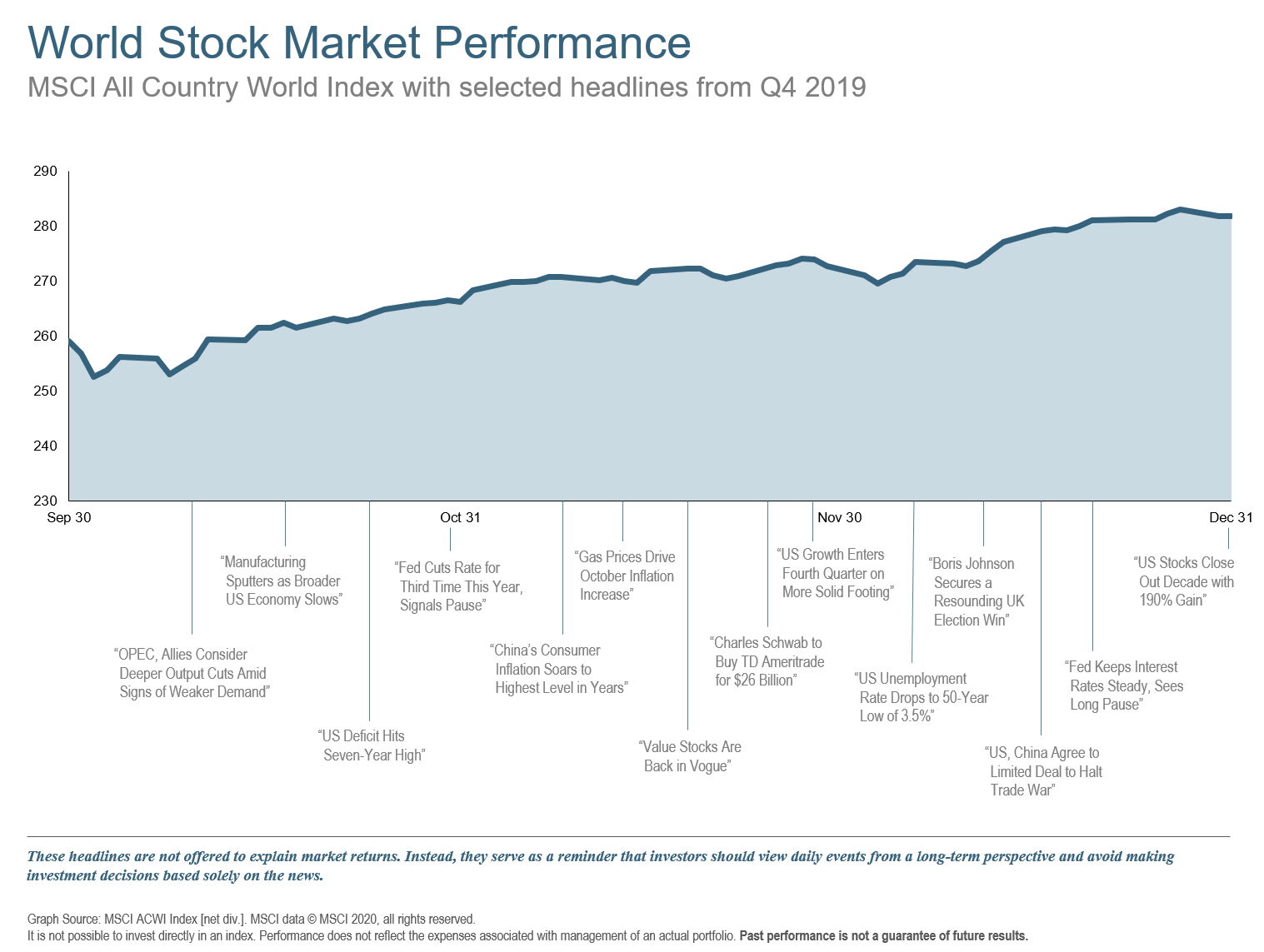

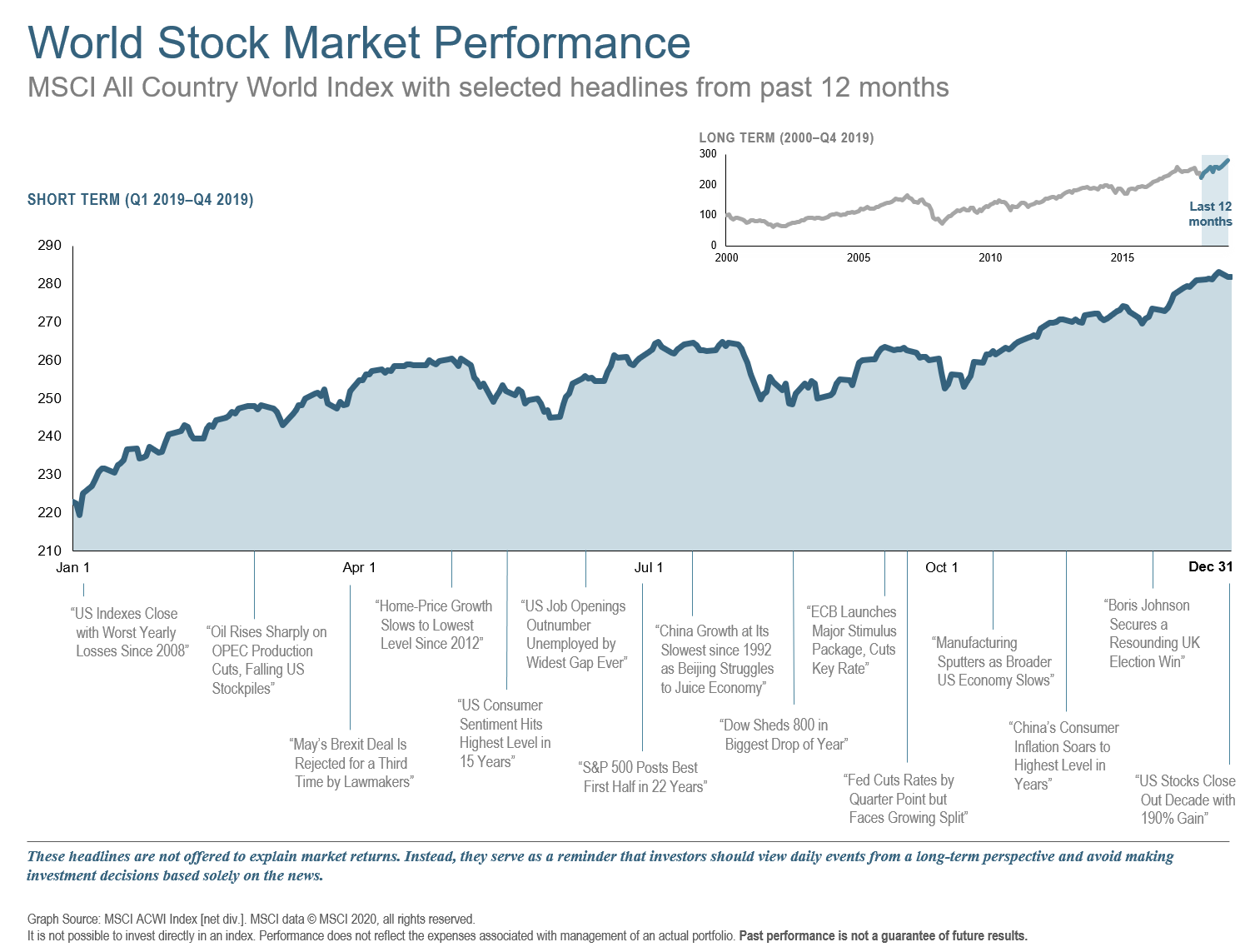

Stock markets ended 2019 with a bang, buoyed by an improved economic picture, alleviated trade tensions, a dovish Fed, and solid corporate earnings. The markets seemed impervious to previous worries such as impeachment, continued Brexit drama, and Middle East tensions.

Optimism about the economy has improved as recession fears receded and a “phase one” trade deal was announced with China. The Fed cut interest rates in October for the third time in 2019 and actually resumed modest balance sheet expansion (i.e. money printing) to alleviate liquidity issues such as we saw at the end of Q3.

Employment in the US continued to impress with 205k jobs/month added over Q4 with unemployment back down to a historic low of 3.5%. The Federal Reserve has indicated that they will pause rate cuts and with inflation remaining around their target of 2%, it’s unlikely they will hike rates anytime soon.

