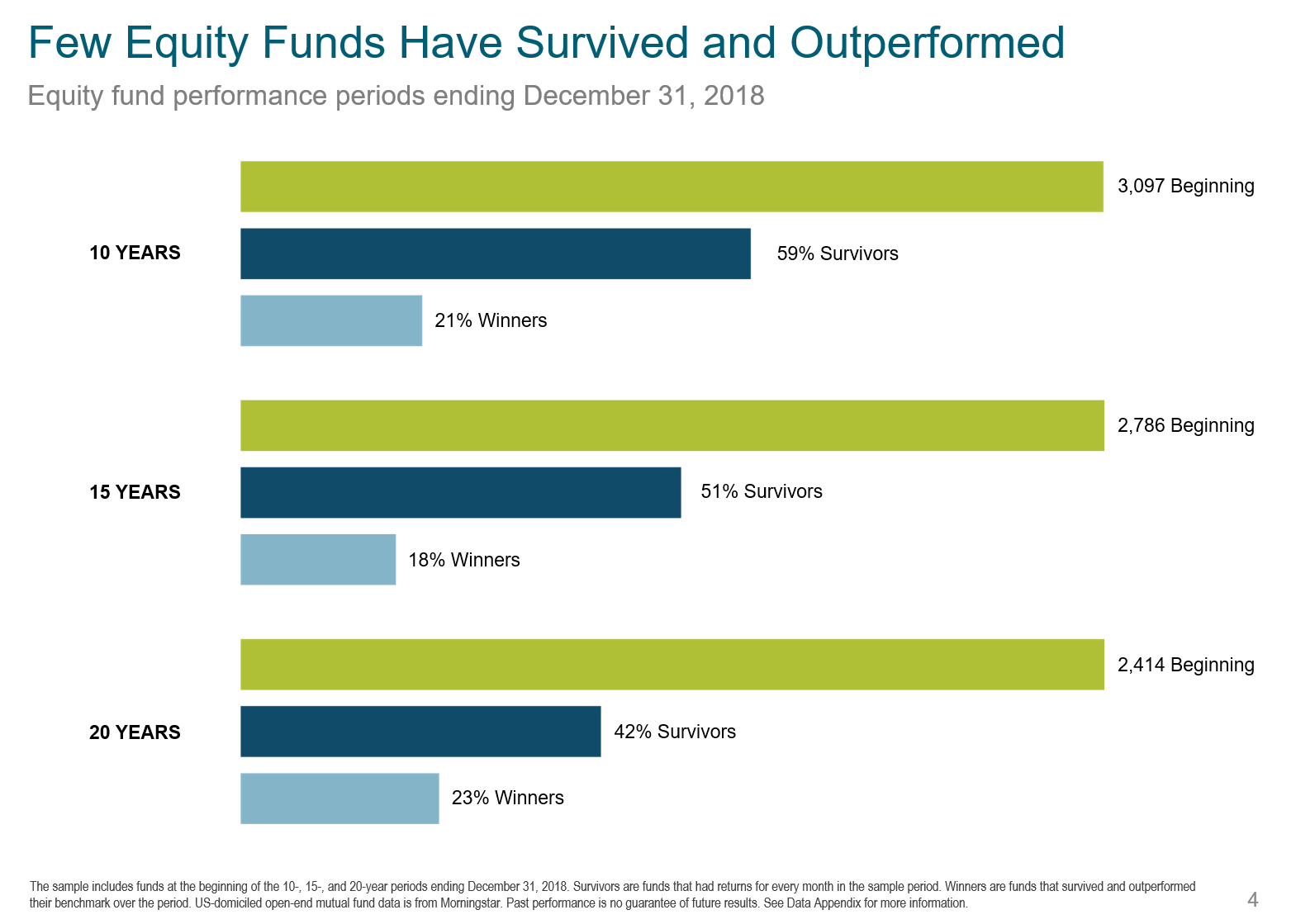

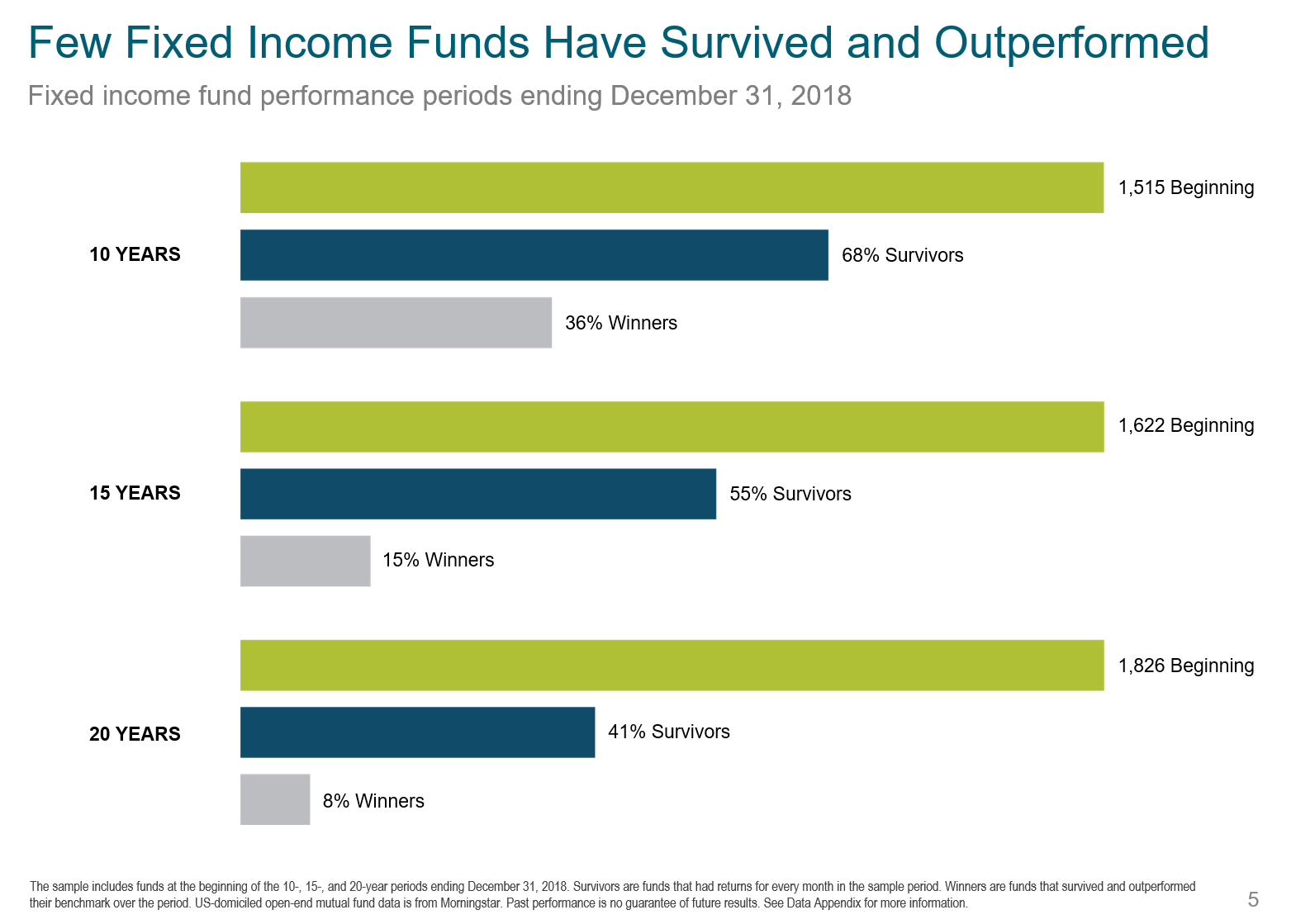

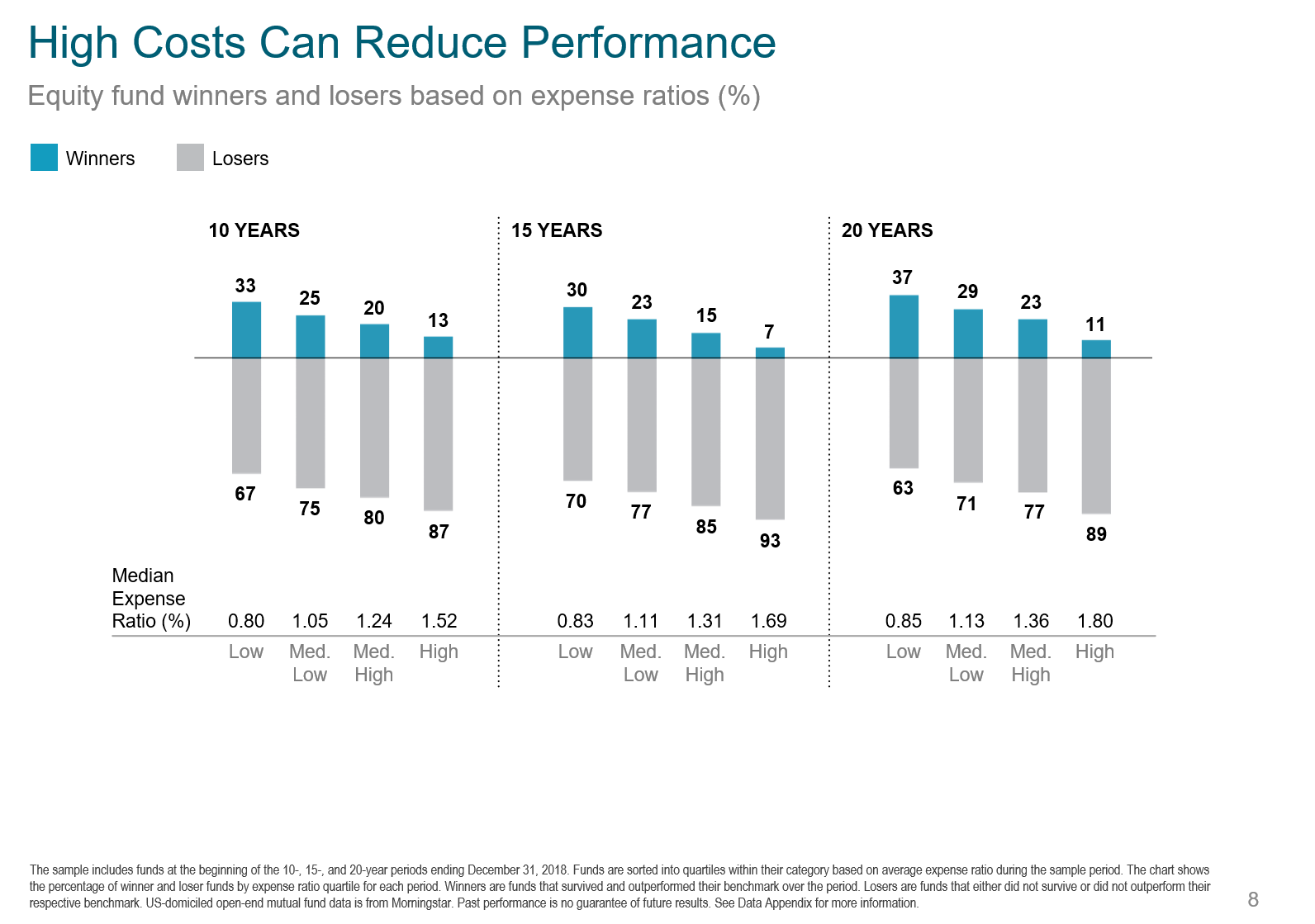

