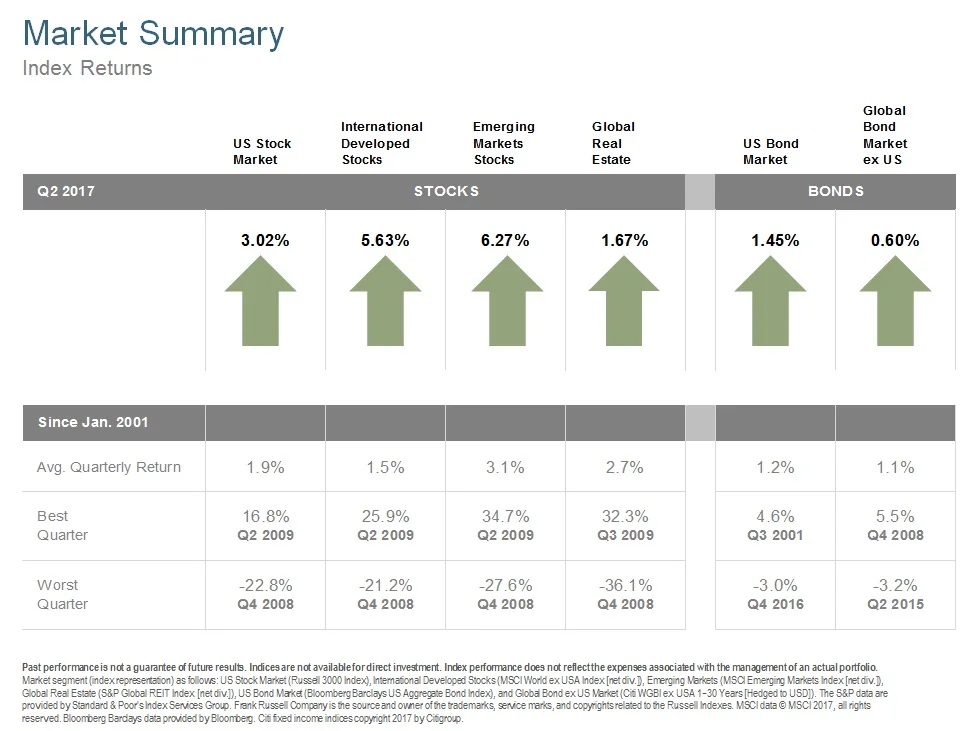

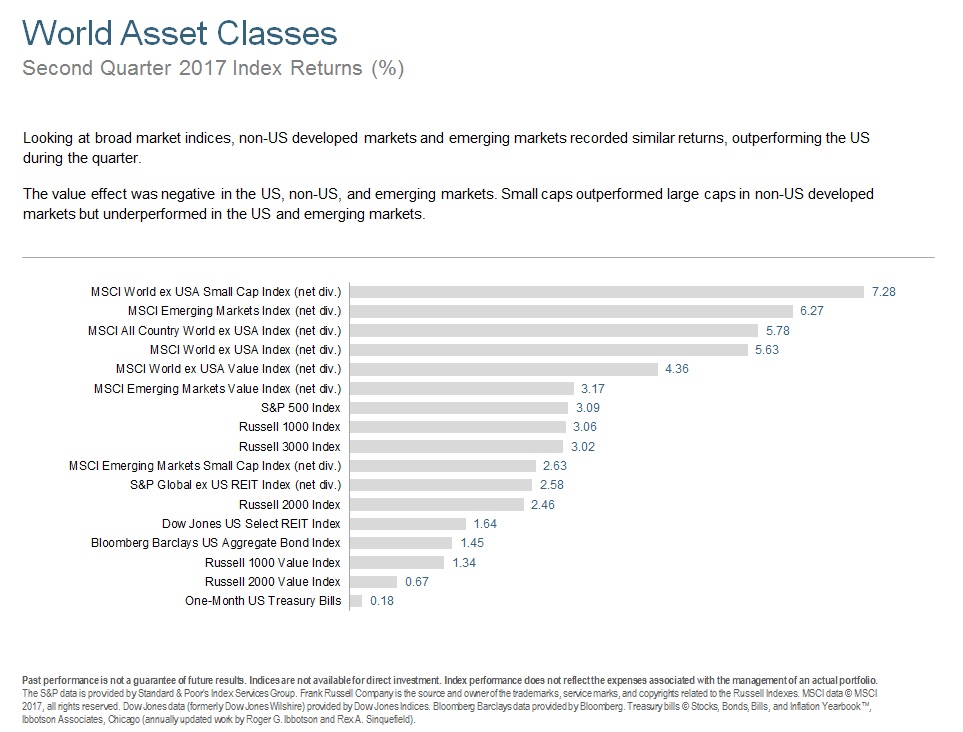

As summer heats up, the US stock market stayed hot by posting its seventh consecutive quarter of positive returns. Much of that growth recently was led by large growth stocks, such as Facebook, Amazon, Netflix, and Alphabet (formerly known as Google); but small company growth stocks provided plenty of heat, too. Value stocks trailed growth stocks across all size ranges.

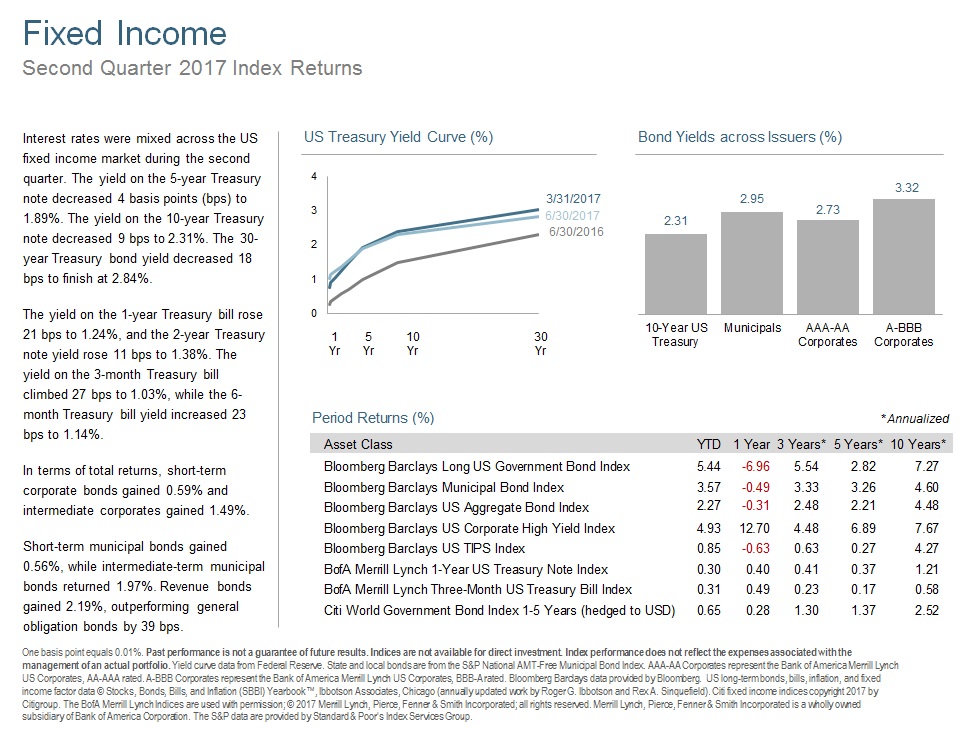

The Federal Reserve made no changes to monetary policy during the quarter but did start to release some of their discussions about how they may wind down the $4.5 trillion of bonds they bought with printed money following the Great Recession. While US and global bonds turned in a positive quarter, the tightrope between deflation and inflation that policy makers will be forced to traverse while unwinding the world central banks' unprecedented balance sheets would make even the Flying Wallendas nervous. All eyes are certain to be glued to Ms. Yellen and her global peers in coming months.

