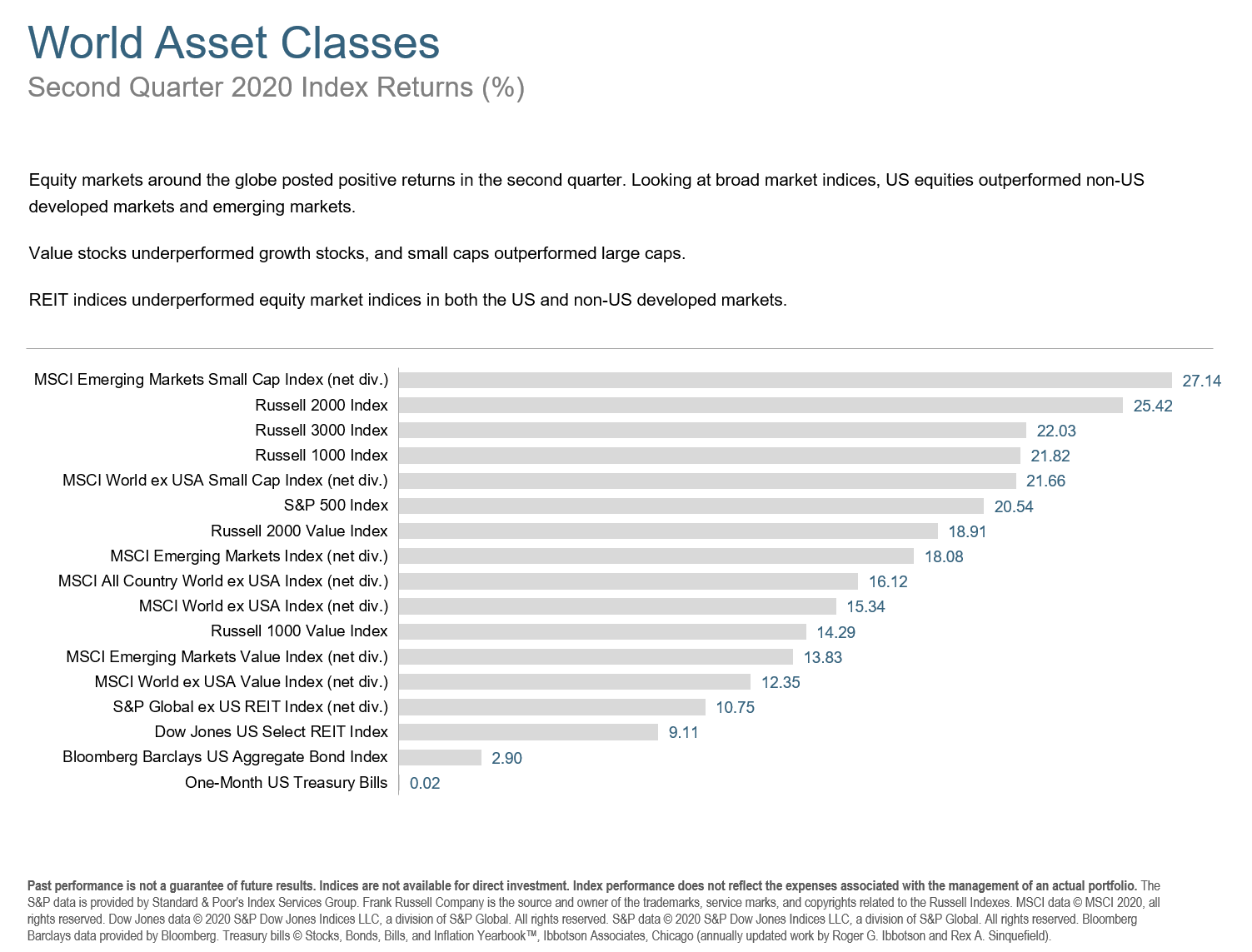

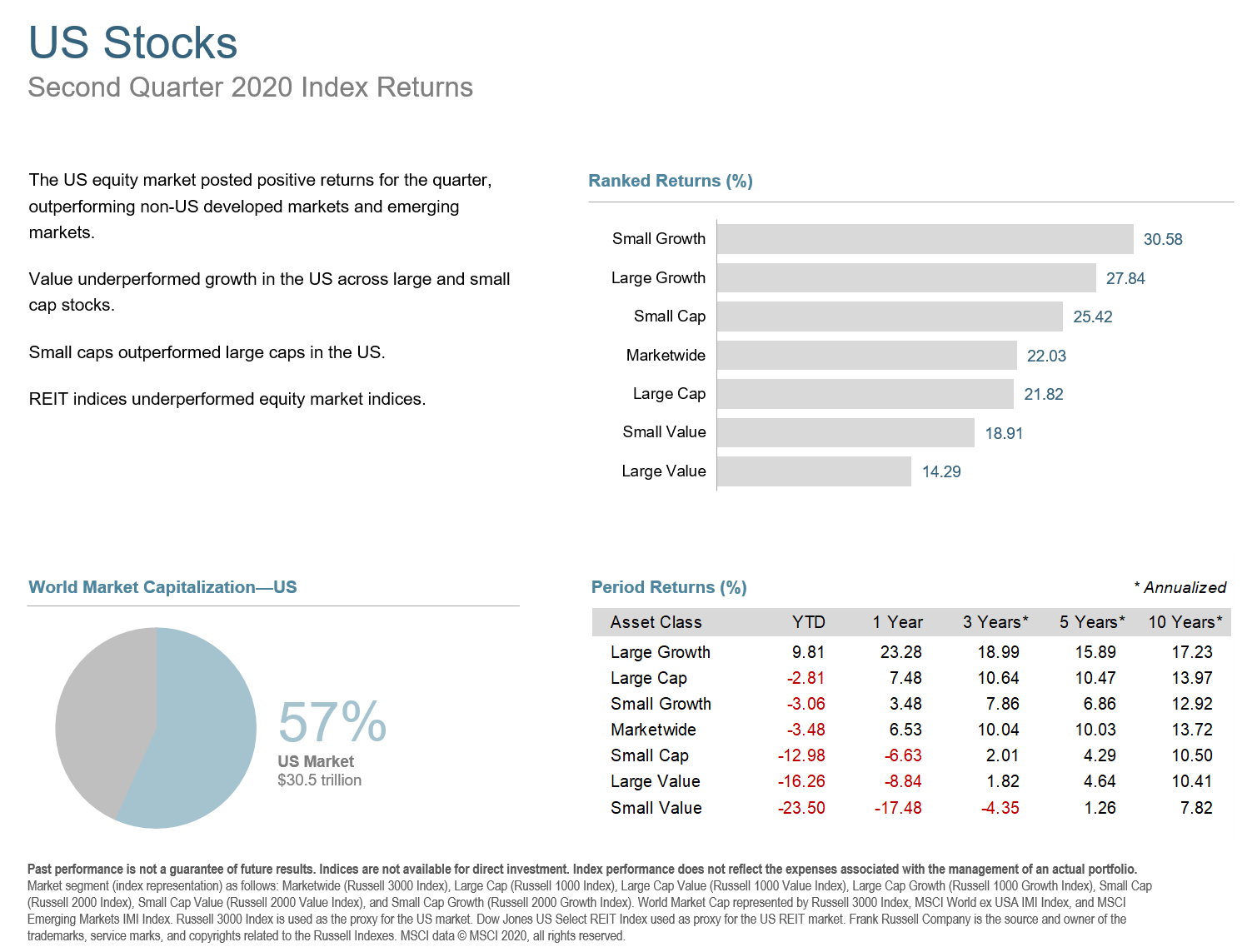

The US equity market posted positive returns for the quarter, outperforming non-US developed markets and emerging markets. Value underperformed growth in the US across large and small cap stocks. Small caps outperformed large caps in the US. REIT indices underperformed equity market indices.