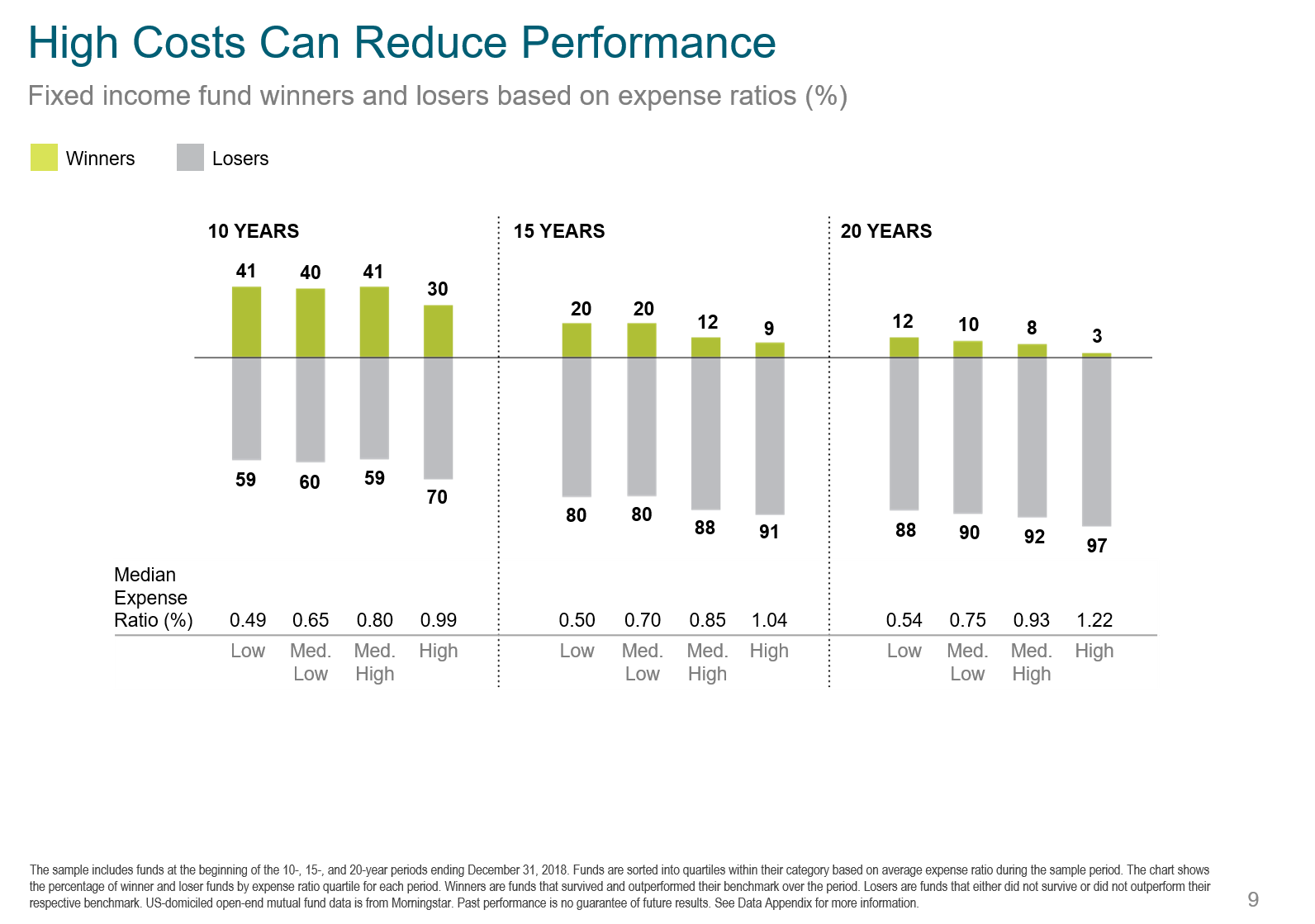

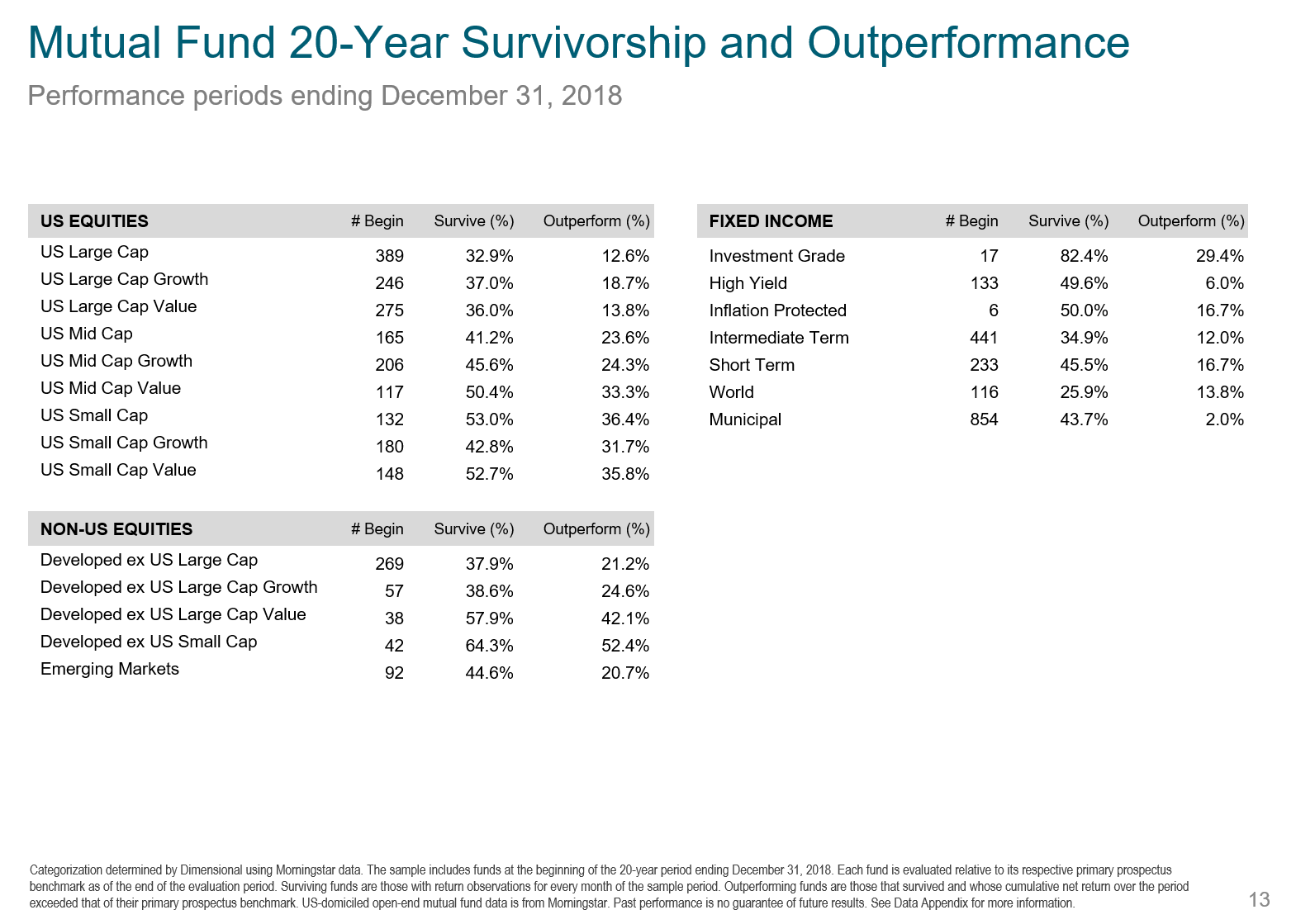

Last week, I took a look at how the growth of index funds has led to more scrutiny