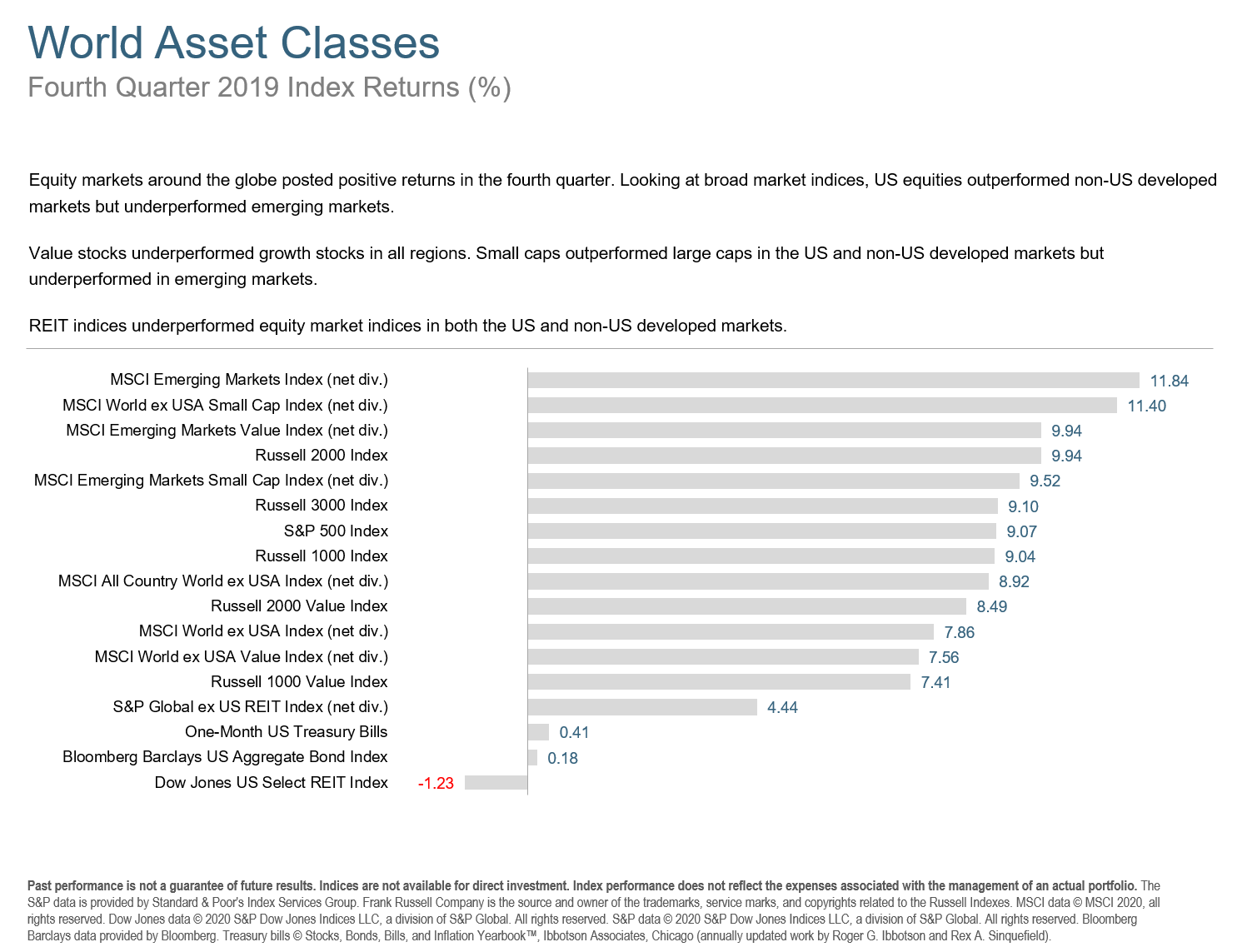

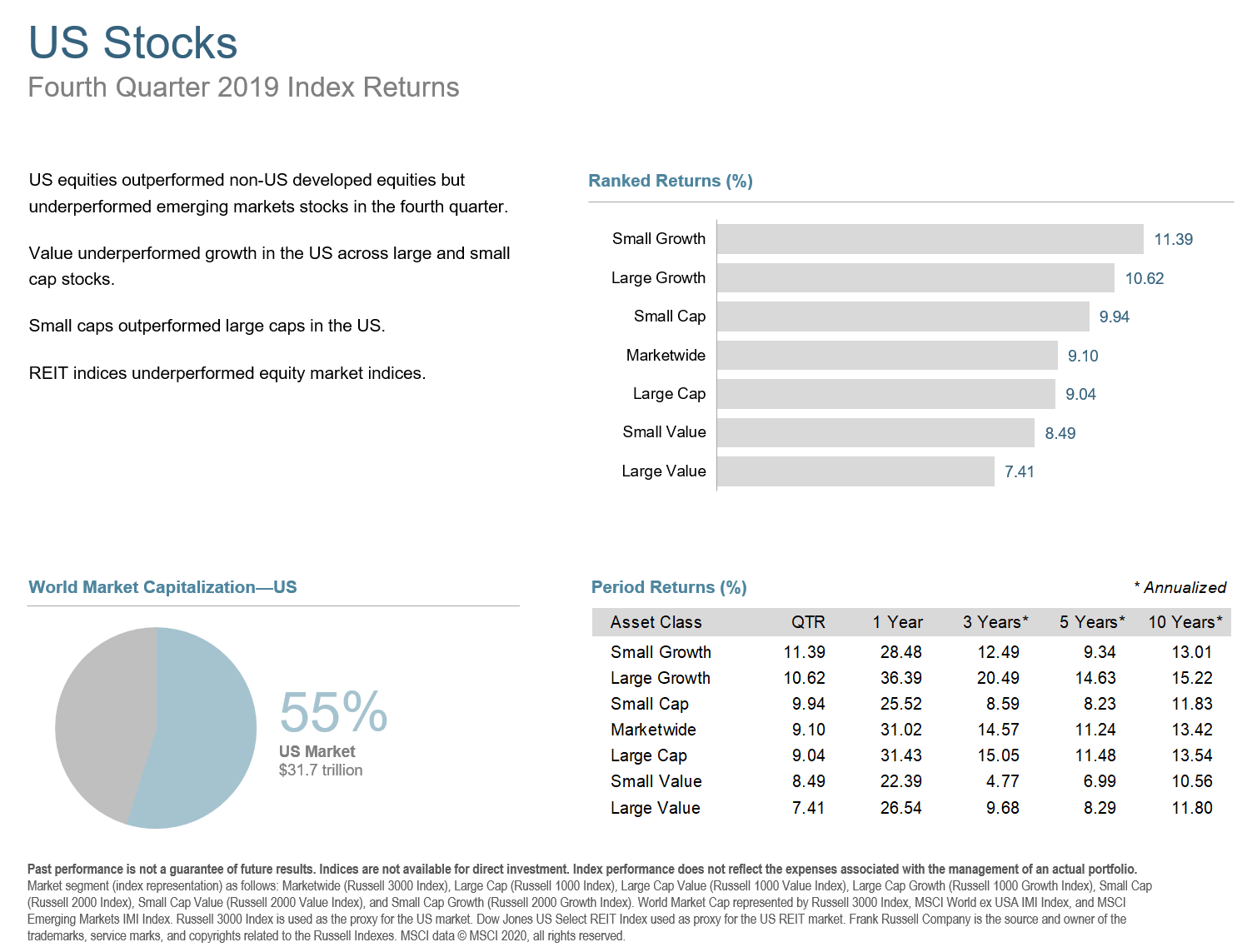

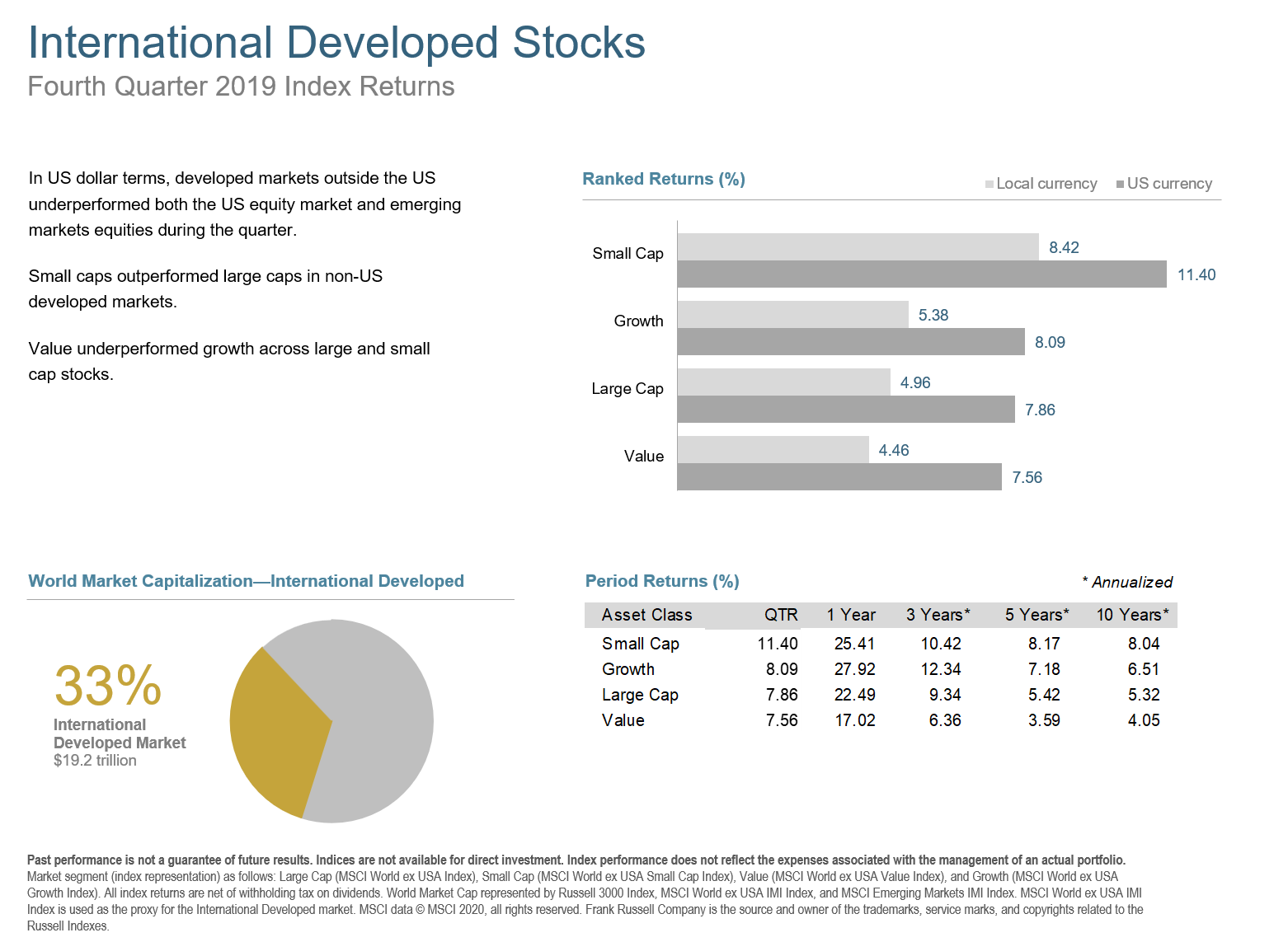

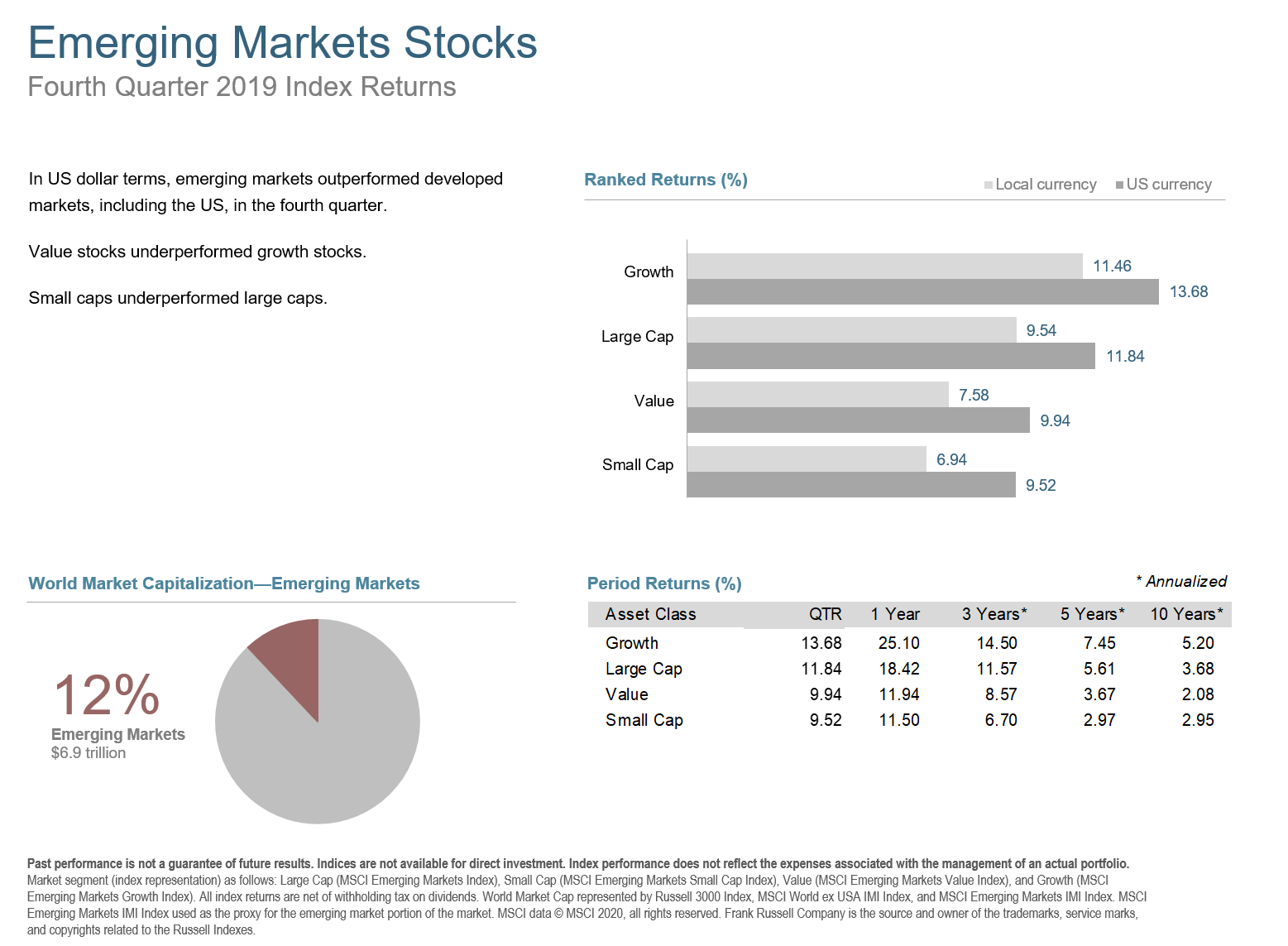

Equity markets around the globe posted strong returns in Q4. Looking at broad market indices, US equities again outperformed non-US developed but trailed emerging markets during the quarter. Value stocks underperformed growth on a market wide basis in the US and in developed and emerging non-US markets. Small caps out-performed large caps in the US and developed non-US markets but under-performed in emerging markets.

