“My last three investment advisers never seemed to return anything close to the S&P 500 whether it was up or down. I fired my last one because he just didn’t make enough trades to justify what he was charging me,” said a prospective client that called me this week.

“What kind of trades should he have been doing,” I asked?

“Heck, I don’t know, that’s what I was paying him to figure out,” he exclaimed!

New relationships are always challenging. We have to build trust, develop rapport, and in financial advisory situations, ultimately reach a comfort level in sharing intimate details of our pecuniary attributes, ambitions, and anxieties. But before any of that is even worth attempting, we have to find some common ground.

In most relationships, we tend to share beliefs, interests, and world views with our partners. A lifetime of information, experience, and thought can go into answering seemingly simple questions that can largely define whether two people can get along.

Democrat or Republican?

Religious or Secular?

Cat or Dog?

Beach or Mountains?

Cowboys or Texans?

Fortunately, in financial advice and planning relationships, we work with clients that have diverse opinions. While we may prefer different political candidates, sports teams, etc., the role of rules and math in the planning and investment process allows for a détente from most of the world’s divisions. But it is the answer to an unasked question that can largely determine if a prospective client may be a fit for ATX Portfolio Advisors.

Evidence or Eloquence?

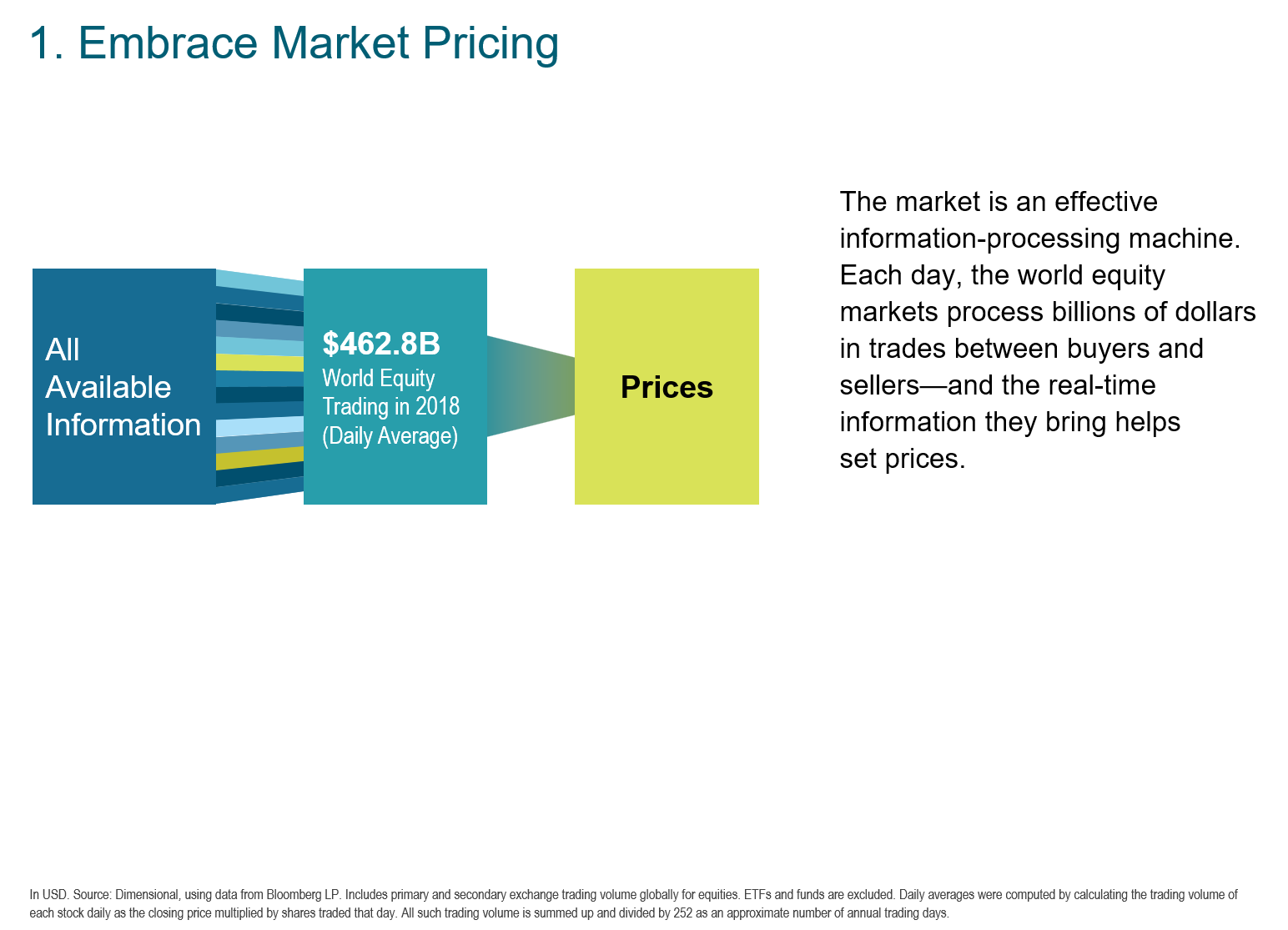

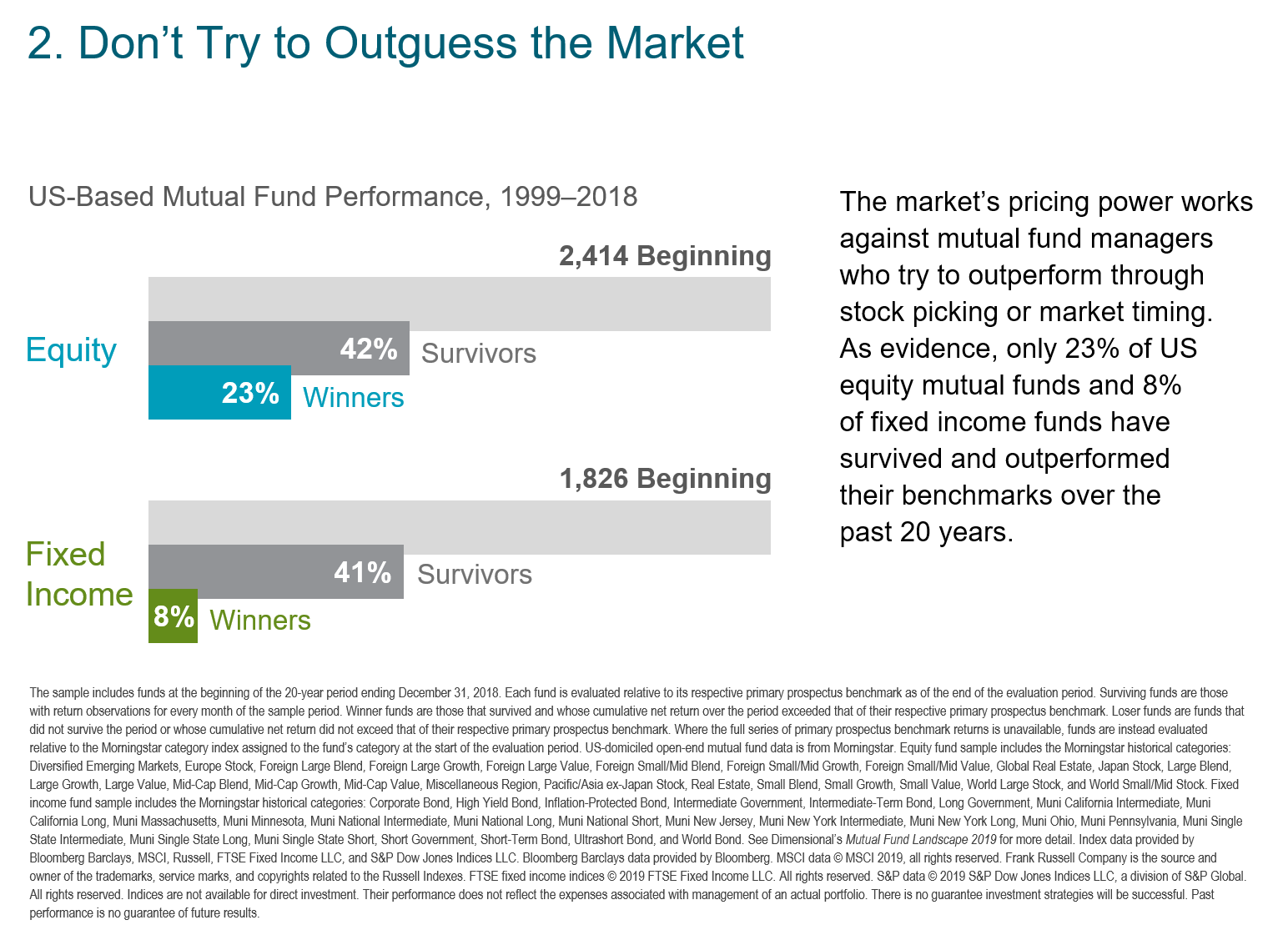

The investment industry is rife with fast-talking well-dressed pitchmen whose sartorial elegance is matched only by their verbal eloquence. They talk about beating the market through security selection, sector rotation, technical trading, or other fanciful approaches that rely on outsmarting (or more likely, outguessing) a majority of other investors more often than mere chance would suggest.