of passive investments and their impacts on the market. This week, we’ll look at more evidence of the futility of high cost active management as compiled in DFA’s recently updated annual Mutual Fund Landscape report. The analysis shows that a majority of fund managers evaluated failed to deliver benchmark-beating returns after costs.

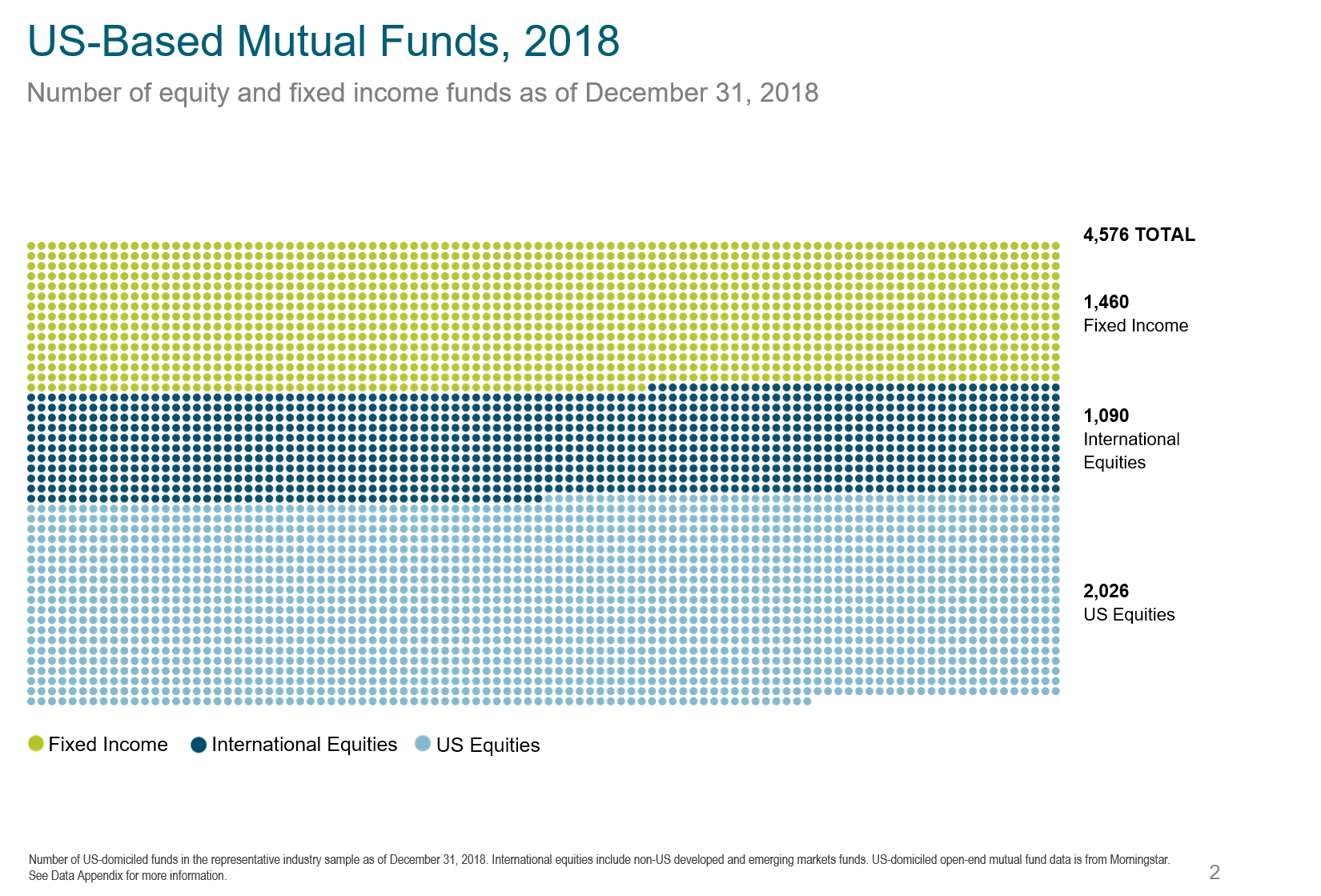

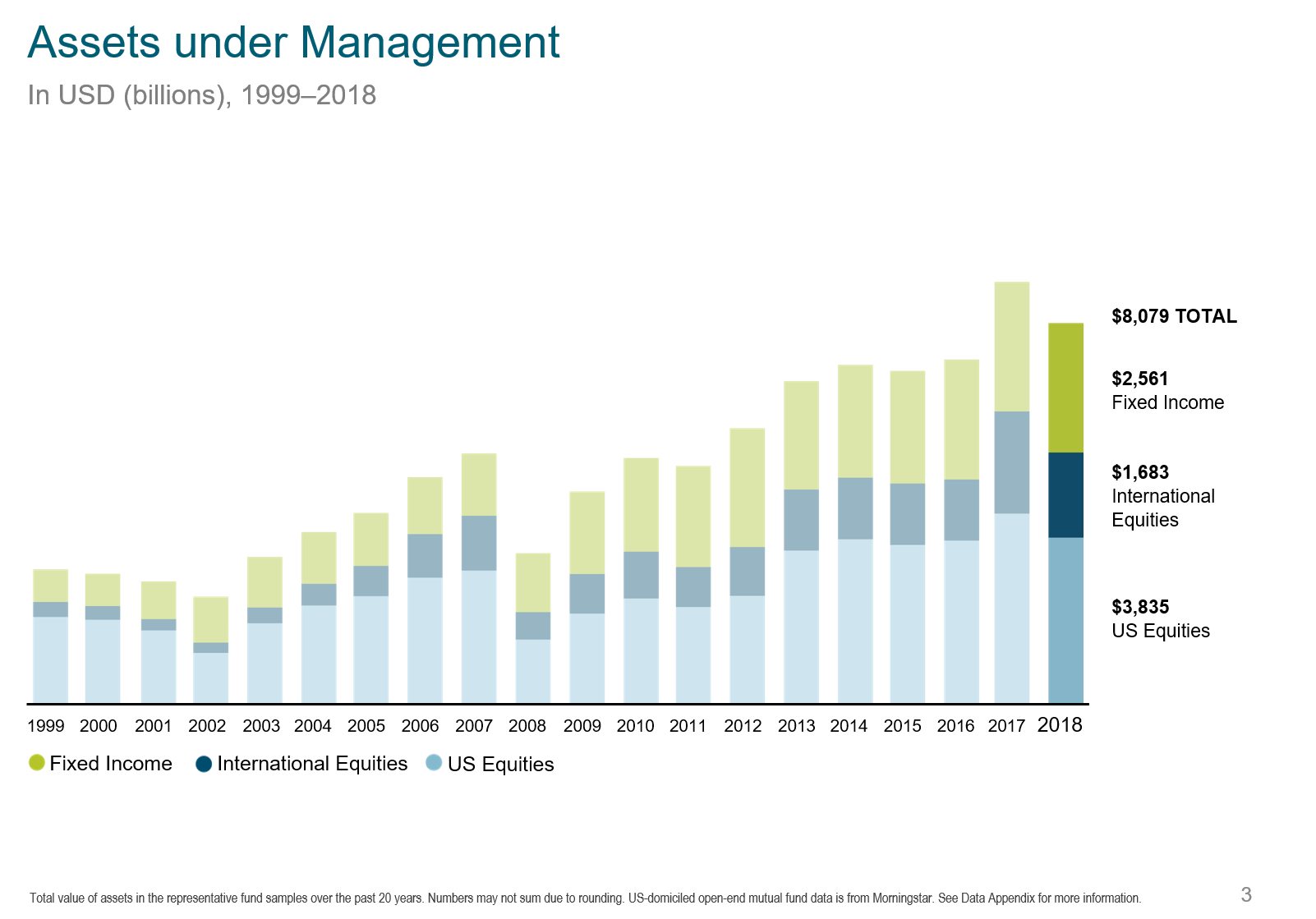