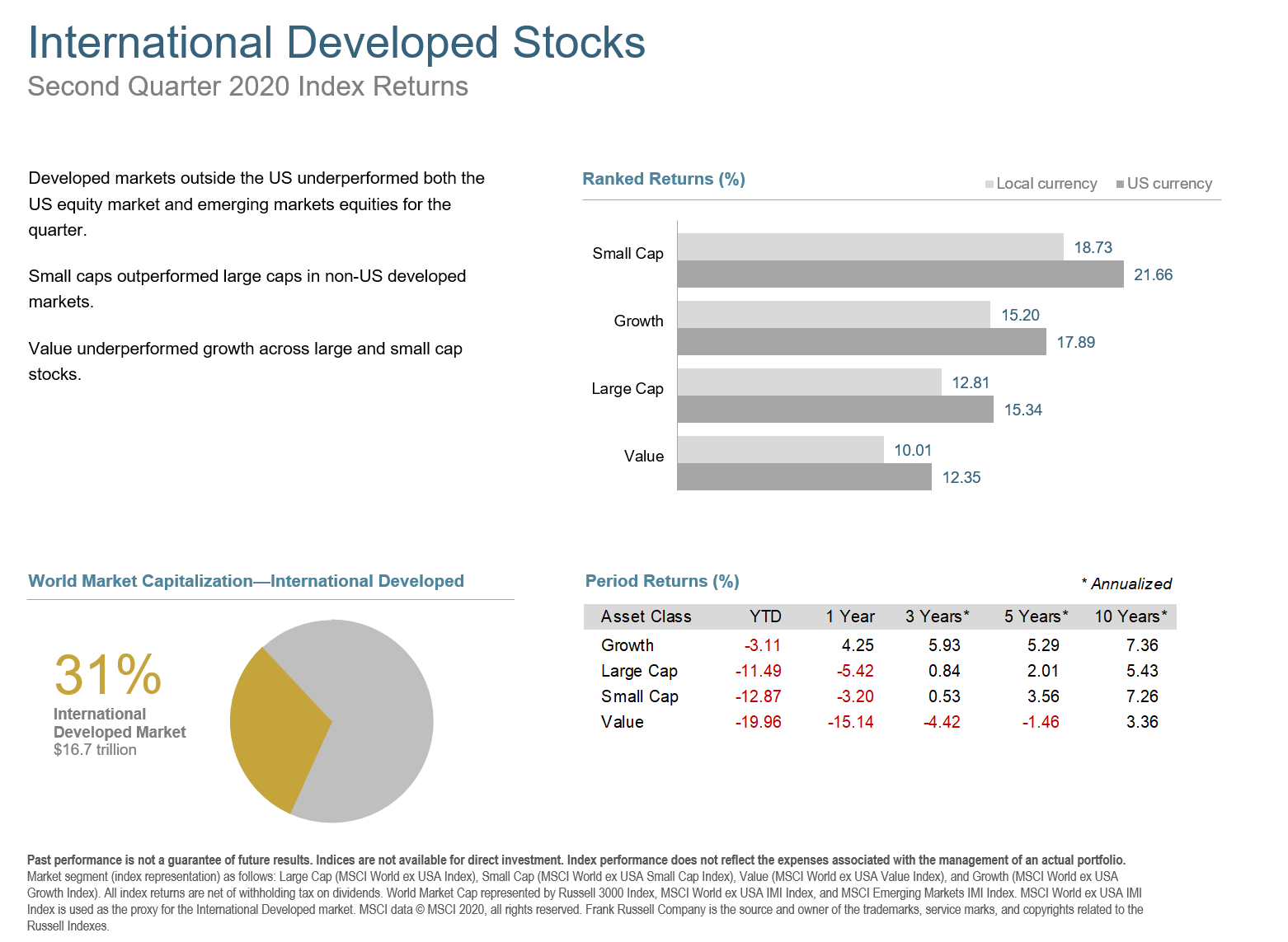

Developed markets outside the US underperformed both the US equity market and emerging markets equities for the quarter. Small caps outperformed large caps in non-US developed markets. Value underperformed growth across large and small cap stocks.