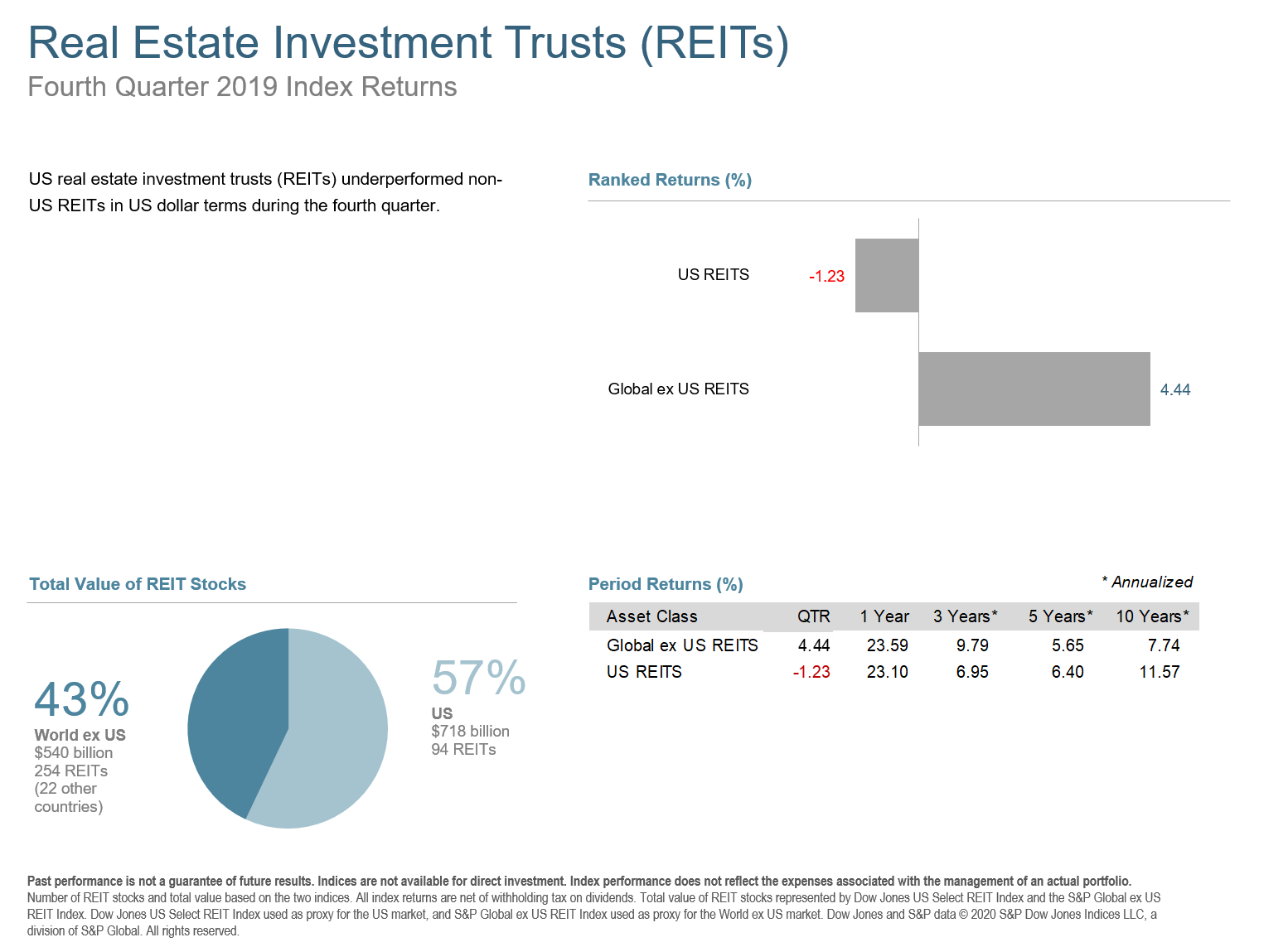

Real Estate Investment Trust (REIT) indices under-performed equity markets in both the US and non-US developed markets, with non-US REITs having a little better showing than the US.

US stocks continued what has been about a decade of outperformance of international developed and but emerging markets equities bested both in Q4 . In US dollar terms, emerging markets stocks outperformed developed non-US markets equities in Q4. Small caps out-performed large caps in non-US developed markets but under-performed in emerging markets. Growth stocks outperformed value across developed and emerging international large and small cap stocks.

