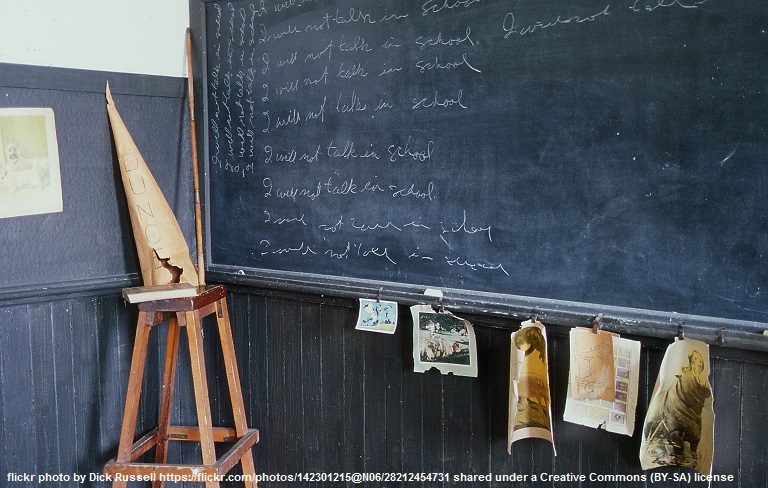

Remember when the class Dunce was relegated to the corner? If the internet has made the world a village, it has also given rise to many of the idiots that once were confined to a corner or at least a local coffee shop. No place was this more evident than an interview this week with entrepreneur Grant Cardone on CNBC.

In the article, Cardone was quoted as saying, "I would never, ever invest money in a 401(k). Why would I go to work, have my employer give me another $6,000 a year, and then take that money and send it off to Wall Street, where I can't even touch it for 30 years? I wouldn't do that."

Hey Grant, since no one answered your question in the article, I thought I would help you out. The reason you would invest in a retirement account and take advantage of an employer match, if offered, is so you won't be one of the 55% of Americans that a 2016 study by Fidelity Investments showed do not have enough money to afford 80% of expenses in retirement.

Sure, everybody could take your advice to “focus on earning”, but what about the fact that 71% of small businesses fail by their 10th year? No doubt you have enjoyed successful business ventures, but winning the lottery doesn’t qualify you to suggest that buying Powerball tickets is a good idea.

It's at least partially due to ignorant or stupid statements such as these that lead to 1 out of 4 employees leaving employer 401(k) matching money on the table each year, an average of $1,336, according to Financial Engines.

If you are interested in some ideas that arguably aren't quite as dumb as Grant's, consider the following before year end:

Review Your Portfolio - Year end is a great time to review your investments to see if you are on track. During the review, you should confirm that your investment mix is still appropriate for your goals. If the mix has drifted too far off target, now is an ideal time to re-balance or make a clean break for 2017. If you have any investment losses in your taxable accounts, you should consider selling some losers to generate a tax write off or to offset other capital gains.

An often overlooked tactic when addressing imbalances is to contribute shares of appreciated stock to your favorite charity or a donor advised fund (DAF). This approach may allow you to simultaneously lighten your exposure, avoid capital gains, and get a tax deduction.

Pay Yourself First - Are you getting the most from your retirement accounts? If your employer offers a matching contribution, you are passing up free money if you aren't contributing up to the matching amount. If you are getting a year-end bonus or raise, use this opportunity to increase the amount you are saving in your retirement accounts. If you are 50 years old or more, there are probably "Catch Up Contributions" available to allow you to save even more. You not only will be increasing your savings, but you may save some tax money, too.

Remember that retirement contributions are perishable. Once you pass the deadline, you’ll never be able to take advantage of this year’s contributions again.

Check Your Beneficiaries - This is a simple administrative task, but is a crucial step in insuring your estate plan will work as you intend. If you want your state or the IRS to get more of your inheritance, not naming beneficiaries is a great way to increase their share.

A more common problem is not updating beneficiaries after deaths, divorces, births, etc. These designations are considered contractual and supersede your will. 10 minutes a year on this task can save a lot more than money. Don't believe me? Check out this Accountable Update from last year.

Don't Forget Your Required Distributions - For most folks, if you are 70.5 before year-end, you are required to distribute some money from your retirement accounts. The penalty for not taking the Required Minimum Distribution (RMD) can be 50% of the amount not taken, so it is very prudent to always confirm that you have satisfied the requirement. The only year you get a grace period is the year you turn 70.5, and then for only 3 months. Mistakes can often be made when inheriting an IRA or when accounts have been transferred from one company to another, so be especially mindful if this applies to you.

Use Your Flexible Spending Account (FSA) - If you set aside money in an FSA and have more than $500 left at year end, you need to use it or lose it. Here is a list of eligible expenses.

If all of this is a little much, give me a call if you would like some help.