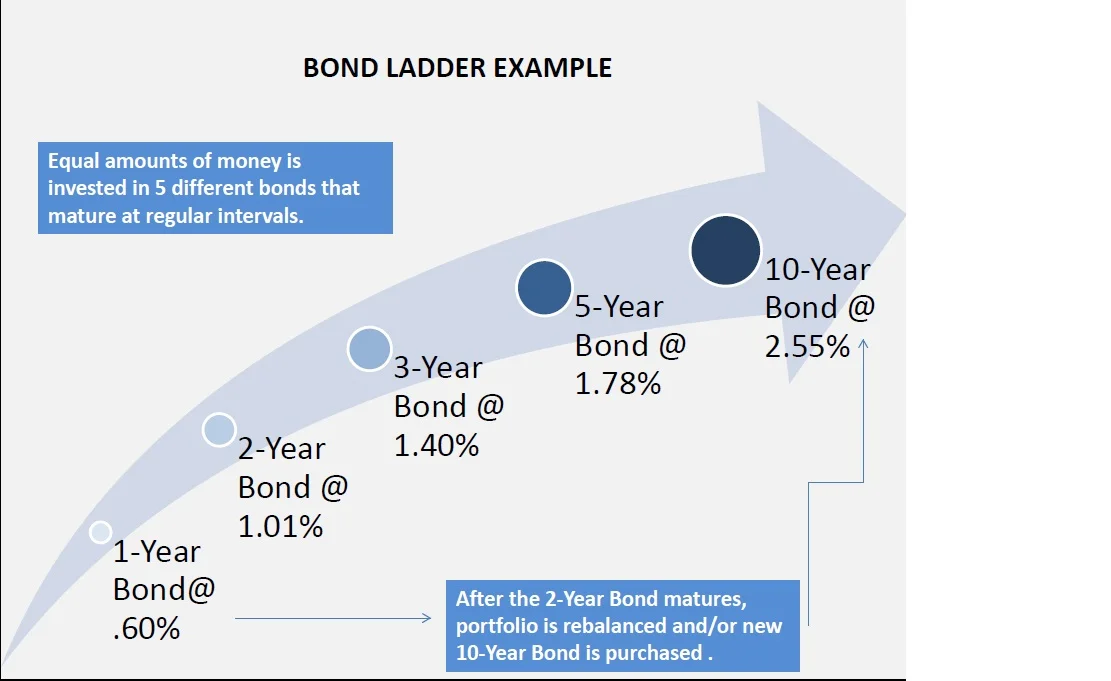

Example of a bond ladder

“Ha, interest rates are a joke! You would have to be crazy to buy bonds today, rates can only go up from here,” said my client (we’ll call him Mr. Cash) in 1993 when I called him with a AAA rated 6% tax free bond. At the time, his money market was earning 3-4%, if I recall correctly. As far as I know, he is still mostly invested in cash and short term CDs to this day, waiting for rates to go up.

With money market rates at 0.01% currently, maybe his prediction is closer to reality today. Of course, those money market rates have been at essentially zero since 2008. Who’s laughing now? Politicians, bankers, real estate speculators, or anyone else who PAYS interest. Certainly, no one who lives off interest thinks it’s very funny.

Mr. Cash was not terribly unique in his thinking for the generation that had experienced double digit inflation and interest rates of the late 70’s and early 80’s. So is the nature of markets, things that seem so obvious and rationale, such as “rates can only go up from here,” frequently don’t work out the way that we expect.

At ATX, we think the market does a great job of pricing assets, whether that be stocks, bonds, commodities, real estate, or baseball cards for that matter. What we can do is take the information the market is providing us and do our best to create a plan that works.

That’s why we use individual bonds due to their predictable maturity and cash flow. If Mr. Cash had been willing to build a ladder of individual bonds back in 1993, with one rung of his ladder being that 6% bond, he would have earned roughly double what cash was paying at the time and more than cash earned at any time over the next 20 years.

Today, a AAA rated 10-Year municipal ladder could be built with a yield in the ballpark of 1.45%. On the short end, the 1-Year is currently paying about 0.60% and on the long end the 10-Year is around 2.5%. A year from today, the .60% bond will be reinvested in a 10-Year at whatever that yield is at the time. We can’t predict what that will be, but over time the longer maturities typically have higher yields than cash. In a few years you’re getting the yield on 10-year bonds but your money, on average, is committed for a much shorter time.

And don’t forget the real punch line, and that is bonds provide protection against one of the biggest risks we all face, our emotions. Having enough of our capital securely tucked away in the relative calm of high quality bonds when the volatility storm that occasionally hits stocks is raging helps prevent emotional mistakes, like selling during a downturn.

Investing in bonds hedges us against bad investment decisions and gives us a better chance of having long-term success.

That is no joke.

2/14/15 Rate Snapshot

| Bond | 1-Year | 2-Year | 3-Year | 5-Year | 10-Year | 20-Year |

|---|---|---|---|---|---|---|

| CDs | 1.20% | 1.35% | 1.65% | 2.35% | 2.90% | 2.50% |

| US Treasuries | 0.43% | 0.85% | 1.18% | 1.60% | 2.05% | NA |

| US Agency/GSE | 0.74% | 1.17% | 1.58% | 2.05% | 3.03% | 3.55% |

| Munis(AAA) | 0.60% | 1.01% | 1.40% | 1.78% | 2.55% | 2.69% |

| SPDAs(A) | NA | NA | 1.60% | 2.75% | 3.25% | NA |

Disclaimer:

The views expressed herein are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by ATX Portfolio Advisors, LLC. Differences in account size, timing of transactions and market conditions prevailing at the time of investment may lead to different results, and clients may lose money. Past performance is not indicative of future results.

The yield table categorize bonds by Standard & Poor's (S&P) rating. Bonds which are not rated by S&P were excluded. Single Premium Deferred Annuities are categorized by AM Best ratings.

For purposes of determining a municipal bond’s rating, the yield table uses the greater of the third party guarantor's or insurer's financial strength rating and underlying rating, where applicable. Consider the financial strength ratings of the third party guarantor or insurer as well as any published underlying rating of the issuer for a more complete assessment of the bond's credit risk profile.

Ratings are opinions and not recommendations to purchase, hold or sell securities, and they do not address the market value of securities or their suitability for investment purposes. Ratings should not be relied on as investment advice. Please read important disclaimer information.

The bond yields displayed represent Yield to Worst and are subject to change and availability.

Ratings are opinions and not recommendations to purchase, hold or sell securities, and they do not address the market value of securities or their suitability for investment purposes. Ratings should not be relied on as investment advice.

In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so avoiding losses caused by price volatility by holding them until maturity is not possible.

Lower-quality debt securities generally offer higher yields, but also involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

Fixed annuities available at ATX Portfolio Advisors, LLC are issued by third-party insurance companies which pay ATX a commission. A contract’s financial guarantees are solely the responsibility of and are subject to the claims-paying ability of the issuing insurance company.

Guarantees are subject to the claims-paying ability of the issuing insurance company. Principal and interest are guaranteed if held for the length of the guarantee period.

Before exchanging, check with your current provider to see if it will assess a surrender charge, and also consider the existing benefits and features you may lose in an exchange, which may be of particular importance if poor market conditions.

Withdrawals of taxable amounts from an annuity are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty.

Before investing, consider the investment objectives, risks, charges, and expenses of the annuity and its investment options. Call or write to ATX Portfolio Advisors, LLC for a free prospectus and, if available, summary prospectus containing this information. Read it carefully.