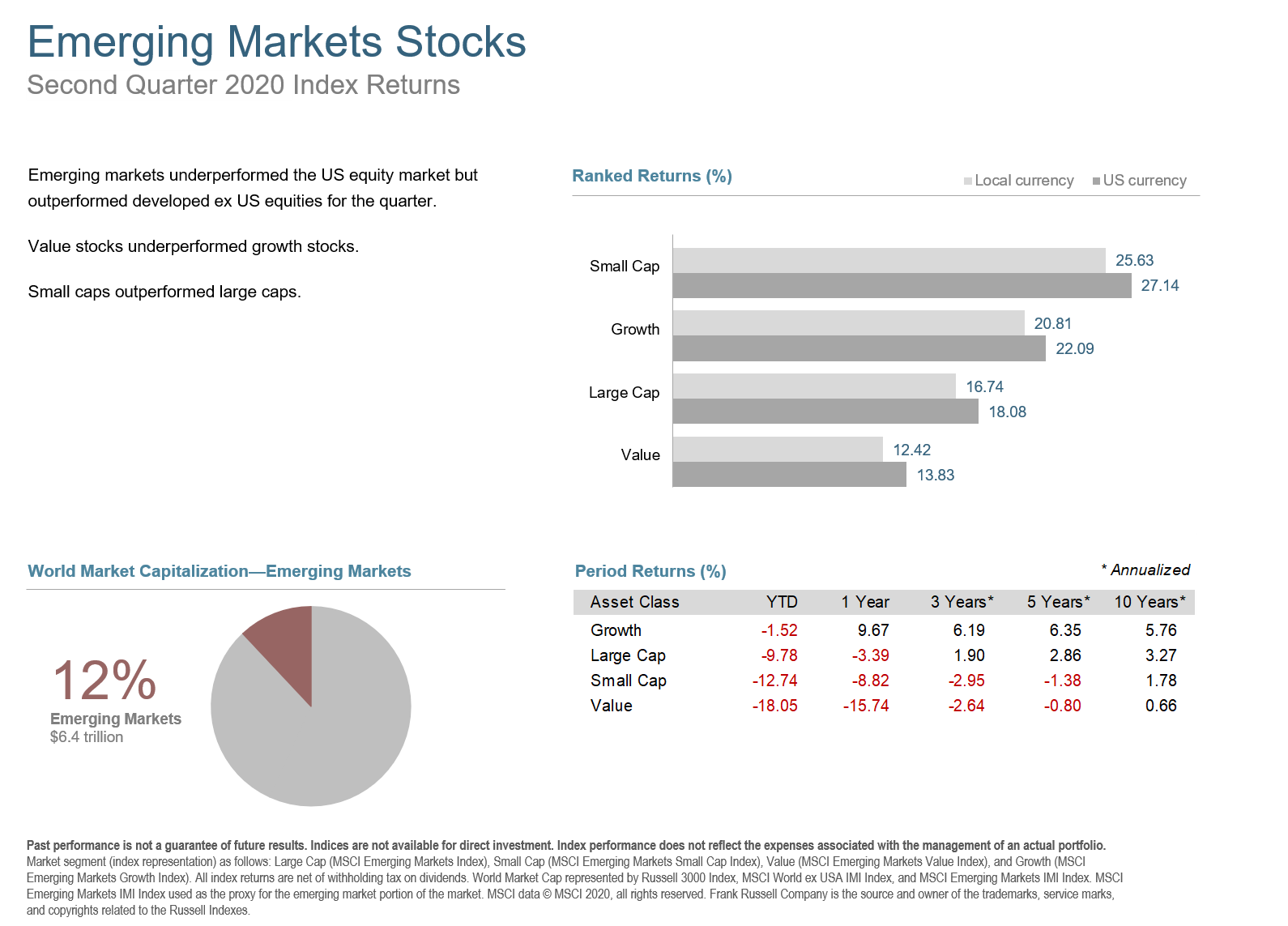

Emerging markets underperformed the US equity market but outperformed developed ex-US equities for the quarter. Value stocks underperformed growth stocks. Small caps outperformed large caps.