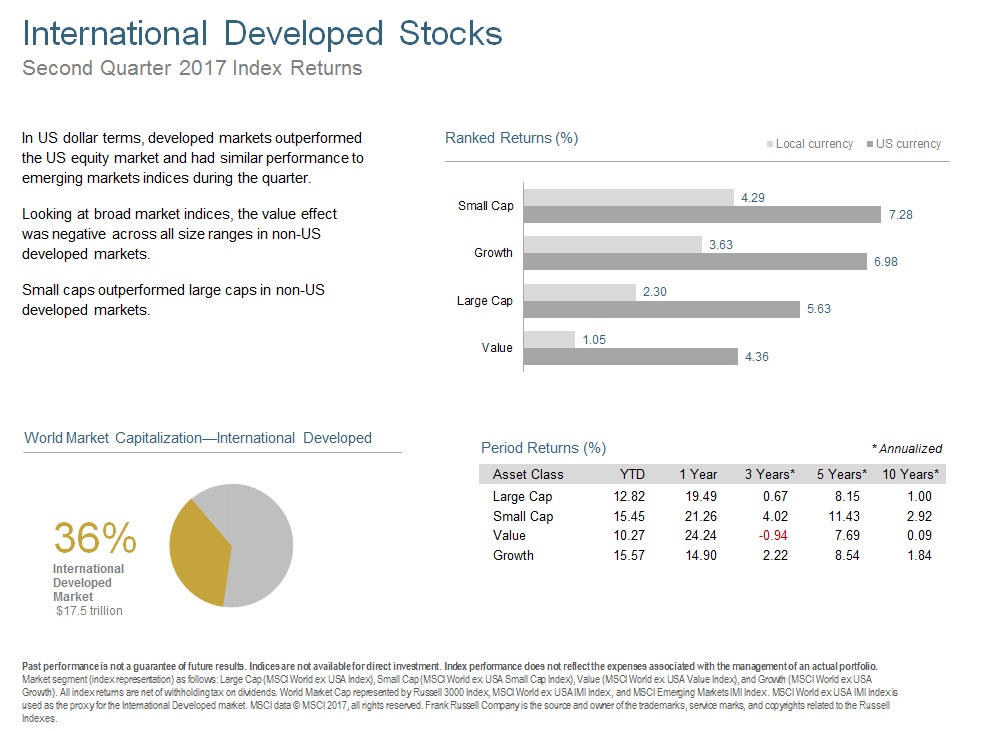

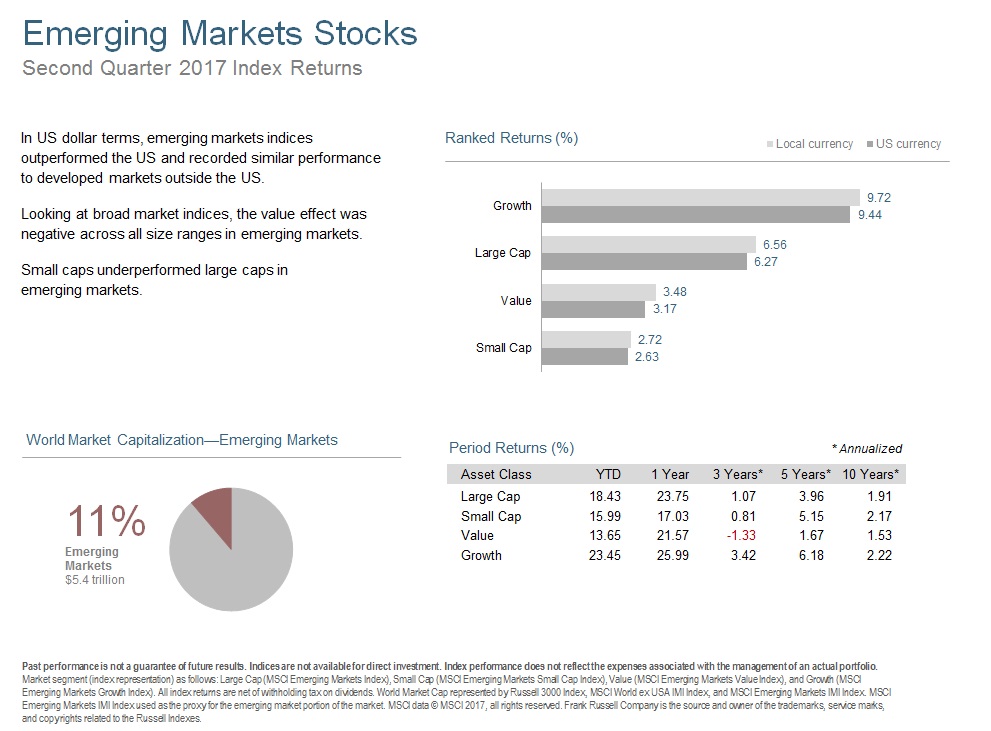

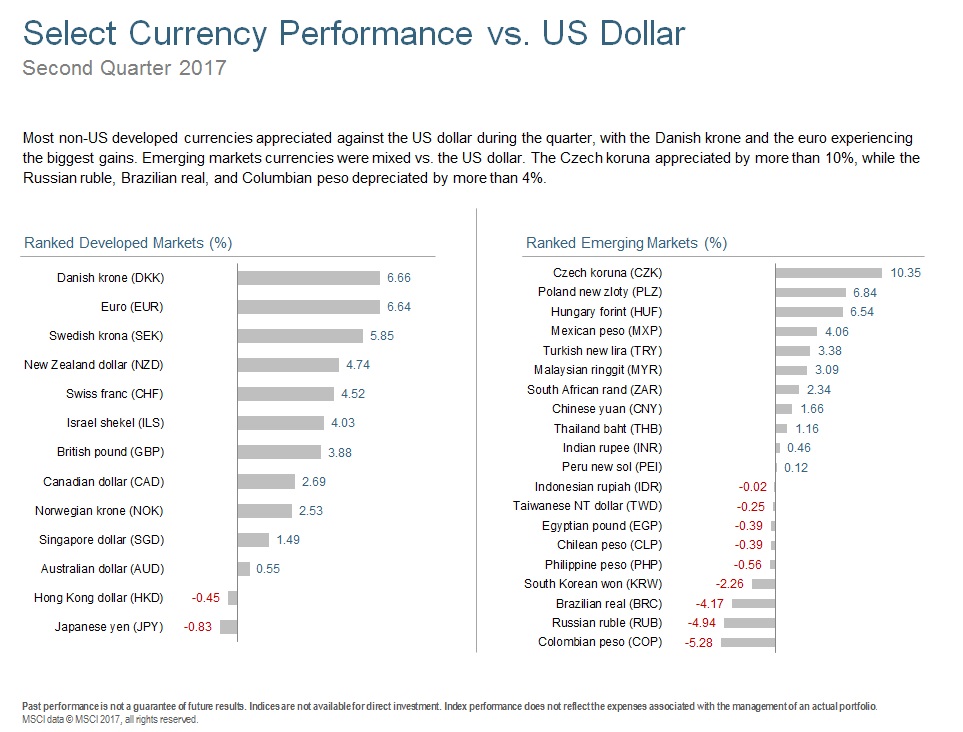

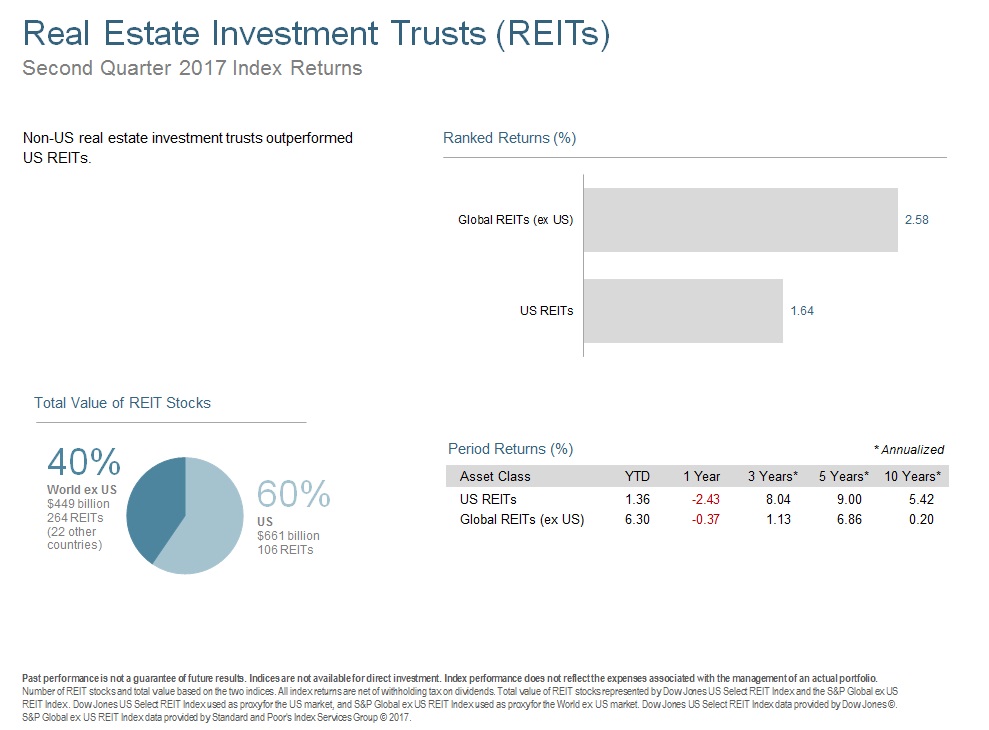

International markets, both developed and emerging, outperformed domestic markets, while commodities and REITs lagged. Longer maturity bonds and high yield corporates were the strongest performers in the fixed income markets, but the increasing noise about quantitative tightening has led to increased volatility.

