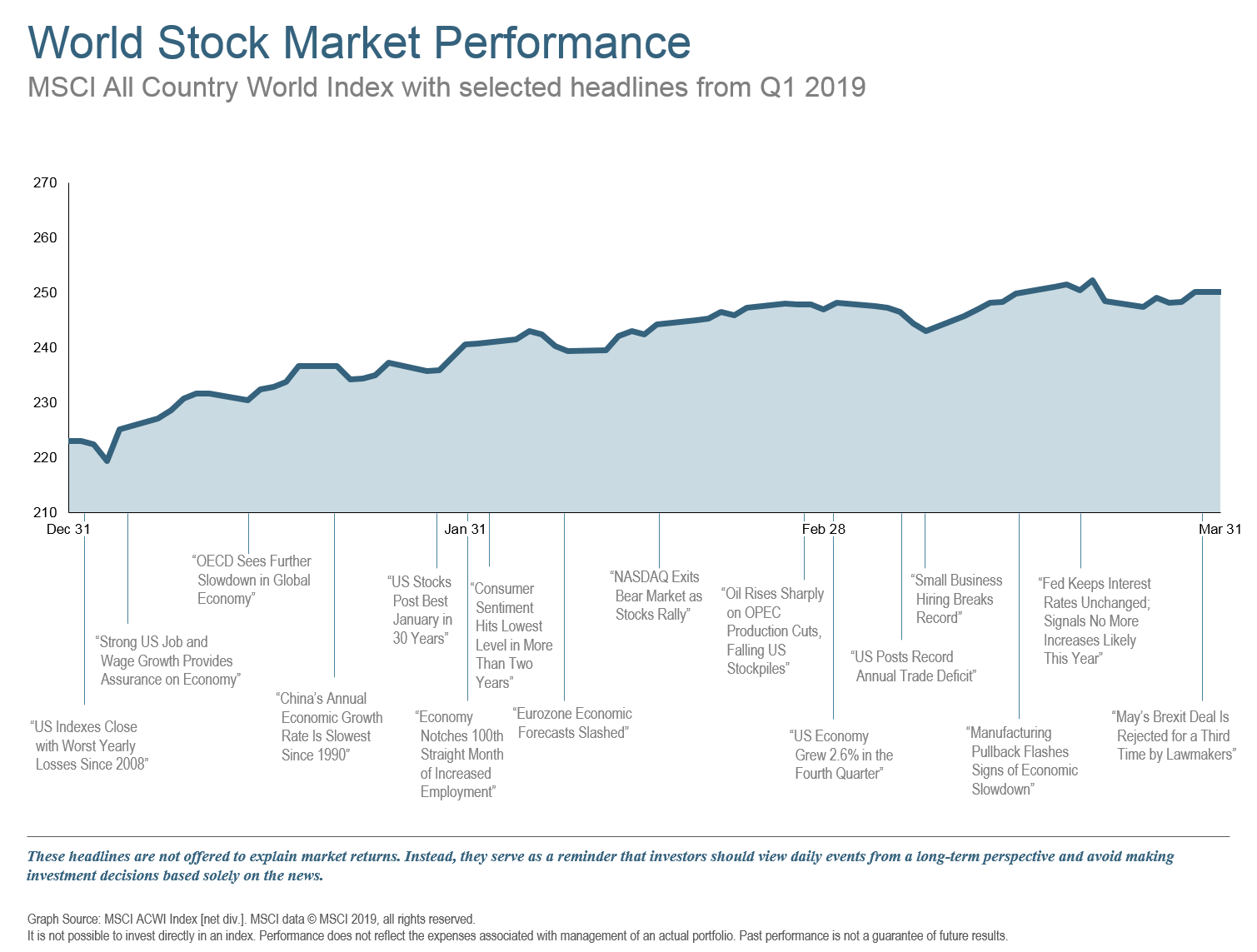

Remember how bleak the markets seemed at the end of 2018? All of the worries about whether the Fed may have applied the brakes a tad too long, an escalating trade war with China, a mid-term shakeup in Washington DC, ongoing Brexit drama, and a eurozone confidence slowdown? While some of those issues remain unresolved, hopes for a trade deal with China and an about face toward dovishness by key central banks buoyed markets in spite of a Polar Vortex and another government shutdown that created more headwinds.