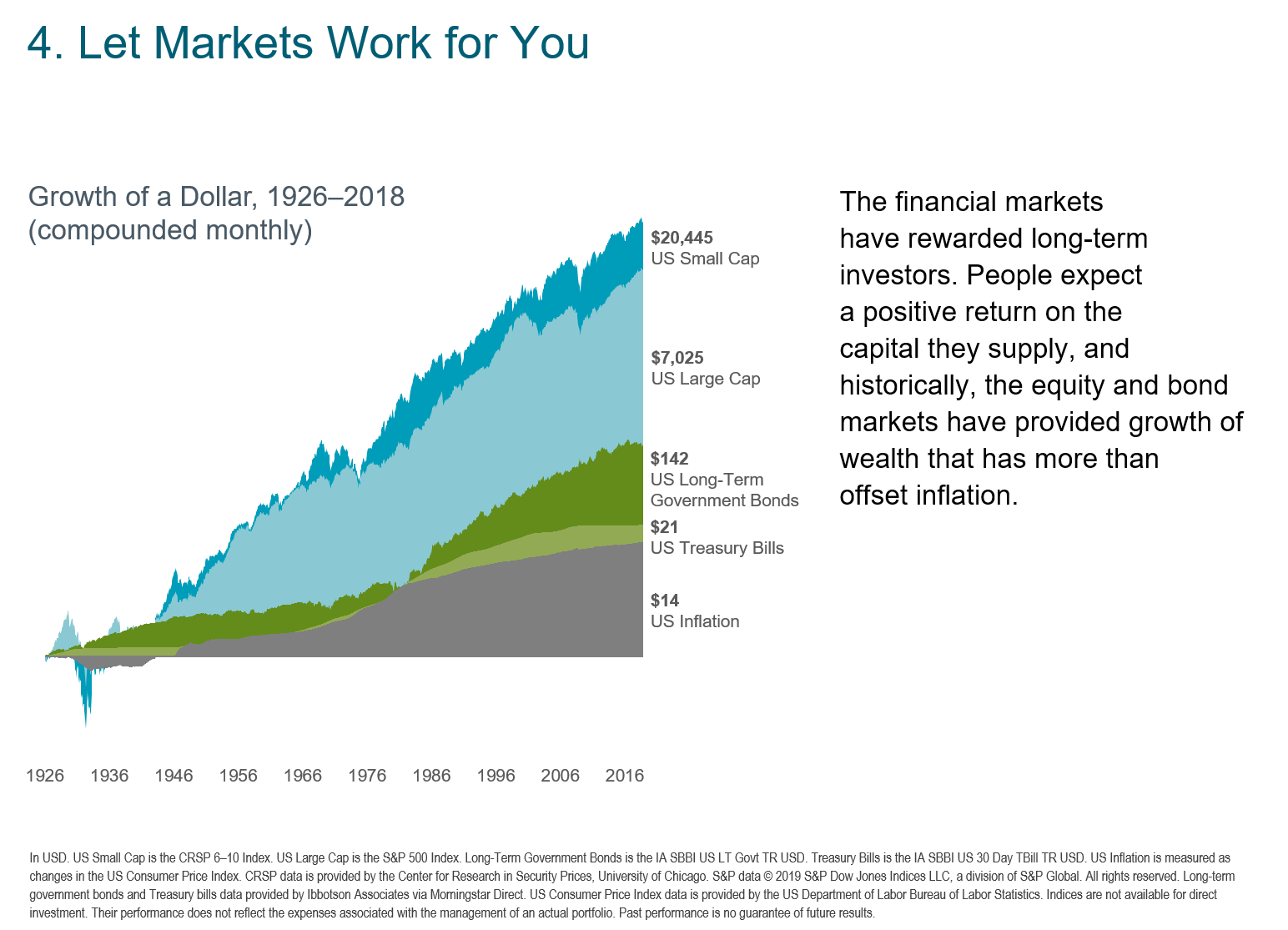

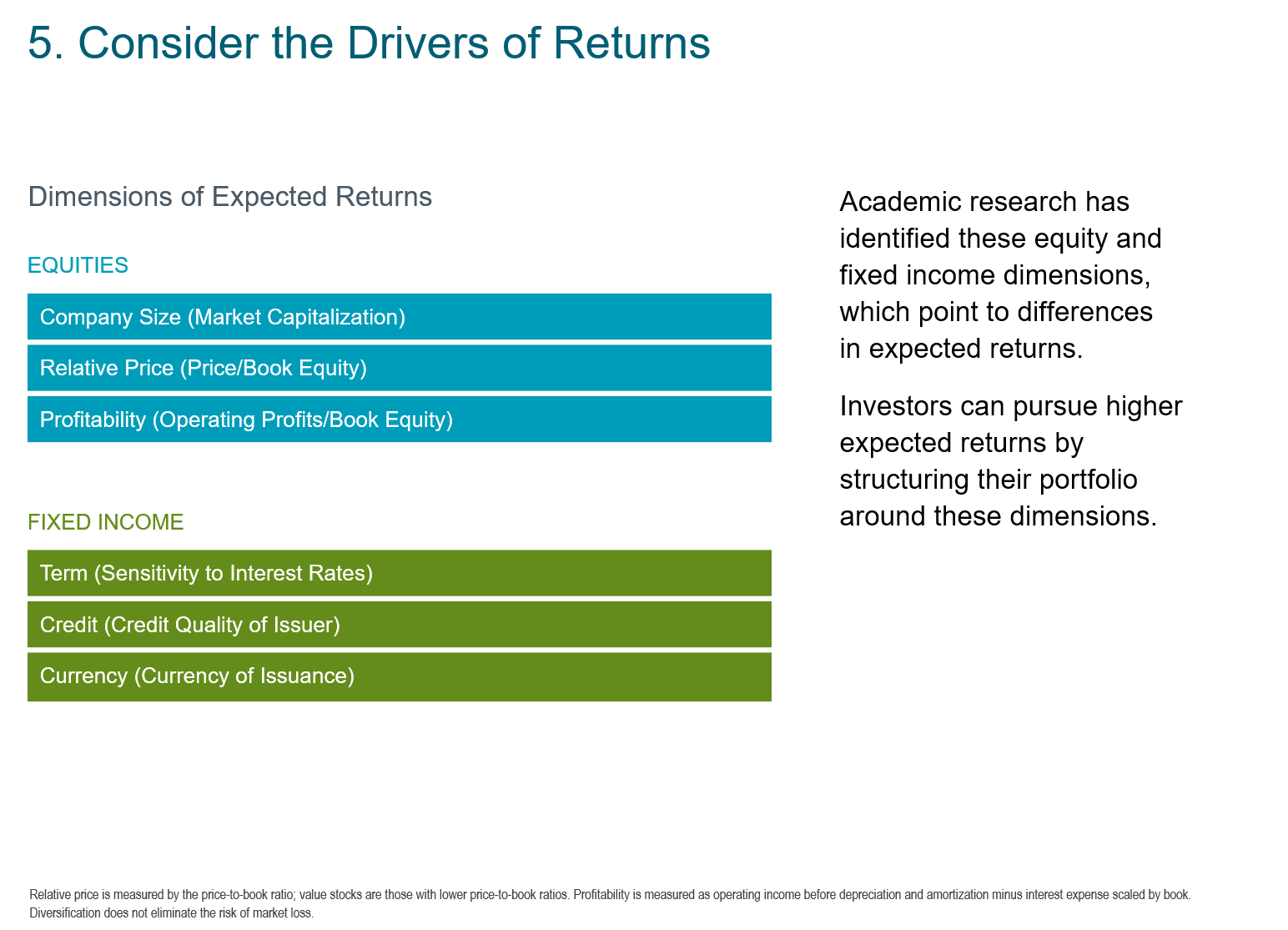