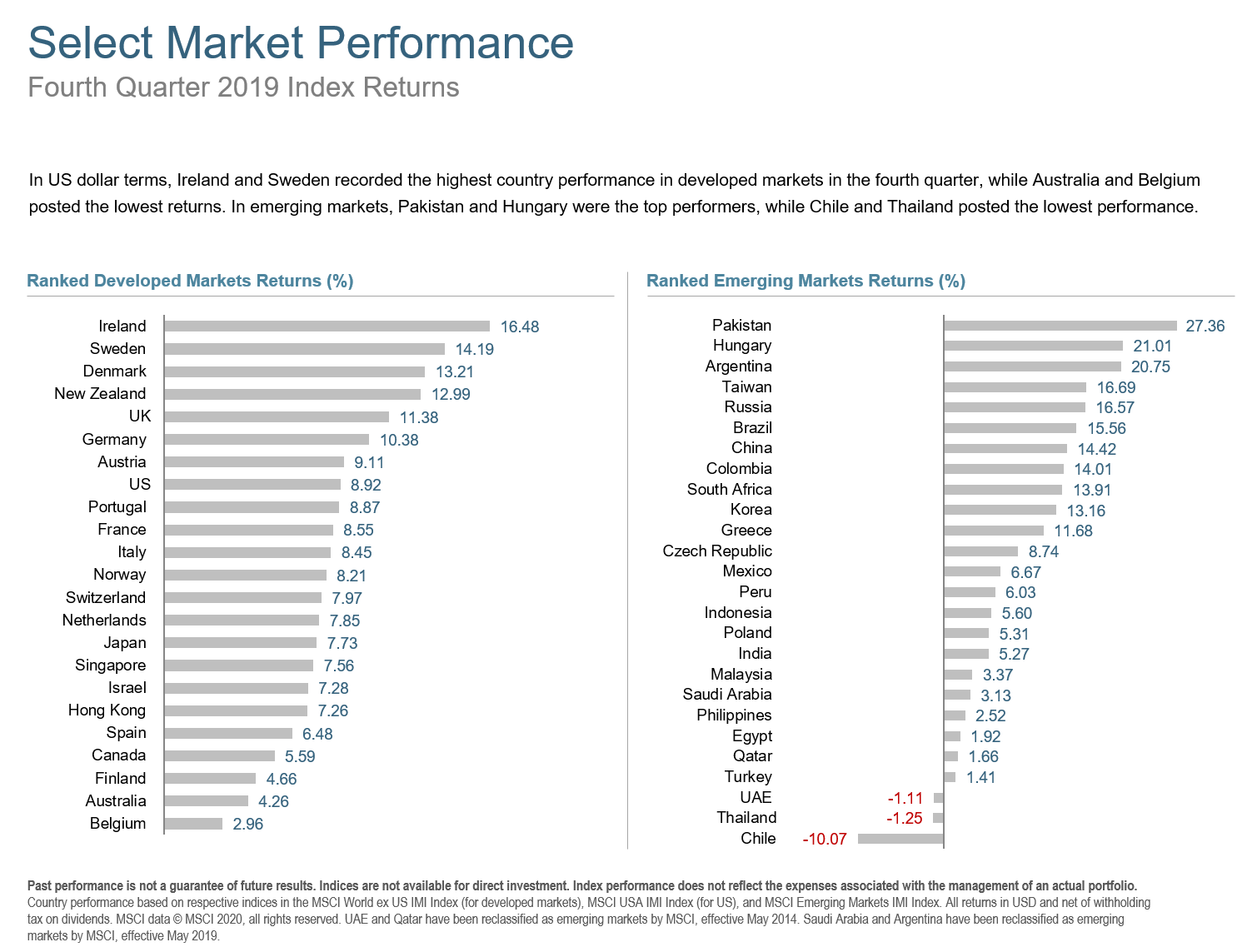

Ireland and Sweden recorded the highest country performance in developed markets, while Australia and Belgium posted the lowest returns for the quarter. There was a wide dispersion in returns across emerging markets. Pakistan recorded the highest country performance with a gain of 27.36%, while Chile posted the lowest performance, declining 10.07%.

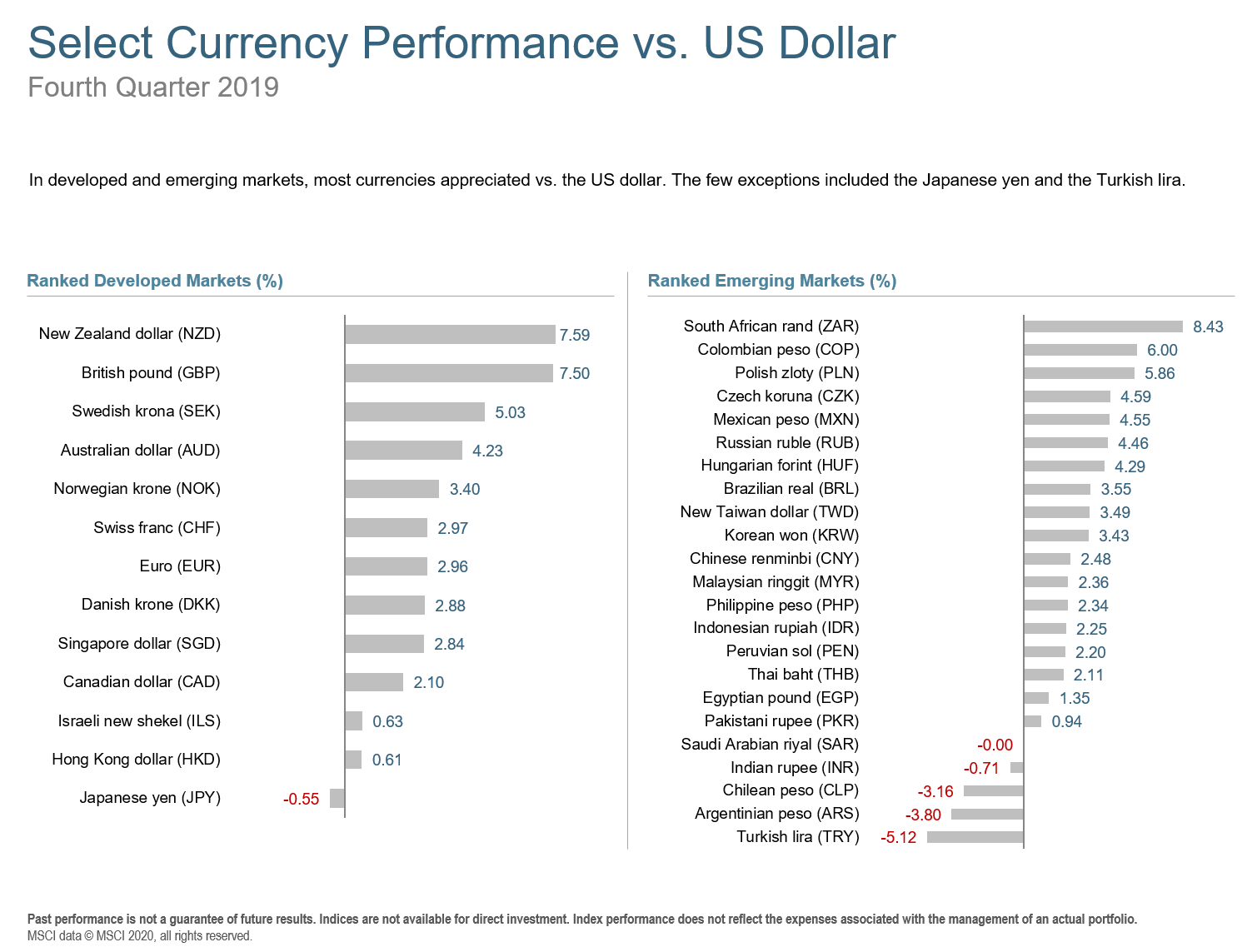

In both developed and emerging markets, currencies were mostly stronger against the US dollar.