US growth stocks, both small and large, were the big winners of the quarter, but every equity category saw gains. Unresolved trade issues with China, the EU, and even the US Mexico Canada (USMCA) agreement continue to create uncertainty, however. An observation by the FOMC in their March meeting that “economic activity has slowed from its solid rate in the fourth quarter,” has shifted expectations from future rate increases to when the next rate cut will occur.

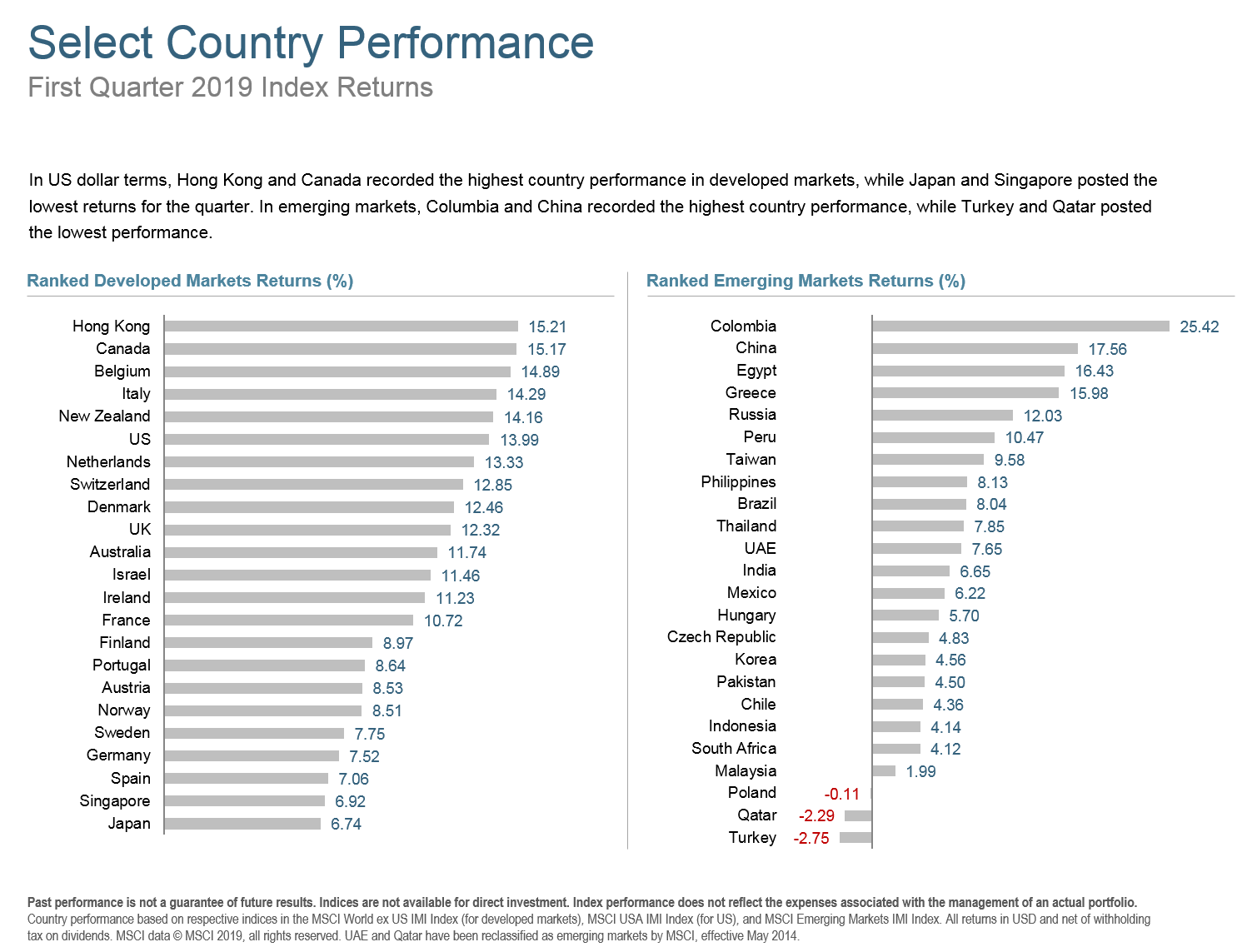

International equity markets also had strong gains in Q1. Similar to the US, foreign stock markets were supported by central banks stepping away from tighter monetary policy. There has been continued uncertainty about how the UK’s exit from the EU (aka Brexit) will play out though, which has added to growth concerns in the EU and UK. Hong Kong was the strongest foreign market of the quarter.