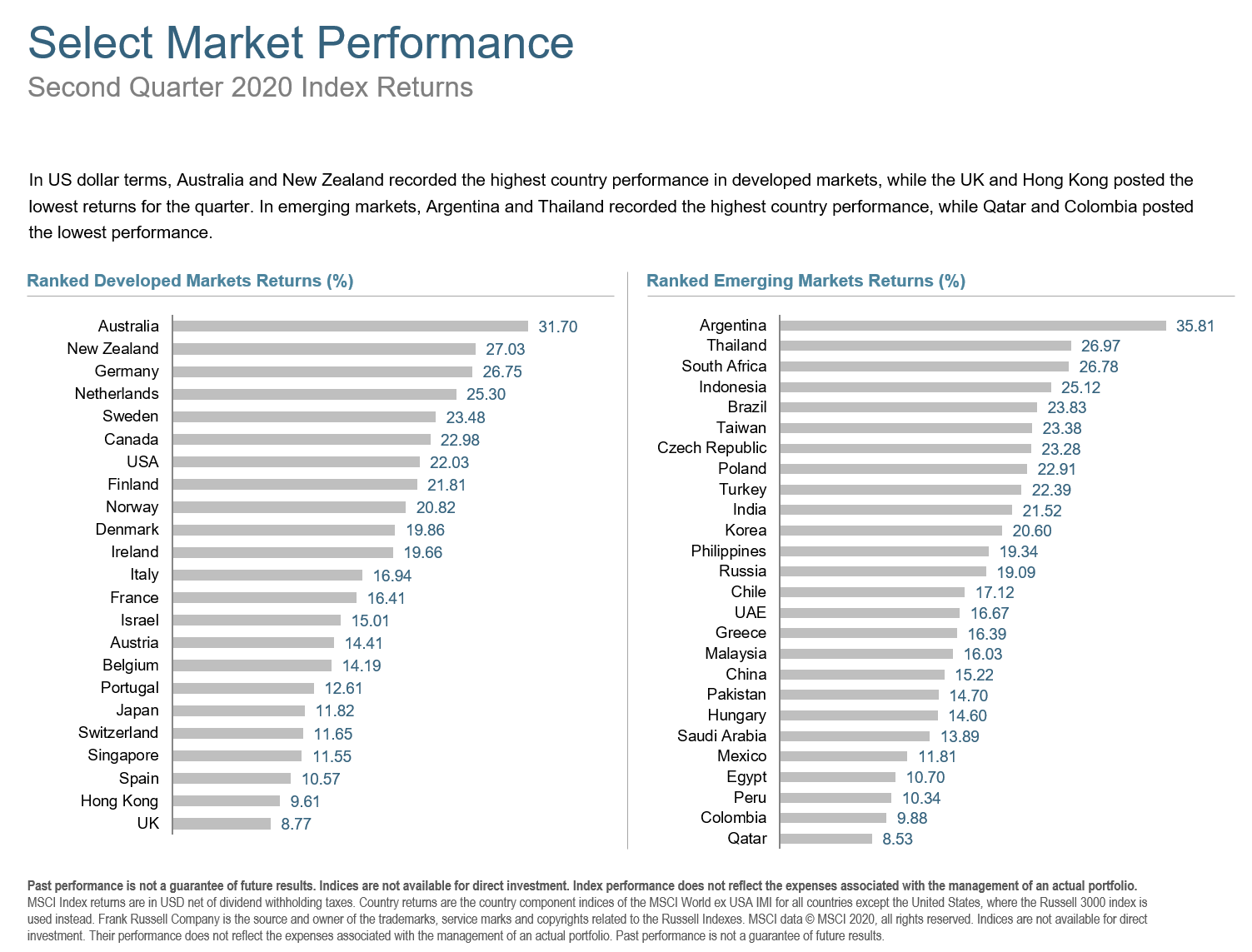

In US dollar terms, Australia and New Zealand recorded the highest country performance in developed markets, while the UK and Hong Kong posted the lowest returns for the quarter. In emerging markets, Argentina and Thailand recorded the highest country performance, while Qatar and Colombia posted the lowest performance.