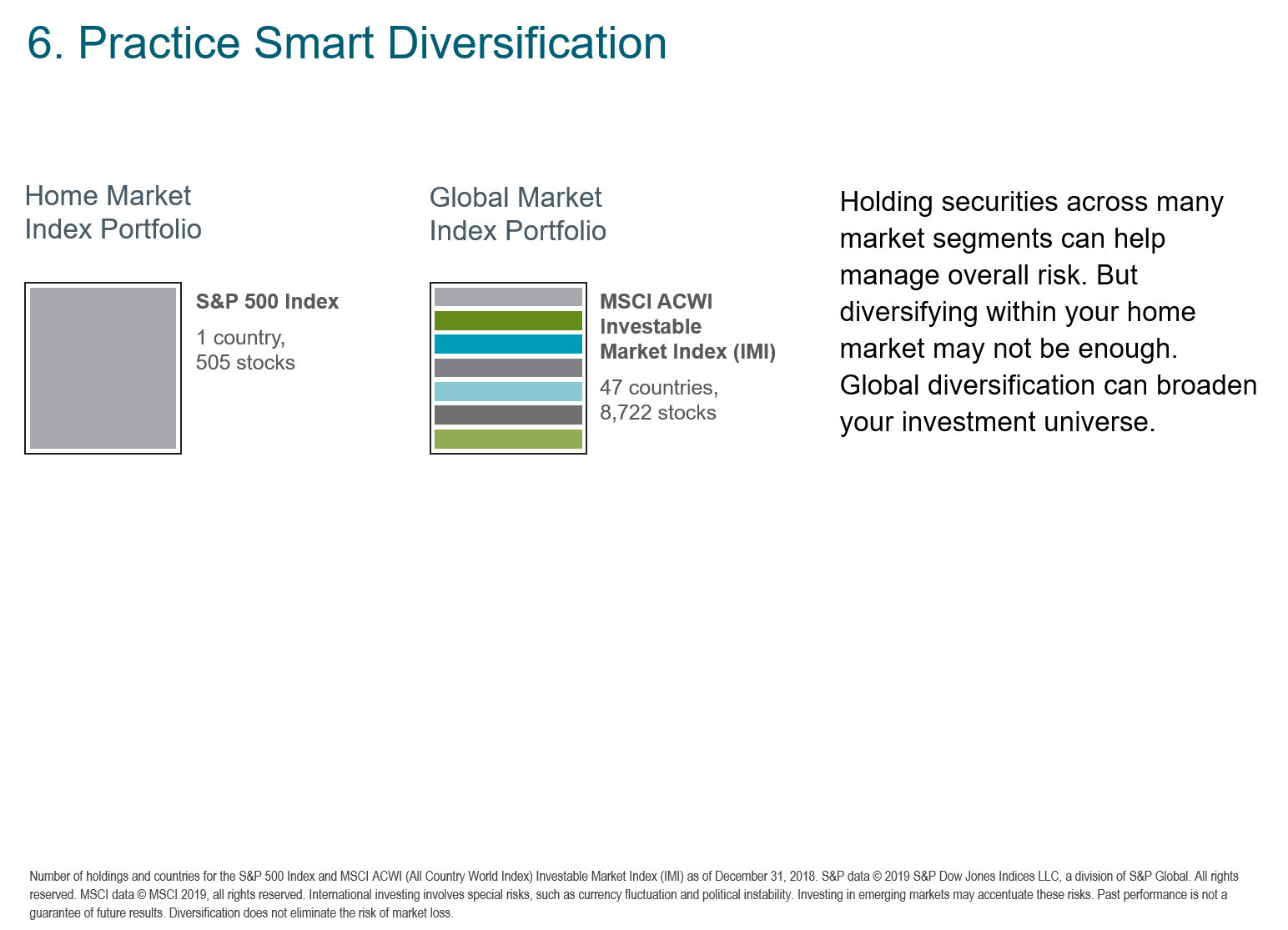

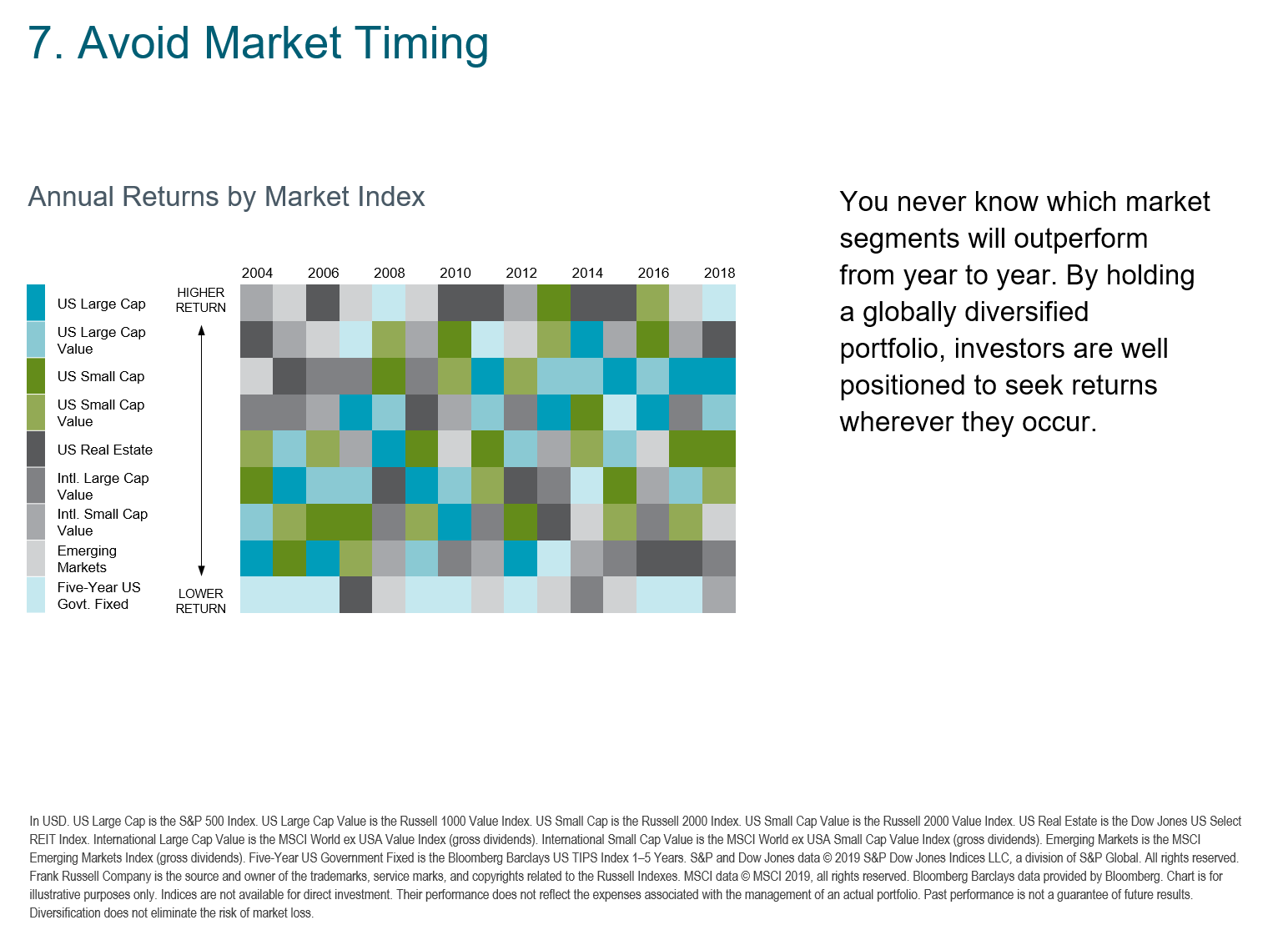

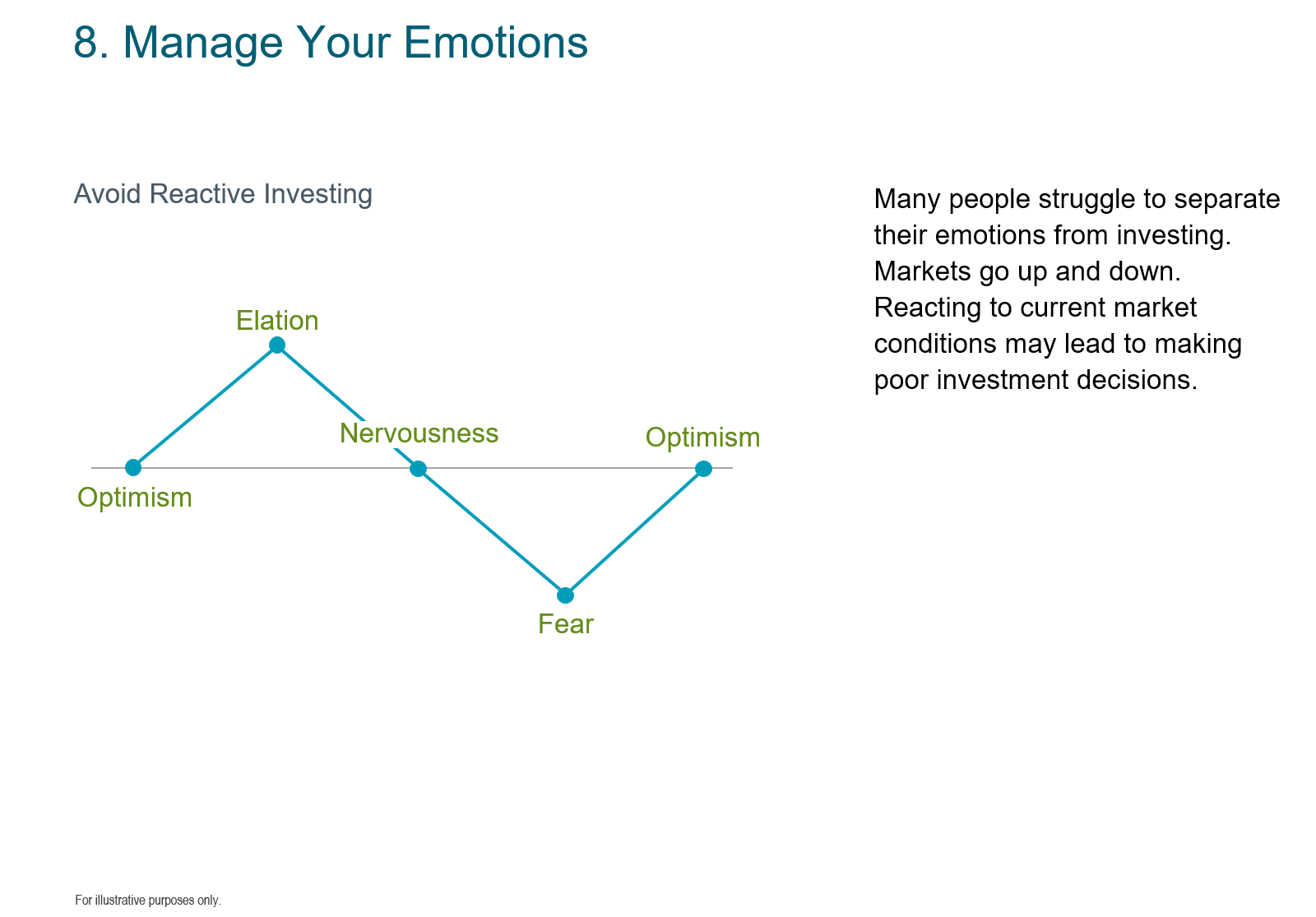

The right choice can lead to a better investment experience. The wrong one to being disappointed, paying more fees, and even to a new investment advisor every couple of years. Need to see the evidence? Check out the 2019 version of “Pursuing a Better Investment Experience”.