The US’s decision to suspend tariff hikes on $200 billion of Chinese goods, together with ongoing government support for the Chinese domestic economy, contributed to a strong returns in China. The rally wasn’t limited to Asia though, as Columbia, Egypt, Greece, Russia, and Peru all saw double digit returns. In fact, only Poland, Qatar, and Turkey had negative returns.

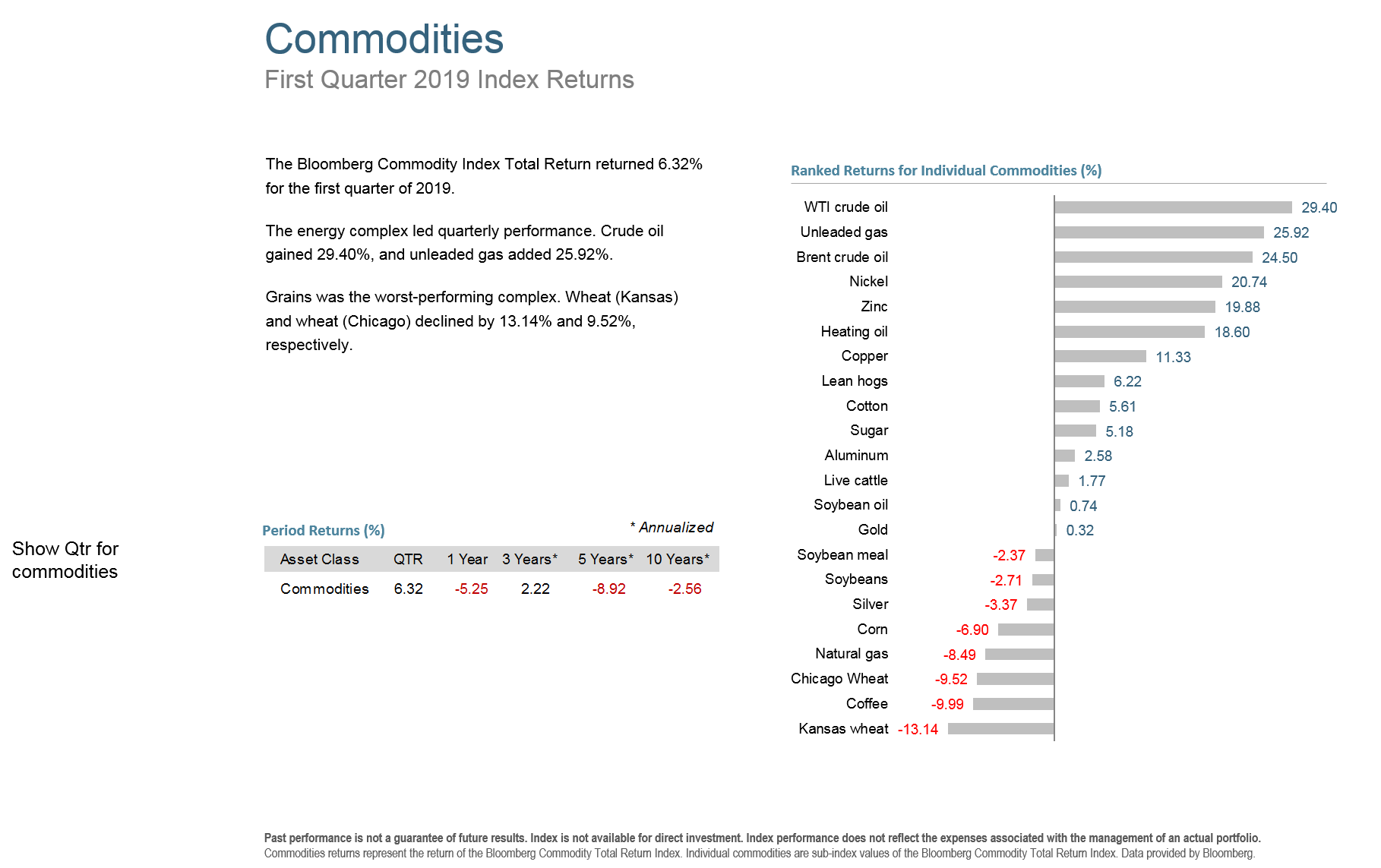

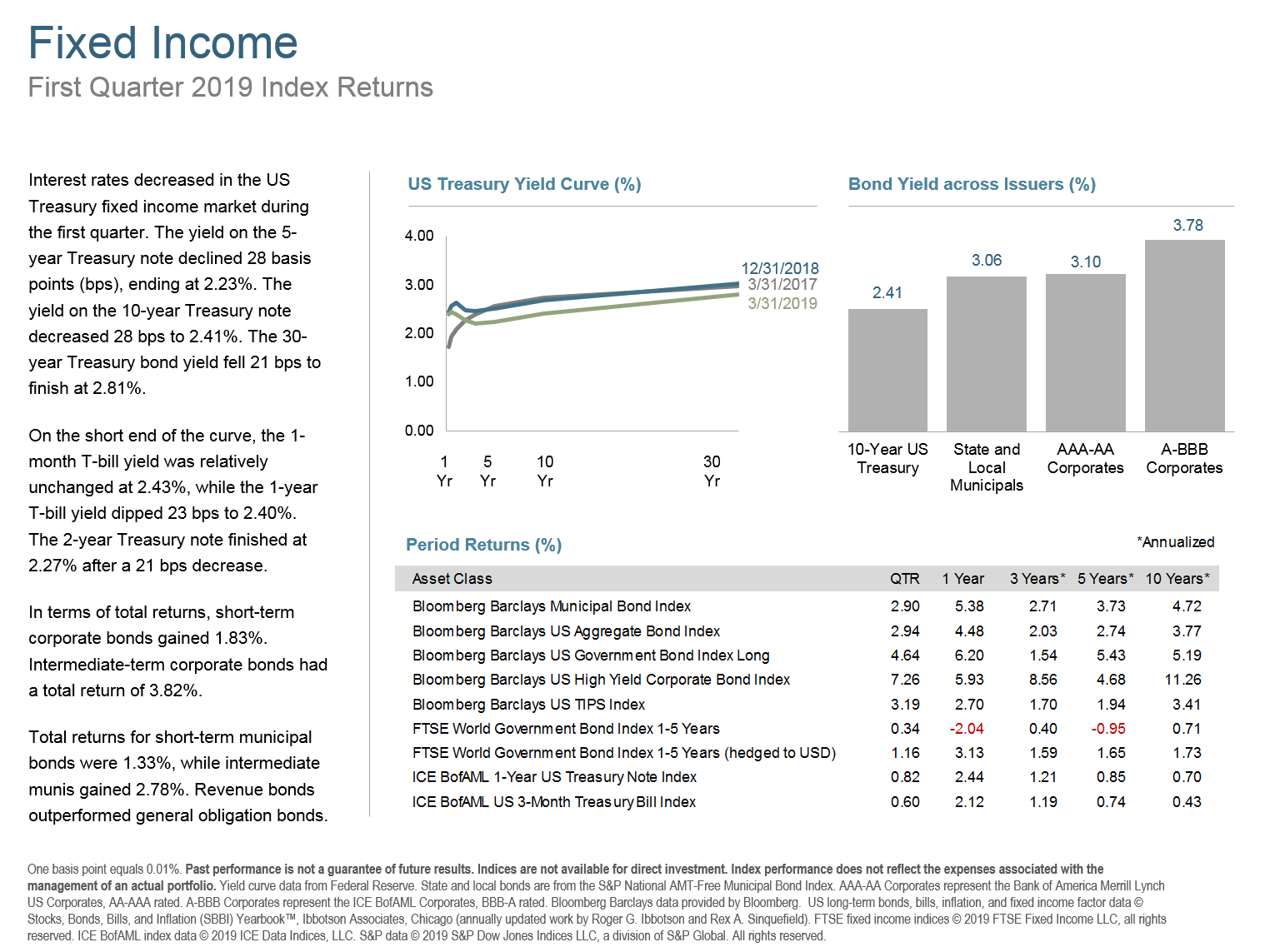