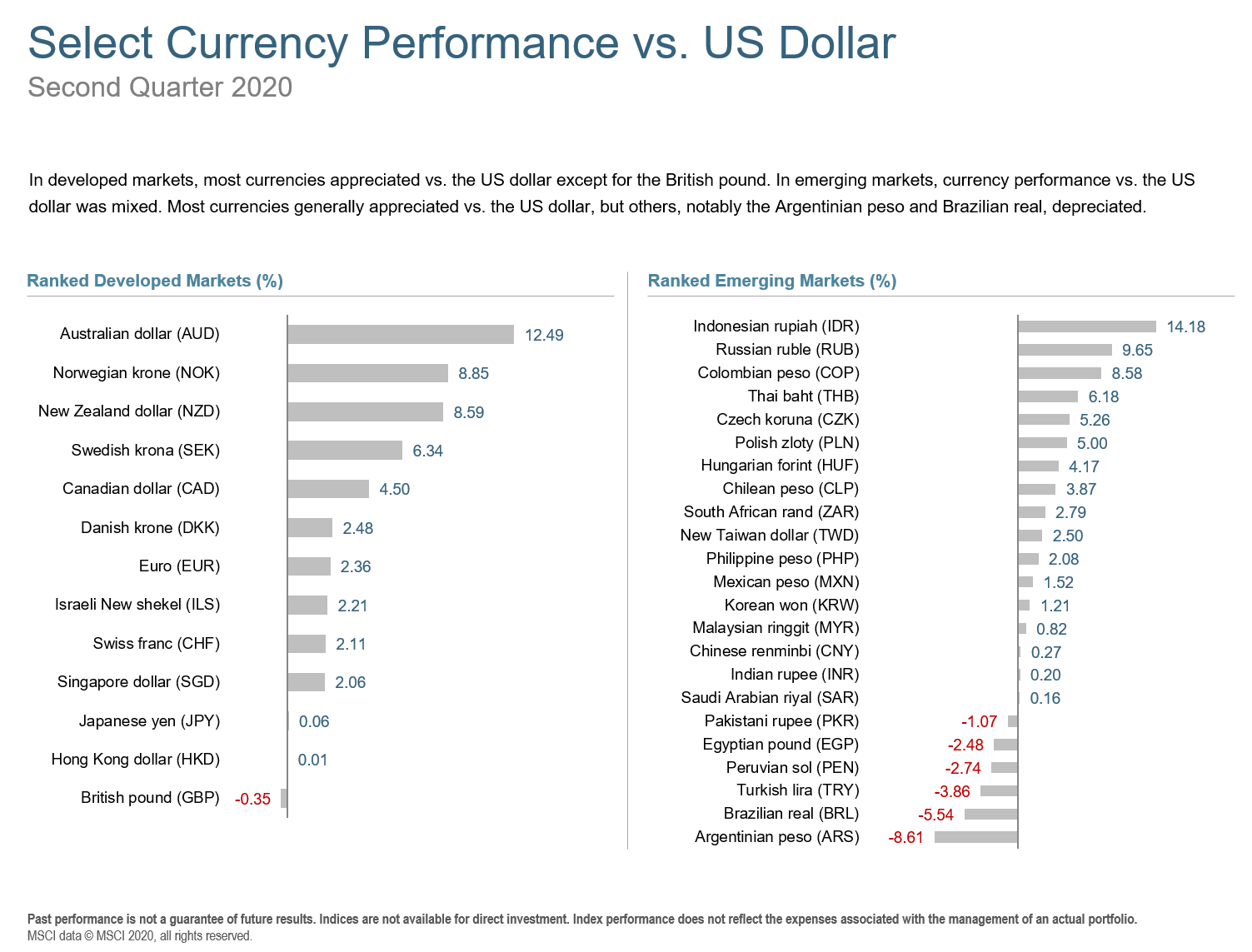

In developed markets, most currencies appreciated vs. the US dollar except for the British pound. In emerging markets, currency performance vs. the US dollar was mixed. Most currencies generally appreciated vs. the US dollar, but others, notably the Argentinian peso and Brazilian real, depreciated.

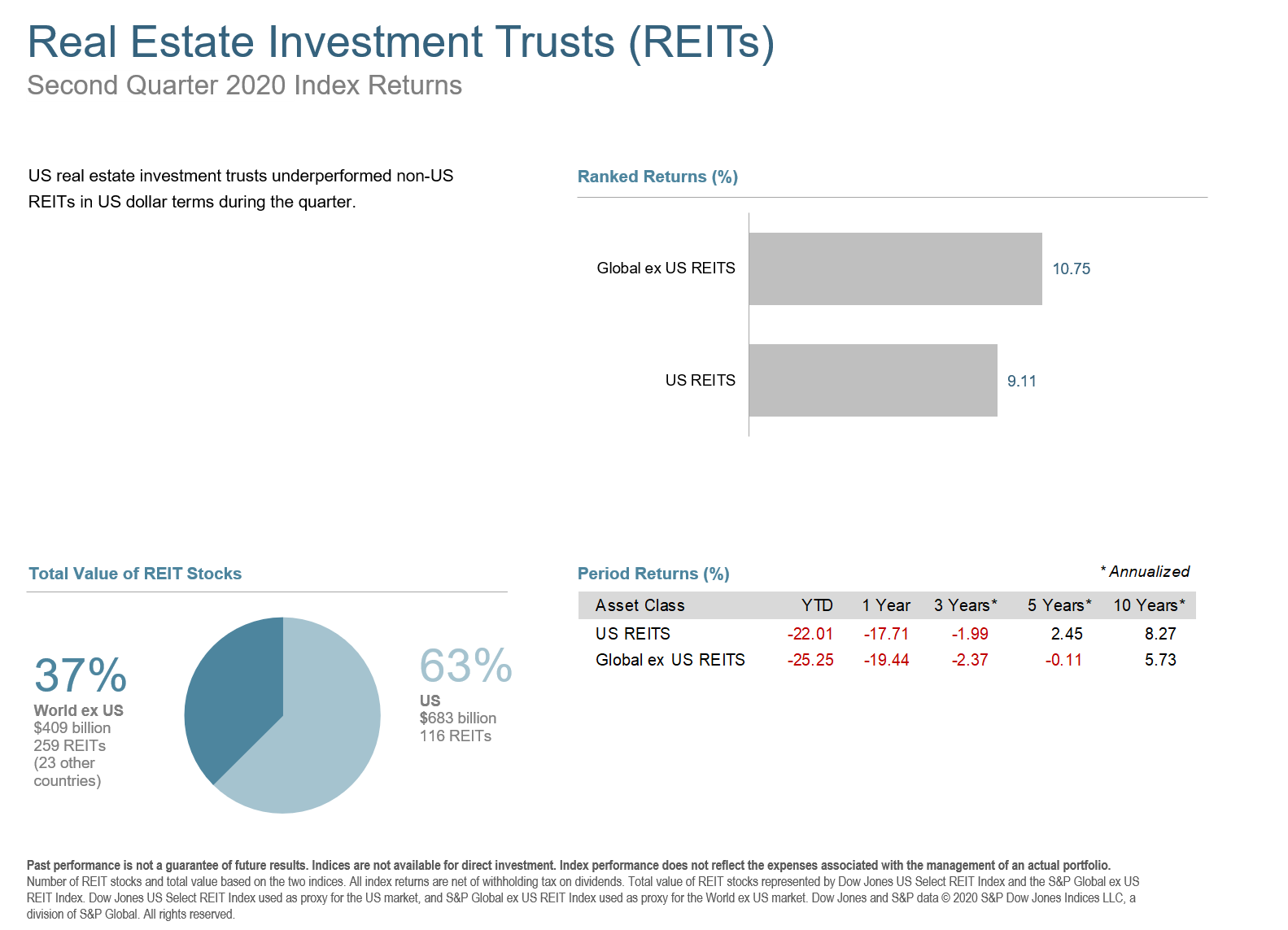

US real estate investment trusts underperformed non-US REITs in US dollar terms during the quarter.

