Trivia time: how many stocks make up the Wilshire 5000

Total Market Index (a widely used benchmark for the US equity market)?

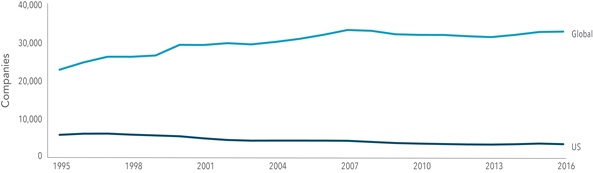

While the logical guess might be 5,000, as of December 31, 2016, the index actually contained around 3,600 names. In fact, the last time this index contained 5,000 or more companies was at the end of 2005.[1] This mirrors the overall trend in the US stock market. In the past two decades there has been a decline in the number of US-listed, publicly traded companies. Should investors in public markets be worried about this change? Does this mean there is a material risk of being unable to achieve an adequate level of diversification for stock investors? We believe the answer to both is no. When viewed through a global lens, a different story begins to emerge—one with important implications for how to structure a well-diversified investment portfolio.

U.S. AGAINST THE WORLD

When looked at globally, the number of publicly listed companies has not declined. In fact, the number of firms listed on US, non-US developed, and emerging markets exchanges has increased from about 23,000 in 1995 to 33,000 at the end of 2016. (See Exhibit 1.)

It should be noted, however, that this number is substantially larger than what many investors consider to be an investable universe of stocks. For example, one well-known global benchmark, the MSCI All Country World Index Investable Market Index (MSCI ACWI IMI) contains between 8,000 and 9,000 stocks. This index applies restrictions for inclusion such as minimum market capitalization, volume, and price. For comparison, the Dimensional investable universe, at around 13,000 stocks, is broader than the MSCI ACWI IMI.

Exhibit 1. Number of Publicly Listed Companies