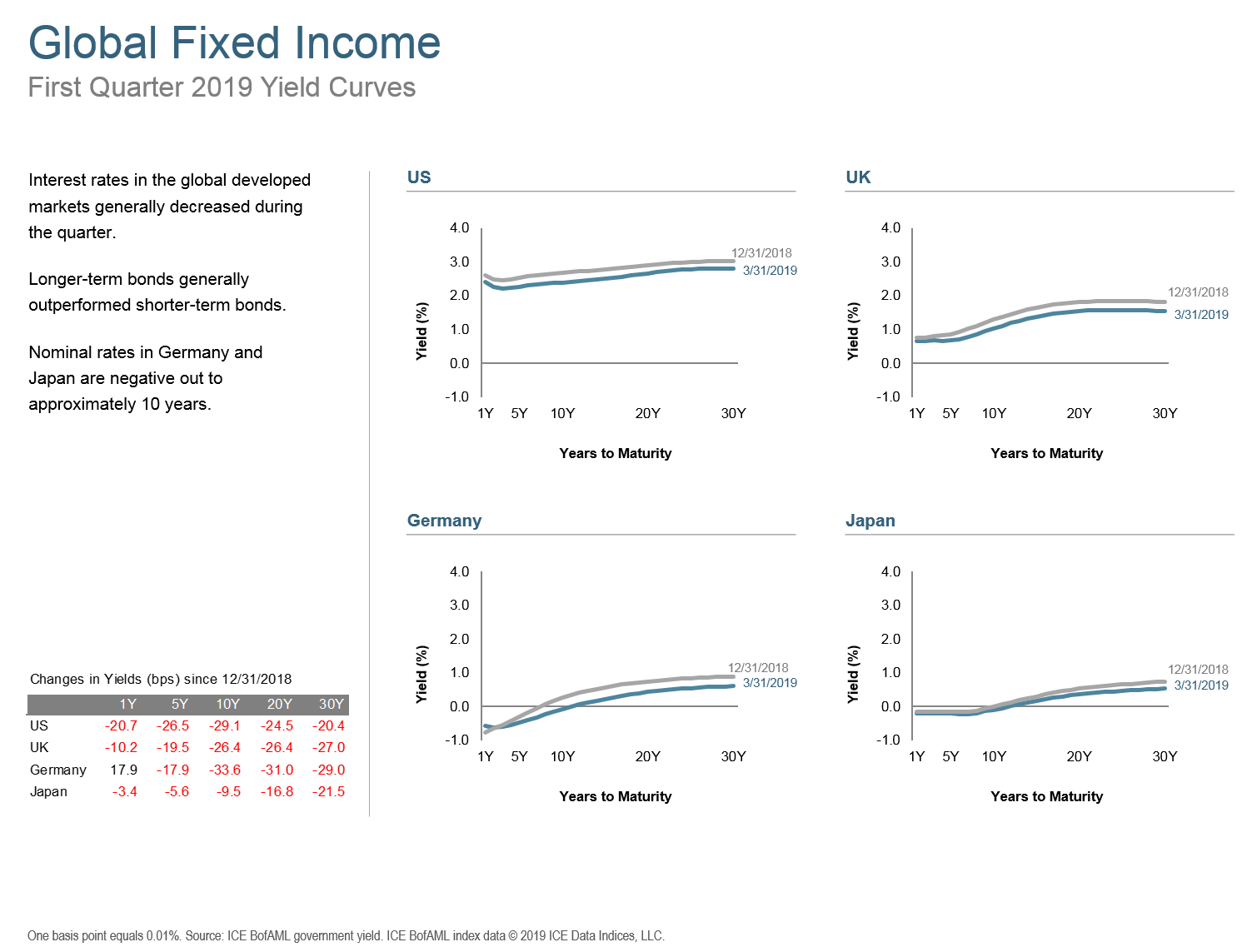

Bonds rebounded strongly across the globe. REITs, always sensitive to interest moves, were among the best performers of the quarter. Commodities, led by energy prices, also posted robust returns.