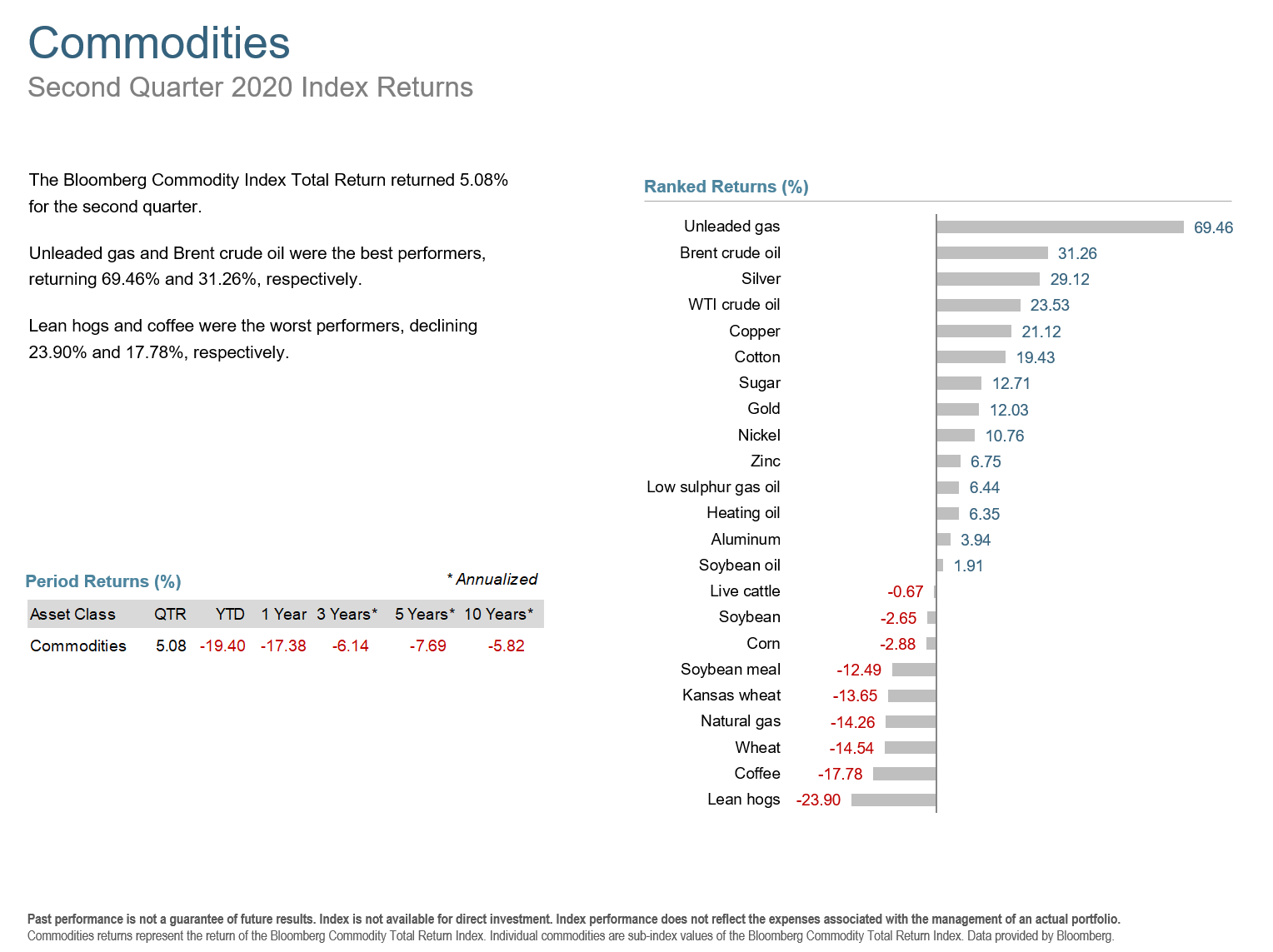

The Bloomberg Commodity Index Total Return returned 5.08% for the second quarter. Unleaded gas and Brent crude oil were the best performers, returning 69.46% and 31.26%, respectively. Lean hogs and coffee were the worst performers, declining 23.90% and 17.78%, respectively.