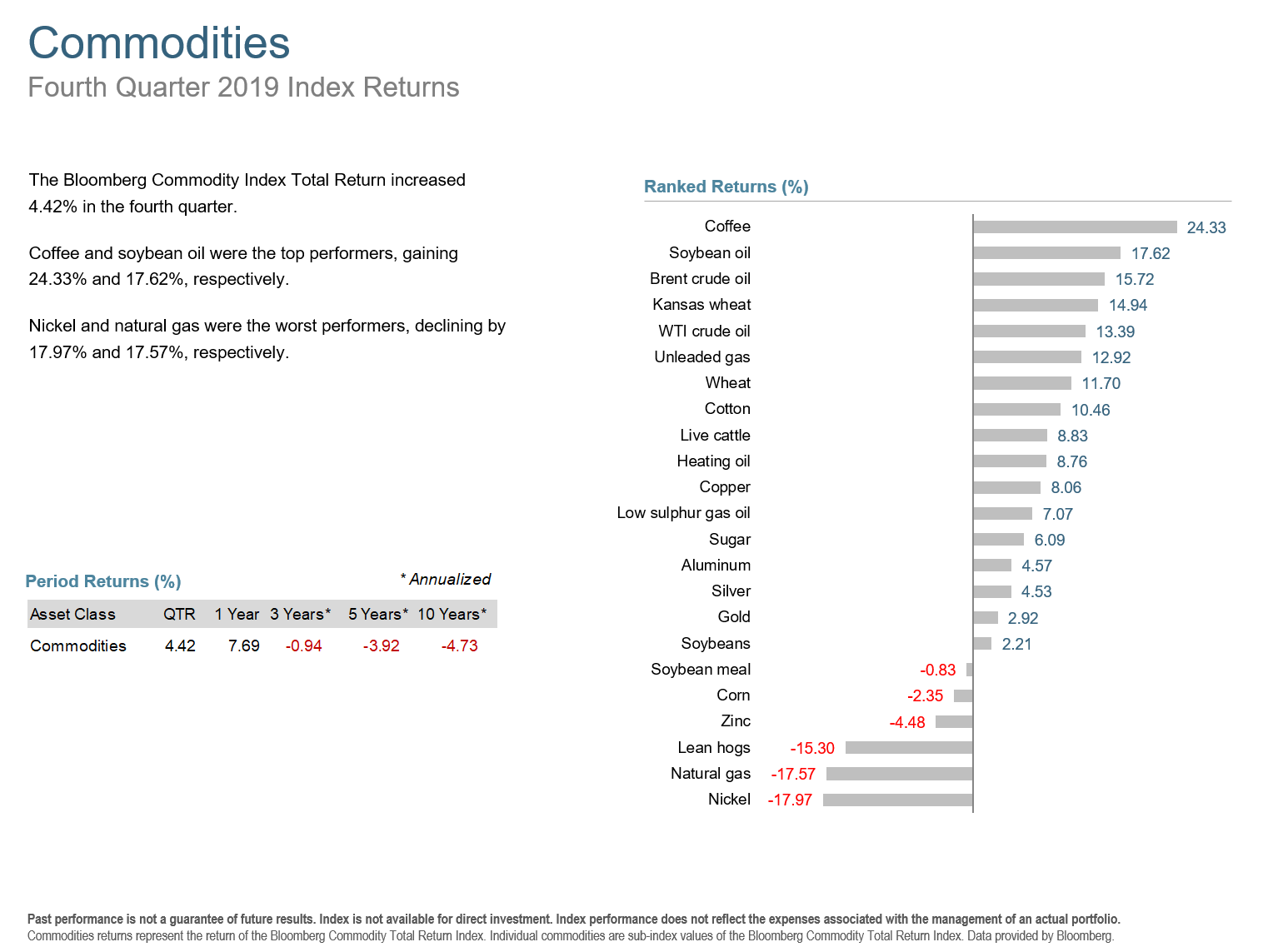

Commodities lagged but the Bloomberg Commodity Index Total Return rose 4.42% in the quarter. Coffee and Soybean oil led performance, returning 24.33% and 17.62%, respectively. Natural gas and Nickel were the worst performers, declining by 17.57% and 17.97%, respectively.