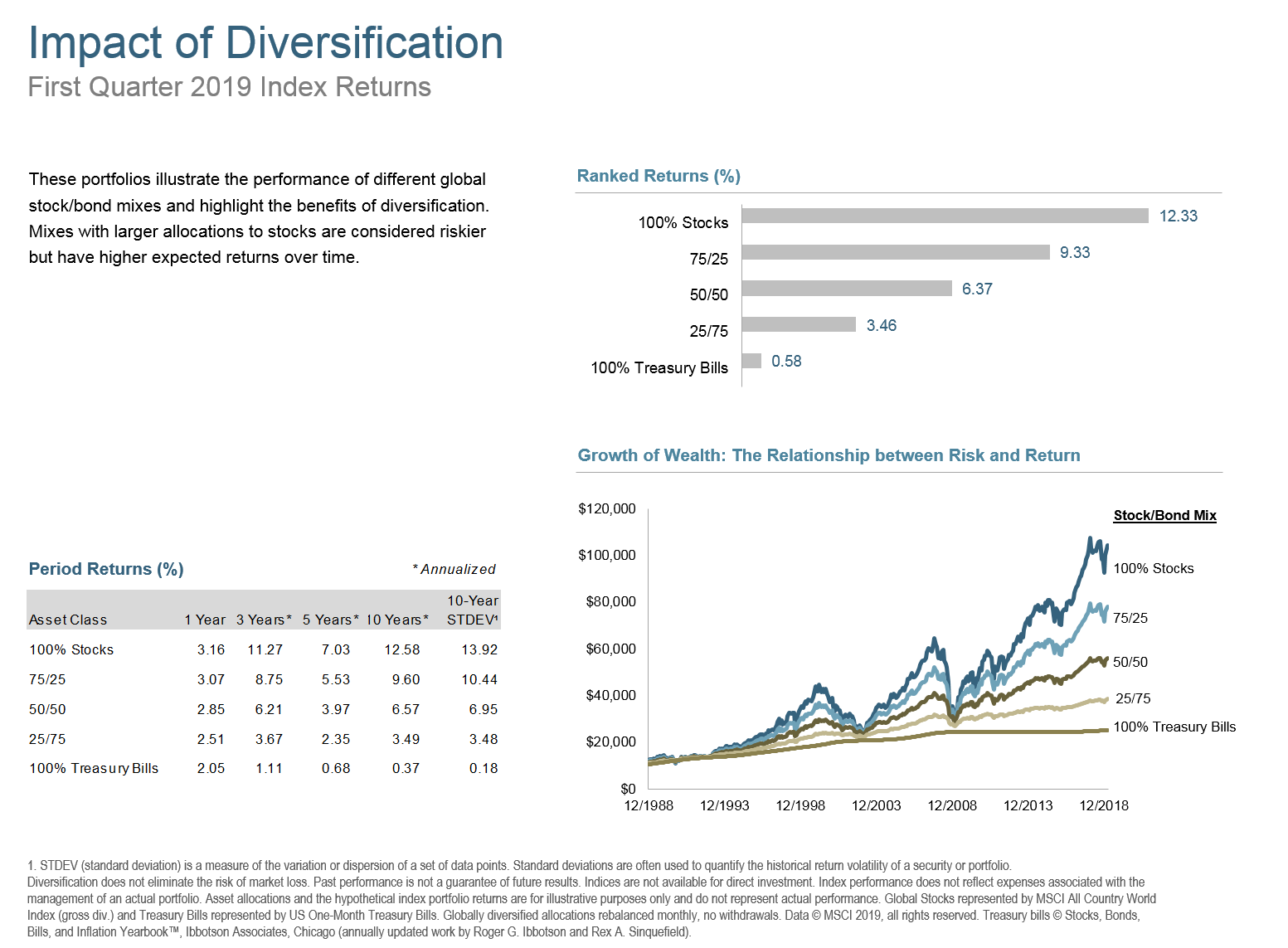

Investors that weren’t spooked away by the volatility at the end of 2018 were rewarded for their discipline in Q1. As I mentioned last quarter, if I have done my job, your portfolio is invested in such a way that you are able to ride out those dips without panicking so that you can enjoy rallies such as we saw in the last few months.

While I don’t know of any ATX Portfolio Advisors’ clients that succumbed to the understandable fears that market downturns such as we saw in Q4 2018 can create, I challenge readers to use this rally as an opportunity to reflect on how you felt during that period. We can complete risk tolerance surveys and play hypothetical games about how you may behave during difficult periods, but nothing proves our mettle like actual experience. If yours reached its bending point during the last selloff, it may be a good time to review your plans now that the storm clouds have cleared.

The Q1 2019 Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets.

As always, if current markets have you concerned about your portfolio, please get in touch for a review.

-Jeff