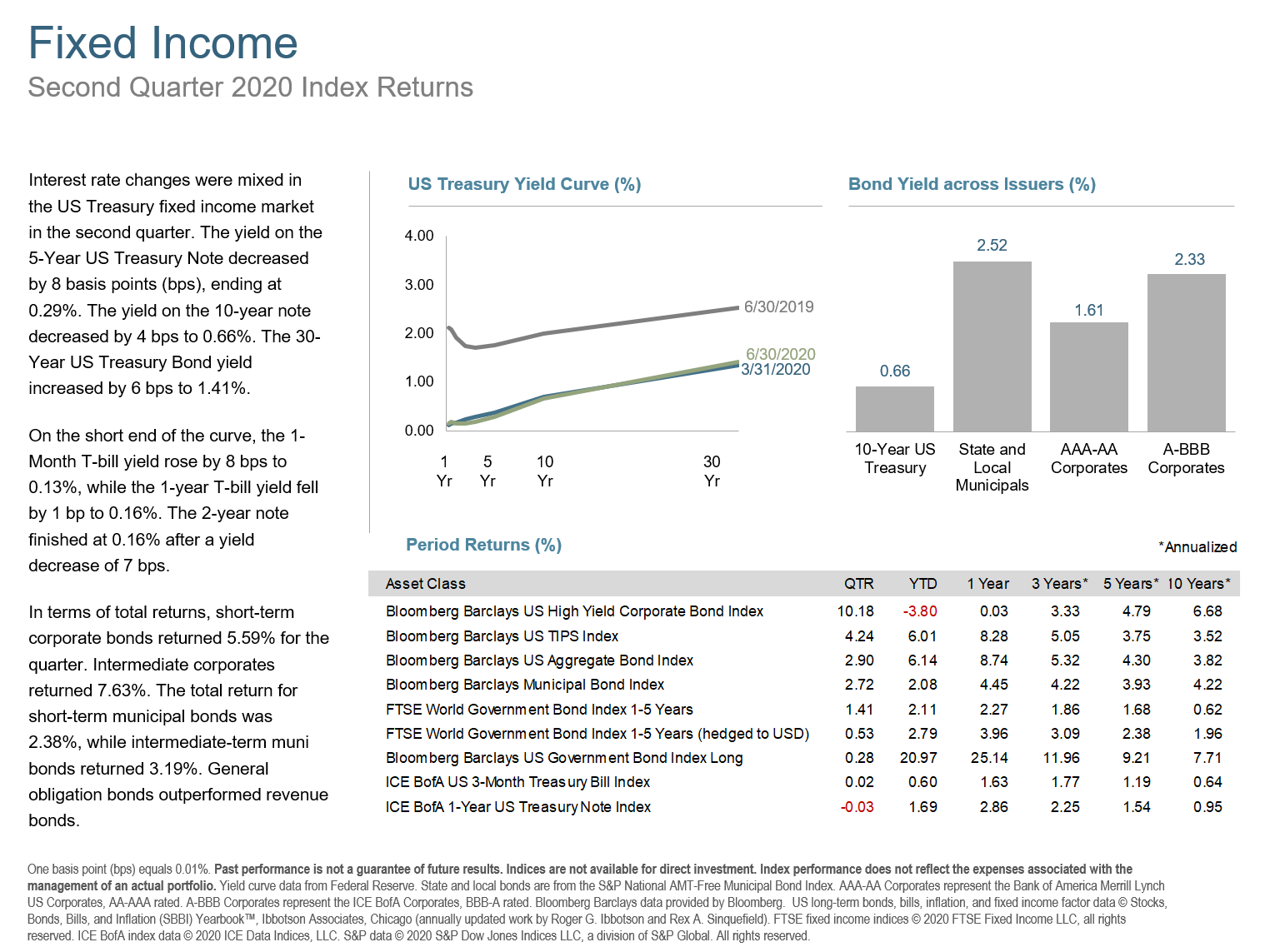

Interest rate changes were mixed in the US Treasury fixed income market in the second quarter. The yield on the 5-Year US Treasury Note decreased by 8 basis points (bps), ending at 0.29%. The yield on the 10-year note decreased by 4 bps to 0.66%. The 30-Year US Treasury Bond yield increased by 6 bps to 1.41%.

On the short end of the curve, the 1-Month T-bill yield rose by 8 bps to 0.13%, while the 1-year T-bill yield fell by 1 bp to 0.16%. The 2-year note finished at 0.16% after a yield decrease of 7 bps.

In terms of total returns, short-term corporate bonds returned 5.59% for the quarter. Intermediate corporates returned 7.63%. The total return for short-term municipal bonds was 2.38%, while intermediate-term muni bonds returned 3.19%. General obligation bonds outperformed revenue bonds.