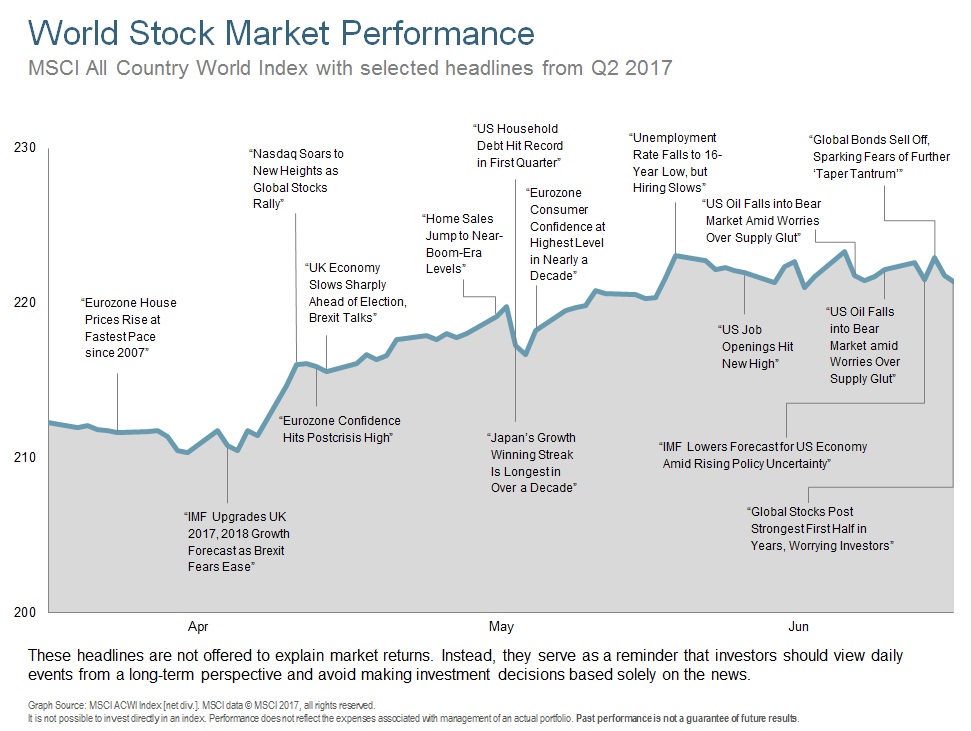

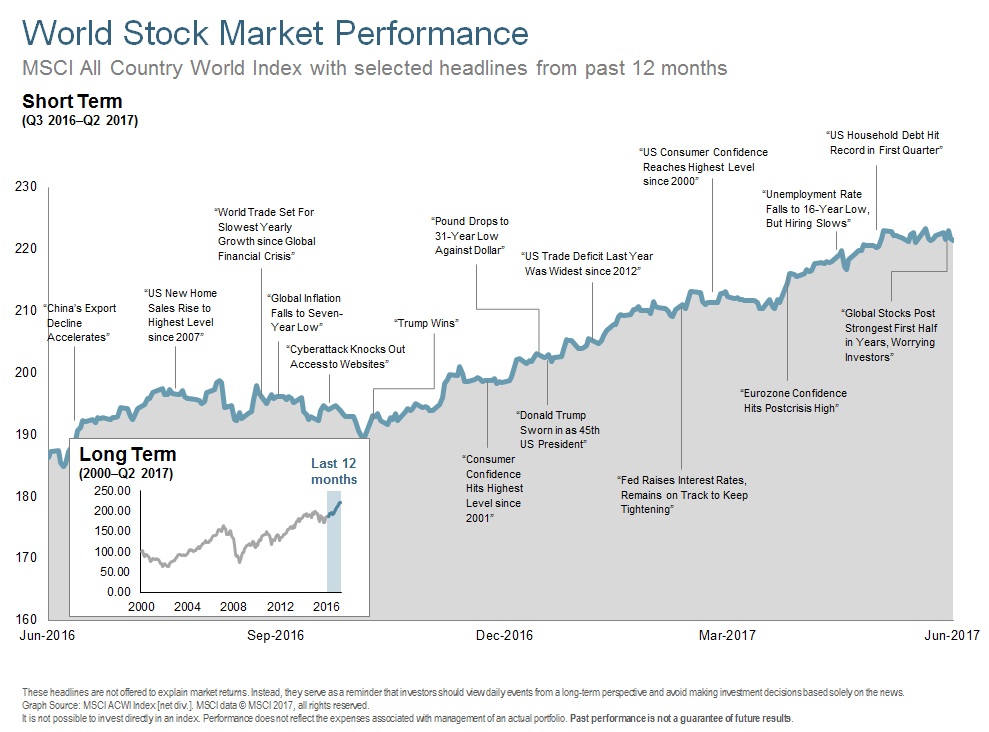

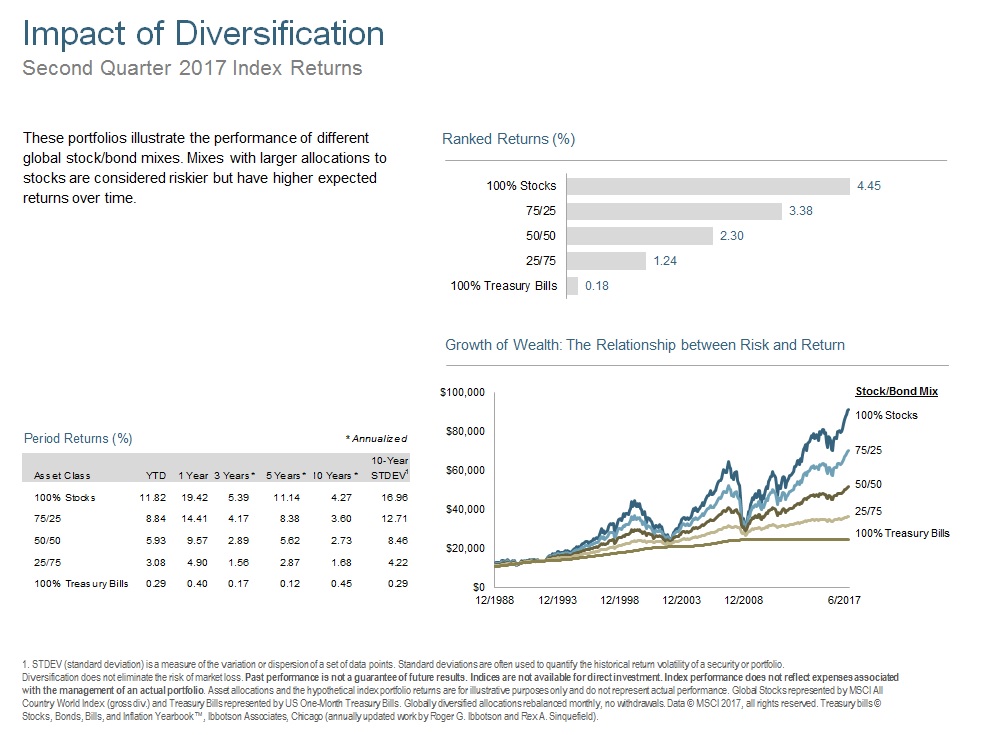

It has been a good ride over the last couple of years. Long ago, I gave up trying to predict what the next short term moves in the market may be, but we should react to what market prices are telling us from time to time. Recently, we have rebalanced some portfolios due to drift from target allocations and aligned our models more closely to global equity weightings. While we all hope that Q3 produces a screen as green as Q2, at some point we will see red. By taking some gains off the table now, we hope to keep our clients in step with their risk tolerance and capacity while taking advantage of the benefits that diversification can provide.

If you have concerns about your portfolio or level of diversification, get in touch for a free review. In the meanwhile, stay cool and enjoy the Q2 2017 Market Review!