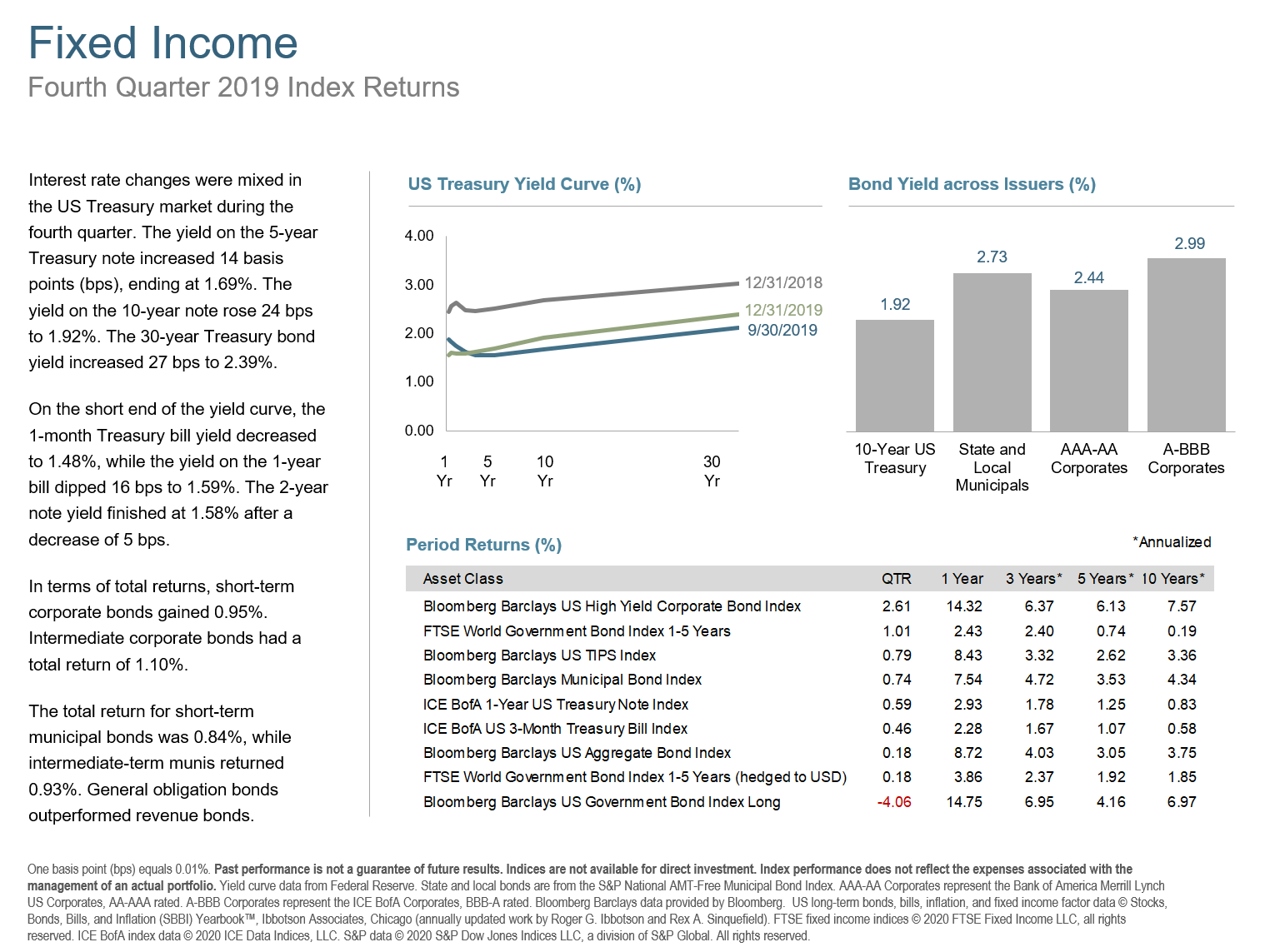

Interest rates were mixed in the US Treasury market, with the the yield on the 5-year Treasury note increasing by 14 basis points (bps), ending at 1.69%. The yield on the 10-year Treasury note rose by 24 bps to 1.92%. The 30-year Treasury bond yield increased by 27 bps to finish at 2.39%.

However, on the short end of the curve, the 1-month Treasury bill yield decreased to 1.48%, while the 1-year T-bill yield fell to 1.59%, a 16 bps drop. The 2-year T-note yield finished at 1.58%, decreasing 5 bps.

In terms of total returns, short-term corporate bonds increased by .95% and intermediate-term corporate bonds rose by 1.10%. The total return for short-term municipal bonds was .84%, while intermediate munis returned .93%. General obligation bonds outperformed revenue bonds.

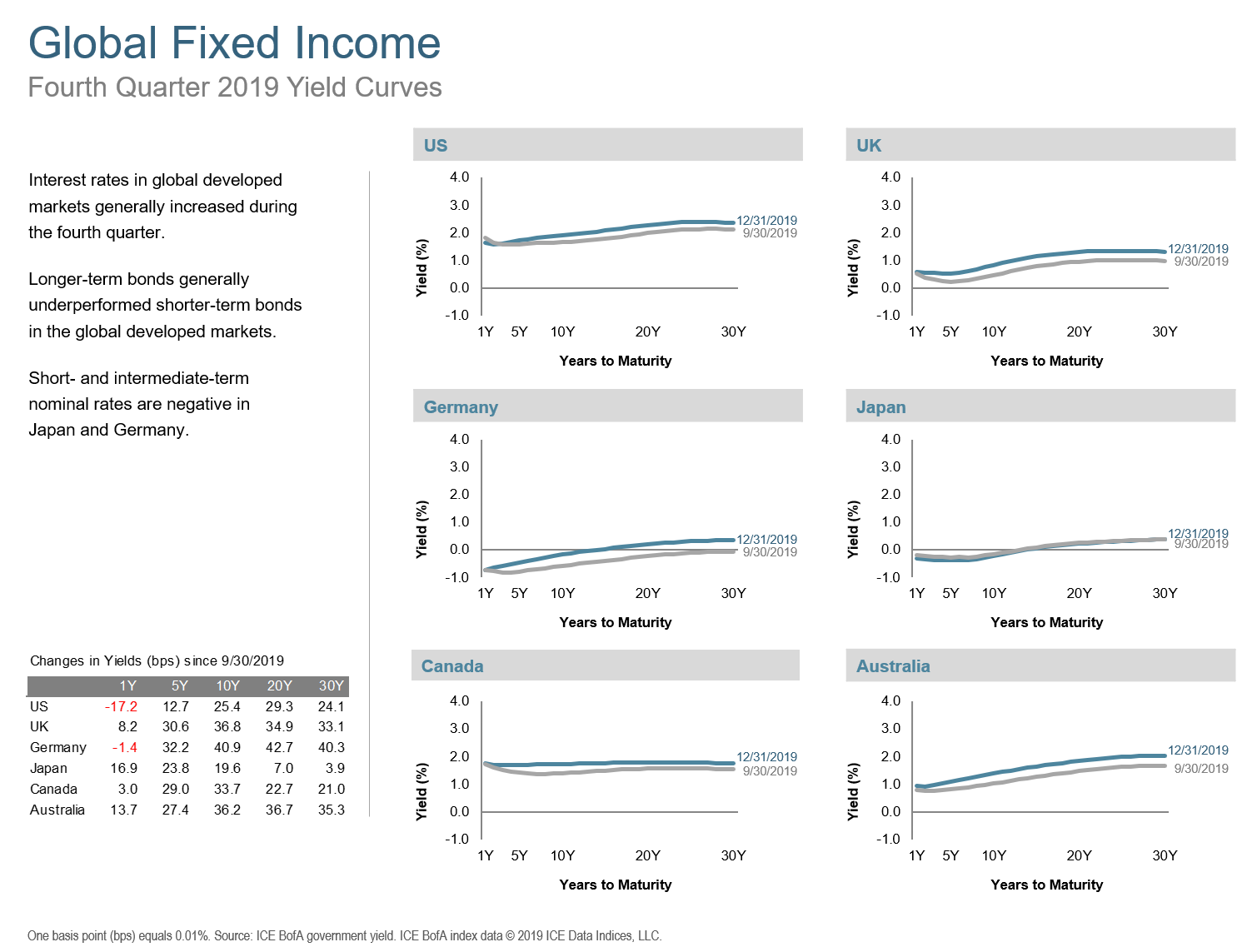

Interest rates in the global developed markets generally increased during the quarter. Longer-term bonds generally underperformed shorter-term bonds in those markets. Short- and intermediate-term nominal interest rates again were negative in Germany and Japan.

The Q4 2019 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As with any market condition, a sound plan makes the ups and downs much more manageable. Get in touch if you would like to review your plan.