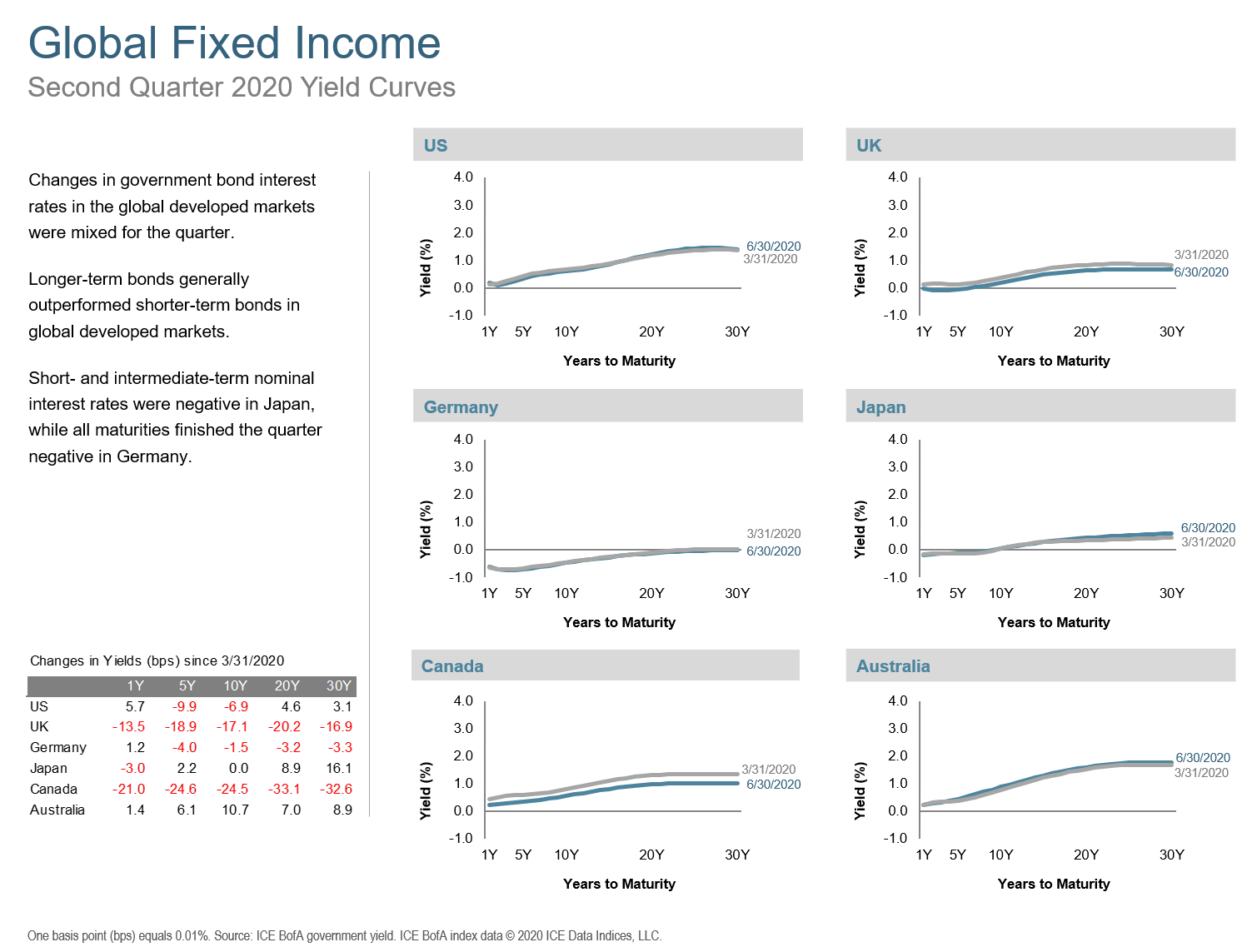

Changes in government bond interest rates in the global developed markets were mixed for the quarter.

Longer-term bonds generally outperformed shorter-term bonds in global developed markets. Short- and intermediate-term nominal interest rates were negative in Japan, while all maturities finished the quarter negative in Germany.

The Q2 2020 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

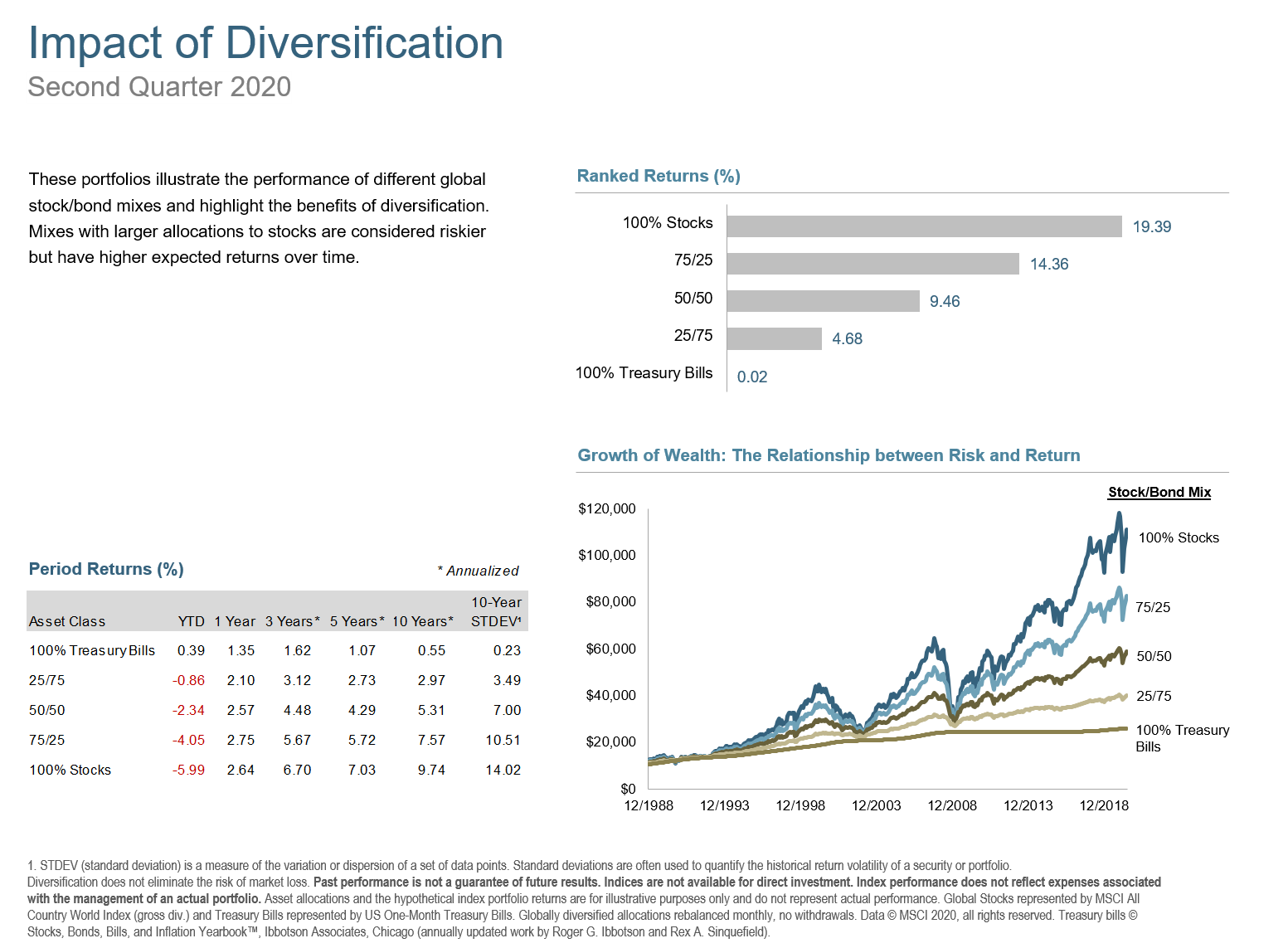

As with any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan. Stay safe and be well!