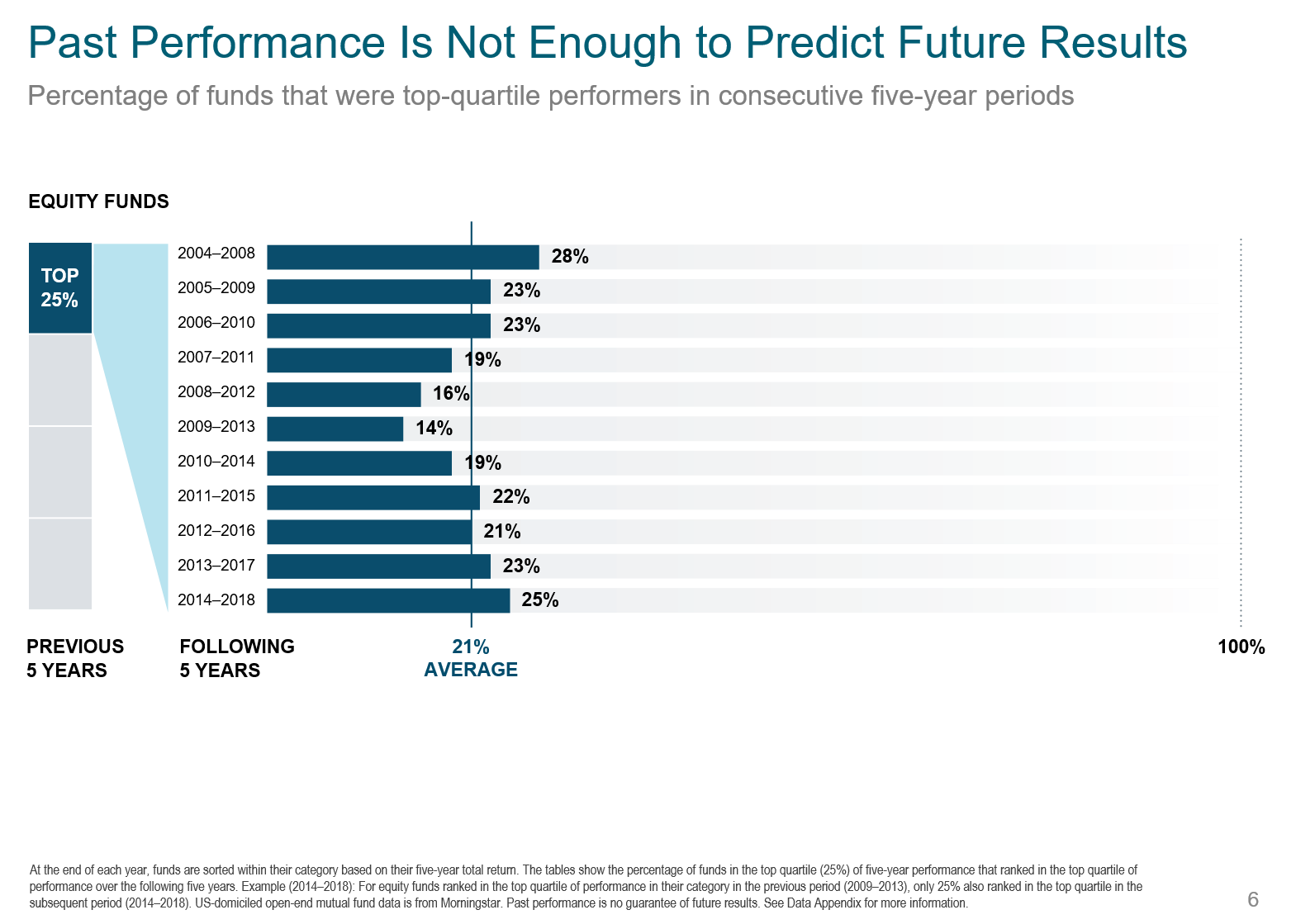

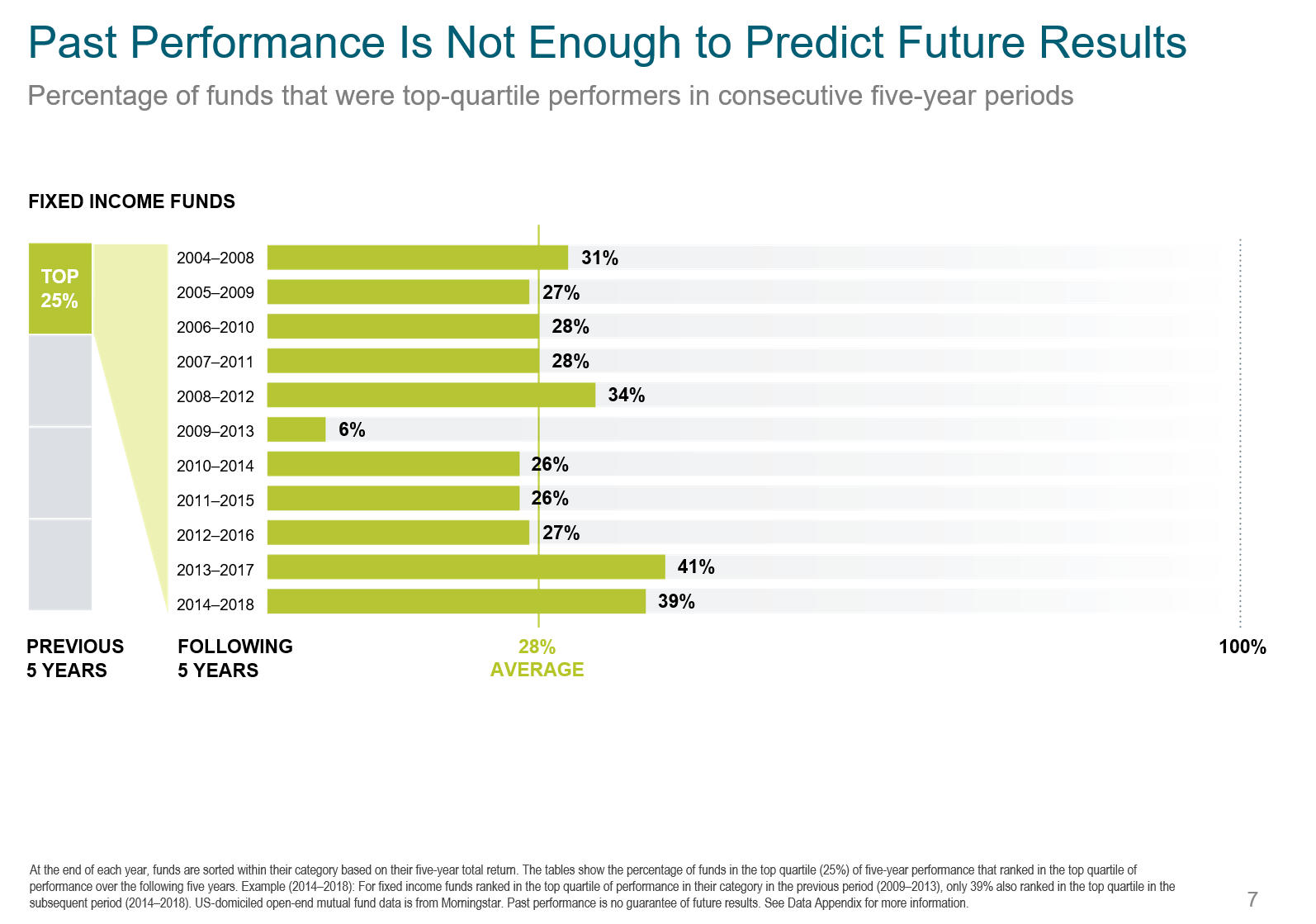

Using a representative sample of US-domiciled mutual fund returns from Morningstar, the report documents the power of market prices by assessing fund returns over multiyear periods. The exhibits include data visualizations of fund survivorship and outperformance, persistence of top-quartile funds, and the impact of high fees and turnover on manager performance.